Japan Small Home Appliances Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

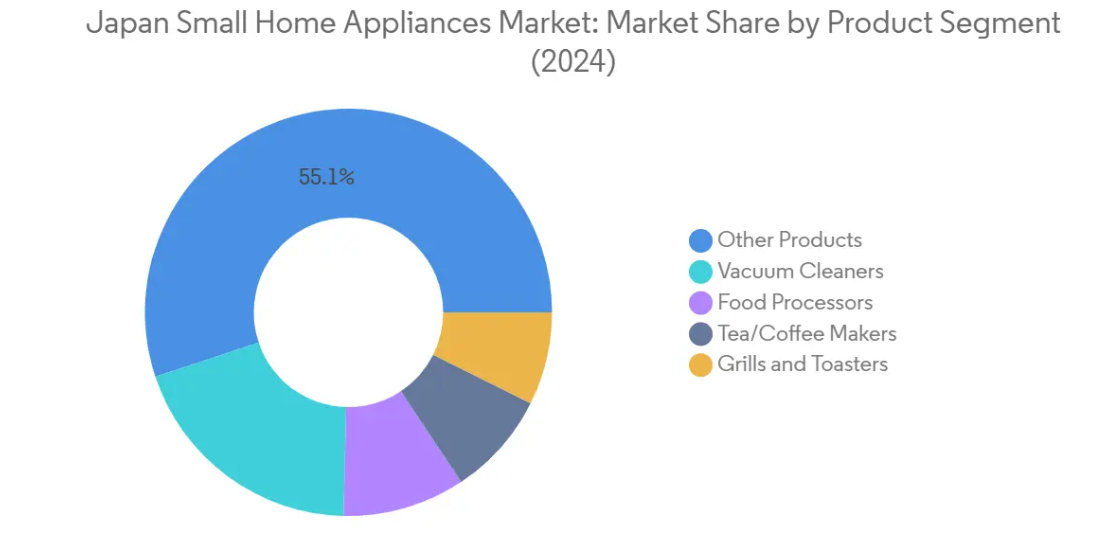

The Japan Small Home Appliances Market is Segmented By Product (Tea/Coffee Makers, Vacuum Cleaners, Food Processors, Grills and Toasters, and Others), and by Distribution Channel (Multi-brand Stores, Exclusive Stores, Online, and Other Distribution Channels).

Japan Small Home Appliances Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Japan Small Home Appliances Market Size

| Study Period | 2020 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

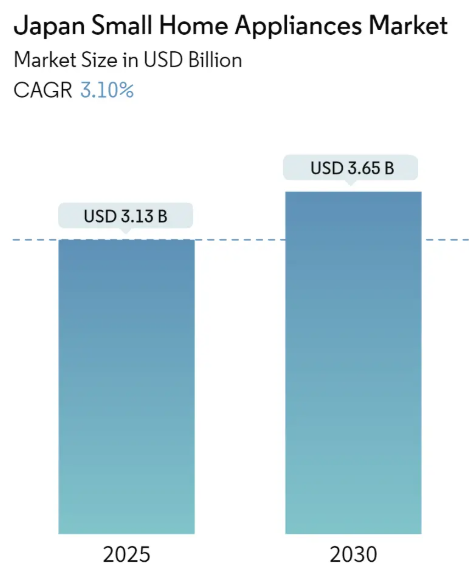

| Market Size (2025) | USD 3.13 Billion |

| Market Size (2030) | USD 3.65 Billion |

| CAGR (2025 – 2030) | 3.10 % |

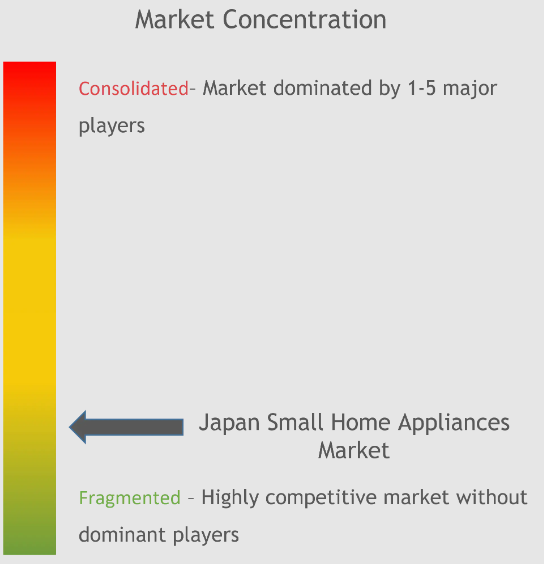

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Japan Small Home Appliances Market with other markets in Home and Property Improvement Industry

Japan Small Home Appliances Market Analysis

The Japan Small Home Appliances Market size is estimated at USD 3.13 billion in 2025, and is expected to reach USD 3.65 billion by 2030, at a CAGR of 3.1% during the forecast period (2025-2030).

The Japanese small home appliances market is experiencing significant transformation driven by evolving consumer preferences and lifestyle changes. The market structure is characterized by strong domestic brands like Panasonic, Hitachi, Sharp, Toshiba, and Mitsubishi dominating the landscape, while foreign companies maintain a relatively small market share primarily in specialized product segments. The market’s evolution is particularly evident in the retail sector, where traditional multi-brand stores are adapting their strategies to compete with the growing online channel. The increasing urbanization and rising standard of living have led to greater demand for sophisticated, energy-efficient household electrical appliances that align with the needs of modern Japanese households.

The distribution landscape is witnessing a dramatic shift toward digital channels, with e-commerce emerging as a crucial sales platform. According to a September 2021 survey of over 3,500 respondents, approximately 80% of Japanese consumers cited price as the primary factor influencing their online purchasing decisions. Consumer appliances have secured the second-highest share in Japan’s e-commerce market, highlighting the growing consumer comfort with purchasing these products online. This shift has prompted traditional retailers to adopt omnichannel strategies, integrating offline and online experiences to maintain competitiveness.

Technological innovation continues to drive market development, with manufacturers focusing on smart features, energy efficiency, and enhanced functionality. Japanese manufacturers are particularly emphasizing the development of products that combine advanced technology with practical design, catering to the space-conscious urban population. The integration of IoT capabilities and smart home compatibility has become increasingly important, with companies investing in R&D to create connected home electronics that offer improved user experience and convenience. This focus on innovation has led to the introduction of products with sophisticated features such as automated controls, energy monitoring, and remote operation capabilities.

The market is characterized by intense competition among established domestic players, who leverage their strong brand recognition and understanding of local preferences. Traditional electrical appliance retailers, particularly those near major metro stations like Akihabara and Shinjuku, continue to play a significant role in the market by offering multiple brands on the same floor, providing consumers with comprehensive product comparison opportunities. The supermarket channel has also demonstrated significant potential, with electric household electronics sales through this channel reaching approximately USD 1.19 billion in 2021, indicating the growing importance of diverse distribution channels in reaching consumers.

Japan Small Home Appliances Market Trends

Growing E-Commerce Market is Helping in Market Expansion

Japan has established itself as one of the world’s most sophisticated e-commerce markets, driven by a highly developed economy, an urbanized population, and exceptional internet penetration rates. The country’s unique single-language culture and advanced digital infrastructure have created an ideal environment for online retail growth. Consumer appliances, particularly small domestic appliances, have emerged as a crucial category in Japan’s e-commerce landscape, accounting for the second-highest share among all sectors in the digital marketplace. This prominence is supported by Japanese consumers’ increasing comfort with purchasing household electronics through digital channels, backed by the country’s reliable delivery infrastructure and strong consumer protection policies.

The evolution of e-commerce platforms in Japan has been marked by sophisticated features that particularly benefit small domestic appliances sales. According to a comprehensive survey conducted in September 2021, price remained the primary factor influencing online purchases, with nearly 80% of respondents citing it as a major consideration. The same survey revealed that 38.9% of consumers actively compare online prices with in-store retail prices, while 38.2% value loyalty points services. This consumer behavior has prompted e-commerce platforms to develop more sophisticated pricing strategies and loyalty programs specifically tailored to the kitchen electronics segment. The robust digital infrastructure, supported by approximately 116.3 million internet users as of 2021, has created an environment where consumers can easily research, compare, and purchase home electronics through various online channels.

Domestic e-commerce platforms are continuously evolving to provide enhanced shopping experiences, implementing innovative features such as detailed product comparisons, virtual product demonstrations, and comprehensive review systems specifically for kitchen electronics. These platforms are also making significant investments in logistics and delivery infrastructure to ensure safe and timely delivery of appliances to consumers’ doorsteps. The integration of multiple payment options, including digital wallets and installment plans, has further simplified the purchasing process for Japanese consumers. Additionally, the platforms’ focus on customer service, including easy return policies and post-purchase support, has helped build consumer confidence in buying small domestic appliances online.

Segment Analysis: By Product

Vacuum Cleaners Segment in Japan Small Home Appliances Market

The vacuum cleaners segment has established itself as a dominant force in Japan’s small home cleaning appliances market, commanding approximately 19% market share in 2024. This significant market position is driven by the growing urban population, increased employment of women, and rising household discretionary income in Japan. The segment’s strength is further reinforced by technological advancements, with Japanese consumers showing a strong preference for technically advanced products featuring low power usage, increased energy efficiency, and low maintenance requirements. The market has seen particular growth in stick vacuum cleaners and robotic vacuum cleaners, with the latter gaining popularity among Japan’s health-conscious inhabitants due to integrated air purifier features. Major manufacturers like Sharp, Hitachi, Panasonic, and Dyson continue to drive innovation in this segment, focusing on quality improvements in size, weight, suction power, battery life, and maintenance ease.

Tea/Coffee Makers Segment in Japan Small Home Appliances Market

The tea/coffee makers segment is projected to experience the highest growth rate of approximately 4% during the forecast period 2024-2029, driven by Japan’s deeply rooted coffee culture and increasing coffee consumption trends. This growth is supported by the introduction of new products such as green and organic coffee variants, along with rising awareness of coffee’s health benefits, including reduced risk of type 2 diabetes and liver disorders. Japanese manufacturers are responding to this growth by offering a diverse range of coffee brewing equipment, including popular styles like siphon, drip filter, and cold brew machines. The segment’s expansion is particularly notable in the premium category, where Japanese brands like Hario, Kalita, and Panasonic are leading innovation in brewing technology and design. The market is seeing increased demand for customizable brewing solutions, reflecting Japanese consumers’ sophisticated preferences and growing appreciation for specialized coffee preparation methods.

Remaining Segments in Japan Small Home Appliances Market

The other segments in Japan’s small home appliances market, including food preparation appliances like food processors and grills and toasters, continue to play vital roles in shaping the overall market landscape. Food processors have gained prominence due to changing food preparation habits and increasing demand for convenient cooking solutions among Japanese households. The grills and toasters segment has found particular resonance with urban consumers seeking space-efficient, multi-functional cooking appliances. These segments are characterized by continuous innovation in terms of functionality, energy efficiency, and design aesthetics, reflecting Japanese consumers’ preference for high-quality, technologically advanced kitchen appliances. The market also includes a substantial “other products” category encompassing various small appliances such as electric kettles, rice cookers, and food steamers, which collectively contribute to the market’s diversity and depth.

Segment Analysis: By Distribution Channel

Online Segment in Japan Small Home Appliances Market

The online distribution channel has emerged as the dominant segment in Japan’s small home appliances market, commanding approximately 41% market share in 2024. This channel’s prominence is driven by the high penetration of internet and smartphones in Japan, coupled with sophisticated technological infrastructure. Japanese consumers are increasingly preferring online purchasing due to the convenience of home delivery and extensive product selection available through e-commerce platforms. The segment’s growth is further supported by the nation’s robust logistics networks, widespread internet accessibility, and dense urban populations eager to embrace digital shopping experiences. Major domestic online retailers like Rakuten and Mercari, alongside international platforms such as Amazon and Yahoo, have established strong positions in the market by offering competitive pricing, extensive product ranges, and efficient delivery services.

Growth Trajectory of Online Sales in Japan Small Home Appliances Market

The online distribution channel is projected to maintain its growth momentum with an expected growth rate of approximately 5% during the forecast period 2024-2029. This growth is being fueled by the increasing adoption of digital payment solutions, improved logistics infrastructure, and evolving consumer preferences toward convenient shopping experiences. E-commerce platforms are enhancing their service offerings through features like detailed product comparisons, customer reviews, and competitive pricing strategies. The integration of advanced technologies in online platforms, coupled with the expansion of mobile commerce, is expected to further accelerate this segment’s growth. Japanese retailers are increasingly adopting omnichannel strategies, integrating their offline and online presence to provide seamless shopping experiences, which is anticipated to contribute significantly to the segment’s expansion.

Remaining Segments in Distribution Channel

The traditional distribution channels, including exclusive stores and multi-brand stores, continue to play significant roles in the Japanese small home appliances market. Exclusive stores maintain their importance by offering comprehensive product displays, expert guidance, and after-sales services, while multi-brand stores provide consumers with the advantage of comparing different brands under one roof. These physical retail formats are adapting to modern market demands by incorporating digital elements and enhancing in-store experiences. Other distribution channels, including mixed retailers and warehouse clubs, serve specific consumer segments by offering unique value propositions such as bulk purchasing options and specialized product selections. These channels are evolving their business models to remain competitive in the increasingly digital marketplace.

Japan Small Home Appliances Industry Overview

Top Companies in Japan Small Home Appliances Market

The Japanese small home appliances market is characterized by intense innovation and strategic developments among key players like Panasonic, Hitachi, Sharp, Mitsubishi, and Toshiba, alongside international brands such as LG and Samsung. Companies are increasingly focusing on developing smart and connected consumer appliances, incorporating AI and IoT capabilities to meet evolving consumer preferences. Operational agility is demonstrated through rapid product development cycles and flexible manufacturing processes to address changing market demands. Strategic moves in the industry include strengthening distribution networks, particularly in e-commerce channels, and expanding product portfolios through technological advancement. Market players are also emphasizing sustainability and energy efficiency in their product development, while simultaneously working on enhancing after-sales service networks and customer support infrastructure.

Domestic Dominance with High Market Consolidation

The Japanese household electrical appliances market exhibits a highly consolidated structure dominated by well-established domestic conglomerates with decades of market presence and strong brand recognition. These local giants leverage their extensive manufacturing capabilities, established distribution networks, and deep understanding of Japanese consumer preferences to maintain their market positions. The market’s competitive dynamics are shaped by these domestic players’ ability to offer products specifically tailored to Japanese household needs and cultural preferences, while international players struggle to gain significant market share despite their global presence.

The market demonstrates limited merger and acquisition activity, as major domestic players focus on organic growth and internal innovation rather than external expansion. Companies primarily compete through product differentiation, technological advancement, and brand strength rather than price-based competition. The presence of strong domestic manufacturing capabilities and well-established supply chains has created high entry barriers for new entrants, while existing players continue to strengthen their positions through continuous investment in research and development and manufacturing capabilities.

Innovation and Customer Experience Drive Success

For incumbent players to maintain and expand their market share, the focus needs to be on continuous innovation in smart technology integration and energy efficiency features. Companies must invest in developing products that align with the growing trend of connected homes while maintaining the high-quality standards expected by Japanese consumers. Success in this market requires a strong emphasis on after-sales service, warranty support, and customer engagement programs, alongside the ability to quickly adapt to changing consumer preferences and technological advancements.

Contenders looking to gain ground in this market need to develop specialized product offerings that address specific market gaps while building strong relationships with local distribution partners. The relatively low threat of substitution products provides opportunities for companies to focus on premium segments and innovative features. However, success requires significant investment in building brand trust and establishing reliable service networks. Companies must also stay ahead of potential regulatory changes, particularly regarding energy efficiency standards and environmental regulations, while maintaining competitive pricing strategies to attract price-sensitive segments of the market. The focus on residential appliances and home electronics is crucial to meet the demands of modern Japanese households.

Japan Small Home Appliances Market Leaders

-

- Panasonic Corporation

- LG Electronics

- Sharp Corporation

- Samsung

- Mitsubishi Corporation

- *Disclaimer: Major Players sorted in no particular order

Japan Small Home Appliances Market News

- December 3, 2021,Panasonic announced the latest innovation in its robust solar energy portfolio of Total Home Energy Solution offerings, the EverVolt™ 2.0 Home Battery.

- In 2021, as the conciousness towards health and being hygienic grew among people, appliances of germ attack,dust free came into existence.

Japan Small Home Appliances Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

- 4.5 Porters Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights into Technological Advancements in the Industry

- 4.7 Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Tea/Coffee Makers

- 5.1.2 Vacuum Cleaners

- 5.1.3 Food Processors

- 5.1.4 Grills and Toasters

- 5.1.5 Others

- 5.2 Distribution Channel

- 5.2.1 Multi-brand Stores

- 5.2.2 Exclusive Stores

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

6. COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Panasonic Corporation

- 6.2.2 LG Electronics

- 6.2.3 Hitachi

- 6.2.4 Sharp Corporation

- 6.2.5 Samsung

- 6.2.6 Mitsubishi Corporation

- 6.2.7 Toshiba Corporation

- 6.2.8 Kenwood Corporation

- 6.2.9 Electrolux AB

- 6.2.10 Miele*

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. DISCLAIMER AND ABOUT US

Japan Small Home Appliances Industry Segmentation

A complete background analysis of the market, including the analysis of market size and forecast, market shares, industry trends, growth drivers, and vendors, is provided. Additionally, the report features qualitative and quantitative assessments by analyzing the data gathered from industry analysts and market participants across key points in the industry’s value chain. The Market is Segmented By Product (Tea/Coffee Makers, Vacuum Cleaners, Food Processors, Grills and Toasters, and Others), and by Distribution Channel (Multi-brand Stores, Exclusive Stores, Online, and Other Distribution Channels).

| Product | Tea/Coffee Makers |

| Vacuum Cleaners | |

| Food Processors | |

| Grills and Toasters | |

| Others | |

| Distribution Channel | Multi-brand Stores |

| Exclusive Stores | |

| Online | |

| Other Distribution Channels |

Japan Small Home Appliances Market Research FAQs

The Japan Small Home Appliances Market size is expected to reach USD 3.13 billion in 2025 and grow at a CAGR of 3.10% to reach USD 3.65 billion by 2030.

In 2025, the Japan Small Home Appliances Market size is expected to reach USD 3.13 billion.

Panasonic Corporation, LG Electronics, Sharp Corporation, Samsung and Mitsubishi Corporation are the major companies operating in the Japan Small Home Appliances Market.

In 2024, the Japan Small Home Appliances Market size was estimated at USD 3.03 billion. The report covers the Japan Small Home Appliances Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Japan Small Home Appliances Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.