Saudi Arabia Cold Chain Logistics Services Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Report Covers Saudi Arabia Supply Chain Logistics Companies and the Market is Segmented by Service (Storage, Transportation, and Value-added Services), by Temperature (Chilled and Frozen), and by End User (Horticulture, Dairy Products, Meats, Fish, and Poultry, Processed Food Products, Pharma and Life Sciences, and Other End Users). The market size and forecasts for the Saudi Arabian cold chain logistics market are provided in terms of value (USD million) for all the above segments.

Saudi Arabia Cold Chain Logistics Services Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

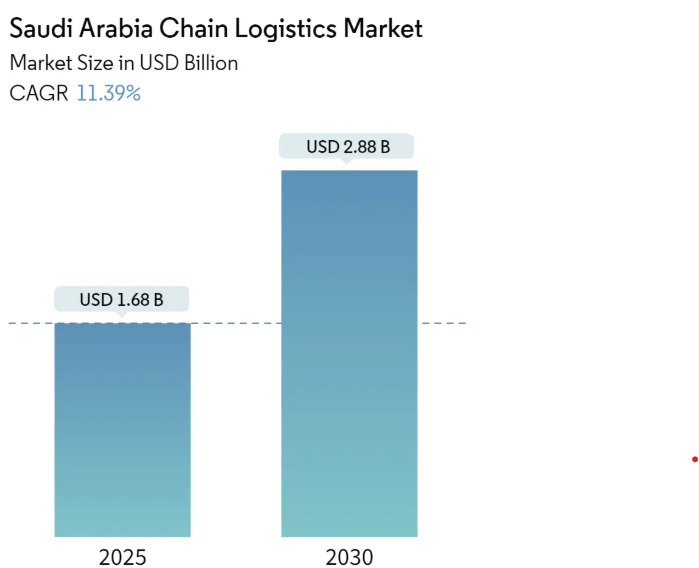

Saudi Arabia Chain Logistics Market Size

| Study Period | 2020 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

| Market Size (2025) | USD 1.68 Billion |

| Market Size (2030) | USD 2.88 Billion |

| CAGR (2025 – 2030) | 11.39 % |

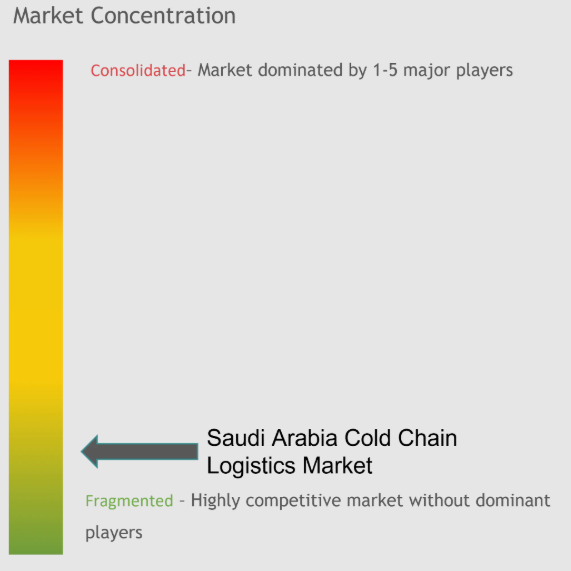

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Saudi Arabia Chain Logistics Market Analysis

The Saudi Arabia Chain Logistics Market size is estimated at USD 1.68 billion in 2025, and is expected to reach USD 2.88 billion by 2030, at a CAGR of 11.39% during the forecast period (2025-2030).

Saudi Arabia’s cold chain logistics sector is undergoing significant transformation driven by massive infrastructure investments and technological advancements. The Kingdom’s Vision 2030 initiatives have catalyzed substantial developments in cold chain logistics infrastructure, with major players making strategic investments. In March 2024, Almarai unveiled an ambitious SAR 18 billion (USD 4.8 billion) investment plan through 2028, focusing on enhancing supply chain management capabilities and leveraging technology for operational efficiency. The modernization of cold chain logistics facilities is particularly evident in key logistics hubs, with AP Moller-Maersk’s recent establishment of a state-of-the-art cold storage facility at King Abdulaziz Port in Dammam, featuring advanced temperature monitoring systems and handling capabilities for various temperature-sensitive products.

The Kingdom’s push toward food security and self-sufficiency has become a major driver for cold chain logistics development. Saudi Arabia has made remarkable progress in domestic food production, with poultry meat self-sufficiency increasing from 45% in 2016 to 68% in 2022. The dairy sector has shown particularly impressive growth, with current production exceeding 7 million liters of milk per day, supported by a robust supply chain management network of over 10,000 trucks serving 38,000 retail stores daily. This expansion in domestic production has necessitated corresponding growth in cold storage and transportation infrastructure to maintain product quality and reduce waste.

The pharmaceutical and healthcare sectors are emerging as significant drivers of cold chain logistics development in Saudi Arabia. The Kingdom currently hosts approximately 50 pharmaceutical factories that meet 28% of the country’s demands by value and 42% by volume, necessitating sophisticated temperature-controlled storage and distribution networks. In February 2024, NEOM announced a groundbreaking joint venture with Tabuk Fisheries Company, establishing Topian Aquaculture, which includes plans for the region’s largest hatchery and marine-pen production facilities, further driving demand for specialized cold chain logistics solutions.

The industry is witnessing significant consolidation and strategic partnerships aimed at enhancing operational efficiency and service coverage. Major logistics providers are investing in advanced warehouse management systems, automated storage and retrieval systems, and real-time temperature monitoring solutions. The integration of artificial intelligence, Internet of Things (IoT), and blockchain technologies is revolutionizing the Saudi cold chain logistics industry, enabling real-time supply chain visibility, enhanced operational efficiency, and optimized inventory management. These technological advancements are particularly crucial in maintaining the integrity of temperature-sensitive products across the supply chain management, from production to last-mile delivery.

Saudi Arabia Chain Logistics Market Trends

Growing Food & Beverage Industry and Import Dependencies

Saudi Arabia’s position as the largest importer of food and agricultural products among GCC countries has created an unprecedented demand for cold chain logistics services infrastructure. The Kingdom’s substantial import dependencies, particularly in temperature-sensitive products like meat and poultry, have necessitated robust cold chain networks. This is evidenced by the country’s trade relationships with major global suppliers – notably Brazil, which accounts for over 70% of Saudi Arabia’s poultry imports, followed by significant volumes from France, Ukraine, and the United Arab Emirates. The increasing trade volumes and diversification of supply sources have made sophisticated logistics solutions indispensable for maintaining product quality and safety.

The Kingdom’s exceptional per capita meat consumption, reaching approximately 50 kg – among the highest globally, has further intensified the need for advanced cold chain facilities. This demand is amplified by cultural and religious events such as Eid al-Adha and Hajj, which drive periodic surges in the import of live animals and meat products requiring temperature-controlled storage and transportation logistics. In March 2024, the collaboration between NADEC and United Feed Co. to launch a joint venture focusing on intensive animal husbandry and red meat production demonstrates the ongoing expansion of the food sector, creating additional demand for cold chain infrastructure.

Expanding Pharmaceutical and Healthcare Sector

The pharmaceutical sector’s transformation in Saudi Arabia has emerged as a significant driver for cold chain logistics development. The government’s strategic decision to allow 100% foreign direct investment in the pharmaceutical sector has catalyzed substantial investments in pharmaceutical manufacturing and distribution infrastructure. With more than 40 registered pharmaceutical factories currently operating in the Kingdom, covering 36% of local market needs, the demand for temperature-controlled logistics solutions has intensified. The pharmaceutical industry’s specific requirements for maintaining product integrity through strict temperature controls have necessitated specialized cold chain solutions.

The Kingdom’s ambitious National Transformation Plan, which aims to localize 40% of the pharmaceutical sector, has spurred significant investments in cold chain infrastructure. This initiative is particularly crucial given that Saudi Arabia currently imports all its biological molecules, requiring robust cold chain networks to maintain product efficacy. In January 2024, a significant development occurred when Tanmiah Food Company secured a new long-term credit facility of SAR 450 million (USD 120 million) to support strategic expansion plans, indicating the growing investment in temperature-controlled supply chain logistics infrastructure. These developments, coupled with the rapid reforms in the healthcare sector, have created sustained demand for sophisticated cold chain logistics solutions.

Rising Population and Evolving Consumer Preferences

Saudi Arabia’s demographic advantage, with a population more than double that of the five GCC states combined, has created substantial demand for cold chain logistics services. This large population base, coupled with increasing urbanization and rising disposable incomes, has led to evolving consumer preferences and shopping habits that necessitate reliable cold chain infrastructure. The growing adoption of modern retail formats and the increasing preference for frozen and chilled products have made temperature-controlled warehouse logistics essential for meeting consumer expectations for product quality and freshness.

The transformation in consumer lifestyle patterns, particularly the increasing number of working professionals and students, has led to the widespread adoption of the food-on-the-go trend. This shift in consumption patterns has created new demands for temperature-controlled storage and distribution networks. The flourishing retail industry, coupled with the increasing working women population, has further accelerated the need for efficient cold chain solutions. Additionally, the government’s Vision 2030 initiative, which aims to attract 30 million religious tourists annually, has created additional pressure on the cold chain infrastructure to support the hospitality and retail sectors in meeting the diverse dietary preferences of international visitors. Effective logistics planning and logistics tracking are crucial to manage this growing demand efficiently.

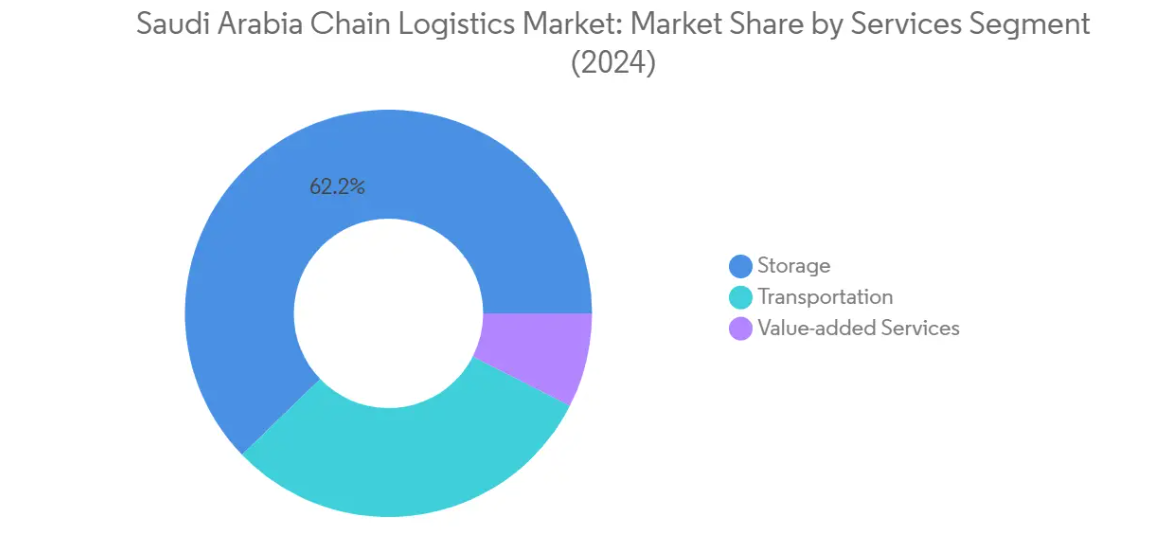

Segment Analysis: By Services

Storage Segment in Saudi Arabia Chain Logistics Market

The storage segment dominates the Saudi Arabia chain logistics market, commanding approximately 62% market share in 2024. This significant market position is driven by the growing demand for specialized storage facilities across various industries, including pharmaceuticals, food and beverages, and retail sectors. The segment’s prominence is further bolstered by Saudi Arabia’s strategic position as a regional logistics hub and the government’s Vision 2030 initiatives promoting infrastructure development. Major players like Maersk and other logistics companies have been expanding their cold storage capabilities, particularly in key locations such as King Abdulaziz Port in Dammam, demonstrating the segment’s robust growth trajectory. The increasing adoption of automation technologies in storage facilities, including automated storage and retrieval systems, cloud storage, and Internet of Things integration, has further strengthened this segment’s market leadership. Additionally, the integration of logistics software and inventory management systems enhances operational efficiency.

Transportation Segment in Saudi Arabia Chain Logistics Market

The transportation segment is projected to experience the fastest growth rate of approximately 12% during the forecast period 2024-2029. This accelerated growth is primarily attributed to the expanding e-commerce sector and the increasing demand for efficient distribution logistics solutions across Saudi Arabia. The segment’s growth is further supported by significant investments in transportation infrastructure, including the development of new logistics hubs and the implementation of advanced tracking and monitoring systems. The rise in cross-border trade activities and the growing adoption of temperature-controlled transportation solutions have also contributed to this segment’s rapid expansion. Additionally, the integration of digital technologies and route optimization solutions has enhanced the efficiency of transportation services, making it increasingly attractive to businesses seeking reliable logistics partners.

Remaining Segments in Services Market Segmentation

The value-added services segment, while smaller in market share, plays a crucial role in the Saudi Arabia chain logistics market by offering specialized services such as blast freezing, labeling, and inventory management. This segment has become increasingly important as businesses seek comprehensive logistics solutions that go beyond basic storage and transportation services. The growing demand for customized logistics solutions and the increasing need for efficient inventory management systems have made value-added services an integral part of the logistics ecosystem. These services have become particularly vital in supporting the pharmaceutical and food industries, where specialized handling and processing requirements necessitate advanced logistics capabilities.

Segment Analysis: By Temperature

Ambient Segment in Saudi Arabia Cold Chain Logistics Market

The ambient segment dominates the Saudi Arabian cold chain logistics market, commanding approximately 70% of the total market share in 2024. This segment, which maintains storage temperatures between 15 to 25 degrees Celsius, primarily caters to shelf-stable food products like pasta, rice, bread, cereals, canned goods, sauces, condiments, biscuits, cakes, tea, and coffee. The segment’s prominence is driven by the rising urban population’s demand for convenient, ready-to-eat, processed, and preserved foods that do not require refrigeration. The growth in disposable income among middle-class families has further boosted the consumption of processed food, while quick-service restaurants’ rapid expansion worldwide has increased the demand for convenience meals, strengthening the ambient segment’s position in the market.

Chilled Segment in Saudi Arabia Cold Chain Logistics Market

The chilled segment is projected to experience the fastest growth in the Saudi Arabian cold chain logistics market during 2024-2029, with an expected growth rate of approximately 12%. This segment, which maintains temperatures between -2°C to 6°C, is witnessing substantial growth driven by increasing demand for fresh dairy products, including milk, cream, yogurt, and specific pharmaceutical products. The Kingdom’s position as one of the top dairy exporting countries globally has significantly influenced this growth. The dairy sector’s achievement of 120% self-sufficiency has created extensive opportunities for chilled logistics services. Additionally, technological advancements in cooling and chilling processes, particularly the development of multi-temperature refrigerated trucks capable of maintaining different temperature zones, have further catalyzed the segment’s expansion.

Remaining Segments in Temperature-Based Cold Chain Logistics Market

The frozen segment, while smaller in market share, plays a crucial role in the Saudi Arabian cold chain logistics market by maintaining temperatures between -18°C to -24°C. This segment primarily serves the frozen food industry, including meat, poultry, seafood, and ice cream products. The segment’s importance has grown significantly with the increasing adoption of frozen food products, particularly during and after the pandemic period. The frozen segment benefits from the government’s initiatives to reduce food waste and investigate sanitary food preservation practices, though its growth potential is somewhat constrained by the need for specialized infrastructure and higher operational costs compared to other temperature segments.

Segment Analysis: By End User

Meats, Fish, and Poultry Segment in Saudi Arabia Cold Chain Logistics Market

The meats, fish, and poultry segment dominates the Saudi Arabia cold chain logistics market, holding approximately 38% of the market share in 2024. This segment’s prominence is driven by Saudi Arabia’s massive demand for poultry meat and its significant role as a major meat importer globally. The country has engaged in several trade agreements with major meat-producing countries to meet consumer demand for high-quality meat that complies with local slaughtering regulations. The Saudi government’s Vision 2030, which aims for 30 million religious tourists by 2030, is expected to boost the country’s hospitality and retail sectors, further driving demand in this segment. Additionally, the growing catering service industry, particularly during the Hajj pilgrimage which attracts millions yearly, significantly contributes to the segment’s dominance.

Pharmaceutical and Life Sciences Segment in Saudi Arabia Cold Chain Logistics Market

The pharmaceutical and life sciences segment is projected to experience the fastest growth rate of approximately 13% during the forecast period 2024-2029. This robust growth is attributed to Saudi Arabia’s comprehensive strategy to construct world-class biotechnology infrastructure, aiming to attract top talent and foster innovation in healthcare and life sciences. The Kingdom recognizes the sector’s potential, leveraging its population’s unique genetic makeup, digitized disease records, and global clinical research infrastructure. The chemical and pharmaceutical businesses have demonstrated particular effectiveness in addressing challenges, with Saudi Arabia currently housing roughly 50 recognized pharmaceutical factories. The dominant companies in the Saudi Arabian pharmaceutical market are focusing on effective business tactics such as drug development collaborations, partnerships, R&D activities, and regional expansions, all contributing to the segment’s accelerated growth.

Remaining Segments in Saudi Arabia Cold Chain Logistics Market End-User Segmentation

The remaining segments in the market include horticulture (fresh fruits and vegetables), dairy products, processed food products, and other end-users. The horticulture segment plays a crucial role in supporting Saudi Arabia’s position as a significant fruit and vegetable importer, while the dairy products segment benefits from the flourishing dairy industry and increasing consumption of milk and dairy products in the country. The processed food products segment is driven by rising disposable income among middle-class families and changing consumer preferences, while other end-users encompass various industries requiring temperature-controlled logistics solutions. Each of these segments contributes uniquely to the market’s dynamics, reflecting the diverse needs of Saudi Arabia’s cold chain logistics infrastructure. The integration of 3PL services and smart logistics solutions is enhancing the efficiency and effectiveness of these segments, ensuring that retail logistics and logistics optimization are achieved across the board.

Saudi Arabia Chain Logistics Industry Overview

Top Companies in Saudi Arabia Cold Chain Logistics Market

The Saudi Arabian cold chain logistics market features prominent players like Agility Logistics, Mosanada Logistics, Takhzeen Logistics, Wared Logistics, United Warehouse Company, Almajdouie, and AL Jelaidan. Companies are increasingly focusing on technological integration, with widespread adoption of automation technologies such as automated storage and retrieval systems, cloud storage, and Internet of Things solutions to enhance operational efficiency. Strategic partnerships and collaborations with global logistics providers have become a key trend, enabling local players to expand their service offerings and geographical reach. Infrastructure modernization initiatives, particularly in major cities like Riyadh, Jeddah, and Dammam, demonstrate the industry’s commitment to expanding cold storage capacity. Companies are also prioritizing sustainability through investments in solar-powered facilities and energy-efficient cooling systems, while simultaneously developing specialized solutions for the pharmaceutical and food logistics sectors.

Market Structure Shows Dynamic Growth Potential

The Saudi Arabian cold chain logistics market exhibits a dispersed competitive structure, characterized by a mix of established global players and strong regional operators. Global logistics giants like DHL, Aramex, and Maersk bring international expertise and advanced technological capabilities, while regional players such as Saudi Logistics Services and Jeldian Cold Store leverage their local market knowledge and established networks. The market is witnessing increased consolidation through strategic acquisitions and partnerships, as evidenced by recent moves from major players to strengthen their market positions through both horizontal and vertical integration strategies. The competitive landscape is further shaped by government initiatives supporting logistics sector development, particularly through the National Industrial Development and Logistics Program.

The market’s evolution is marked by significant investments in infrastructure development and capacity expansion, particularly in key logistics hubs. Companies are increasingly focusing on developing specialized capabilities in handling temperature-sensitive products, especially in the pharmaceutical and food sectors. The competitive dynamics are influenced by rising operational costs, including labor, land, and energy expenses, pushing companies to seek efficiency improvements through logistics technology adoption. Market participants are also expanding their service portfolios to include value-added services such as inventory management, quality control, and last-mile delivery solutions. The integration of logistics analytics is becoming crucial for optimizing these services and enhancing decision-making processes.

Innovation and Adaptation Drive Market Success

Success in the Saudi Arabian cold chain logistics market increasingly depends on companies’ ability to adapt to evolving customer requirements and technological advancements. Market leaders are strengthening their positions by investing in digital transformation initiatives, including warehouse automation, real-time tracking systems, and advanced temperature monitoring solutions. Companies focusing on developing specialized expertise in handling specific product categories, particularly pharmaceuticals and perishable foods, are gaining competitive advantages. The ability to offer integrated logistics solutions, combined with strong local market knowledge and international best practices, has become crucial for maintaining market share.

For new entrants and expanding players, success factors include developing strong partnerships with key stakeholders, including suppliers, retailers, and technology providers. The market presents opportunities for companies that can effectively address the growing demand for sustainable and energy-efficient cold chain solutions. Regulatory compliance, particularly with Saudi Food and Drug Authority requirements and international quality standards, remains a critical factor for success. Companies must also consider the increasing focus on localization initiatives and the need to develop local talent pools. The ability to provide flexible and customized solutions while maintaining cost efficiency will be crucial for long-term success in this evolving market. Leveraging a logistics control tower can enhance operational visibility and efficiency, providing a competitive edge.

Saudi Arabia Chain Logistics Market Leaders

-

- Coldstores Group of Saudi Arabia

- NAQEL Express

- Mosanada Logistics Services

- Agility Logistics

- Tamer Logistics

- *Disclaimer: Major Players sorted in no particular order

Saudi Arabia Chain Logistics Market News

- February 2023 – A. P. Moller – Maersk and Saudi Ports Authority ‘Mawani’ broke ground for Saudi Arabia’s largest Integrated Logistics Park at Jeddah Islamic Port. The bonded and non-bonded warehousing & distribution (W&D) facility will cover more than 70% of the total area of the Integrated Logistics Park while the remaining part will act as a hub for transhipment, air freight and LCL cargo. The W&D part will have several different sections to accommodate general warehousing and cold chain storage (fruits & vegetables, protein and confectionary & consumables). To cater to the rapid penetration of eCommerce in Saudi Arabia, the facility will also have a dedicated eCommerce fulfilment centre. The Integrated Logistics Park will be able to handle annual volumes of close to 200,000 TEUs across different products.

- November 2022 – As part of a land-concession deal announced by Saudi Arabia’s State Properties General Administration, Agility, a supply chain services, infrastructure, and innovation business, would develop a huge logistics park for storage and distribution near Jeddah. Agility will invest 611 million SAR (USD 163 million) in the park and will have the right to run it for 25 years under the terms of its deal with SPGA.

Saudi Arabia Chain Logistics Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Government Regulations and Initiatives

- 4.5 Technological Trends and Automation in Cold Storage Facilities

- 4.6 Industry Value Chain / Supply Chain Analysis

- 4.7 Porters Five Force Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Insights into Refrigerants and Packaging Materials used in Refrigerated Warehouses

- 4.9 Insights into Multi-temperature Controlled Vehicles

- 4.10 Impact of COVID-19 on the Market

5. Market Segmentation

- 5.1 By Service

- 5.1.1 Storage

- 5.1.2 Transportation

- 5.1.3 Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.)

- 5.2 By Temperature

- 5.2.1 Chilled

- 5.2.2 Frozen

- 5.3 By End User

- 5.3.1 Horticulture (Fresh Fruits and Vegetables)

- 5.3.2 Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3 Meats, Fish, and Poultry

- 5.3.4 Processed Food Products

- 5.3.5 Pharma and Life Sciences

- 5.3.6 Other End Users

6. Competitive Landscape

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Coldstores Group of Saudi Arabia

- 6.2.2 Mosanada Logistics Services

- 6.2.3 Wared Logistics

- 6.2.4 Agility Logistics

- 6.2.5 NAQEL Express

- 6.2.6 Al-Theyab Logistics Co.

- 6.2.7 IFFCO Logistics

- 6.2.8 Almajdouie Logistics

- 6.2.9 3 Camels Party Logistics

- 6.2.10 United Warehouse Company

- 6.2.11 Takhzeen Logistics*

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution by Activity, Contribution of Transport and Storage Sector to Economy)

- 8.2 Insights on Capital Flows (Investments in the Transport and Storage Sector)

- 8.3 E-commerce and Consumer Spending-related Statistics

- 8.4 External Trade Statistics – Exports and Imports, by Product and by Country of Destination/Origin

Saudi Arabia Chain Logistics Industry Segmentation

Cold chain logistics comprises establishments primarily engaged in operating refrigerated warehousing, storage facilities, and transportation of goods in temperature-controlled vehicles. The services provided by these establishments include blast freezing, tempering, and modified atmosphere storage services. A complete background analysis of the Saudi Arabia Cold Chain Logistics Market, including the assessment of the economy and contribution of sectors in the economy, market overview, market size estimation for key segments, and emerging trends in the market segments, market dynamics, and geographical trends, and COVID-19 impact, is covered in the report.

The Saudi Arabian cold chain logistics market is segmented by Service (Storage, Transportation, and Value-added Services), by Temperature (Chilled and Frozen), and by End User (Horticulture, Dairy Products, Meats, Fish, and Poultry, Processed Food Products, Pharma and Life Sciences, and Other End Users). The report offers the market sizes and forecasts for the Saudi Arabian cold chain logistics market in value (USD Million) for all the above segments.

| By Service | Storage |

| Transportation | |

| Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.) | |

| By Temperature | Chilled |

| Frozen | |

| By End User | Horticulture (Fresh Fruits and Vegetables) |

| Dairy Products (Milk, Ice-cream, Butter, etc.) | |

| Meats, Fish, and Poultry | |

| Processed Food Products | |

| Pharma and Life Sciences | |

| Other End Users |

Saudi Arabia Chain Logistics Market Research FAQs

The Saudi Arabia Chain Logistics Market size is expected to reach USD 1.68 billion in 2025 and grow at a CAGR of 11.39% to reach USD 2.88 billion by 2030.

In 2025, the Saudi Arabia Chain Logistics Market size is expected to reach USD 1.68 billion.

Coldstores Group of Saudi Arabia, NAQEL Express, Mosanada Logistics Services, Agility Logistics and Tamer Logistics are the major companies operating in the Saudi Arabia Chain Logistics Market.

In 2024, the Saudi Arabia Chain Logistics Market size was estimated at USD 1.49 billion. The report covers the Saudi Arabia Chain Logistics Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Saudi Arabia Chain Logistics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.