Iraq Logistics Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Iraq Logistics & Freight Market is Segmented by Function (Freight Transport (Road, Shipping, Air, and Rail), Freight Forwarding, Warehousing, and Value-added Services and Other Functions) and by End User (Manufacturing and Automotive; Oil and Gas, Mining, and Quarrying; Agriculture, Fishing, and Forestry; Construction; Distributive Trade; and Other End Users). The report offers market size and forecasts for the Iraq Freight & Logistics Market in value (USD Billion) for all the above segments.

Iraq Logistics Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Iraq Logistics & Frieght Market Size

| Study Period | 2020 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

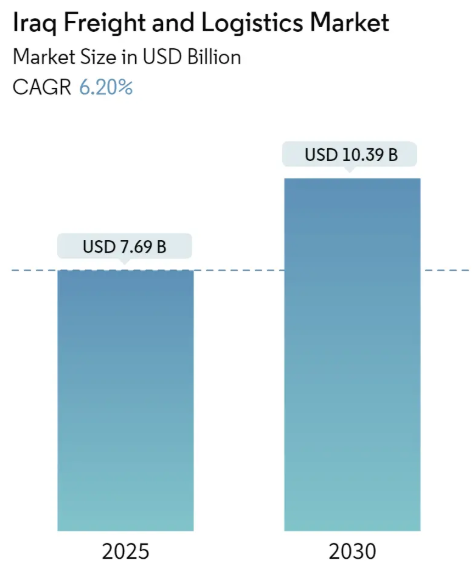

| Market Size (2025) | USD 7.69 Billion |

| Market Size (2030) | USD 10.39 Billion |

| CAGR (2025 – 2030) | 6.20 % |

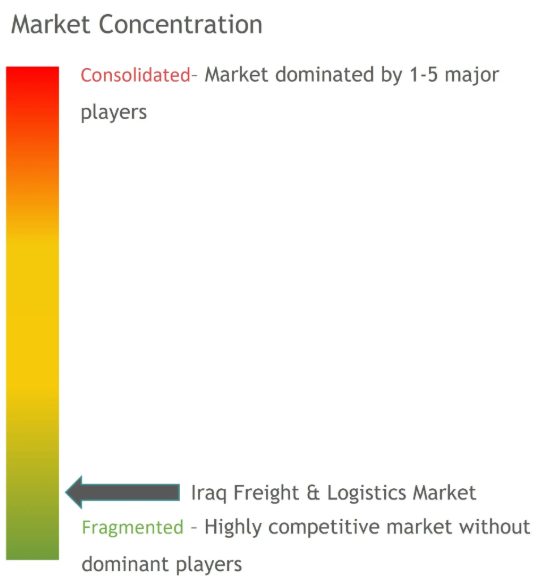

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Iraq Freight & Logistics Market with other markets in Logistics Industry

Iraq Logistics & Frieght Market Analysis

The Iraq Freight & Logistics Market size is estimated at USD 7.69 billion in 2025, and is expected to reach USD 10.39 billion by 2030, at a CAGR of 6.2% during the forecast period (2025-2030).

Iraq’s freight and logistics sector is experiencing significant transformation driven by infrastructure development and international partnerships. The country’s strategic position in the Belt and Road Initiative is evidenced by construction projects worth USD 1,470 million in 2022, highlighting its growing importance in regional trade networks. The Transport Ministry and Construction & Housing Ministry are jointly managing transportation infrastructure development, with the latter overseeing more than 44,000 kilometers of paved motorways that form crucial surface transportation links connecting Iraq to neighboring countries.

The digitalization of logistics operations is reshaping the industry landscape, with technology adoption becoming increasingly crucial for competitive advantage. This digital transformation is supported by an internet penetration rate of 49.4% as of 2022, enabling the implementation of advanced tracking systems and automated logistics solutions. Major logistics companies are investing in digital infrastructure, with dnata notably deploying its “OneCargo” system to digitize processes and increase efficiency across cargo operations in Iraq. The integration of logistics data analytics is becoming pivotal in optimizing these operations.

The maritime sector is undergoing substantial development, particularly with the ambitious Al Faw Grand Port project. In a significant move to enhance port operations, AD Ports Group signed a partnership with Iraq’s International Development Bank in 2023 to explore opportunities for ports and logistics projects. This collaboration aims to strengthen trade flows between the UAE and Iraq while modernizing port infrastructure. Additionally, dnata announced in January 2023 a USD 14 million investment in a new 20,000-square-meter cargo warehouse at Erbil International Airport, demonstrating growing confidence in Iraq’s logistics infrastructure. The use of shipping analytics is expected to further enhance operational efficiency in these maritime ventures.

The automotive and commercial vehicle sector is driving significant logistics demand, with the market experiencing a robust 27.6% growth in sales. The General Land Transport Company maintains a fleet of 535 trucks for goods transport, supplemented by 2,600 non-owned trucks working under contract, indicating a strong public-private partnership in the logistics sector. The November 2023 launch of the Iraq National Trade Forum marks a significant step in connecting small and medium logistics firms with international suppliers, particularly benefiting the agriculture and agri-food industries’ supply chains. The application of supply chain analytics is increasingly important in managing these complex logistics networks and ensuring seamless operations. Furthermore, transportation analytics is being leveraged to optimize route planning and fleet management, enhancing the overall efficiency of the logistics sector.

Iraq Logistics & Frieght Market Trends

Manufacturing and Automotive Industry Growth Driving the Logistics Market

The manufacturing and automotive sectors are emerging as significant drivers of Iraq’s logistics market, with the automotive market being one of the largest in the Middle East and North Africa (MENA) region. The industry’s foreign direct investments significantly contribute to the nation’s GDP, with labor productivity in the manufacturing sector standing at USD 10.1, positioning Iraq among the top four countries in the Middle East for manufacturing productivity. The automotive market has shown remarkable resilience, with approximately 85,380 units sold annually, predominantly in passenger automobiles, while commercial vehicle purchases have shown consistent growth since 2017. This growth in automotive sales and manufacturing activities has created increased demand for sophisticated logistics services, particularly in transportation and warehousing. The integration of freight forecasting techniques is becoming essential to manage this demand efficiently.

The entry of new competitors and foreign corporations’ plans to develop production facilities have further stimulated the logistics sector. Notable developments include the debut of EXEED, a high-end automobile brand, in the Iraqi market, joining established players like Toyota, Ford, and Volkswagen. The government’s strong support for the sector, viewing it as a primary source of income, has led to improved infrastructure and logistics networks. With rising disposable income levels and projected economic growth through 2026, the automotive market’s expansion is expected to continue driving demand for logistics services. The passenger automobile market alone is anticipated to generate revenue of USD 1.16 billion, with large SUVs comprising the majority of sales, necessitating robust logistics solutions for vehicle transportation and distribution. This scenario underscores the importance of transportation research in optimizing logistics operations.

Oil and Gas Sector Supporting Logistics Activities

The oil and gas sector remains a fundamental driver of Iraq’s logistics market, with significant developments in infrastructure and transportation networks supporting the industry’s growth. The government has embarked on ambitious plans to upgrade and expand its energy industry, signing substantial investment contracts for gas capture, oilfield development, and solar energy production. A notable example is the USD 27 billion deal with TotalEnergies signed in September 2021, encompassing four major projects including the development of the Ratawi oilfield, a gas processing plant, seawater supply facility, and solar power infrastructure. These developments have created extensive demand for specialized logistics services, particularly in equipment transportation and project cargo handling.

The sector’s logistics requirements have been further amplified by recent strategic partnerships and infrastructure developments. In October 2022, SAFEEN Group signed a significant agreement with Amaan Baghdad Company for the transportation and storage of fuel oil from Iraq’s Khor Al Zubair and Umm Qasr oil terminals. This project involves the deployment of three Very Large Crude Carriers (VLCCs) and one Medium Range (MR) tanker, demonstrating the scale of logistics operations required in the sector. The expansion of port infrastructure, including the development of six new berths at the Khor Al Zubair port for oil operations, has created additional demand for logistics services. These developments, coupled with Iraq’s position as one of the world’s major producers of associated gas, releasing 17.89 billion m3 of gas in 2021, continue to drive growth in specialized logistics services for the energy sector. The role of supply chain research is crucial in enhancing the efficiency of these logistics operations.

Segment Analysis: By Function

Freight Transport Segment in Iraq Freight & Logistics Market

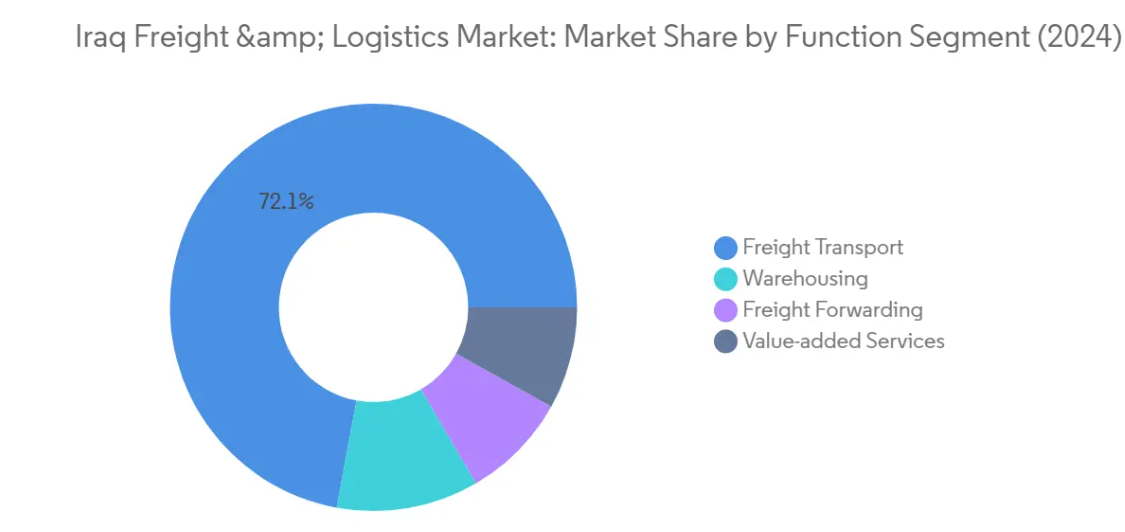

The freight transport segment continues to dominate the Iraq freight and logistics market, commanding approximately 72% of the total market share in 2024. This substantial market position is primarily driven by the country’s growing international trade activities and increasing domestic transportation needs. The segment’s strength is particularly evident in road transport, which handles the majority of inland freight movement across Iraq. The segment benefits from ongoing infrastructure developments, including improvements in port connectivity and road networks. The government’s focus on enhancing port efficiency and increasing the efficiency of road transport has further solidified this segment’s market leadership. Additionally, the integration of digital technologies and transportation analytics in freight transport operations has helped maintain its dominant position in the market.

Value-Added Services Segment in Iraq Freight & Logistics Market

The value-added services segment is emerging as the fastest-growing segment in the Iraq freight and logistics market, projected to grow at approximately 8% during 2024-2029. This growth is being driven by increasing demand for specialized services such as kitting and assembly, labeling, packaging and repackaging, sorting, and return solutions. The segment’s expansion is further supported by the rising adoption of digital technologies and automation in warehouse operations. Companies are increasingly focusing on offering customized value-added services to differentiate themselves in the market. The integration of technology with value-added services, combined with strong warehousing and distribution networks, has enabled 3PL companies to provide more comprehensive logistics solutions. The segment is also benefiting from the growing e-commerce sector, which requires specialized handling and processing services. The application of logistics performance analysis is crucial in optimizing these services.

Remaining Segments in Iraq Freight & Logistics Market

The warehousing and freight forwarding segments continue to play vital roles in Iraq’s freight and logistics market. The warehousing segment is experiencing significant growth due to expanding industrial activities and the strong growth of e-commerce in the country. Companies like Agility, DHL, and DB Schenker are expanding their warehousing operations to meet increasing demand. Meanwhile, the freight forwarding segment is benefiting from increasing international trade and the emergence of new e-commerce companies. Both segments are witnessing technological advancement with the integration of warehouse management systems and digital platforms, contributing to improved operational efficiency and customer service delivery. The use of logistics data analytics is enhancing these advancements, ensuring efficient operations and customer satisfaction.

Segment Analysis: By End User

Oil & Gas, Mining and Quarrying Segment in Iraq Freight & Logistics Market

The oil and gas, mining and quarrying segment dominates the Iraq freight and logistics market, commanding approximately 38% market share in 2024. This substantial market position is primarily driven by Iraq’s ambitious plans for upgrading and expanding its energy industry, with the government aiming to boost oil production to 8 Mbpd by 2027. The segment’s dominance is further strengthened by significant investments in gas capture, development of oilfields, solar energy production, and regional integration of the electric grid. A notable development is the USD 27 billion deal with Total-Energies signed for developing Iraq’s energy sector over 25 years, which includes multiple strategic projects such as the development of the Ratawi oilfield, gas processing plant, seawater supply facility, and solar power plant development. The sector’s robust performance is also supported by the government’s heavy reliance on oil receipts, which account for nearly 87% of total government revenue.

Manufacturing & Automotive Segment in Iraq Freight & Logistics Market

The manufacturing and automotive segment is emerging as the fastest-growing sector in the Iraq freight and logistics market, with a projected growth rate of approximately 8% during 2024-2029. This remarkable growth is driven by Iraq’s position as one of the largest automotive markets in the Middle East and North Africa (MENA) region. The segment’s expansion is fueled by increasing foreign corporation investments and new market entrants developing their production facilities. The automotive market’s growth is particularly notable with passenger automobiles gaining significant market share, and revenue from the passenger automobile market is anticipated to show strong growth. The introduction of electric vehicles, exemplified by the launch of Iraq’s first EV, the Jaguar I-Pace, further demonstrates the segment’s progressive development and future potential in the logistics sector. The application of supply chain analytics is essential in optimizing the automotive logistics processes.

Remaining Segments in Iraq Freight & Logistics Market

The other significant segments in the Iraq freight and logistics market include construction, distributive trade, agriculture, fishing and forestry, and other end users. The construction segment plays a vital role through various infrastructure development projects and government initiatives. The distributive trade segment is crucial for supporting Iraq’s import-export activities and retail distribution networks. The agriculture, fishing and forestry segment contributes significantly to the logistics market through the transportation of agricultural products and food security initiatives. The other end users segment, which includes telecommunications and pharmaceuticals, provides diversification to the market through specialized logistics requirements and value-added services. Each of these segments contributes uniquely to the overall market dynamics and helps maintain a balanced logistics ecosystem in Iraq.

Iraq Logistics & Frieght Industry Overview

Top Companies in Iraq Freight & Logistics Market

The freight and logistics market in Iraq is characterized by both international and domestic players actively competing through service innovation and operational excellence. Companies are increasingly focusing on technology integration, including live tracking systems, automation, AI capabilities, and IoT solutions to enhance their service offerings and operational efficiency. Strategic partnerships and collaborations, particularly with e-commerce platforms and regional logistics networks, have become crucial for market expansion. Players are also investing in developing specialized services for key sectors like oil and gas, manufacturing, and retail distribution. The market has seen significant emphasis on value-added services, including warehousing solutions, supply chain optimization, and customs clearance services, as companies strive to differentiate themselves in an increasingly competitive landscape.

Fragmented Market with Growing Consolidation Trends

The Iraqi freight and logistics market exhibits a fragmented structure with a mix of established global players like DHL and local specialists such as Sheraz International Trade & Transport, ENKI Transport & Trading, and Zarawa Company. The market includes over 2,500 transport and integration companies, with larger players typically operating extensive networks of 500-1,000 points of sale, substantial vehicle fleets, and significant workforce strength. The competitive dynamics are shaped by both international logistics conglomerates bringing global expertise and local players leveraging their deep understanding of regional markets and established relationships.

The market is witnessing increasing consolidation through strategic partnerships and acquisitions, particularly as companies seek to expand their geographic reach and service capabilities. Global players are entering the market through partnerships with local operators, while domestic companies are strengthening their position through technology investments and service diversification. The emergence of digital logistics platforms and e-commerce fulfillment specialists is reshaping traditional market structures, driving established players to adapt their business models and embrace digital transformation initiatives. This shift highlights the importance of logistics consulting as companies navigate these changes.

Innovation and Adaptability Drive Market Success

Success in the Iraqi freight and logistics market increasingly depends on companies’ ability to integrate technological solutions while maintaining operational flexibility. Incumbent players are focusing on developing comprehensive end-to-end logistics solutions, investing in digital capabilities, and expanding their service portfolios to include specialized offerings for high-growth sectors. Market leaders are also emphasizing sustainable practices and efficient last-mile delivery solutions, particularly in urban areas, while building strong relationships with key industrial sectors and government entities.

For emerging players and contenders, market entry and growth strategies center on identifying and serving underserved market segments and developing specialized capabilities. The increasing focus on e-commerce logistics and digital transformation presents opportunities for new entrants to establish themselves through innovative business models and technology-driven solutions. Success factors also include the ability to navigate regulatory requirements, build strong local partnerships, and develop efficient customs clearance capabilities. Companies must also consider the concentration of demand in key industrial sectors and urban centers while developing their market approach and service offerings. The role of supply chain analytics is becoming pivotal in optimizing these strategies and ensuring competitive advantage.

Iraq Logistics & Frieght Market Leaders

-

- Al-Rashed United Shipping Services

- Zarawa Company

- Move One Logistics

- Crown Logistics LTD

- Guangzhou International

- *Disclaimer: Major Players sorted in no particular order

Iraq Logistics & Frieght Market News

November 2022: The AD Ports Group and Iraq-based International Development Bank (IDB) signed a MoU (memorandum of understanding) to review opportunities for ports and logistics projects that could enhance trade flows between the UAE and Iraq. This MoU is expected to bring more trade options among both the countries.

February 2022: Leading international air and travel services company Dnata reached a significant milestone in Erbil. In order to digitise procedures and increase efficiency throughout all of its cargo operations in Iraq, the company deployed the “OneCargo” system. The cutting-edge tool, which dnata intends to introduce globally, is anticipated to offer major business advantages to users.

Iraq Logistics & Frieght Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.2.3 Opportunities

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Porter’s Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Advancements in Freight Forwarding

- 4.6 Overview of Global Freight Forwarding Market

- 4.7 Market segmentation of Freight Forwarding

- 4.8 Digitalisation of Freight Forwarding Market

- 4.9 Pricing Analysis and Revenue Analysis of Freight Forwarding Market

- 4.10 Regional Insights on Freight Forwarding Market

- 4.11 Pricing Analysis of Freight Forwarding Market By Region

- 4.12 Assessment of the Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

- 5.1 Function

- 5.1.1 Freight Transport

- 5.1.1.1 Road

- 5.1.1.2 Shipping

- 5.1.1.3 Air

- 5.1.1.4 Rail

- 5.1.2 Freight Forwarding

- 5.1.3 Warehousing

- 5.1.4 Value-added Services and Others

- 5.2 End User

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Oil and Gas, Mining, and Quarrying

- 5.2.3 Agriculture, Fishing, and Forestry

- 5.2.4 Construction

- 5.2.5 Distributive Trade (Wholesale and Retail Segments – FMCG included)

- 5.2.6 Other End Users (Telecommunications, Pharmaceuticals, etc.)

6. COMPETITIVE LANDSCAPE

- 6.1 Overview

- 6.2 Company Profiles

- 6.2.1 Al-Rashed United Shipping Services

- 6.2.2 Zarawa Company

- 6.2.3 Move One Logistics

- 6.2.4 Crown Logistics LTD

- 6.2.5 Guangzhou International

- 6.2.6 Transparency Co.

- 6.2.7 Arch Star Logisitcs

- 6.2.8 Mateen Express and Logistics

- 6.2.9 Sheraz Co.

- 6.2.10 DHL Global Forwarding

- 6.2.11 Nippon Express Co. Ltd

- 6.2.12 Dsv Global Transports and Logistics

- 6.2.13 The Maersk Group

- 6.2.14 C.H. Robinson*

- *List Not Exhaustive

7. FUTURE OF THE MARKET

8. APPENDIX

Iraq Logistics & Frieght Industry Segmentation

Freight management is defined as the process of controlling and executing a cost-effective procedure for goods delivery. In contrast, logistics management can be defined as the comprehensive process of acquiring, storing, and transporting resources to their final destination. A complete background analysis of the Iraq Freight & Logistics Market, including the assessment of the economy and contribution of sectors in the economy, market overview, market size estimation for key segments, and emerging trends in the market segments, market dynamics, and geographical trends, and COVID-19 impact, is covered in the report.

The Iraq Freight & Logistics Market is segmented by Function (Freight Transport (Road, Shipping, Air, and Rail), Freight Forwarding, Warehousing, and Value-added Services and Other Functions) and by End User (Manufacturing and Automotive; Oil and Gas, Mining, and Quarrying; Agriculture, Fishing, and Forestry; Construction; Distributive Trade; and Other End Users). The report offers market size and forecasts for the Iraq Freight & Logistics Market in value (USD Billion) for all the above segments.

| Function | Freight Transport | Road |

| Shipping | ||

| Air | ||

| Rail | ||

| Freight Forwarding | ||

| Warehousing | ||

| Value-added Services and Others | ||

| End User | Manufacturing and Automotive | |

| Oil and Gas, Mining, and Quarrying | ||

| Agriculture, Fishing, and Forestry | ||

| Construction | ||

| Distributive Trade (Wholesale and Retail Segments – FMCG included) | ||

| Other End Users (Telecommunications, Pharmaceuticals, etc.) |

Iraq Logistics & Frieght Market Research FAQs

The Iraq Freight & Logistics Market size is expected to reach USD 7.69 billion in 2025 and grow at a CAGR of 6.20% to reach USD 10.39 billion by 2030.

In 2025, the Iraq Freight & Logistics Market size is expected to reach USD 7.69 billion.

Al-Rashed United Shipping Services, Zarawa Company, Move One Logistics, Crown Logistics LTD and Guangzhou International are the major companies operating in the Iraq Freight & Logistics Market.

In 2024, the Iraq Freight & Logistics Market size was estimated at USD 7.21 billion. The report covers the Iraq Freight & Logistics Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Iraq Freight & Logistics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.