Kuwait Oilfield Services Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

the Report Covers Kuwait Oilfield Services Market Size & Share and It is Segmented by Service Type (Drilling Services, Completion Services, Production Services, and Other Services) and Location of Deployment (Onshore and Offshore). the Report Offers Market Size and Demand Forecasts for the Kuwait Oilfield Services Market in USD for all the Above Segments.

Kuwait Oilfield Services Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Kuwait Oilfield Services Market Size

| Study Period | 2020 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

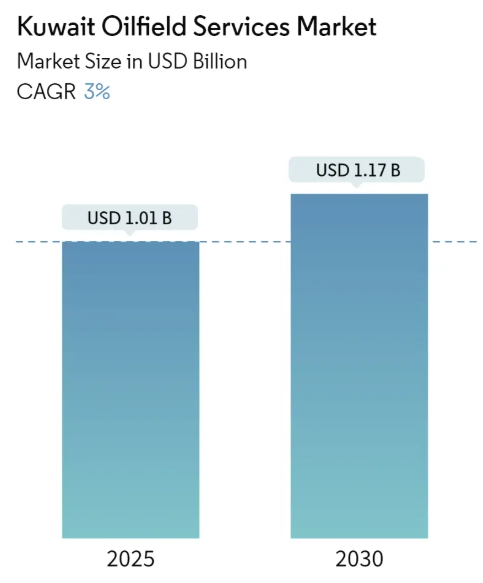

| Market Size (2025) | USD 1.01 Billion |

| Market Size (2030) | USD 1.17 Billion |

| Growth Rate (2025 – 2030) | 3.00% CAGR |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Kuwait Oilfield Services Market with other markets in Energy & Power Industry

Kuwait Oilfield Services Market Analysis

The Kuwait Oilfield Services Market size is estimated at USD 1.01 billion in 2025, and is expected to reach USD 1.17 billion by 2030, at a CAGR of 3% during the forecast period (2025-2030).

Kuwait’s oilfield services industry plays a vital role in the country’s economy, with the hydrocarbon sector contributing significantly to its economic growth. As of 2022, Kuwait holds approximately 7% of global oil reserves with a current production capacity of about 3.15 million barrels per day, positioning it as a major player in the global oil market. The Kuwait Petroleum Corporation (KPC), through its subsidiary Kuwait Oil Company (KOC), maintains comprehensive oversight of the country’s oil and gas sector, implementing strategic initiatives to enhance production capabilities and modernize operations. The industry has witnessed substantial technological advancement, particularly in areas such as digital oilfield technologies and enhanced oil recovery techniques.

The sector is experiencing a transformative phase with an increased focus on both onshore and offshore services developments. In mid-2022, Kuwait embarked on its first offshore drilling campaign, marking a significant milestone in the country’s oil and gas exploration history. This development came after Kuwait Oil Company signed a contract with Halliburton for drilling services, including the provision of drilling fluids, well testing, and offshore logistical services. The expansion into offshore exploration represents a strategic diversification of Kuwait’s traditional onshore-focused operations.

Investment in infrastructure and exploration activities has remained robust, with Kuwait announcing plans to invest approximately USD 44 billion in oil production, exploration, and related projects until 2025. This substantial investment commitment is part of a broader strategy to enhance production capabilities and modernize existing facilities. The Kuwait Oil Company has set ambitious targets, including plans to drill approximately 700 wells annually in the coming years, demonstrating the country’s commitment to expanding its production capacity and maintaining its position as a key global oil supplier.

The industry is witnessing significant technological integration and modernization efforts across its operations. Kuwait Oil Company (KOC) has prioritized the digitalization of oil fields to reduce costs and improve operational workflows, implementing advanced technologies for reservoir management and production optimization. In February 2023, a notable development occurred when Combined Group Contracting (CGC) secured a USD 76.5 million contract from Kuwait Oil Company for the installation of flow lines and associated works in Umm Niqa and South Ratqa, highlighting the ongoing infrastructure development in the sector. These technological advancements and infrastructure improvements are positioning Kuwait’s oilfield services sector for enhanced efficiency and productivity. Furthermore, the integration of oil and gas equipment and services is crucial in supporting these advancements, ensuring the industry remains competitive on a global scale.

Kuwait Oilfield Services Market Trends

Increase in Offshore Oil & Gas Projects and Related Investments

Kuwait’s strategic push into offshore oil and gas exploration represents a significant shift in the country’s energy landscape, backed by substantial investments and government initiatives. In 2022, the government of Kuwait announced a landmark USD 44 billion investment plan for oil production, exploration, and related projects until 2025, demonstrating its commitment to expanding offshore capabilities. The Kuwait Petroleum Corporation (KPC) has specifically focused on offshore exploration drilling projects, with an ambitious target of having offshore projects contribute 25% to the overall hydrocarbon output. This strategic direction is further reinforced by the commencement of Kuwait’s first offshore drilling rig in 2022, which holds the potential to produce 615,000 barrels of oil per day, primarily aimed at meeting Europe’s increasing energy demands.

The development of offshore projects has gained significant momentum through strategic partnerships and international collaboration. A notable example is the contract between Kuwait Oil Company and Halliburton, where the latter manages offshore services and provides comprehensive drilling services, including wireline, perforating, well-testing, coring, and logistical support. Additionally, Kuwait has partnered with Saudi Arabia to develop the offshore Durra Gas field in the partitioned Neutral Zone, which is projected to produce approximately one billion cubic feet of natural gas and 84,000 barrels of condensates daily. These developments are particularly significant considering Kuwait’s position as a major global oil producer, holding approximately 7% of global oil reserves and maintaining a production capacity of about 3.15 million barrels per day as of 2022. The expansion into offshore projects is crucial for achieving Kuwait’s strategic goal of reaching a production capacity of 4 million barrels per day by 2040, creating sustained demand for oil exploration services and oil and gas support services across various operational aspects.

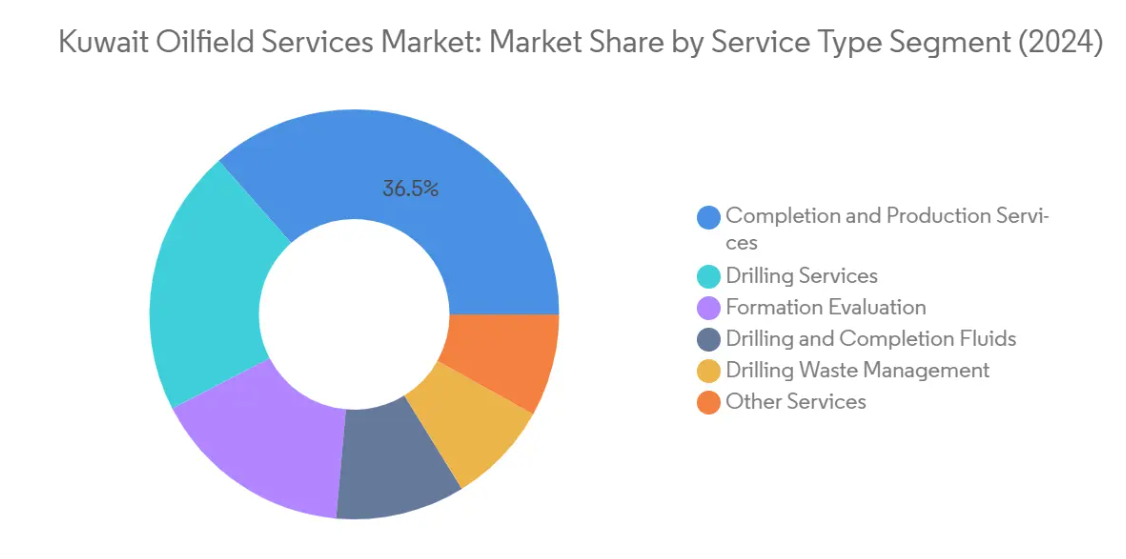

Segment Analysis: By Service Type

Completion and Production Services Segment in Kuwait Oilfield Services Market

The completion services and production services segment dominates the Kuwait Oilfield Services market, holding approximately 37% market share in 2024. This segment’s prominence is driven by Kuwait’s ambitious plans to increase its oil production capacity to 3.5 million barrels per day by 2025 and 4 million barrels per day by 2040. The segment’s growth is further supported by significant investments in optimizing operational efficiency and increasing production from major oilfields like West Kuwait, South Kuwait, and East Kuwait. The implementation of advanced technologies, including cloud-based subscription services for exploration and production applications and automated work processes, has enhanced the segment’s capabilities. Additionally, the development of offshore projects and the rising demand for well completion services and production technology in offshore wells have contributed to the segment’s market leadership.

Formation Evaluation Segment in Kuwait Oilfield Services Market

The Formation Evaluation segment is emerging as the fastest-growing segment in the Kuwait oilfield services market, with a projected growth rate of approximately 4% during 2024-2029. This robust growth is primarily driven by increasing investments in exploration activities and technological upgrades in data collection and processing techniques. The integration of advanced technologies, such as cloud computing and improved data collection methods, has significantly enhanced the quality of data and productivity of well-logging techniques. The segment’s growth is further supported by Kuwait’s substantial proven reserves of more than 101 billion barrels of crude oil and 1.784 trillion cubic meters of natural gas, which require sophisticated formation evaluation services for efficient extraction and utilization of these hydrocarbon reserves.

Remaining Segments in Kuwait Oilfield Services Market

The other significant segments in the Kuwait Oilfield Services market include drilling services, Drilling and Completion Fluids, Drilling Waste Management Services, and Other Services. The drilling services segment plays a crucial role in both onshore and offshore operations, particularly with Kuwait’s recent expansion into offshore drilling activities. The Drilling and Completion Fluids segment is essential for successful well completion, with water-based muds being preferred due to their cost-effectiveness and environmental friendliness. The Drilling Waste Management Services segment has gained importance due to increasing environmental consciousness and regulatory requirements. Other Services, including seismic data acquisition and offshore support services, continue to support the overall market growth through specialized technical offerings.

Segment Analysis: Location of Deployment

Onshore Segment in Kuwait Oilfield Services Market

The onshore segment dominates the Kuwait oilfield services market, accounting for approximately 93% of the total market share in 2024. This dominance is primarily attributed to Kuwait’s extensive onshore oil and gas infrastructure, including major producing areas like north Kuwait, west Kuwait, and southeast Kuwait. The Greater Burgan field, which is the world’s second-largest oilfield, remains a crucial contributor to Kuwait’s onshore production capabilities, sustaining an output of about 1.6 million barrels per day through advanced gas injection and water flooding techniques. The Kuwait Oil Company’s ambitious plans to boost production and significant investments in onshore field development continue to drive the segment’s growth. The company’s focus on developing fields such as Bahra in North Kuwait and implementing enhanced oil recovery techniques in mature fields demonstrates the ongoing importance of onshore operations. Additionally, the substantial investment of USD 44 billion allocated for oil production, exploration, and other projects until 2025 primarily targets onshore developments, further solidifying this segment’s market leadership.

Offshore Segment in Kuwait Oilfield Services Market

The offshore segment is emerging as the fastest-growing sector in Kuwait’s oilfield services market, driven by the country’s strategic push to diversify its production capabilities beyond onshore fields. Kuwait’s first offshore drilling campaign, initiated with advanced drilling services and offshore logistical support, marks a significant milestone in the country’s oil and gas industry development. The segment’s growth is further accelerated by collaborative projects such as the development of the Durra offshore gas field in partnership with Saudi Arabia, which aims to produce approximately one billion cubic feet of natural gas and 84,000 barrels of condensates daily. The Kuwait Petroleum Corporation’s strategic vision includes offshore production contributing up to 25% of the overall output, supported by extensive exploration activities and infrastructure development. This ambitious expansion into offshore operations, coupled with technological advancements and international partnerships, positions the segment for substantial growth in the forecast period from 2024 to 2029.

Kuwait Oilfield Services Industry Overview

Top Companies in Kuwait Oilfield Services Market

The Kuwait oilfield services market features a mix of established international players and local specialists, with companies like Kuwait Petroleum Corporation, Fugro NV, KCA Deutag Drilling, and SGS SA leading the sector. The industry demonstrates strong product innovation trends, particularly in digital technologies, with companies investing in advanced drilling technologies, formation evaluation tools, and integrated service platforms. Companies are increasingly focusing on operational agility through the development of smart software applications and remote operations capabilities, exemplified by developments like KCA Deutag’s +veDRILL platform suite. Strategic partnerships and collaborations have become paramount, as evidenced by multiple long-term agreements between service providers and national oil companies. Market players are also emphasizing technological upgrades in data collection and processing techniques, while simultaneously expanding their service portfolios through strategic acquisitions and joint ventures to strengthen their market positions.

Market Consolidation Drives Strategic Partnerships Growth

The Kuwait oil and gas equipment and services market exhibits a balanced mix of global conglomerates and specialized local players, with international companies leveraging their technological expertise while local firms capitalize on their regional knowledge and established relationships. The market structure is characterized by a moderate level of consolidation, with major players actively pursuing strategic acquisitions to enhance their service capabilities and geographic reach. Recent years have witnessed significant merger and acquisition activities, particularly exemplified by KCA Deutag’s acquisition of Saipem’s onshore drilling operations in Kuwait and National Energy Services Reunited’s strategic acquisitions in the region.

The competitive dynamics are further shaped by the strong presence of state-owned enterprises and their influence on market operations, creating a unique environment where public-private partnerships play a crucial role. The market demonstrates a clear trend toward vertical integration, with service providers expanding their capabilities across the value chain through strategic alliances and joint ventures. This evolution has led to the emergence of integrated service providers capable of offering comprehensive solutions, while specialized players maintain their competitive edge through niche expertise and local market understanding.

Innovation and Integration Key to Growth

Success in the Kuwait energy field services market increasingly depends on companies’ ability to integrate advanced technologies while maintaining cost competitiveness. Incumbent players must focus on developing comprehensive digital solutions, enhancing operational efficiency through automation, and strengthening their local presence through strategic partnerships with Kuwaiti entities. The ability to offer integrated services while maintaining specialized expertise in critical areas has become crucial for maintaining market share. Companies must also demonstrate strong environmental compliance capabilities and invest in sustainable technologies to align with evolving industry standards and regulatory requirements.

For contenders looking to gain ground, the focus should be on developing specialized technological capabilities while building strong relationships with key stakeholders in the Kuwaiti oil and gas sector. Success factors include the ability to offer innovative solutions that address specific regional challenges, maintaining competitive pricing structures, and demonstrating strong local content capabilities. The market’s future will be significantly influenced by the ability to adapt to changing end-user requirements, particularly in terms of technological integration and environmental sustainability. Companies must also consider the increasing emphasis on local content requirements and the need to develop strong local workforce capabilities while managing potential regulatory changes in the sector.

Kuwait Oilfield Services Market Leaders

-

- Kuwait Petroleum Corporation

- Fugro Nv

- Kca Deutag Alpha Limited

- Saipem Spa

- Senergy Holding Company Kpsc.

- *Disclaimer: Major Players sorted in no particular order

Kuwait Oilfield Services Market News

- January 2023: The Kuwait Petroleum Corporation (KPC) announced the issue of around 15 tenders in the next fiscal year 2023-2024 for global and local firms in sectors including supply of equipment, maintenance of computer systems, operation of oilfield systems, management of technology repair and maintenance services for oil installations in various areas, and other services.

- October 2022: A Canadian drilling rig contractor, Precision Drilling Corporation, announced that it was recently awarded four contracts in Kuwait, each with a five-year term and an optional one-year renewal. The contract awards were for AC Super Triple 3000 HP drilling rigs, and this was expected to increase the company’s active rig count in Kuwait from three rigs to five rigs by the middle of 2023.

Kuwait Oilfield Services Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2. EXECUTIVE SUMMARY

3. RESEARCH METHODOLOGY

4. MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecasts in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Investments in Offshore Oil and Gas Projects

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Renewable Energy

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5. MARKET SEGMENTATION

- 5.1 By Service type

- 5.1.1 Drilling Service

- 5.1.2 Drilling and Completion Fluids

- 5.1.3 Formation Evaluation

- 5.1.4 Completion and Production Services

- 5.1.5 Drilling Waste Management Services

- 5.1.6 Other Service Types

- 5.2 Location Of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

6. COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Kuwait Petroleum Corporation

- 6.3.2 Fugro Nv

- 6.3.3 Kca Deutag Alpha Limited

- 6.3.4 Saipem Spa

- 6.3.5 SGS S.A.

- 6.3.6 Senergy Holding Company Kpsc.

- 6.3.7 National Energy Services Reunited Corp.

- 6.3.8 National Petroleum Services Company Kscc

- 6.3.9 Burgan Company For Well Drilling

- 6.3.10 Gas And Oilfield Services Company (gofsco)

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in the Region’s Exploration and Production Activities

Kuwait Oilfield Services Industry Segmentation

Oilfield services (OFS) refer to all the services that support onshore and offshore oil and gas extraction and production processes. These include drilling and formation evaluation, well construction, and completion services.

Kuwait’s oilfield services market is segmented by service type and location type. The market is segmented by service type into drilling, completion, production, and other services. By location of deployment, the market is segmented into onshore and offshore. The market size and forecasts for each segment have been calculated based on USD.

| By Service type | Drilling Service |

| Drilling and Completion Fluids | |

| Formation Evaluation | |

| Completion and Production Services | |

| Drilling Waste Management Services | |

| Other Service Types | |

| Location Of Deployment | Onshore |

| Offshore |

Kuwait Oilfield Services Market Research Faqs

The Kuwait Oilfield Services Market size is expected to reach USD 1.01 billion in 2025 and grow at a CAGR of 3% to reach USD 1.17 billion by 2030.

In 2025, the Kuwait Oilfield Services Market size is expected to reach USD 1.01 billion.

Kuwait Petroleum Corporation, Fugro Nv, Kca Deutag Alpha Limited, Saipem Spa and Senergy Holding Company Kpsc. are the major companies operating in the Kuwait Oilfield Services Market.

In 2024, the Kuwait Oilfield Services Market size was estimated at USD 0.98 billion. The report covers the Kuwait Oilfield Services Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Kuwait Oilfield Services Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.