Italy Courier, Express, and Parcel (CEP) Market SIZE & SHARE ANALYSIS – GROWTH TRENDS & FORECASTS UP TO 2030

The Italy Courier, Express, and Parcel (CEP) Market is segmented by Destination (Domestic, International), by Speed Of Delivery (Express, Non-Express), by Model (Business-to-Business (B2B), Business-to-Consumer (B2C), Consumer-to-Consumer (C2C)), by Shipment Weight (Heavy Weight Shipments, Light Weight Shipments, Medium Weight Shipments), by Mode Of Transport (Air, Road, Others) and by End User Industry (E-Commerce, Financial Services (BFSI), Healthcare, Manufacturing, Primary Industry, Wholesale and Retail Trade (Offline), Others). Key Data Points observed include Number of Parcels; Production Trends (Manufacturing, E-Commerce etc. in USD); Import and Export trends (in USD).

Italy Courier, Express, and Parcel (CEP) Market SIZE & SHARE ANALYSIS – GROWTH TRENDS & FORECASTS UP TO 2030

Italy Courier, Express, and Parcel (CEP) Market Size

| Study Period | 2017 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

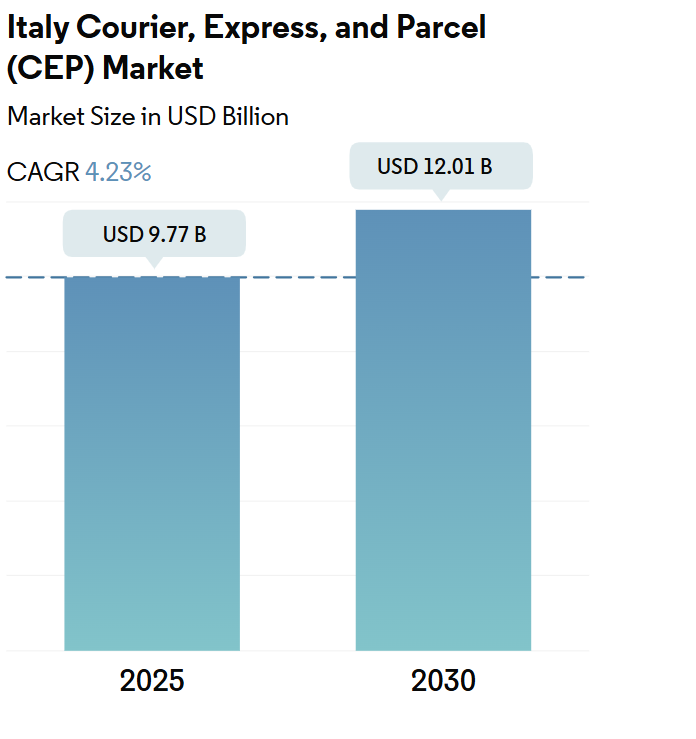

| Market Size (2025) | USD 9.77 Billion |

| Market Size (2030) | USD 12.01 Billion |

| Growth Rate (2025 – 2030) | 4.23% CAGR |

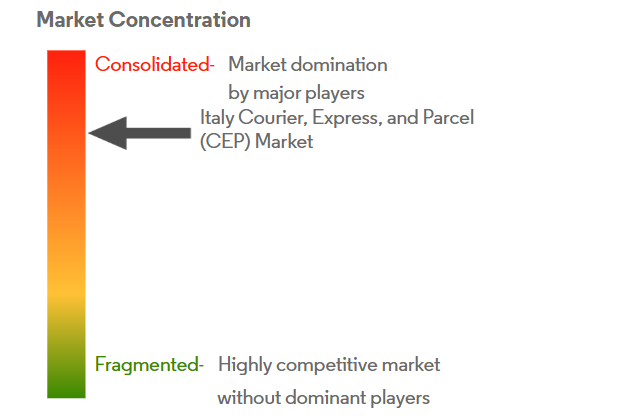

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Italy Courier, Express, and Parcel (CEP) Market with other markets in Logistics Industry

Italy Courier, Express, and Parcel (CEP) Market Analysis

The Italy Courier, Express, and Parcel (CEP) Market size is estimated at 9.77 billion USD in 2025, and is expected to reach 12.01 billion USD by 2030, growing at a CAGR of 4.23% during the forecast period (2025-2030).

Italy’s logistics and transportation infrastructure is undergoing significant transformation, with substantial investments aimed at modernizing and expanding capabilities. In March 2024, the government unveiled a EUR 30 billion initiative for enhancing road infrastructure over a 15-year span, overseen by Autostrade per l’Italia (ASPI) across its 3,000 km network. The country’s airport infrastructure comprises 42 facilities, with the southern region of Sicily leading with six airports, demonstrating the nation’s commitment to maintaining robust air connectivity. This infrastructure development is complemented by the ambitious announcement of constructing a suspension bridge connecting Sicily with mainland Italy, featuring the world’s longest single span at 3,300 meters.

The Italian CEP market is witnessing a significant shift toward sustainable and innovative delivery solutions, particularly in urban areas. DHL Group’s launch of Continental Europe’s first EV Center in Pozzuolo Martesana near Milan in 2024 exemplifies this trend, showcasing the industry’s commitment to environmental sustainability. The facility spans approximately 10,000 square meters and serves as a logistics hub specifically designed for electric vehicles. This development aligns with the broader industry trend of adopting eco-friendly delivery solutions, with several major Italian courier companies investing in electric delivery fleets and sustainable infrastructure.

Cross-border operations have become increasingly significant in the Italian CEP market landscape, with 67% of Italian consumers purchasing from international websites as of 2022. The market has responded to this trend through strategic partnerships and infrastructure development, such as the collaboration between DHL and Poste Italiane announced in 2023, which aims to enhance cross-border delivery capabilities. Over 55% of Italian businesses utilize e-commerce platforms for international sales, with significant portions targeting markets in the United States, United Kingdom, and various Asian countries.

The integration of financial technology within the CEP Italy sector is driving market evolution, particularly in payment systems and delivery tracking capabilities. The credit card penetration in Italy is projected to grow from 48.76% in 2022 to 62.79% by 2028, indicating increasing digitalization of payment systems in the delivery sector. Major carriers are investing in digital infrastructure to enhance customer experience, with companies like FedEx revamping their retail network in Italy to incorporate advanced technology solutions such as RetailShip, providing unified contact points for both domestic and international services. These technological advancements are enabling more efficient tracking systems, improved delivery accuracy, and enhanced customer communication channels.

Italy Courier, Express, and Parcel (CEP) Market Trends

Growing future prospects due to planned overhaul of superheavy cargo transport fleet by 2026 in Italy

- In July 2024, the Italian Ministry of Transport greenlit a project to establish a rail freight station in Piacenza, strategically placed between Milan and Bologna. The upcoming station will be situated in the eastern part of Piacenza, specifically in the Le Mose area. Moreover, Le Mose already hosts the Piacenza Intermodal Terminal, overseen by Hupac. This existing terminal is currently undergoing significant enhancements, with completion slated for late 2024 or early 2025. These developments paint a promising future for Piacenza’s rail freight prospects.

- In 2024, Italy plans to upgrade its superheavy cargo transport fleet due to poor conditions and failure to meet EU standards. Shippers and carriers are urging the government to implement a public incentive plan amid challenges from the Russian-Ukrainian conflict and stricter EU regulations. The plan requires a USD 747.24 million investment by 2026 to phase out 25-30% of the oldest, most polluting, and least safe vehicles over three years. Italy’s support for the freight sector has lagged behind France and Germany, but changes are expected as early as late 2024.

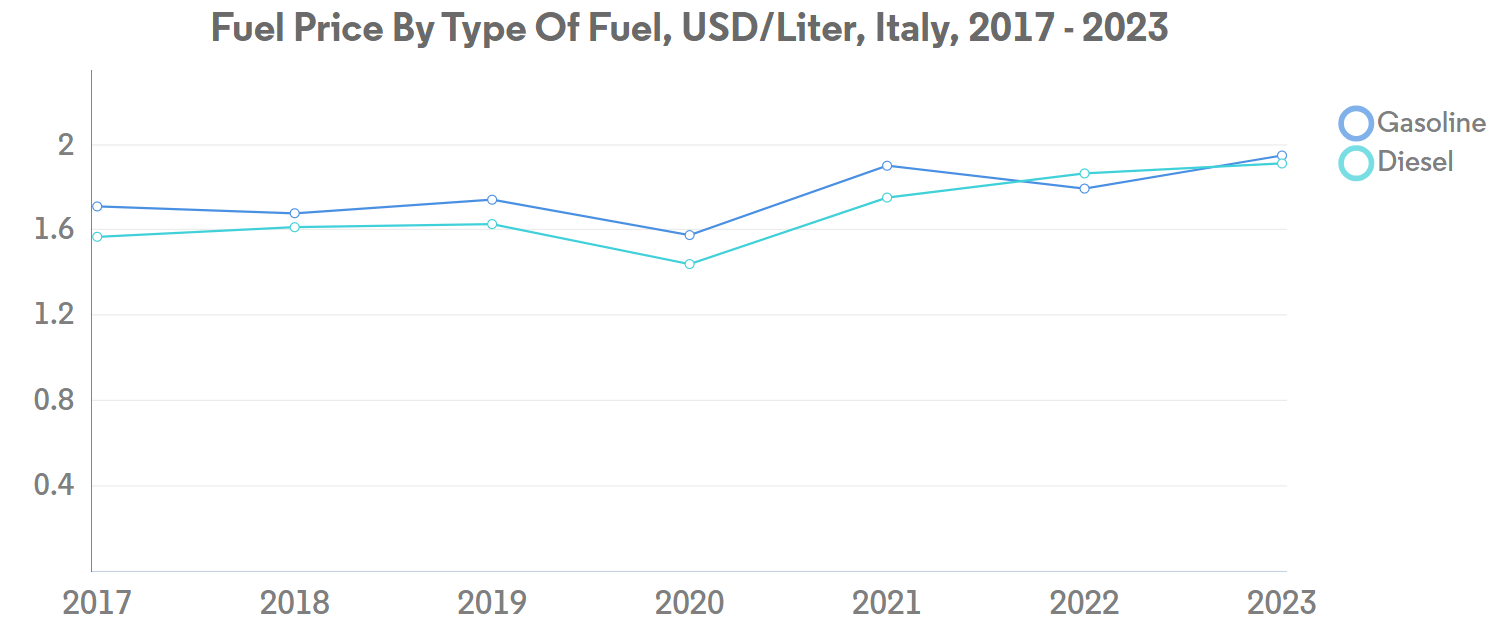

Fuel prices surged in Italy after the discount on fuel-related excise duties expired at the end of 2022

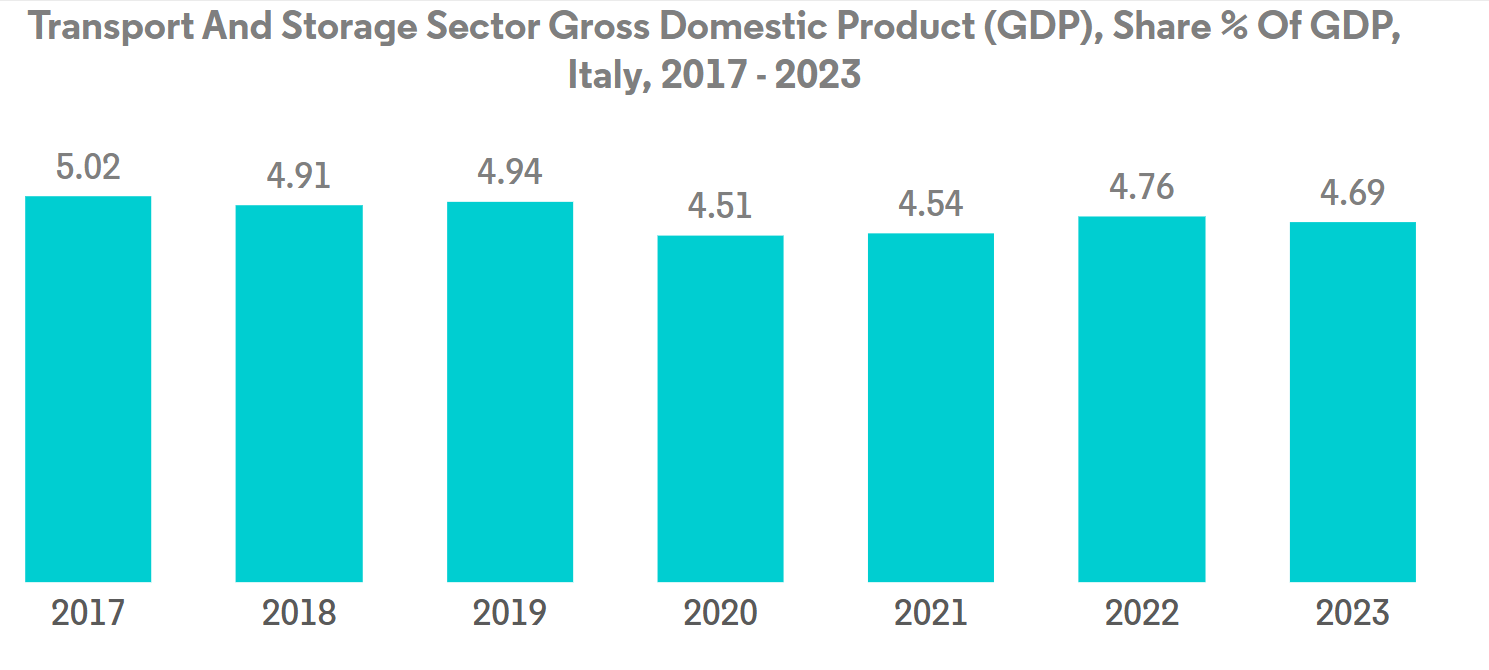

- For the last three years, Italy has consistently held the record for the highest average wholesale power prices among major European markets. This is primarily due to its heavy reliance on natural gas for electricity generation, a strategy that sets it apart from its European counterparts. In 2023, Italy’s wholesale power prices stood at an average of USD 137.80 per megawatt hour, a figure that was a third higher than both Germany’s and France’s averages, and over 50% more than Spain’s. Moving into 2024, Italy’s power costs have continued to surge, with recent wholesale prices sitting nearly 40% above France’s and a striking 60% higher than Spain’s.

- As of March 2024, Italy’s power and gas regulator, Arera, has increased the maximum payments in capacity auctions for 2025-2027 to USD 86,466.7/MW for new capacity. Previous auctions for 2022-2024 offered maximum payments of USD 74,724.3/MW for new capacity and USD 35,227.2/MW for existing capacity, payable over 15 years. In coming years, Italian power demand will rise due to increased electrification from electric vehicles, heat pumps, and electrolyzers.

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- Italy’s population declines with lower birth rates and an increasing elderly population

- The construction and manufacturing sectors recorded highest growth during 2017-2023

- Italy’s e-commerce market grew over 13% YoY in 2023, showing rapid expansion

- Italian exports are set to rise due to lower inflation and improved global conditions

- Italy secures 19th ranking in 2023 LPI due to strong trade infrastructure and competence in logistics services

- Italy is expected to boost domestic chip manufacturing with investments of over USD 4 billion by 2030

- Italy inflation dropped significantly since 2022 and has the lowest inflation rate in Europe region as of 2024

- Italy’s “Piano Transizione 4.0” boosts AM tech with USD 14 billion tax credits, widening subsidies

- Italy aims to phase out Russian LNG imports amid deals with African countries

- Rising investments from Italy Government since 2021 for the modernization, upgradation, and expansion of infrastructure

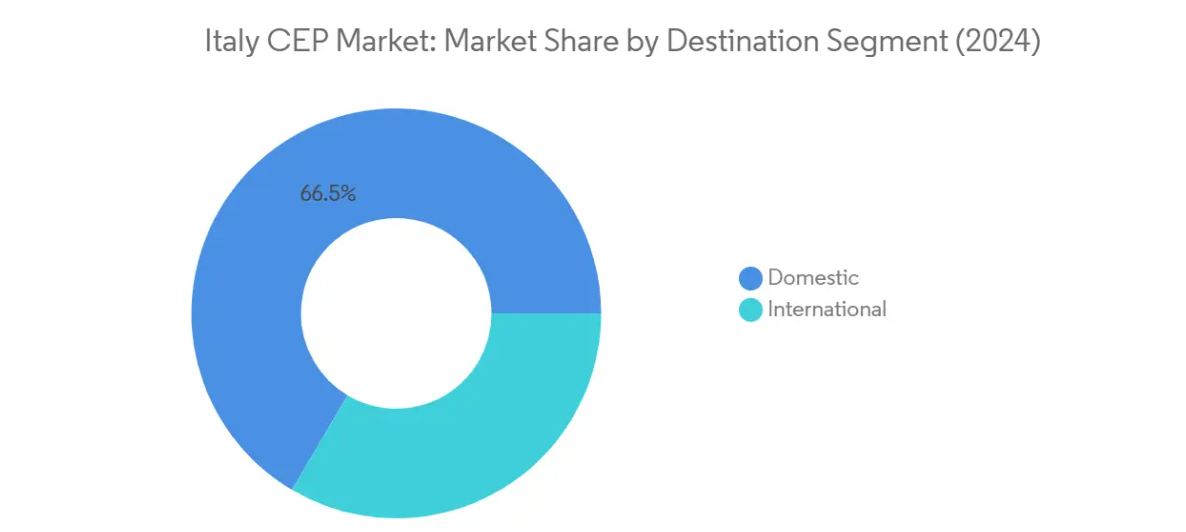

Segment Analysis: By Destination

Domestic Segment in Italy CEP Market

The domestic segment dominates the CEP market in Italy, commanding approximately 67% market share in 2024. This significant market position is primarily driven by the robust growth of e-commerce in Italy, with the sector generating USD 47.7 billion in 2023 and projected to reach USD 74 billion by 2027. The segment’s strength is further reinforced by the extensive infrastructure of key players like Poste Italiane, which operates through 12,755 post offices, 5,800 pick-up lines, 91 branches/agencies, and 15,724 collection points across Italy. The domestic segment benefits from innovative service offerings, such as Poste Italiane’s “Fresh” service launched in 2023, which focuses on delivering fresh groceries to customers’ homes in 16 Italian cities including Milan, Bologna, Rome, and Florence. Additionally, the segment’s growth is supported by the increasing adoption of digital services, with 94% of consumers having bank accounts and 84% having internet access, facilitating greater participation in domestic e-commerce activities.

International Segment in Italy CEP Market

The international segment of Italy’s CEP market is projected to demonstrate robust growth, with an estimated CAGR of approximately 4.5% from 2024 to 2029. This growth trajectory is significantly driven by cross-border e-commerce activities, with about 67% of Italian consumers actively purchasing from international websites. The segment’s expansion is further supported by strategic partnerships between major players, such as the collaboration between DHL and Poste Italiane announced in 2023, which aims to enhance cross-border delivery capabilities. The international segment is also benefiting from technological advancements, with companies like Amazon revealing plans to introduce drone delivery services in Italy by late 2024. Additionally, over 55% of Italian businesses are leveraging e-commerce for international sales, with significant trade flows to EU countries, the United States, and Asian markets. Major courier companies are investing in infrastructure improvements to support this growth, exemplified by GLS Italy’s launch of its new International Hub in Sordio, spanning approximately 27,000 sqm.

Segment Analysis: By Speed of Delivery

Non-Express Segment in Italy Courier, Express, and Parcel (CEP) Market

The non-express segment dominates the Italian CEP market, commanding approximately 76% market share in 2024. This significant market position is primarily driven by the substantial growth in e-commerce activities, particularly in B2C and B2B commerce segments. The segment has been particularly strengthened by the increasing adoption of digital technologies among businesses and consumers, with local small and medium enterprises setting up online marketplaces to expand domestically. Amazon’s expansion of waterborne transportation, known as Amazon Sea, has also contributed significantly to this segment’s dominance, as approximately 60% of the inventory within its logistics network is owned by independent sellers. The strategic partnership between DHL and Poste Italiane announced in March 2023 has further bolstered this segment by enhancing service offerings and allowing customers to conveniently drop off packages at Poste Italiane’s service points.

Express Segment in Italy Courier, Express, and Parcel (CEP) Market

The express delivery segment is experiencing rapid growth in the Italian CEP market, driven by increasing demands and expectations regarding service speed and quality. Poste Italiane’s introduction of a new express courier service called “Fresh” in 2023, developed in collaboration with MLK Deliveries and Mazzocco, has significantly contributed to this growth by focusing on delivering fresh groceries to customers’ homes in 16 Italian cities including Milan, Bologna, Rome, and Florence. The segment’s expansion is further supported by the growing availability of alternative delivery points and timed slots, particularly in major cities. The increasing prominence of e-commerce has led to higher demands for faster delivery services, with companies like GLS Italy launching new International Hubs and expanding their infrastructure to meet these growing needs.

Segment Analysis: By Model

Business-to-Consumer (B2C) Segment in Italy CEP Market

The Business-to-Consumer (B2C) segment dominates the Italy Courier, Express, and Parcel (CEP) market, commanding approximately 60% market share in 2024. This segment’s prominence is primarily driven by the rapid expansion of e-commerce in Italy, with the sector growing by over 13% year-over-year in 2023 and estimated to rise by 16% by the end of 2024. The increasing domestic and international e-commerce transactions, supported by rising investments from major players, are fueling this segment’s growth. The segment benefits from the expanding presence of small and medium-sized enterprises on various online marketplaces, with cross-border e-commerce expected to soar as Italian consumers increasingly purchase about 17% of their online goods from international sellers. Major CEP companies are making strategic investments and partnerships driven by e-commerce to capitalize on the expected growth, with companies like Amazon collaborating with 25,000 Italian SMEs to provide investments and digital resources for online business internationalization.

Remaining Segments in Model Segmentation

The Business-to-Business (B2B) and Consumer-to-Consumer (C2C) segments complete the Italian CEP market landscape. The B2B segment serves the manufacturing and industrial sectors, facilitating the movement of goods between businesses, with particular strength in sectors like automotive, pharmaceuticals, and machinery parts. This segment benefits from Italy’s position as the second-largest manufacturing country in Europe. The C2C segment, while smaller, plays a crucial role in enabling peer-to-peer deliveries and is particularly active in the second-hand market and personal item shipping. The growth of digital resale platforms and environmental consciousness has increased the popularity of C2C deliveries, with platforms like Subito.it and various parcel shop networks facilitating these transactions. Both segments are witnessing technological advancement in terms of tracking capabilities, delivery options, and customer service improvements.

Segment Analysis: By Shipment Weight

Segment Analysis: By Mode of Transport

Road Segment in Italy Courier, Express, and Parcel (CEP) Market

The road transport segment dominates the Italian CEP market, commanding approximately 64% of the market value in 2024. This segment’s prominence is driven by the extensive road infrastructure network across Italy, particularly in regions like Lombardy, Emilia-Romagna, and Veneto, which collectively generate about 65% of the total road traffic. The segment’s strength is further reinforced by the fact that 80% of truck movements cover distances less than 200 km, making road transport the most practical and cost-effective option for last-mile delivery services. Major players like BRT, DHL, and FedEx have significantly invested in expanding their road fleet capabilities, with companies focusing on sustainable solutions through the introduction of electric vehicles and optimization of delivery routes. The growth in e-commerce, particularly in B2C deliveries, has further cemented the road segment’s dominance, as it offers the flexibility and accessibility needed for efficient parcel delivery across Italy’s diverse geographical landscape.

Remaining Segments in Mode of Transport

The air transport segment plays a crucial role in the Italian CEP market, particularly for time-sensitive deliveries and international shipments. Major logistics hubs like Milano-Malpensa, Roma-Fiumicino, and Bergamo-Orio Al Serio serve as key nodes for air cargo operations, facilitating both domestic and cross-border deliveries. The segment has seen significant developments with express courier services like FedEx and DHL establishing dedicated air freight operations at these airports. The integration of air transport with ground operations has enabled courier companies to offer comprehensive delivery solutions, especially for high-value and urgent shipments. The segment’s growth is supported by increasing cross-border e-commerce activities and the need for faster delivery times in certain business sectors such as pharmaceuticals, electronics, and other time-critical industries.

Segment Analysis: By End User Industry

E-commerce Segment in Italy Courier, Express, and Parcel (CEP) Market

The e-commerce segment dominates the Italy CEP market, commanding approximately 33% market share in 2024, driven by the rapid digitalization of retail and changing consumer preferences. Italy’s e-commerce sector is experiencing substantial growth, with the market value projected to reach USD 64.8 billion by 2025. The segment’s prominence is further reinforced by increasing cross-border e-commerce activities, with about 67% of Italian consumers purchasing from foreign websites, particularly from Chinese, British, and American e-stores. Major CEP companies are making strategic investments and partnerships to capitalize on this growth, as evidenced by Amazon’s collaboration with 25,000 Italian SMEs in 2023 to provide investments and digital resources for online business expansion. The segment’s growth is also supported by the rising adoption of digital services, with 94% of consumers having bank accounts, 84% having internet access, and 83% having smartphones.

Healthcare Segment in Italy Courier, Express, and Parcel (CEP) Market

The healthcare segment is emerging as the fastest-growing core segment in the Italy CEP market, driven by increasing demand for medical supplies and equipment delivery services. UPS Healthcare’s investment of over USD 21.34 million in temperature-controlled vehicles across Europe, including Italy, demonstrates the segment’s growth potential. These specialized vehicles maintain temperatures between 2 to 8 degrees and 15 to 25 degrees Celsius, ensuring secure transport of healthcare products. The segment’s growth is further supported by Italy’s position as the fourth-largest medical equipment market in Europe, with the medical devices market expected to reach USD 13.28 billion by 2027. The COVID-19 pandemic has accelerated the demand for express delivery services in healthcare, particularly for medical equipment and supplies. The segment’s expansion is also driven by rising healthcare expenditure and the adoption of advanced healthcare technologies, creating sustained demand for specialized courier services.

Remaining Segments in End User Industry

The other segments in the Italy CEP market include manufacturing, financial services (BFSI), primary industry, and wholesale and retail trade, each serving distinct market needs. The manufacturing segment benefits from Italy’s position as Europe’s second-largest manufacturing country, particularly in machinery and equipment. The BFSI segment continues to generate demand through the delivery of banking documents, cards, and financial instruments, supported by the expanding network of bank branches across Italy. The primary industry segment serves agricultural and mining sectors with specialized delivery requirements, while the wholesale and retail trade segment caters to traditional brick-and-mortar businesses. These segments collectively contribute to the market’s diversity and stability, with each addressing specific industry requirements and maintaining steady growth trajectories.

Italy Courier, Express, and Parcel (CEP) Industry Overview

Top Companies in Italy Courier, Express, and Parcel Market

The Italian CEP market is characterized by continuous innovation and strategic expansion by major players. Companies are heavily investing in sustainable delivery solutions, including electric vehicles and carbon reduction initiatives, with several players launching EV centers and green delivery options. Operational agility is being enhanced through the establishment of new hubs, automated sorting facilities, and technology integration for improved tracking and delivery efficiency. Strategic partnerships are becoming increasingly common, particularly for cross-border deliveries and e-commerce fulfillment, while companies are also focusing on expanding their pickup and delivery networks through parcel shops and lockers. The market is seeing significant investment in cold chain capabilities and specialized delivery services, particularly for fresh food and healthcare products, as players aim to capture growing segment opportunities.

Mix of Global and Local Players

The Italian CEP market features a balanced mix of international logistics giants and established domestic operators. Global players like DHL, FedEx, and UPS leverage their extensive international networks and technological capabilities, while domestic players such as Poste Italiane and BRT maintain strong local market positions through their deep understanding of regional dynamics and extensive local infrastructure. The market shows moderate consolidation, with the top five players commanding a significant market share, though there remains space for specialized operators in niche segments.

The market is experiencing active consolidation through strategic acquisitions and partnerships, particularly in the e-commerce and last-mile delivery segments. Companies are acquiring local operators to strengthen their regional presence and expand their service portfolios. International players are forming partnerships with local companies to enhance their domestic delivery capabilities, while domestic operators are collaborating with global players to improve their cross-border services. This trend is reshaping the competitive landscape and creating more integrated service offerings.

Innovation and Sustainability Drive Future Success

For established players to maintain and grow their market share, focus needs to be placed on developing comprehensive omnichannel delivery solutions and investing in automated sorting facilities and digital technologies. Success will increasingly depend on the ability to offer sustainable delivery options, specialized services for high-growth segments like healthcare and fresh food, and flexible delivery solutions that cater to changing consumer preferences. Companies must also strengthen their last-mile delivery capabilities and expand their network of alternative delivery points to remain competitive.

Emerging players can gain ground by focusing on niche markets and specialized services where larger players may have less presence. Building strong e-commerce capabilities, developing innovative delivery solutions, and forming strategic partnerships will be crucial for growth. The market’s future will be shaped by increasing environmental regulations pushing for sustainable operations, growing e-commerce penetration requiring enhanced delivery capabilities, and evolving consumer expectations demanding more flexible and faster delivery options. Success will depend on companies’ ability to adapt to these changes while maintaining operational efficiency and service quality. In this context, courier services in Italy providers and Italian courier companies are well-positioned to capitalize on these trends by leveraging their local expertise and innovative approaches.

Italy Courier, Express, and Parcel (CEP) Market Leaders

-

- DHL Group

- FedEx

- International Distributions Services (including GLS)

- La Poste Group (including BRT)

- Poste Italiane

- *Disclaimer: Major Players sorted in no particular order

Italy Courier, Express, and Parcel (CEP) Market News

- September 2024: FedEx partnered with and invested in Nimble, an AI robotics and autonomous e-commerce fulfillment technology company, to scale FedEx Fulfillment with their fully autonomous 3PL model. FedEx offered a comprehensive approach to help e-commerce and omnichannel brands make faster, smarter supply chain decisions. With more than 130 warehouse and fulfillment operations in North America and 475 million returns processed annually, FedEx Supply Chain helped brands consolidate functions, increase agility, and accelerate click-to-door speed to maximize supply chain value.

- August 2024: FedEx introduced new digital visibility products, enhancing the experience for shippers and recipients by merging digital solutions with essential data. These paid solutions catered to the rising market demand for advanced data analytics. Businesses harnessed near real-time insights and predictive analytics, refining their customers’ post-purchase experience. FedEx also offered paid data integration solutions, granting third-party providers access to shipment tracking information, including the Track API, Track EDI, and new webhook subscriptions, all designed to enhance premium post-purchase tracking and supply chain visibility.

- July 2024: BRT launched a user-friendly platform enabling online payment for shipments. Users could select both pick-up and delivery locations, calculate shipping costs, and conveniently drop off items be it parcels, envelopes, or documents at any of the over 8,800 BRT fermopoints or lockers. BRT’s online shipping platform prioritized flexibility where users could make payments anytime and opt for one-off shipments without any contractual obligations. Furthermore, shipments paid for online incurred no extra charges when dropped off at a locker or BRT fermopoint.