Robotics Industry Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Robotics Industry is Segmented by Type (Industrial, Service), End-User (End-Users of Industrial Robots (Automotive, Food & Beverage, Electronics, Other End-Users of Industrial Robots), End-Users of Service Robots (Logistics, Military and Defense, Medical and Healthcare, Other End-Users of Service Robots), and Geography (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa). The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

Robotics Industry Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Robotics Market Size

| Study Period | 2019 – 2030 |

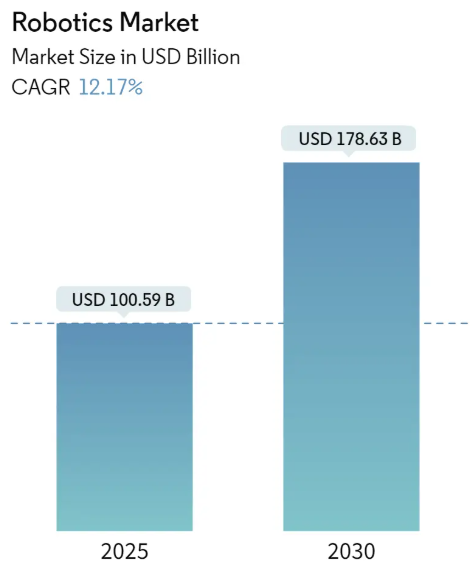

| Market Size (2025) | USD 100.59 Billion |

| Market Size (2030) | USD 178.63 Billion |

| CAGR (2025 – 2030) | 12.17 % |

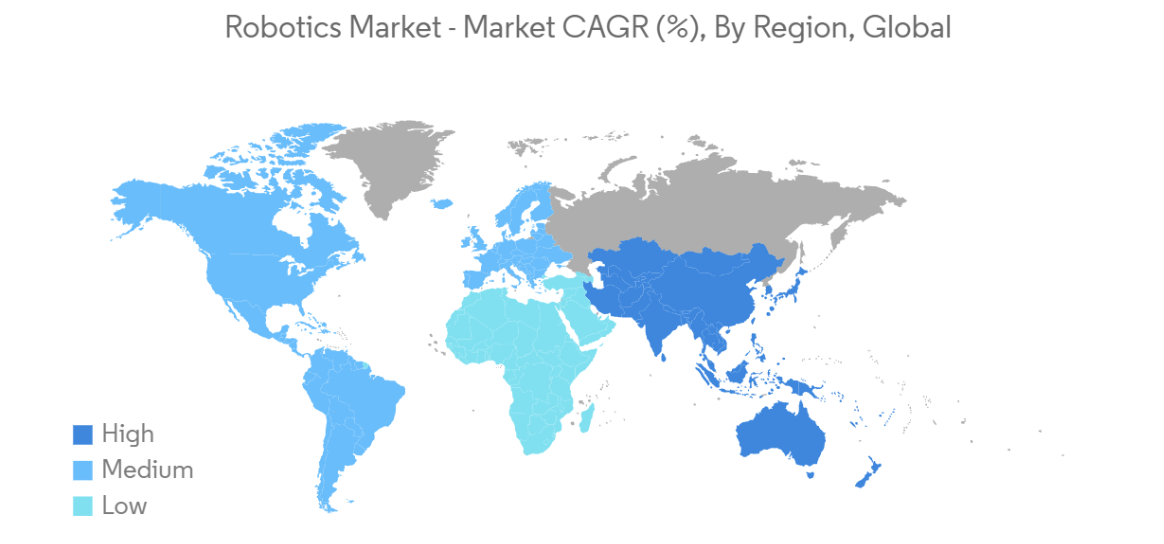

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Robotics Market with other markets in Technology, Media and Telecom Industry

Robotics Market Analysis

The Robotics Market size is estimated at USD 100.59 billion in 2025, and is expected to reach USD 178.63 billion by 2030, at a CAGR of 12.17% during the forecast period (2025-2030).

Robotics merges engineering and technology to develop intelligent machines known as robots. Whether human-controlled or autonomous, these robots can entertain or undertake tasks that may be tedious, complex, or pose health and safety risks. Robotics, categorized mainly into industrial and service types, finds extensive application across diverse end-user industries.

• Industrial robots are robotic systems used for manufacturing and industrial automation applications. They are programmable, automated, and capable of movement on three or more axes. These robots have sensors, controllers, and actuators to perform various functions and operations in industrial environments.have many uses, like welding, painting, assembly, disassembly, picking and placing, packaging and labeling, palletizing, material handling, and transporting goods. They are also used in heavy industry, such as mining and construction, for tasks that are too dangerous or difficult for human workers.

• In recent years, various industries have increasingly adopted advanced machinery and technological solutions. This trend is driven by several factors. For instance, businesses globally face rising labor costs, often resulting in reduced productivity. These escalating labor costs stem from government regulations, imbalances in supply and demand, and a dearth of skilled labor. As a result, many companies are turning to automated solutions as a more economical choice. This transition significantly boosts the 4.0 market, which is crucial for improving functionality, controllability, and safety in industrial settings.

• With the rising prominence of SMEs, governments worldwide are championing the adoption of digital and advanced industrial technologies. These efforts aim to streamline operations and boost efficiency, fostering a conducive environment for market growth. For context, in 2023, the United States boasted approximately 33 million SMEs. In India, as of February 2024, there were 39.32 million registered micro industries (Source: IBEF, Ministry of MSME), alongside 0.61 million small industries and 0.06 million medium industries.

• Robots integrated with advanced technologies cost more than traditional robots. The costs of robotic systems are associated with robust hardware and efficient software. Automation equipment involves the usage of advanced automation technologies that require high capital investment. For instance, an automated system may cost millions of dollars for design, fabrication, and installation.

• The pandemic has wreaked economic havoc on industries worldwide, from small enterprises to large corporations. Compounding these challenges, government-imposed lockdowns aimed at curbing the virus’s spread have adversely affected various sectors. For example, OPEC noted a drop in global crude oil demand from 100.27 million barrels per day in 2019 to 91.19 million barrels per day in 2020. However, projections indicate a rise to 104.46 million barrels per day by 2024.

Robotics Market Trends

Service Robots to Lead the Market During the Forecast Period

- Professional robots are primarily utilized outside manufacturing facilities in various professional settings. While industrial robots focus on automating manufacturing tasks, professional service robots—diverse in both form and function—take on menial, dangerous, time-consuming, or repetitive tasks. This automation allows human workers to engage in more cognitive functions.

- When businesses deploy professional safety is paramount. Instead of replacing human workers, these robots manage hazardous tasks, enabling humans to concentrate on cognitive functions and stay safe. For instance, in the defense sector, professional service robots are designed to shield soldiers from harm during combat.

- Advancements in technology have largely enhanced the functionality of security robots. These robots can be deployed in challenging scenarios for surveillance, with actions determined by sophisticated analytics. By integrating various sensors, professional robots have become adept at environmental analysis, yielding more dependable data. This evolution has notably bolstered their roles in security and patrolling.

- In addition, field robots are gaining traction in agriculture and construction. These robots are engineered to undertake tasks that are often challenging, hazardous, and time-intensive for humans, including bricklaying, demolition, and crop planting.

- Field robots, equipped with sensors like cameras, lidar, and GPS, autonomously navigate and perceive their surroundings. These advantages have spurred numerous manufacturers to develop field robots.

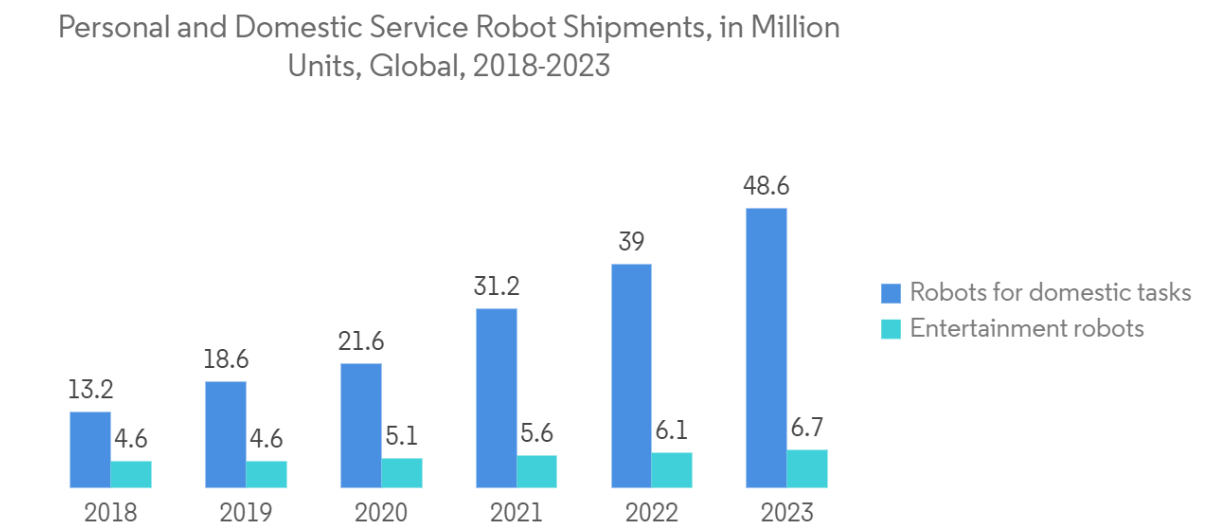

- The demand for domestic robots, particularly assistance, companion, and entertainment robots, has surged. This uptick is largely attributed to an aging population and a growing number of individuals facing mobility challenges.

- The World Health Organization (WHO) highlights a global trend: people are living longer, with many expecting to reach their sixties and beyond. This trend is universal, with every nation witnessing an increase in the number and proportion of older individuals. Projections indicate that by 2030, one in six people worldwide will be aged 60 or even older, with this demographic swelling from 1 billion in 2020 to 1.4 billion. By 2050, this number is set to double to 2.1 billion, and those aged 80 and above are expected to triple, reaching 426 million.

- According to the IFR, robots for domestic tasks constituted the largest group of consumer robots. Vacuuming and other indoor domestic floor cleaning robots are currently the most used applications. In 2023, the shipments of robots for domestic tasks and entertainment robots were anticipated to reach 48.6 million and 6.7 million, respectively. Such developments are expected to drive the market’s growth in the future.

Asia Pacific Expected to Witness Significant Growth

- China is leading the global manufacturing industry and creating significant market demand. More Chinese manufacturers are adopting Industry 4.0 solutions to improve efficiency, driving further market growth.

- China’s manufacturing sector is quickly moving toward Industry 4.0, with the country being a key player in the digital revolution. China focuses on innovation and boosting competitiveness by leveraging its strong industrial base and technological knowledge. Under initiatives like “Made in China 2025,” the Chinese government aims to bolster the nation’s manufacturing prowess and foster high-tech industries. Such initiatives are likely to drive the growth of the market.

- In addition, South Korea, bolstered by a robust manufacturing sector and steadfast government support for tech innovation, stands at the forefront of adopting industrial automation. With its technological strides and industrial might, the country is poised to excel and significantly bolster its economic standing in this market.

- South Korea’s thriving automotive sector presents promising prospects for expanding the market studied. South Korean car manufacturers, including Kia and Hyundai, are ramping up production capacities and significantly investing in R&D, buoyed by rising global interest in electric vehicles and government support for bolstering domestic manufacturing.

- The automotive industry in Taiwan has experienced significant growth in recent years. With a focus on electric vehicles and smart mobility solutions, Taiwan positioned itself as a key player in the global automotive industry. In addition, Taiwan’s expertise in semiconductor manufacturing allowed it to supply critical components for advanced driver-assistance systems (ADAS) and autonomous vehicles.

- In addition, Japan’s automotive sector, which historically contributes to over 89% of the nation’s GDP, is undergoing a significant shift. Driven by Japan’s ambitious targets of achieving net-zero emissions by 2050 and a 46% reduction by 2030, electric vehicles (EVs) are gaining traction.

- Further emphasizing this shift, Japan’s Ministry of Economy, Trade, and Industry (METI) set an even more ambitious goal under the Green Growth Strategy: achieving a 100% sales share for EVs by 2035. Notably, hybrid electric vehicles (HEVs) are already a significant player, accounting for nearly 30% of total vehicle sales in Japan.

Robotics Industry Overview

In the robotics market, global and regional players vie for dominance in a fiercely competitive arena. Competition hinges on factors like pricing, product offerings, and market share, as well as the vigor with which firms engage in the market. Leading companies wield significant influence through their R&D and consolidation efforts. However, the market is marked by high penetration and growing fragmentation.

Innovation is key to securing a lasting competitive edge in this landscape. Established players strategically focus on product differentiation and expand their market reach to maintain their positions. Acquisitions, partnerships with industry participants, and new product/service rollouts have been key competitive strategies exhibited by vendors in the market.

Some of the major players in the market are ABB Ltd, Yaskawa Electric Corporation, Denso Corporation, Fanuc Corporation, and KUKA AG, among others. Competition hinges on factors like pricing, product offerings, and market share, as well as the vigor with which firms engage in the market. Leading companies wield significant influence through their R&D and consolidation efforts.

Robotics Market Leaders

- ABB Ltd

- Yaskawa Electric Corporation

- Denso Corporation

- Fanuc Corporation

- KUKA Aktiengesellschaft

- *Disclaimer: Major Players sorted in no particular order

Robotics Market News

- July 2024: FANUC America officially inaugurated its expansive 650,000-square-foot West Campus in Auburn Hills, Michigan. With this expansion, FANUC’s presence in Michigan exceeds 2 million square feet. This move aligns with the company’s strategic vision to bolster industrial automation across North America. The West Campus, a significant USD 110 million investment, sprawls across 67 acres. It boasts state-of-the-art product manufacturing, tailored automation systems, and ample warehouse space, accommodating over 6,000 swiftly deliverable robots and a multitude of parts.

- May 2024: ABB Robotics expanded its modular large robot portfolio with the launch of the new IRB 7710 and IRB 7720. These additions, alongside the recently introduced IRB 5710-IRB 5720 and IRB 6710-IRB 6740, bring the total to 46 distinct variants. These variants can handle payloads ranging from 70 kg to 620 kg, providing customers enhanced flexibility, a broader selection, and improved performance in their operations.

- April 2024: Yaskawa Europe, the European arm of Japan’s Yaskawa Electric, inaugurated the construction of a new robotics distribution center and assembly hall for robot welding systems in Kočevje, southern Slovenia. This distribution hub aims to streamline robot order processing for the Europe, Middle East, and African (EMEA) regions.

Robotics Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness – Porter’s Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry