Japan Freight and Logistics Market SIZE & SHARE ANALYSIS – GROWTH TRENDS & FORECASTS UP TO 2030

The Japan Freight and Logistics Market is segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others) and by Logistics Function (Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage). Market Value (USD) and Market Volume (ton-km, number of parcels, warehousing & storage space in square feet) are both presented. Key Data Points observed include Freight Transport Volume (ton-km) by Mode of Transport; Production Trends (Manufacturing, E-Commerce etc. in USD); Import and Export trends (in USD); and Freight Pricing Trends (USD per ton-km).

Japan Freight and Logistics Market SIZE & SHARE ANALYSIS – GROWTH TRENDS & FORECASTS UP TO 2030

Japan Freight and Logistics Market Size

| Study Period | 2017 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

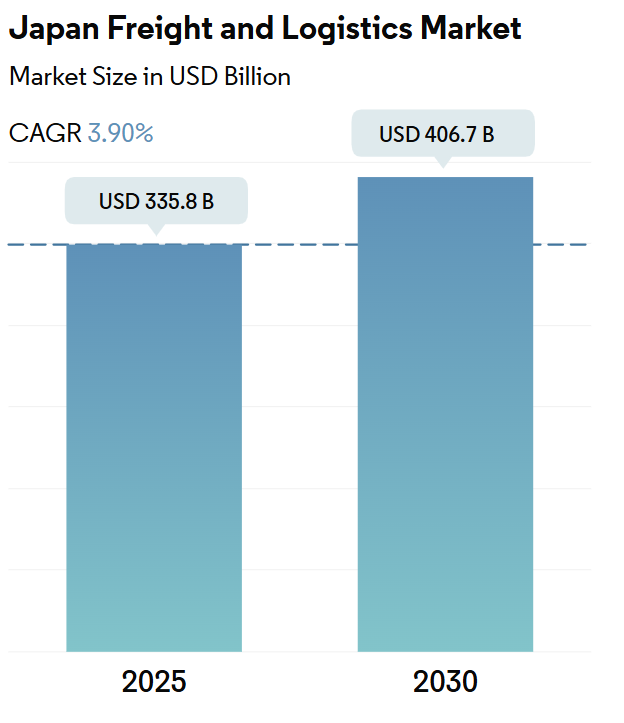

| Market Size (2025) | USD 335.8 Billion |

| Market Size (2030) | USD 406.7 Billion |

| CAGR (2025 – 2030) | 3.90 % |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Japan Freight and Logistics Market with other markets in Logistics Industry

Japan Freight and Logistics Market Analysis

The Japan Freight and Logistics Market size is estimated at 335.8 billion USD in 2025, and is expected to reach 406.7 billion USD by 2030, growing at a CAGR of 3.90% during the forecast period (2025-2030).

Japan’s logistics industry is undergoing significant technological transformation and infrastructure modernization to address operational challenges. In June 2024, the country announced plans to construct an innovative automated conveyor belt network called the Autoflow-Road, designed to transport goods over 500 kilometers between Tokyo and Osaka. This ambitious infrastructure project aims to tackle the freight logistics crisis by incorporating tunnels beneath highways and above-ground tracks, with the capacity to match the freight volume of 25,000 truck drivers daily. The industry faces significant workforce challenges, with truck drivers earning approximately USD 34,000 annually, about 10% below the average across industries despite working 20% longer hours. These challenges have prompted the government to implement new regulations limiting truck drivers’ annual overtime to 960 hours starting April 2024.

The maritime and aviation sectors are witnessing substantial developments to enhance connectivity and sustainability. Japan’s liner shipping connectivity index demonstrated strong growth, increasing by 4.8% year-over-year in Q1 2024, elevating the country to become the 5th best-connected nation globally. In December 2023, DHL Express and Japan Airlines (JAL) established a strategic partnership utilizing JAL’s Boeing 767-300 freighters, aiming to capitalize on the growing international express and e-commerce shipping demand in East Asia. Additionally, the government has committed JPY 30.6 billion (USD 216.89 million) toward electric aircraft systems development, with research initiatives beginning in 2024, demonstrating its commitment to achieving carbon neutrality by 2050.

Infrastructure modernization remains a critical focus area, particularly in addressing aging facilities and introducing innovative transportation solutions. Starting April 2024, Japan will debut its first cargo-dedicated bullet trains, operated by East Japan Railway (JR East), primarily serving major cities with Tokyo as the focal point. These trains will prioritize the swift delivery of fresh produce, particularly vegetables and fish, utilizing either exclusive freight services or hybrid cargo-passenger operations based on demand. However, the country faces significant challenges with its warehousing infrastructure, as over 30% of domestic warehouses are more than 40 years old, creating concerns about their replacement and expansion capabilities due to high construction costs and limited land availability.

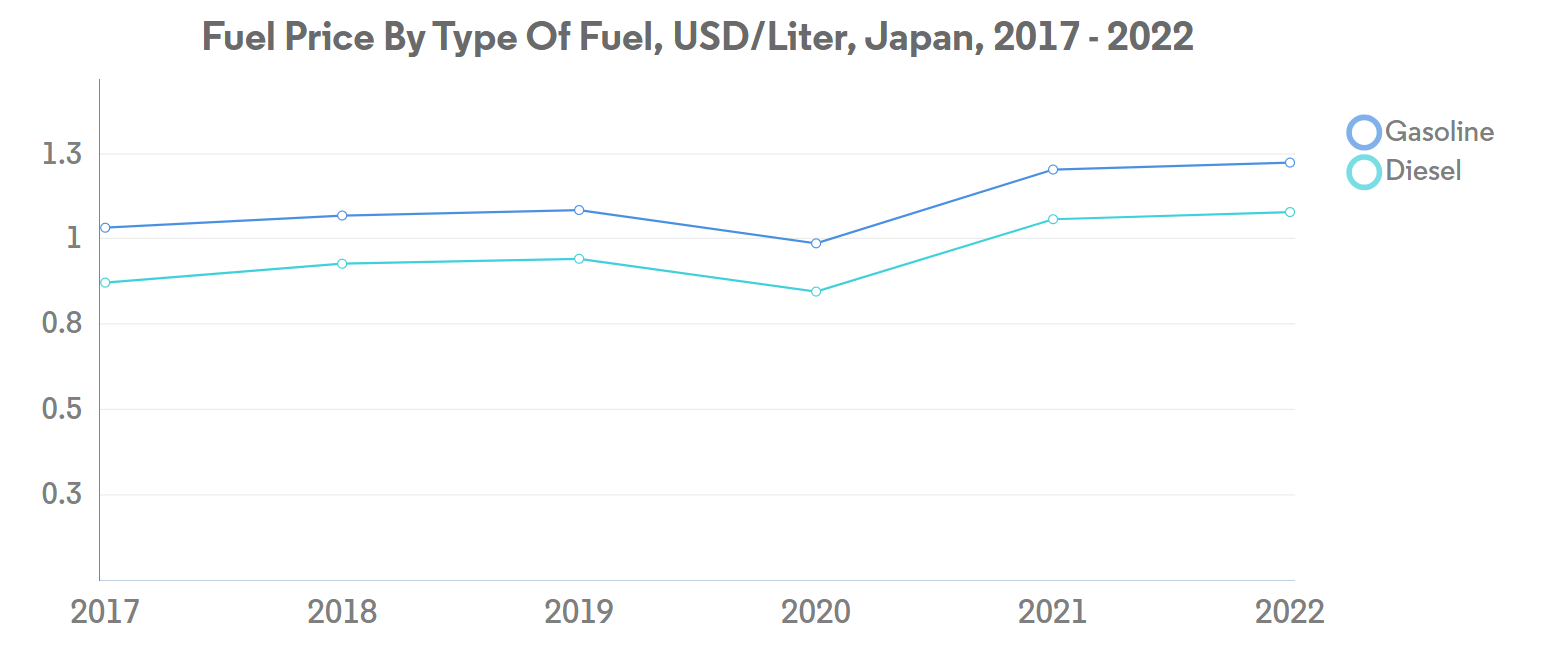

The Japan logistics market is actively addressing fuel costs and environmental sustainability through various initiatives. As of August 2023, Japan’s average retail gasoline price reached JPY 183.70 (USD 1.26) per liter, marking a 15-year high and highlighting the need for alternative fuel solutions. In response to these challenges, the government has initiated several environmental programs, including the allocation of JPY 17.3 billion for hydrogen fuel cell system development for aircraft and JPY 13.3 billion for enhancing fuel-efficient engine control systems. These investments demonstrate Japan’s commitment to reducing its carbon footprint while maintaining its position as a leading logistics hub in the Asia-Pacific region.

Japan Freight and Logistics Market Trends

With growing demand for home deliveries & labour shortages, the MILT is focusing on construction of automatic cargo transport roads and logistics tunnels

- On May 17, 2024, a fair at Tokyo Station highlighted the growing use of high-speed passenger trains for light freight. This shift, driven by a shortage of commercial drivers and new overtime laws, has increased road delivery costs by up to 20%. Since August 2023, JR East has been running a same-day delivery service from Niigata to Tokyo using a dedicated 12-car Series E trainset. Items transported include fresh food, confectionery, drinks, flowers, precision components, and medical supplies. In September 2023, JR East launched a freight-only service on the Tohoku Shinkansen and now offers Hakobyun-branded freight services across its high-speed and Limited Express networks.

- In March 2024, Central Japan Railway Co. abandoned its plan to launch a high-speed maglev train between Tokyo and Nagoya by 2027 due to ongoing environmental opposition in Shizuoka Prefecture, possibly delaying the project until 2034 or later. The Linear Chuo Shinkansen aims to connect Tokyo and Osaka with trains reaching speeds of 500 kilometers per hour, but a small section in Shizuoka has been a major obstacle.

Rising prices of fuel in Japan witnessed in July 2024, highest since October 2023, despite government subsidies

- In July 2024, the Agency for Natural Resources and Energy announced that the retail price of regular gasoline reached USD 1.33 per liter, marking an increase of USD 0.006 from June 2024. This price point is the highest observed in nearly nine months, dating back to October 2023. The uptick in retail prices is attributed to surging wholesale prices. To counteract this, the government has been subsidizing oil refiners, ensuring that wholesale prices remain subdued. Moreover, the subsidy amount saw an uptick, rising to USD 0.19 between June 27 and July 3, which is an increase of USD 0.01 from the week prior.

- Japanese gas utilities expect city gas demand to rise in the fiscal year April 2024 to March 2025, following reduced usage in 2023-24 due to unusually warm weather. Tokyo Gas, Japan’s largest gas retailer, forecasts city gas sales will increase by 1.1% to 11.422 billion cubic meters by 2025. Household sales are expected to grow by 3.4% to 2.8 billion cubic meters, while supplies to industry and commercial users are projected to rise by 0.3% to 8.6 billion cubic meters.

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- Japan’s population decline accelerated due to the rise in old age population, expected to shrink by 20 million by 2050

- The Japanese government aims for food self-sufficiency in the country with the help of the MAFF basic plan

- The Japanese e-commerce market grew by 6.89% YoY in 2023, supported by robust digital infrastructure

- Japan aims to expand machine tools exports to USD 11.98 trillion by 2030 under the Machine Tool Industry Vision 2030

- Rising fuel prices, average truck driver wages, and truck driver shortage impact the overall trucking operational costs

- Japan falls to the 13th rank in LPI owing to a decline in the logistics sector in 2022 amid labor shortages and rising costs

- Land and maritime transportation modes contributed the highest revenue share as of 2022, supported by government investments

- Japan is enhancing maritime connectivity in the Indian Ocean to boost bilateral trade and network connectivity

- Growth in freight pricing was witnessed due to rising fuel prices, rising inflation and the network disruptions caused by the Russia-Ukraine War

- Japan aims for USD 606.4 billion FDI by 2030, encouraging global partnership and infrastructure needs

- Japan strives to increase chip sales to USD 113.72 billion by 2030 to strengthen semiconductor manufacturing

- Japan witnessing decline in inflation rate in 2024, with Bank of Japan increasing interest rate due to weak Yen

- The government allocated USD 39.3 billion in FY 2023 to support supply chain resiliency for manufacturing companies

- Japan plans to cut the use of LNG in the power sector to 20% by 2030 from 37% in 2019

- Isuzu and Honda plan to launch their fuel cell-powered heavy-duty trucks in the Japanese market by 2027

- Japan targets a market share of 30% in the global software-defined vehicles (SDV) by 2030

- Declining shipbuilding and iron ore imports are expected to impact maritime fleet capacity during 2023-2030

- To achieve carbon neutrality by 2050 and reduce its carbon footprint, Japan has started trials for autonomous vessels

- Rising freight tonnage witnessed in Japan supported by growing manufacturing activity and government initiatives supporting infrastructure development

Segment Analysis: End User Industry

Wholesale and Retail Trade Segment in Japan Freight and Logistics Market

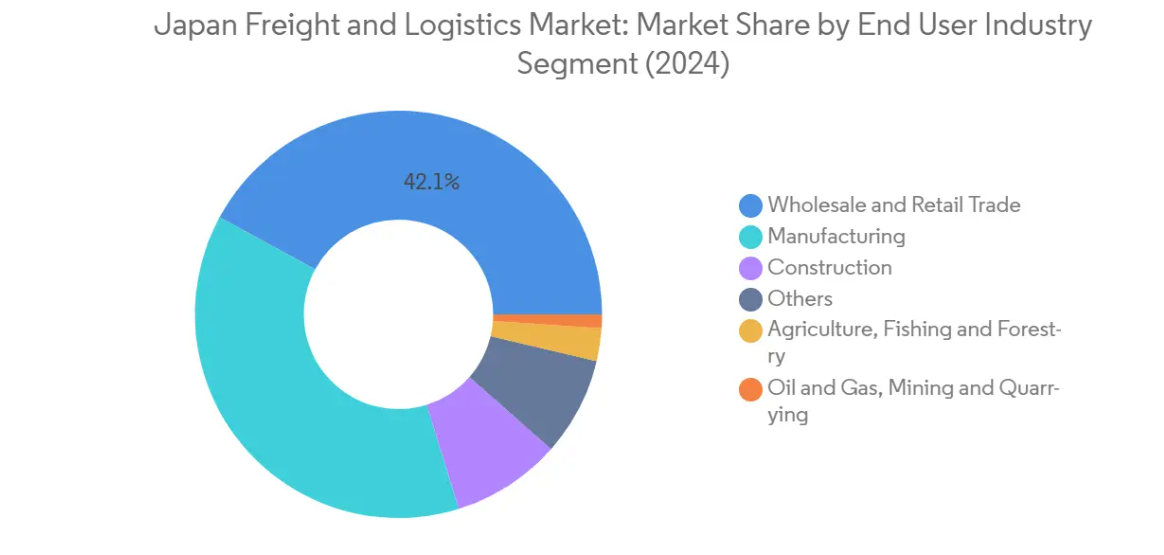

The wholesale and retail trade segment dominates the Japan logistics market, accounting for approximately 42% of the total market value in 2024. This segment’s prominence is largely driven by the rapid growth of e-commerce, which is expected to reach USD 225 billion by 2027. Major e-commerce platforms like Rakuten, Yahoo Japan, and Amazon continue to shape the logistics landscape, with Rakuten maintaining a strong presence in digital and communication segments through diverse offerings, including eBooks, video distribution, and mobile telecommunication services. The segment’s growth is further supported by retail sales, which rose by 5.6% in 2023, particularly driven by increased demand for boxed meals and soft drinks following the relaxation of pandemic restrictions.

Manufacturing Segment in Japan Freight and Logistics Market

The manufacturing segment is projected to exhibit the strongest growth trajectory in the Japan freight and logistics market during 2024-2029, with an expected growth rate of approximately 5%. This growth is primarily driven by Japan’s position as a leading exporter of cars, automotive parts, and electronic circuits. The government’s substantial allocation of USD 30.32 billion between FY 2021 and FY 2023 for semiconductor plant subsidies has created new opportunities in the sector. Notable developments include Rapidus’s plans to build a state-of-the-art semiconductor plant in Chitose, Hokkaido, focusing on 2-nanometer chip production. Additionally, Japanese manufacturing companies are estimated to invest USD 4.1 billion in digital infrastructure by 2030, further driving the segment’s growth.

Remaining Segments in End User Industry

The construction segment maintains a significant presence in the market, driven by key infrastructure projects and the government’s initiatives in renewable energy development, including plans for 10 GW of offshore wind capacity by 2030. The agriculture, fishing, and forestry segment continues to evolve with the government’s target of raising annual agricultural and seafood exports to JPY 5 trillion by 2030. The oil and gas, mining, and quarrying segment, though smaller, remains crucial for energy security, while the others segment encompasses various industries contributing to the market’s diversity. Each of these segments plays a vital role in shaping the overall logistics landscape in Japan, influenced by specific regulatory frameworks and industry developments.

Segment Analysis: Logistics Function

Freight Transport Segment in Japan Freight and Logistics Market

The freight logistics segment dominates the Japan logistics market, accounting for approximately 42% market share in 2024. This segment’s strong position is primarily driven by Japan’s extensive road transportation network spanning over 1.28 million kilometers and robust maritime infrastructure connecting major ports. The segment has seen significant developments in 2024, including the introduction of cargo-dedicated bullet trains by East Japan Railway (JR East), focusing on the swift delivery of fresh produce between major cities. Additionally, the implementation of autonomous vehicle trials on key routes connecting Tokyo, Nagoya, and Osaka, along with plans for dedicated self-driving lanes on the Shin-Tomei Expressway, demonstrates the segment’s commitment to technological advancement and efficiency improvements.

Air Freight Transport Segment in Japan Freight and Logistics Market

The air cargo logistics segment is emerging as the fastest-growing segment in the market, with a projected growth rate of approximately 5% during 2024-2029. This remarkable growth is being fueled by several key developments, including the Japanese government’s commitment to allocate JPY 30.6 billion toward electric aircraft systems and the expansion of air cargo networks. The segment has witnessed significant strategic partnerships, such as the collaboration between DHL Express and Japan Airlines (JAL) to employ Boeing 767-300 freighters, enhancing connectivity between Japan, Seoul, Shanghai, and Taipei. The growth is further supported by increasing investments in airport infrastructure, with Narita International Airport Corporation announcing plans for a new terminal and expansion of cargo facilities with an estimated investment of USD 6.06 billion.

Remaining Segments in Logistics Function

The other significant segments in the market include CEP (Courier, Express, and Parcel), freight forwarding, warehousing and storage, and other logistics services. The CEP segment has been particularly dynamic with the rise of e-commerce and last-mile delivery innovations. The freight forwarding segment continues to play a crucial role in international trade facilitation, while the warehousing and storage segment has been evolving with the introduction of automated facilities and cold chain solutions. Other services, including value-added logistics services and specialized transportation solutions, complement the main segments by providing customized solutions for specific industry requirements and contributing to the overall market development.

Japan Freight and Logistics Industry Overview

Top Companies in Japan Freight and Logistics Market

The Japan logistics company market features prominent players like Yamato Holdings, Nippon Express, SG Holdings, Mitsui O.S.K. Lines, and NYK Line leading the competitive landscape. Companies are increasingly focusing on digital transformation initiatives, with many players implementing automated warehousing solutions and AI-powered route optimization systems to enhance operational efficiency. Strategic partnerships, particularly in the e-commerce fulfillment space, have become a key trend as companies aim to strengthen their last-mile delivery capabilities. Environmental sustainability has emerged as a crucial focus area, with major players investing in electric vehicles and sustainable fuel alternatives. Companies are also expanding their cold chain capabilities and specialized logistics services to cater to growing demands in the healthcare and pharmaceutical sectors. The market has witnessed significant investment in cross-border logistics infrastructure, with companies establishing new routes and facilities to capitalize on increasing international trade volumes.

Market Dominated by Domestic Logistics Giants

The Japan logistics market is characterized by strong domestic players who have established deep-rooted networks across the country. These local giants leverage their extensive understanding of Japan’s unique business culture and consumer preferences to maintain their market positions. The market structure shows a mix of traditional logistics conglomerates and specialized service providers, with the former holding significant market share through their integrated service offerings. International players, while present in the market, typically operate through partnerships with local entities or focus on specific market segments like international freight forwarding.

The market has witnessed selective consolidation through strategic acquisitions and partnerships, particularly in specialized segments like cold chain logistics and e-commerce fulfillment. Major domestic players are increasingly forming alliances with international logistics companies to enhance their global reach and technological capabilities. The market also sees vertical integration trends, with many players expanding their service portfolio to include value-added services like packaging, labeling, and inventory management. This consolidation trend is driven by the need to achieve economies of scale and offer comprehensive end-to-end logistics solutions to customers.

Innovation and Sustainability Drive Future Success

Success in the Japan logistics market increasingly depends on companies’ ability to embrace technological innovation and sustainable practices. Market leaders are investing heavily in digital transformation initiatives, including blockchain for supply chain transparency and IoT for real-time tracking. The ability to offer specialized solutions for emerging sectors like e-commerce and healthcare logistics has become crucial for maintaining market position. Companies are also focusing on developing sustainable logistics solutions, including green warehousing and eco-friendly transportation options, to meet growing environmental concerns and regulatory requirements.

For new entrants and smaller players, success lies in identifying and serving niche market segments with specialized solutions. The market shows particular potential in areas like temperature-controlled logistics, urban logistics solutions, and specialized handling services for high-value goods. Building strong partnerships with e-commerce platforms and retailers has become essential for growth, given the increasing shift towards online shopping. Companies must also focus on developing robust last-mile delivery capabilities and implementing flexible delivery options to meet changing consumer preferences. The regulatory environment, particularly regarding environmental standards and labor laws, continues to shape competitive strategies, with companies needing to balance operational efficiency with compliance requirements.

Japan Freight and Logistics Market Leaders

-

- Mitsui O.S.K. Lines, Ltd.

- Nippon Express Holdings

- NYK (Nippon Yusen Kaisha) Line

- SG Holdings Co., Ltd.

- Yamato Holdings Co., Ltd.

- *Disclaimer: Major Players sorted in no particular order

Japan Freight and Logistics Market News

- September 2024: DHL Express launched a new direct flight route from Hong Kong to Jakarta, Indonesia, enhancing its transit times. The dedicated flight, utilizing the B737-800 freighter, operated four times weekly. By flying directly from Hong Kong to Jakarta, this new service offered a non-stop alternative. The B737-800 freighter, boasting a 20-ton payload capacity, handled everything from e-commerce packages to larger consignments. It transports shipments originating from China, Hong Kong, Japan, Korea, Taiwan, the Philippines, and Vietnam via the Central Asia Hub in Hong Kong.

- September 2024: DSV completed the acquisition of Schenker from Deutsche Bahn for EUR 14.3 billion (around USD 15.78 billion). Following the acquisition, DSV and Schenker was expected to achieve a combined revenue of about EUR 39.3 billion (USD 43.73 billion) (based on 2023 estimates) and employ roughly 147,000 individuals across over 90 nations. Beyond expanding its global footprint, the Schenker acquisition was expected to enhance DSV’s growth trajectory and its commitment to a more sustainable, digital future in transport and logistics.

- July 2024: DHL Express introduced a range of digital tools aimed at empowering small and medium enterprises (SMEs) to broaden their global reach and enhance their international trade and shipping endeavors. These tools were designed to assist resource-limited SMEs in efficiently navigating cross-border shipping logistics, facilitating smoother import and export activities from diverse sources and locations. Among the suite of digital solutions crafted by DHL Express were My Global Trade Services (myGTS), DHL Express Commerce, Track & Trace, DHL Pass, and On Demand Delivery. In addition to digital tools, DHL Express also introduced the GoTrade program, which supports small businesses in trading their goods internationally.