System Integrator Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

System Integrator Companies and the Market Segmented by Service Type (Infrastructure Integrators, Software Integrators), End-User Industry (Oil & Gas, Automotive, Aerospace & Defense, Healthcare, Power, Chemical and Petrochemical), and Geography (North America, Europe, Asia Pacific, Rest of the World). The Market Size and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

System Integrator Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

System Integrators Market Size

| Study Period | 2019 – 2030 |

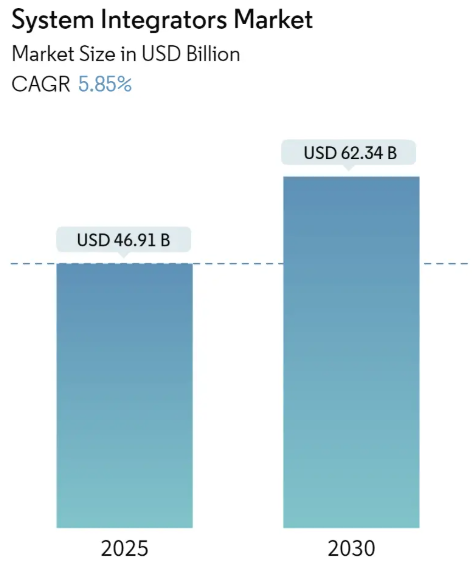

| Market Size (2025) | USD 46.91 Billion |

| Market Size (2030) | USD 62.34 Billion |

| CAGR (2025 – 2030) | 5.85 % |

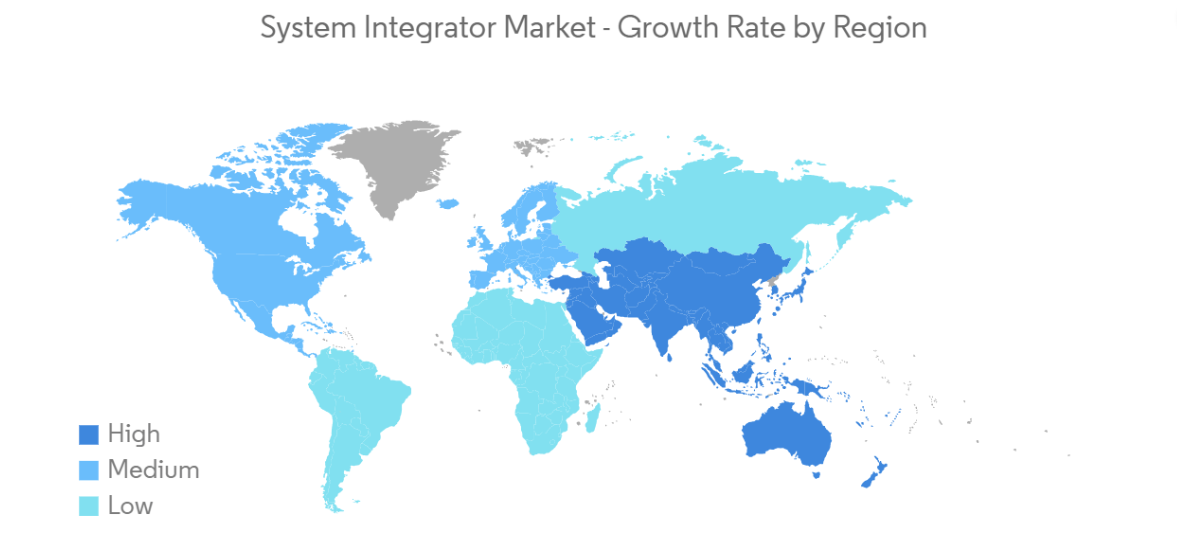

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

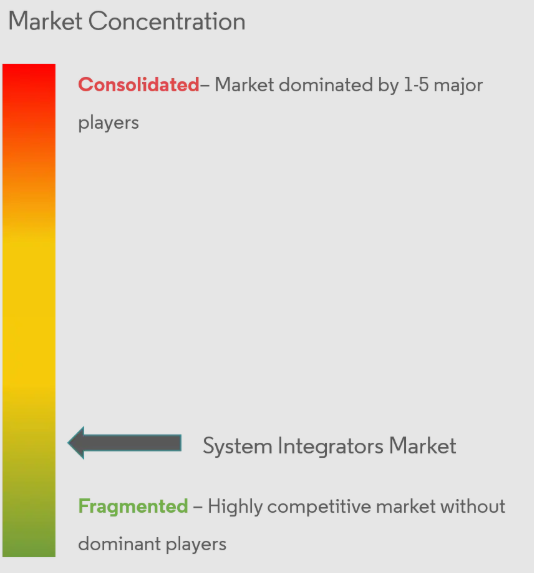

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of System Integrators Market with other markets in Technology, Media and Telecom Industry

System Integrators Market Analysis

The System Integrators Market size is estimated at USD 46.91 billion in 2025, and is expected to reach USD 62.34 billion by 2030, at a CAGR of 5.85% during the forecast period (2025-2030).

System Integrators specialize in conducting component subsystems together into a whole and ensuring that those subsystems function together. In today’s era, manufacturing companies are introducing Flexible Manufacturing Systems (FMS) to break the classic trade-off between dependability and quality.

FMS reduces labor and process variability, improving the quality of the product, and consists of various production, material handling, and computer control modules. This further demands system integrators where the requirement of highly flexible control software makes it simple to integrate the machines with a system such as the PLC system and database.

- The demand for low-cost and energy-efficient production processes drives the market. The industry sector is one of the largest end-use sectors in terms of final energy demand and greenhouse gas emissions. System integrators have been involved in many traditional efficiency improvement activities like a motor replacement, inverters installation, etc., which are strictly related to energy usage reduction. But system integrators can also help a company reduce its environmental impact through operations optimization.

- Connecting the information coming from the production plant and then crossing them with energy consumption information and point-of-sale (POS) details can provide reports that can help identify possible optimizations, whereas having all the information separate could not have been enlightening. Further, one can expect low-cost development tools and the necessary training and support by participating in the system integrator program.

- Further, the growing use of IoT in industrial automation drives the market. The automation systems integrators are equipped with opportunity because, in most businesses, the usage of IoT solutions is shifted from being handled by the IT department to operations, and due to an existing relationship between operations and system integrators, it will, therefore, be easy for systems integrators to cooperate with IIoT vendors.

- Due to the increasing use of the Internet of Things in industrial automation, there will be a wide range of opportunities for market expansion. The vast majority of businesses as well as the already-existing relationship between system integrators and market operations offer automation systems integrators a plethora of opportunity. The market players’ growing need for flexible manufacturing suppliers also increases the likelihood that the system integrator business will grow favorably over the next years.

- In the current business environment, which is technology-driven, Big Data stands as one of the primary drivers of manufacturers’ productivity and efficiency. With the high rate of adoption of connected devices and sensors and the enabling of M2M communication, there has been a massive increase in the data points generated in the manufacturing industry.

System Integrators Market Trends

Advancement of the Industrial Internet of Things (IIoT)

- Implementing automation technologies such as IIoT enables power plant operators to collect real-time data and remotely monitor equipment to improve production efficiency and detect future problems. Running turbines, reciprocating engines, and solar cells/panels efficiently are possible. Power distribution systems improve uptime, lower costs, improve data collection, improve alarm and monitoring systems, and enable autonomous problem resolution.

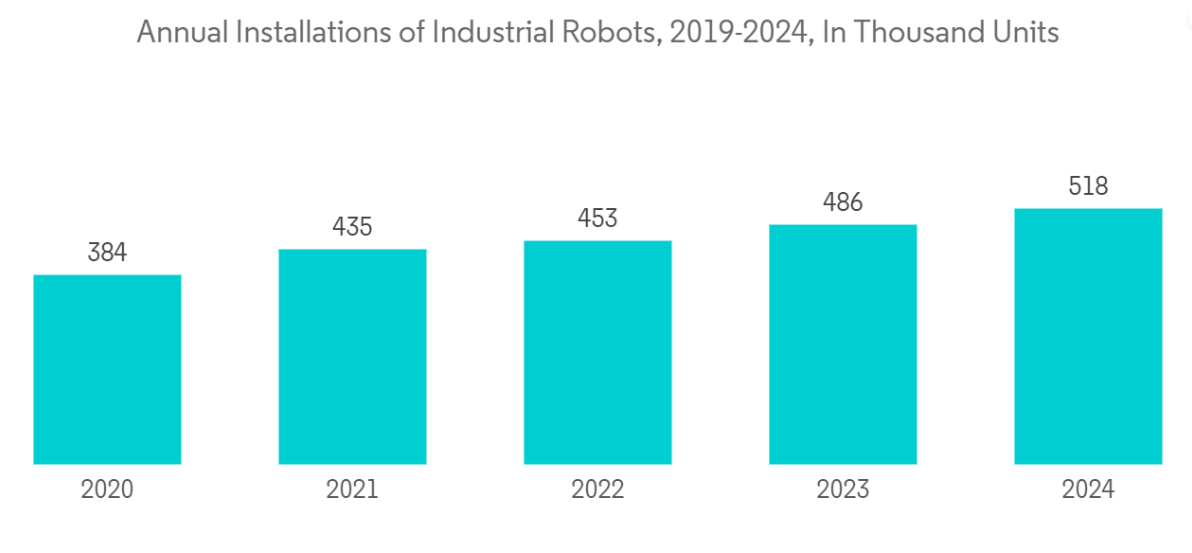

- The IIoT is driving higher levels of connectivity in factories, especially in robotic automation systems. This connectivity enables significant productivity improvements and enhances return on investment in automation equipment.

- The increased adoption of industrial automation technologies, particularly in China and India, has also contributed to market growth. Major electrical product contract manufacturers have already begun to automate their operations. Massive battery manufacturing facilities are also being built to meet the growing demand for electric and hybrid vehicles. The need for industrial automation is expected to bolster the system integrator market.

- Furthermore, in June 2022, READY Robotics, the leader in accelerated computing technology, announced a strategic investment in Robotics, the pioneers in software-defined automation. For decades, software silos between robot vendors have constrained manufacturing. It has broken down those barriers with a standard interface that simplifies enterprise deployment and significantly expands the market opportunity for the automation industry.

- SCADA systems are at the root of industrial processes, assisting organizations in meeting modern demands. Yokogawa, for example, focuses on SCADA evolution to deliver high performance, high availability, broad scalability, and platform independence in their SCADA applications. As a result, organizations benefit from Yokogawa’s SCADA software (Fast/Tools), a comprehensive, fully-integrated SCADA application suite, and the company’s power and flexibility. Increasing adoption of such tools across industries is anticipated to boost the global demand for system integrators.

- Further, the adoption of industrial IoT is a maturation process in which businesses gain increasing levels of benefit as they progress from basic machine connectivity to advanced approaches such as analytics, automation, and edge computing. As organizations realize the growing benefits of implementing IIoT, 73% of technology adoption expect their investment to increase in the next 12 months, with transportation and manufacturing leading O&G. Users anticipate increased achievement of business priorities such as automation and real-time monitoring as a result of this ongoing investment over the coming years.

North America to Hold a Significant Market Share

- North America is anticipated to hold a significant share of the overall system integrator market. Human resources are scarce in the region, and skilled resources for complex processes are expensive. As a result, companies have increased automation in their manufacturing plants.

- Due to technological advancements, North America has been highly competitive in the industrial automation market, with the United States being a developed country that accepts advanced technologies for industrial operations. Automation solutions across industries are becoming more prevalent as 5G wireless technology becomes more widely available. Furthermore, as demand for augmented reality (AR) and virtual reality (VR) grows, the industrial automation and IoT markets are expanding.

- In March 2022, Omron Automation Americas announced that it had added RAMP Inc. to its Certified System Integrator plan. RAMP is a technology development firm that creates custom automation and robotic systems. It enables customers to use IIOT to transform their factories and integrate robotics safely and effectively.

- Additionally, the region is witnessing a rise in the use of robotic technologies. For Flexiv, a global pioneer in general-purpose robotics solutions, and Cardinal Machine, a major player in machine building and systems integration, announced their new collaboration in May 2023. Flexiv will give Cardinal the tools necessary to implement robotic systems that make use of industry-leading force sensitivity and AI. It will be possible to fully automate operations like sanding, polishing, palletizing, and delicate assembling that would traditionally need manual labor.

System Integrators Industry Overview

The system integrator market is fragmented as various local, regional, and international players exist. Further, the players’ acquisition is setting high market competitiveness. The key players are John Wood Group Plc, Tesco Controls Inc., Prime Controls, and LP. o stay competitive in the market, the top firms compete with a variety of creative goods. To meet demand originating from diverse industries, the market’s top players are using a variety of methods. In the market, partnerships, collaborations, and acquisitions are the two main development tactics.

- June 2023 – OSARO SightWorks, a pioneer in machine learning-enabled robotics for e-commerce, is now accessible to system integrators and third-party logistics companies (3PLs) that provide distinctive solutions for fulfillment operations. This includes picking, depalletizing, induction, kitting, and other automated jobs. By taking this activity, solution providers can give clients’ systems new capabilities that increase productivity. Additionally, it significantly expands OSARO’s reach in the explosively growing e-commerce sector.

- January 2022 – Proud Automation has been added to North America’s Mobile Industrial Robots (MiR) certified system integrators. Proud Automation, an RG Group subsidiary, has been named a Certified Systems Integrator by North America’s leading manufacturer of autonomous mobile robots and Mobile Industrial Robots (MiR). Furthermore, the adoption of MiR AMRs is accelerating at an incredible rate, and companies are poised to meet customers’ demands.

System Integrators Market Leaders

- John Wood Group Plc

- TESCO CONTROLS, INC.

- STADLER + SCHAAF

- Prime Controls, LP

- MAVERICK Technologies, LLC

- *Disclaimer: Major Players sorted in no particular order

System Integrators Market News

- November 2022 – SAP Startup Studio, the start-up accelerator of SAP Labs India, plans to collaborate with its partner ecosystem, including system integrators (SIs) to create sustained go-to-market opportunities for start-ups in its cohorts. In order to assist software-as-a-service (SaaS) start-ups in the early and growth stages of development, SAP Startup Studio recently teamed with Capgemini in India.

- January 2022 – Wood has received funding from the Canadian province of Newfoundland and Labrador to increase employment and support the recovery of the area’s offshore oil and gas industry. The project, which was funded by the Newfoundland and Labrador Offshore Oil and Gas Industry Recovery Assistance Fund, aims to establish a regional autonomous robotic inspection and maintenance offering.

System Integrators Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

5. MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Industry Attractiveness – Porter’s Five Forces Analysis

- 5.2.1 Threat of New Entrants

- 5.2.2 Bargaining Power of Buyers/Consumers

- 5.2.3 Bargaining Power of Suppliers

- 5.2.4 Threat of Substitute Products

- 5.2.5 Intensity of Competitive Rivalry

- 5.3 Drivers

- 5.3.1 Digital Transformation and Industry 4.0 initiatives

- 5.4 Restraints

- 5.4.1 Requirement of High Investments for Automation Implementation and Maintenance

- 5.5 Assessment of the COVID-19 Impact on the Market

6. MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Oil and Gas

- 6.1.2 Automotive

- 6.1.3 Aerospace and Defense

- 6.1.4 Healthcare

- 6.1.5 Energy & Power

- 6.1.6 Chemical and Petrochemical

- 6.1.7 Others

- 6.2 By Geography***

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7. Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 John Wood Group

- 7.1.2 TESCO CONTROLS, INC.

- 7.1.3 STADLER + SCHAAF

- 7.1.4 Prime Controls, LP

- 7.1.5 MAVERICK Technologies, LLC

- 7.1.6 Adsyst Automation Ltd.

- 7.1.7 George T. Hall Company

- 7.1.8 Avanceon Ltd.

- 7.1.9 Wunderlich-Malec Engineering, Inc.

- 7.1.10 Burrow Global, LLC

- *List Not Exhaustive

8. Investment Analysis

9. Future of the Market

System Integrators Industry Segmentation

System Integrators are the companies or individuals that implement, plan, coordinate, schedule, test, improve, and maintain a computing operation. System Integrators (SI) include companies that integrate systems such as Supervisory control and data acquisition (SCADA), Manufacturing Execution System (MES), and Human-Machine Interface (HMI), among others.

The system integrators market is segmented by service type (infrastructure integrators, software integrators), end-user industry (oil & gas, automotive, aerospace & defense, healthcare, power, chemical and petrochemical), and geography (North America, Europe, Asia Pacific, Rest of the World). The market sizes and forecasts are provided in terms of value (USD) for all the above segments.

| By End-user Industry | Oil and Gas |

| Automotive | |

| Aerospace and Defense | |

| Healthcare | |

| Energy & Power | |

| Chemical and Petrochemical | |

| Others | |

| By Geography*** | North America |

| Europe | |

| Asia | |

| Australia and New Zealand | |

| Latin America | |

| Middle East and Africa |