Mexico Crop Chemicals Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The report covers Mexican Agro Chemicals Market Research and is Segmented by Type (Fertilizers, Pesticides, Adjuvants, and Plant Growth Regulators) and Application (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Turf and Ornamentals, and Other Applications). The report offers market sizing and forecasts in value (USD million) for all the above segments.

Mexico Crop Chemicals Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Mexican Agro Chemicals Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

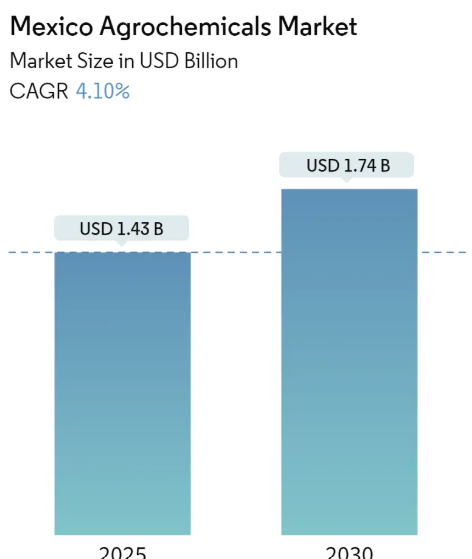

| Market Size (2025) | USD 1.43 Billion |

| Market Size (2030) | USD 1.74 Billion |

| CAGR (2025 – 2030) | 4.10 % |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Mexico Agrochemicals Market with other markets in Agriculture Industry

Seeds

Crop Protection

Fertilizers

Agricultural Commodities

Agriculture Services

Agricultural Machinery and Technology

Mexico Crop Chemicals Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 4.10% (2025 – 2030) |

| Countries/ Region Covered: | Mexico |

| Major Players: | Bayer, BASF, Syngenta, FMC, UPL |

Mexican Agro Chemicals Market Analysis

The Mexico Agrochemicals Market size is estimated at USD 1.43 billion in 2025, and is expected to reach USD 1.74 billion by 2030, at a CAGR of 4.1% during the forecast period (2025-2030).

The Mexican agrochemicals industry is undergoing a significant transformation driven by evolving regulatory frameworks and environmental considerations. A major regulatory shift occurred in December 2021 when Mexico passed a decree to eliminate the use of glyphosate herbicide by 2024, signaling a strong push towards sustainable agricultural practices. The comprehensive regulatory framework currently oversees more than 3,000 different agrochemical products used across various applications, though challenges persist in registration processes and enforcement activities. This regulatory landscape is reshaping product development strategies and forcing industry players to innovate in sustainable alternatives.

The supply chain dynamics of Mexico’s agrochemical sector are heavily influenced by state-level intervention and international trade relationships. Petróleos Mexicanos (PEMEX), the state-owned entity, maintains strict regulation over agricultural inputs imports to control price fluctuations and manage supply constraints, particularly given reduced supplies from major global producers like Russia and China. This centralized import control mechanism has become increasingly crucial as the country adapts to global supply chain disruptions and seeks to ensure stable domestic availability of agricultural inputs.

Agricultural productivity demands are intensifying as Mexico balances decreasing arable land with increasing food production needs. With available arable land standing at 20 million hectares in 2021, showing a decline from 2017 levels, the efficient use of agricultural chemicals has become paramount for maintaining and improving crop yields. The country’s position as the third-largest producer of ornamental plants globally, with 12,600 hectares dedicated to ornamental farming, demonstrates the diverse agricultural base requiring specialized plant protection products.

The industry is witnessing a marked shift towards sustainable and bio-based agricultural solutions, driven by both regulatory requirements and changing farmer preferences. This transition is particularly evident in the development of alternative products to replace conventional pesticides facing regulatory scrutiny. Companies are increasingly investing in research and development of agricultural biologicals, sustainable formulations, and integrated pest management solutions that align with stricter environmental standards while maintaining agricultural productivity. This evolution is creating new market opportunities while requiring significant adaptation from traditional agricultural chemicals manufacturers.

Mexican Agro Chemicals Market Trends

Growing Population and Food Security Concerns

The rapidly expanding population in Mexico has emerged as a primary driver for the agrochemicals market, with the country reaching 132.2 million people in 2022, marking a significant 3% increase from 2020. This demographic growth has created unprecedented pressure on the agricultural sector to enhance food production capabilities and ensure food security for the growing population. The increasing population density has led to a greater emphasis on optimizing agricultural yields from the available arable land, which stood at 20 million hectares in 2020, making fertilizers an essential component of modern farming practices.

The focus on food security has become particularly crucial as the agricultural sector strives to maintain a balance between population growth and food production capabilities. This has resulted in farmers adopting more intensive farming practices and increasing their reliance on agricultural fertilizers to maximize crop yields. The situation is further intensified by the need to protect crops from various pests and diseases, particularly in key agricultural regions such as Veracruz, Tamaulipas, Chiapas, and Michoacan, where the demand for effective crop protection solutions has seen a substantial rise.

Technological Advancements in Agrochemical Products

The Mexican agrochemicals market has been significantly driven by technical and scientific advances that have revolutionized fertilizer application methods and efficiency. These technological improvements have enabled farmers to maximize the benefits of agricultural nutrients while simultaneously reducing associated risks and environmental impact. A notable advancement has been the development and widespread adoption of slow-release fertilizers and controlled-release fertilizers, which have found extensive applications in turf management, nurseries, and broad-acre crops like maize, demonstrating the market’s evolution towards more sophisticated and efficient agricultural solutions.

The innovation in agrochemical formulations has led to the development of more targeted and effective products, particularly in the realm of biological organic fertilizers. These advanced formulations have proven crucial in improving the bioavailability of nutrients, leading to enhanced farm productivity and sustainable agricultural practices. The technological progress has also facilitated the creation of specialty fertilizer products by key market players, addressing specific crop needs and environmental concerns. This continuous innovation in product development and application techniques has not only improved the efficiency of agrochemical usage but has also contributed to better crop yields and reduced environmental impact, making it a significant driver for market growth.

Rising Agricultural Import Dependencies

Mexico’s increasing dependence on agricultural imports has become a significant driver for the agrochemicals market, as evidenced by the substantial rise in fertilizer imports. According to UN Comtrade data, the country’s fertilizer import value witnessed a remarkable increase from USD 1,345.2 million in 2017 to USD 2,091.5 million in 2021, representing a 44.7% increase from the previous year. This significant surge in imports, primarily from major suppliers including the Russian Federation, the United States, and China, reflects the growing domestic demand for agricultural inputs and the need to enhance local agricultural productivity.

The increasing import dependency has prompted both government and private sector stakeholders to focus on improving domestic agricultural productivity through enhanced use of agricultural inputs. This trend is particularly evident in major agricultural states such as Veracruz, Tamaulipas, Chiapas, Michoacan, Chihuahua, Guanajuato, and Sinaloa, where chemical fertilizer usage has seen significant growth. The rising import values have also led to increased investments in domestic agricultural infrastructure and the development of more efficient agrochemical distribution networks, further driving market growth and adoption of advanced agricultural additives.

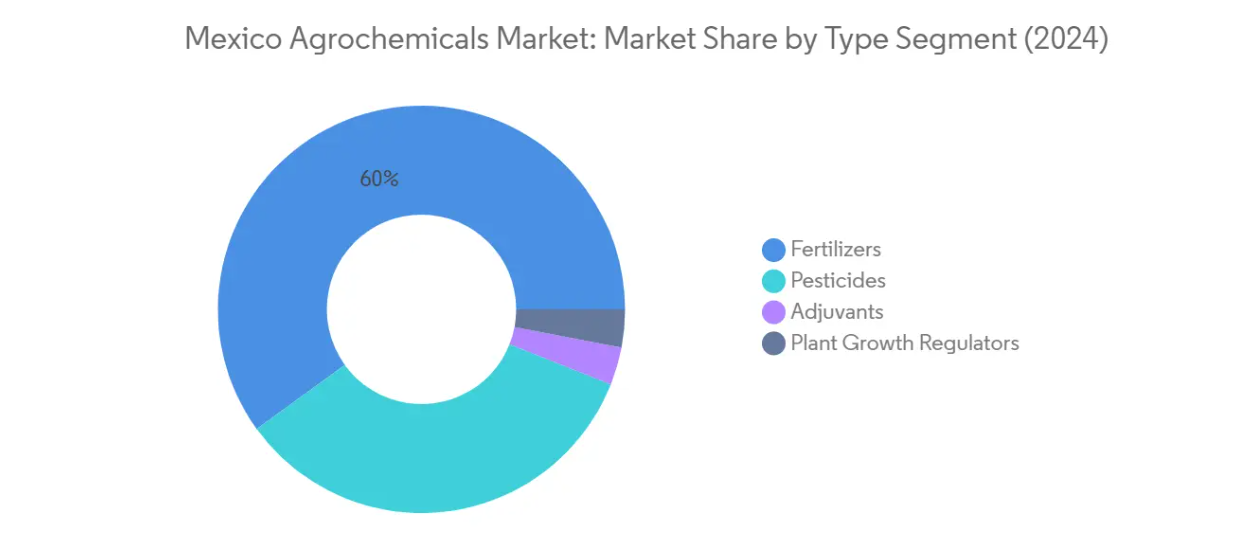

Segment Analysis: Type

Fertilizers Segment in Mexico Agrochemicals Market

The fertilizers segment dominates the Mexico agrochemicals market, accounting for approximately 60% of the total market share in 2024. This segment’s prominence is driven by the increasing focus on improving crop yields and soil fertility across Mexico’s diverse agricultural landscape. According to World Bank data, fertilizer consumption in Mexico has shown a significant upward trend, with consumption rates reaching over 100 kilograms per hectare of arable land. The segment is also experiencing the fastest growth rate in the market, projected to grow at nearly 5% during 2024-2029, driven by the rising adoption of precision farming techniques and the development of specialized fertilizer products. States like Veracruz, Tamaulipas, Chiapas, Michoacan, Chihuahua, Guanajuato, and Sinaloa are the primary consumers of chemical fertilizers in the country. The increasing emphasis on sustainable agriculture and the development of slow-release and controlled-release fertilizers has further strengthened this segment’s position in the market.

Remaining Segments in Mexico Agrochemicals Market by Type

The pesticides segment represents the second-largest portion of the market, followed by smaller but significant segments including adjuvants and plant growth regulators. Pesticides play a crucial role in crop protection and pest management across various agricultural applications. The adjuvants segment, while smaller, is gaining importance due to its role in improving the efficiency of agricultural chemical applications and reducing waste. Plant growth regulators, though representing the smallest segment, are becoming increasingly important in specialized agricultural applications, particularly in fruit and vegetable production. These segments collectively contribute to the comprehensive agricultural chemical solutions available to Mexican farmers, supporting various aspects of crop production from pest control to growth enhancement and chemical application efficiency.

Segment Analysis: Application

Grains and Cereals Segment in Mexico Agrochemicals Market

The grains and cereals segment continues to dominate the Mexico agrochemicals market, commanding approximately 41% of the total market share in 2024. This significant market position is primarily driven by Mexico’s extensive cereal production, particularly maize, which is a staple crop in the country. According to recent agricultural data, the productivity of cereal crops has shown remarkable improvement, largely attributed to enhanced farming practices and systematic application of crop protection products. The segment’s prominence is further reinforced by the rising demand for crop protection chemicals, particularly for addressing challenges like the Fall Army Worm (FAW) infestation in corn fields. Major agrochemical companies are actively introducing innovative products specifically designed for grain and cereal protection, demonstrating the segment’s strategic importance in the market.

Fruits and Vegetables Segment in Mexico Agrochemicals Market

The fruits and vegetables segment is emerging as the fastest-growing category in the Mexico agrochemicals market, projected to grow at approximately 5% during 2024-2029. This robust growth is driven by Mexico’s position as a major producer and exporter of various fruits and vegetables, including tomatoes, bananas, chili peppers, oranges, lemons, limes, mangos, and avocados. The segment’s growth is particularly fueled by the increasing need for specialized pest and disease control solutions, especially for addressing challenges like nematodes and various crop-specific diseases. The rising adoption of advanced agricultural pesticides for high-value fruit and vegetable crops, coupled with the growing emphasis on quality produce for both domestic consumption and export markets, is propelling this segment’s rapid expansion.

Remaining Segments in Application Segmentation

The other significant segments in the Mexico agrochemicals market include pulses and oilseeds, turf and ornamental grass, and other crops. The pulses and oilseeds segment maintains a substantial presence in the market, driven by the growing soybean production and increasing demand for oilseed crops. The turf and ornamental grass segment, while smaller, serves a specialized market catering to sports facilities and ornamental farming, with Mexico being a significant producer of ornamental plants. The other crops segment encompasses various commercial crops such as cotton and sugar cane, contributing to the market’s diversity and overall growth dynamics.

Mexican Agro Chemicals Industry Overview

Top Companies in Mexico Agrochemicals Market

The Mexico agrochemicals market is characterized by strong product innovation initiatives and strategic expansions by leading players. Companies are actively investing in research and development to create novel molecules and sustainable agricultural chemicals solutions, particularly focusing on bio-based alternatives and integrated pest management solutions. Operational agility is demonstrated through robust distribution networks and localized manufacturing facilities, enabling quick responses to market demands. Strategic moves predominantly involve partnerships and collaborations with local distributors and research institutions to enhance market penetration and technical expertise. Market leaders are expanding their presence through acquisitions of smaller regional players and the establishment of new production facilities, while simultaneously focusing on developing digital farming solutions and precision agriculture technologies to maintain a competitive advantage.

Consolidated Market Led By Global Players

The Mexican agrochemicals landscape is highly consolidated, with multinational corporations dominating the market space. These global conglomerates leverage their extensive research capabilities, diverse product portfolios, and established distribution networks to maintain market leadership. The presence of local players is limited, with most operating in specific regional pockets or focusing on niche product segments. Merger and acquisition activities have been particularly prominent, with larger companies acquiring smaller firms to expand their product offerings and geographical reach.

The market structure favors established players who can invest significantly in product development and regulatory compliance. Major agricultural input companies have strengthened their position through vertical integration, controlling everything from research and development to distribution channels. Local manufacturers primarily operate as contract manufacturers or distributors for global players, while some specialize in generic products. The competitive dynamics are further shaped by strategic alliances between multinational companies and local distributors to enhance market access and customer reach.

Innovation and Sustainability Drive Future Success

Success in the Mexican agrochemicals market increasingly depends on companies’ ability to develop sustainable and environmentally friendly solutions while maintaining product efficacy. Market leaders are focusing on developing integrated crop protection products solutions that combine chemical and biological products with digital farming technologies. Companies are also investing in building strong relationships with farming communities through technical support and education programs, while simultaneously expanding their distribution networks to reach underserved areas.

For new entrants and smaller players, success lies in identifying and serving niche markets or specific crop segments where larger players have limited presence. The development of specialized agricultural biologicals for local crop varieties and specific pest problems presents opportunities for differentiation. Companies must also prepare for increasing regulatory scrutiny regarding environmental impact and safety standards, while addressing growing consumer preference for sustainable farming practices. Building partnerships with research institutions and agricultural organizations has become crucial for maintaining technological competitiveness and market relevance.

Mexican Agro Chemicals Market Leaders

-

- Bayer AG

- BASF SE

- Syngenta

- FMC Corporation

- UPL Limited

- *Disclaimer: Major Players sorted in no particular order

Mexican Agro Chemicals Market News

- November 2022; In Mexico, a broad coalition of Mexican lawmakers is pushing the government to ban nearly 200 chemicals used in pesticides, showing that they are harmful to humans. This plan has already alarmed farmers as it will affect food production and agrochemical prices.

- August 2022; Futureco Bioscience, a Spanish manufacturer of sustainable plant bioprotectants and biostimulants, partnered with Innovak Global to distribute BESTCURE in Mexico. The product is registered for high-value crops such as courgette, squash, chayote, melon, watermelon, and cucumber in the Mexican market,

- March 2022: According to the Secretary of Agriculture and Rural Development of Mexico, regarding the expansion of the National Programme of Fertilizers with the support of Petroleos Mexicanos(Premex), it is mandated to produce all the fertilizers nationally and not crucial for all state-owned premix. This is due to the price increase and lack of international supply.

Mexican Agro Chemicals Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Fertilizers

- 5.1.2 Pesticides

- 5.1.3 Adjuvants

- 5.1.4 Plant Growth Regulators

- 5.2 Application

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Fruits and Vegetables

- 5.2.4 Turf and Ornamentals

- 5.2.5 Other Applications

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Bayer AG

- 6.3.2 Rovensa

- 6.3.3 Yara International ASA

- 6.3.4 BASF SE

- 6.3.5 Adama

- 6.3.6 Summit Agro México

- 6.3.7 Ibarquim Group

- 6.3.8 Syngenta

- 6.3.9 FMC Corporation

- 6.3.10 International Chemical Copper SA de CV

- 6.3.11 Velsimex

- 6.3.12 UPL Ltd.

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Mexican Agro Chemicals Industry Segmentation

According to the Organization for Economic Co-operation and Development (OECD), agrochemicals are commercially produced, generally for use in farming as fertilizers, pesticides, or soil conditioners. The agrochemical industry operates in B2B and B2C business formats. To eliminate double-count errors in market estimations, bulk buyers procuring agrochemicals for retail sale after value addition through further processing are not considered part of the agrochemical market. The Mexican agrochemicals market is segmented by type (fertilizers, pesticides, adjuvants, and plant growth regulators) and application (grains and cereals, pulses and oilseeds, fruits and vegetables, turf and ornamentals, and other applications). The report offers market sizing and forecasts in value (USD million) for all the above segments.

| Type | Fertilizers |

| Pesticides | |

| Adjuvants | |

| Plant Growth Regulators | |

| Application | Grains and Cereals |

| Pulses and Oilseeds | |

| Fruits and Vegetables | |

| Turf and Ornamentals | |

| Other Applications |

Mexican Agro Chemicals Market Research FAQs

The Mexico Agrochemicals Market size is expected to reach USD 1.43 billion in 2025 and grow at a CAGR of 4.10% to reach USD 1.74 billion by 2030.

In 2025, the Mexico Agrochemicals Market size is expected to reach USD 1.43 billion.

Bayer AG, BASF SE, Syngenta, FMC Corporation and UPL Limited are the major companies operating in the Mexico Agrochemicals Market.

In 2024, the Mexico Agrochemicals Market size was estimated at USD 1.37 billion. The report covers the Mexico Agrochemicals Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Mexico Agrochemicals Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.