Indonesia Freight and Logistics Market SIZE & SHARE ANALYSIS – GROWTH TRENDS & FORECASTS UP TO 2030

The Indonesia Freight and Logistics Market is segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others) and by Logistics Function (Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage). Market Value (USD) and Market Volume (ton-km, number of parcels, warehousing & storage space in square feet) are both presented. Key Data Points observed include Freight Transport Volume (ton-km) by Mode of Transport; Production Trends (Manufacturing, E-Commerce etc. in USD); Import and Export trends (in USD); and Freight Pricing Trends (USD per ton-km).

Indonesia Freight and Logistics Market SIZE & SHARE ANALYSIS – GROWTH TRENDS & FORECASTS UP TO 2030

Indonesia Freight and Logistics Market Size

| Study Period | 2017 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

| Market Size (2025) | USD 131.2 Billion |

| Market Size (2030) | USD 178.1 Billion |

| CAGR (2025 – 2030) | 6.29 % |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Indonesia Freight and Logistics Market with other markets in Logistics Industry

Indonesia Freight and Logistics Market Analysis

The Indonesia Freight and Logistics Market size is estimated at 131.2 billion USD in 2025, and is expected to reach 178.1 billion USD by 2030, growing at a CAGR of 6.29% during the forecast period (2025-2030).

Indonesia’s logistics market is experiencing significant transformation driven by substantial infrastructure investments and development initiatives. The government has demonstrated its commitment to infrastructure development by completing 190 national strategic projects between 2016 and 2023, with 37 projects finalized in 2023 alone, requiring an investment of USD 30.58 billion. These projects encompass a diverse range of infrastructure developments, including ports, toll roads, railways, airports, and cross-border facilities. For the fiscal year 2025, the Highways Directorate General has been allocated a substantial budget ceiling of USD 2.10 billion, highlighting the government’s continued focus on infrastructure enhancement.

The maritime freight logistics landscape is undergoing notable evolution with strategic initiatives to enhance port connectivity and efficiency. In March 2024, Batam Island authorities launched direct shipping services from Batuampar Port to Guangzhou and Shenzhen in China, a development expected to reduce transportation costs by up to USD 600 per shipment compared to traditional routes via Singapore. This initiative represents a significant step in optimizing maritime logistics operations and strengthening international trade connections. The government’s sea toll programs are targeting the modernization of 24 seaports, aligning with Indonesia Vision 2045’s ambitious goal of positioning the maritime industry to contribute approximately 12.5% to Indonesia’s GDP.

The logistics industry is witnessing significant technological advancement and service enhancement through strategic corporate initiatives. In October 2024, FedEx inaugurated a new gateway facility in Denpasar, Bali, introducing direct routing from Denpasar to Singapore and bypassing the previous Jakarta route, thereby optimizing delivery times and shipping processes. The Public Works and Housing Ministry’s 2025 Draft State Budget proposes a comprehensive allocation of USD 4.91 billion, with specific designations of USD 0.66 billion for road infrastructure and USD 0.34 billion for bridge infrastructure, demonstrating a balanced approach to infrastructure development.

The industry is increasingly embracing sustainable practices and innovative solutions to address operational challenges. Indonesia’s Ministry of Finance has introduced new tax incentives to promote electric vehicle adoption in the logistics sector, including luxury tax exemptions for EVs in 2024 and import tax waivers until 2025. The government has set ambitious targets to become the world’s third-largest producer of electric vehicle batteries by 2027, with plans to achieve an annual EV battery capacity of 140 GWh by 2030. These initiatives are complemented by the development of smart logistics solutions, with companies implementing advanced tracking systems and automated warehouse management solutions to enhance operational efficiency.

Indonesia Freight and Logistics Market Trends

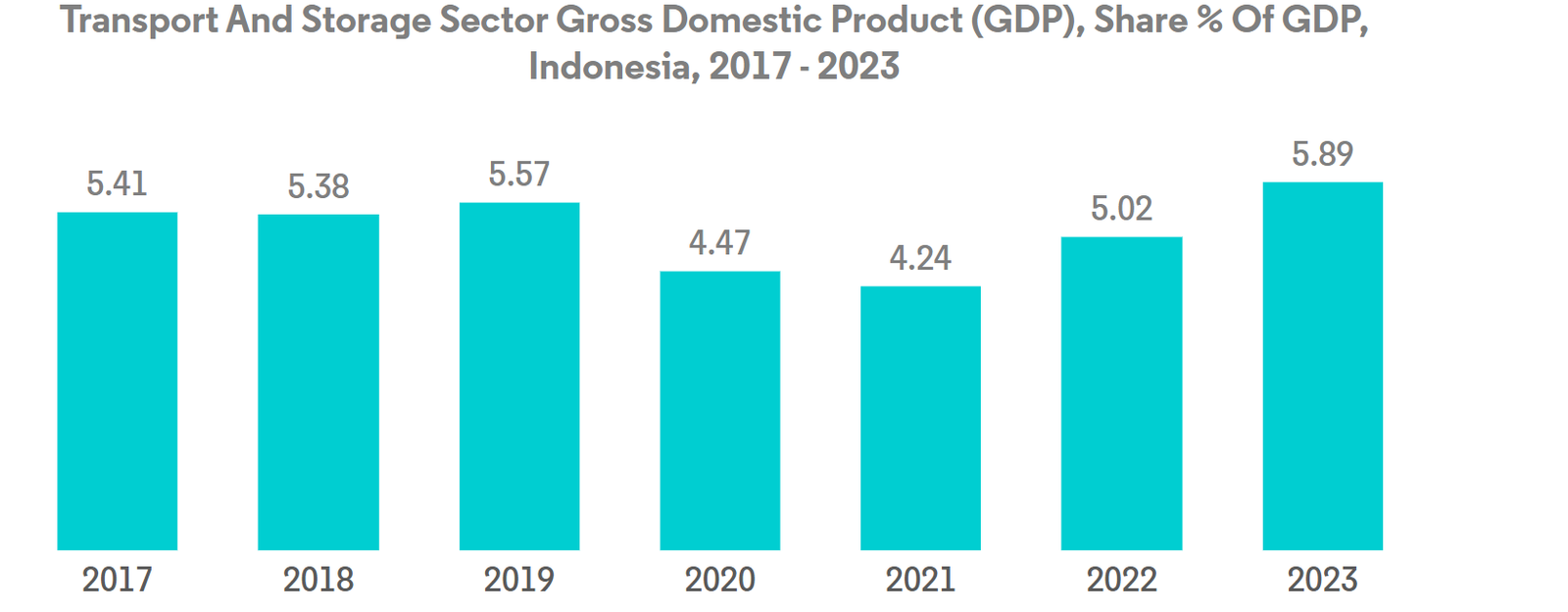

The transportation and storage sector expected to witness boost in GDP contributions, fueled by rising infrastructure projects

- In May 2024, the Japanese government extended a loan of approximately JPY140.7 billion (USD 900 million) for the construction of a high-speed rail line in Jakarta, Indonesia. Spanning 84.1 km, the East-West rail project will be executed in two phases, commencing in 2026 and concluding by 2031. The rail line will incorporate advanced Japanese technology for both trains and signaling systems. These initiatives are poised to enhance the GDP contribution from the transport and storage sector.

- Transportation is at the forefront of the nation’s infrastructure expansion efforts. In this domain, ongoing and upcoming initiatives allocate 29% of their overall value to road projects, 22% to rail, and 23% to port infrastructure. These projects are crucial for enhancing connectivity and boosting economic growth. A significant undertaking in Indonesia is the Lhokseumawe to Langsa Toll Road, spanning 135 km. Commencing in early 2024, this ambitious project is slated for completion by late 2027, with the goal of alleviating traffic congestion and shortening travel times. This toll road will be instrumental in optimizing logistics and boosting the transport and storage sector’s contribution to GDP.

Indonesia faced fiscal challenges amid surging crude oil prices and subsidy pressures in 2022, however the rates remained unchanged till 2024

- In November 2024, Indonesia reformed its fuel subsidy system. The new president is targeting a reduction in subsidies, which constituted roughly 16% of government spending in 2023. While the subsidy for LPG will stay the same, the government is still determining adjustments for fuel and electricity subsidies. Indonesia’s energy subsidies help keep inflation low but expose the nation to global oil price swings. The government plans to replace these subsidies with cash transfers for needy families, aiming to save about USD 12.99 billion through more targeted support.

- As of June 2024, the Indonesian Ministry of Energy and Mineral Resources (ESDM) was drafting regulations to provide incentives and tax relief for green hydrogen developers to boost the industry’s growth. ESDM aimed to produce 9.9 million tons of hydrogen per year by 2060 to meet the needs of industry (3.9 Mtpa), transportation (1.1 Mtpa), electricity (4.6 Mtpa), and household gas networks (0.28 Mtpa). These sectors could also become export commodities.

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- Indonesia’s population is set to grow to 324 million by 2045, up from 277 million in 2023

- Indonesia’s oil and gas industry attracted investments totaling USD 13.7 billion in 2023, marking a 13% YoY growth

- Driven by the launch of BNPL in the country, e-commerce is set to achieve a CAGR of 10.41% from 2023 to 2027

- Indonesia is positioning itself as a global supplier of batteries and electric vehicles (EVs) by advancing its nickel-based industries

- Fuel economy standards, paired with rapid electrification, are projected to reduce fuel costs in the trucking industry

- Rising focus since past 10 years by Indonesian Government aimed at infrastructure development in remote areas

- Government focusing on development of road & sea infrastructure to facilitate international freight services

- Indonesia initiated direct shipments from Batuampar Port to China, aiming for an annual target of 2 million TEUs

- Rising initiatives to promote environment friendly mode of freight transport with a focus on reducing freight costs

- Indonesia invested USD 400 billion in infrastructure development to enhance global connectivity and economic growth

- Under Vision 2045, Indonesia aims to become a leading global economy by bolstering its manufacturing sector

- Supply and worker shortages and the government’s planned VAT rate hike in 2025 expected to increase inflation rate

- The Indonesian government targets the production of 600,000 electric vehicles by 2030

- Indonesia plans to eliminate LPG and fuel imports by 2030, focusing on harnessing its domestic resources

- Indonesia’s booming mining industry is fueling a surge in demand for rigid trucks

- The Indonesian government is promoting the country as a production hub for EV batteries and offering consumer subsidies to boost demand

- Capacity expansion initiatives, coupled with increasing oil exports and wheat imports, are driving growth

- Increasing port freight volumes, coupled with the growing adoption of port digitalization, are fueling economic growth

- The preference for road and sea freight transport is growing due to rising investments and initiatives in Indonesia

Segment Analysis: End User Industry

Wholesale and Retail Trade Segment in Indonesia Freight and Logistics Market

The wholesale and retail trade segment dominates the Indonesia freight and logistics market, accounting for approximately 35% of the market share in 2024. This segment’s prominence is driven by Indonesia’s sizable population and expanding middle-income demographic with increased purchasing power. The country’s retail industry has emerged as one of Asia’s most promising markets, with retail sales showing strong momentum in Q4 2023 with a 1.6% uptick, building on a 1.4% growth in Q3. The e-commerce sector has been a significant catalyst, experiencing a 4.5% year-over-year growth in 2023. Major e-commerce platforms like Tokopedia, Lazada, and Blibli have enhanced their capabilities to facilitate cross-border transactions, enabling vendors to tap into international markets while providing customers access to a wider range of products.

Manufacturing Segment in Indonesia Freight and Logistics Market

The manufacturing segment is projected to exhibit the strongest growth in the Indonesia freight and logistics market from 2024 to 2029, with an estimated CAGR of around 7%. This robust growth is supported by significant developments in the sector, including the manufacturing industry’s 4.07% year-over-year expansion in the fourth quarter of 2023 and 4.64% growth throughout 2023. The sector has been bolstered by strong domestic and global demand for Indonesia’s export products, with manufacturing exports reaching USD 186.98 billion in 2023, representing 72.24% of the nation’s total exports. The government’s commitment to implementing Industry 4.0, as outlined in the Ministry of Industry’s “Making Indonesia 4.0” roadmap, along with various initiatives under the G20 Indonesia Presidency, is expected to further accelerate the segment’s growth.

Remaining Segments in End User Industry

The other significant segments in the Indonesia freight and logistics market include construction, agriculture, fishing and forestry, and oil and gas logistics market, mining, and quarrying sectors. The construction segment has been particularly dynamic with the government’s ambitious infrastructure development plans and the ongoing relocation of the capital city to Nusantara. The agriculture, fishing, and forestry sector continues to play a vital role in the logistics landscape, especially with increasing agricultural imports and the government’s focus on food security. The oil and gas, mining, and quarrying segment maintains its strategic importance, supported by various ongoing projects and the government’s push toward sustainable energy solutions. These segments collectively contribute to the diverse and evolving nature of Indonesia’s freight and logistics market.

Segment Analysis: Logistics Function

Freight Transport Segment in Indonesia Freight and Logistics Market

The freight transport segment dominates the Indonesia freight and logistics market, commanding approximately 42% of the market share in 2024. This significant market position is supported by Indonesia’s extensive infrastructure development initiatives, including the construction of new airports, seaports, and road networks. The government’s commitment to completing 190 national strategic projects has created substantial opportunities for freight logistics services across various modes, including road, rail, air, and maritime transport. The segment’s growth is further bolstered by increasing trade activities, with Indonesia’s strategic location facilitating both domestic and international freight movement across the archipelago’s 17,000 islands.

Air Freight Segment in Indonesia Freight and Logistics Market

The air freight segment is emerging as the fastest-growing category in Indonesia’s freight and logistics landscape, with a projected growth rate of approximately 8% during 2024-2029. This remarkable growth trajectory is driven by several factors, including the government’s ambitious plans to construct six new airports by 2024, encompassing Banggai Laut, Pahuwato, Bolmong, Sobaham, Singkawang, and Mandailing Natal airports. The expansion of air cargo capacity is further supported by the entry of new carriers and fleet expansions, such as BBN Airlines Indonesia’s addition of Boeing freighters to serve the growing air cargo market. The segment’s growth is also propelled by the rising demand for time-sensitive deliveries and the expansion of e-commerce activities across Indonesia’s vast archipelagic geography.

Remaining Segments in Logistics Function

The other significant segments in Indonesia’s freight and logistics market include freight forwarding, warehousing and storage, CEP (Courier, Express, Parcel), and other services. The freight forwarding segment plays a crucial role in facilitating international trade and managing complex supply chains across Indonesia’s diverse geography. The warehousing and storage segment continues to evolve with the introduction of modern facilities and advanced management systems, particularly supporting the growing e-commerce sector. The CEP segment has become increasingly important with the digital transformation of retail and the rise of online shopping, while other services encompass various value-added activities such as customs clearance, packaging, and supply chain consulting services. This logistics market segmentation ensures a comprehensive approach to addressing the diverse needs of the market.

Indonesia Freight and Logistics Industry Overview

Top Companies in Indonesia Freight and Logistics Market

The market’s leading companies are actively pursuing innovation and expansion strategies to strengthen their competitive positions. Companies are heavily investing in warehouse capacity expansion, with multiple players opening new facilities across strategic locations in Indonesia to enhance their storage and distribution capabilities. Digital transformation has emerged as a key focus area, with firms implementing advanced tracking systems, logistics management platforms, and automated warehouse solutions. Strategic partnerships, particularly in the e-commerce sector, have become increasingly common as companies seek to capitalize on the growing online retail market. International logistics companies in Indonesia are strengthening their presence through local partnerships and acquisitions, while domestic players are expanding their service portfolios to offer integrated end-to-end solutions. Sustainability initiatives, including the adoption of electric vehicles and green logistics practices, are becoming increasingly important in companies’ strategic planning.

Dynamic Market with Strong Local Players

The Indonesian freight and logistics market exhibits a mix of established global players and strong local enterprises, with domestic companies holding significant market share due to their deep understanding of local markets and established networks. The market structure is relatively fragmented, with numerous players operating across different segments, though there is a notable concentration of power among the top-tier companies in specific sectors such as express delivery and container shipping. State-owned enterprises maintain a strong presence, particularly in port operations and postal services, while private players dominate the trucking and warehousing segments. The market has witnessed increased consolidation through strategic acquisitions and partnerships, particularly in the e-commerce logistics sector.

Recent years have seen an uptick in merger and acquisition activities, with global logistics companies seeking to establish or expand their presence in Indonesia through strategic partnerships with local players. These collaborations typically aim to combine international expertise with local market knowledge and existing infrastructure networks. The market has also witnessed vertical integration trends, with e-commerce platforms acquiring or developing their own logistics capabilities to better control their supply chains. International shipping lines and freight forwarders are increasingly partnering with local logistics providers to enhance their last-mile delivery capabilities and warehouse networks. The logistics industry in Indonesia continues to evolve, driven by these strategic movements.

Innovation and Integration Drive Future Success

For established players to maintain and expand their market share, developing comprehensive digital capabilities and integrated logistics solutions has become crucial. Companies are investing in advanced technologies such as AI-powered route optimization, automated warehousing systems, and real-time tracking platforms to enhance operational efficiency and customer service. Building strong partnerships with e-commerce platforms and expanding specialized services like cold chain logistics and project cargo handling are becoming increasingly important. The ability to offer customized solutions for different industry verticals while maintaining cost competitiveness through operational optimization is emerging as a key differentiator.

New entrants and smaller players can gain market share by focusing on niche segments or specific geographic regions where they can build expertise and strong customer relationships. Developing specialized capabilities in high-growth sectors such as e-commerce fulfillment, pharmaceutical logistics, or temperature-controlled transportation can provide opportunities for market penetration. The regulatory environment is becoming more supportive of digital transformation and sustainable practices, creating opportunities for innovative business models. Companies that can effectively navigate Indonesia’s complex geography and diverse market needs while maintaining service quality and reliability are better positioned for success. Building strong local networks and understanding regional market dynamics remain critical success factors for both incumbents and new entrants. The size of the freight forwarding market in Indonesia is expected to grow as these trends continue to shape the industry.

Indonesia Freight and Logistics Market Leaders

-

- J&T Express

- Ninja Van (including Ninja Express)

- NYK (Nippon Yusen Kaisha) Line

- PT Jalur Nugraha Ekakurir (JNE Express)

- PT Samudera Indonesia Tangguh

- *Disclaimer: Major Players sorted in no particular order

Indonesia Freight and Logistics Market News

- November 2024: PT BGR Logistik Indonesia (BLI) unveiled a series of innovations and notable achievements in logistics services, all aimed at bolstering the nation’s food requirements. As a subsidiary of Perusahaan Perdagangan Indonesia (PPI), BLI embraced digital transformation in its operations. The company rolled out a Logistics Management System (LMS), a digital platform overseeing logistics flows, encompassing real-time inventory, transportation, and warehousing oversight. Furthermore, BLI harnessed IoT and Big Data technologies to track goods movement, optimize route efficiency, and forecast logistics demands. To top it off, BLI offered a user-friendly web and mobile application, streamlining the process for customers to order, track, and manage logistics services.

Market Definition

- Agriculture, Fishing, and Forestry (AFF) – This end user industry segment captures the external (outsourced) logistics expenditure incurred by the AFF industry players. The end user players considered are the establishments primarily engaged in growing crops, raising animals, harvesting timber, harvesting fish & other animals from their natural habitats and providing related support activities. Herein, Logistics Service Providers (LSPs) play a crucial role in acquisition, storage, handling, transportation, and distribution activities for the optimal & continuous flow of inputs (seeds, pesticides, fertilizers, equipment, and water) from manufacturers or suppliers to the producers and smooth flow of output (produce, agro-goods) to distributors/ consumers. This includes both termperature controlled and non-temperature controlled logistics, as and when required according to the shelf life of goods being transported or stored.

- Construction – This end user industry segment captures the external (outsourced) logistics expenditure incurred by the construction industry players. The end user players considered are the establishments primarily engaged in constructing, repairing and renovating residential & commercial buildings, infrastructure, engineering works, subdividing and developing land. Logistics Service Providers (LSPs) play a crucial role in increasing profitability of construction projects by maintaing the inventory of raw materials & equipment, time-critical supplies and by providing other value added services for effective project management.

- Courier, Express, and Parcel – The Courier, Express, and Parcel services, often called as CEP Market, refers to the logistics and postal service providers which specialize in moving small goods (parcels/packages). It captures the overall market size (USD) and market volume (number of parcels) of (1) the shipments/parcels/packages which are under 70kgs/ 154lbs weight, (2) Business Customer packages viz. Business-to-Business (B2B) & Business-to-Consumer (B2C) as well as private customer packages (C2C), (3) non-express parcel delivery services (Standard and Deferred) as well as express parcel delivery services (Day-Definite-Express and Time-Definite-Express), (4) domestic as well as international parcels.

- Demographics – To analyse total addressable market demand, population growth & forecasts have been studied and presented in this industry trend. It represents population distribution across categories like gender (male/female), development area (urban/rural), major cities among other key parameters like population density and final consumption expenditure (growth and share % of GDP). This data has been used for assessing the fluctations in demand & consumption expenditure, and the major hotspots (cities) of potential demand.

- Export Trends and Import Trends – Overall logistics performance of an economy is positively and significantly (statistically) correlated to its trade performance (exports and imports). Hence, in this industry trend, total value of trade, major commodities/ commodity groups and the major trade partners, for the studied geography (country or region as per the scope of report) have been analysed alongside the impact of major trade/logistics infrastructure investments & regulatory environment.

- Freight Forwarding – Freight forwarding which herein refers to the freight transportation arrangement (FTA) industry includes establishments primarily engaged in arranging & tracking transportation of freight between shippers and carriers. Logistics Service Providers (LSPs) considered are freight forwarders, NVOCCs, custom brokers and marine shipping agents. Others segment under Freight Forwarding captures the revenue earned through value added services of FTA like custom brokerage/clearance activities, preparation of freight related documentation, consolidation-deconsolidation of goods, cargo insurance & compliance, arrangement of warehousing & storage, liasing with shippers, and freight forwarding through other modes of transport viz. road and rail.

- Freight Pricing Trends – Freight pricing by mode of transport (USD/tonkm), over the review period, has been presented in this industry trend. The data has been used in assessing the inflationary environment, impact on trade, freight turnover (tonkm), freight and logistics market demand by mode of transport segments and hence the overall freight and logistics market size.

- Freight Tonnage Trends – Freight tonnage (weight of goods in tons) handled by mode of transport, over the review period, has been presented in this industry trend. The data has been used as one of the parameters apart from average distance per shipment (km), freight volume (tonkm), and freight pricing (USD/tonkm) to assess the freight transport market size.

- Freight Transport – Freight Transport refers to the hiring of a logistics service provider (outsourced logistics) for the transport of commodities (raw materials/final/intermediate/finished goods including both solids and fluids) from the origin to a destination within the country (domestic) or cross-border (international).

- Freight and Logistics – External expenditure on (or outsourced) facilitation of freight transport (freight transportation), arrangement of freight transport through an agent (freight forwarding), warehousing and storage (temperature controlled or non-temperature controlled), CEP (domestic or international courier, express and parcel) and other value-added logistics services involved in the transportation of commodities (raw materials or finished goods including both solids and fluids) from the origin to a destination within the country (domestic) or cross-border (international), through one or more modes of transportation viz. road, rail, sea, air and pipelines constitute freight and logistics market.

- Fuel Price – Fuel price spikes can cause delays and diruption for logistics service providers (LSPs), while drops in the same can result in higher short-term profitability and increased market rivalry to offer consumers with the best deals. Hence, the fuel price variations have been studied over the review period and presented along with the causes as well as market impacts.

- GDP Distribution by Economic Activity – Nominal Gross Domestic Product and distribution of the same, across major economic sectors in the geography studied (country or region as per scope of the report) have been studied and presented in this industry trend. As GDP is positively related to the profitability and growth of logistics industry, this data has been used in adjunction to the input-output tables/ supply-use tables for analyzing the potential major contributing sectors towards the logistics demand.

- GDP Growth by Economic Activity – Growth of Nominal Gross Domestic Product across major economic sectors, for the geography studied (country or region as per scope of the report) have been presented in this industry trend. This data has been utilized for assessing the growth of logistics demand from all the market end users (economic sectors considered here).

- Inflation – Variations in both Wholesale Price Inflation (YoY change in producer price index) and Consumer Price Inflation have been presented in this industry trend. This data has been used to assess the inflationary environment as it plays a vital role in smooth functioning of the supply chain, directly impacting the logistics operational cost components e.g., pricing of tyres, driver wages & benefits, energy/fuel prices, maintenace costs, toll charges, warehousing rents, custom brokerage, forwarding rates, courier rates etc. hence impacting the overall freight and logistics market.

- Infrastructure – As infrastructure plays a vital role in an economy’s logistics performance, variables like length of roads, distribution of road length by surface category (paved v/s unpaved), distribution of road length by road classification (expressways v/s highways v/s other roads), rail length, volume of containers handled by major ports and tonnage handled by major airports have been analysed and presented in this industry trend.

- Key Industry Trends – The report section named “Key Industry Trends” include all the key variables/parameters studied to better analyze the market size estimates and forecasts. All the trends have been presented in the form of data points (time series or latest available data points) along with analysis of the paramter in the form of concise market relevant commentary, for the geography studied (country or region as per the scope of report).

- Key Strategic Moves – The action taken by a company to differentiate from its competitor or used as a general strategy is referred to as a key strategic move (KSM). This includes (1) Agreements (2) Expansions (3) Financial Restructuring (4) Mergers and Acquisitions (5) Partnerships, and (6) Product Innovations. Key players (Logistics Service Providers, LSPs) in the market have been shortlisted, their KSM have been studied and presented in this section.

- Liner Shipping Bilateral Connectivity Index – It indicates a country pair’s integration level into global liner shipping networks and plays a crucial role in determining bilateral trade, which in turn potentially contributes toward the prosperity of a country and its surrounding region. Hence the major economies connected to the country/ region as per scope of the report, have been analyzed and presented in “Liner Shipping Connectivity” industry trend.

- Liner Shipping Connectivity – This industry trend analyses the state of connectivity to the global shipping networks based on the status of maritime transport sector. It includes the analysis of liner shipping connectivity, bilateral shipping connectivity, and port liner shipping connectivity indices for the geography (country/ region as per scope of the report) over the review period.

- Liner Shipping Connectivity Index – It indicates how well countries are connected to global shipping networks based on the status of their maritime transport sector. It is based on five components of the maritime transport sector: (1) The number of shipping lines servicing a country, (2) The size of the largest vessel used on these services (in TEUs), (3) The number of services connecting a country to the other countries, (4) The total number of vessels deployed in a country, (5) The total capacity of those vessels (in TEUs).

- Logistics Performance – Logistics Performance and Logistics Costs are the backbone of trade, and influences trade costs, making countries compete globally. Logistics performance is influenced by market wide adopted supply chain management strategies, government services, investments & policies, fuel/ energy costs, inflationary environment etc. Hence, in this industry trend, the logistics performance of the geography studied (country/ region as per the scope of report) has been analysed and presented over the review period.

- Major Truck Suppliers – Market share of truck brands is influenced by factors like geographical preferences, portfolio of truck types, truck prices, local production, truck repair & maintenance service peneteration, customer support, technological innovations (like electric vehicles, digitalization, autonomous trucks), fuel efficiency, financing options, annual maintenance costs, availability of substitutes, marketing startegies etc. Hence, the distribution (share % for base year of the study) of truck sales volume for leading truck brands and commentary on current market scenario & market anticipation over the forecast period have been presented in this industry trend.

- Manufacturing – This end user industry segment captures the external (outsourced) logistics expenditure incurred by the Manufacturing industry players. The end user players considered are the establishments primarily engaged in the chemical, mechanical or physical transformation of materials or substances into new products. Logistics Service Providers (LSPs) play a crucial role in maintaining a smooth flow of raw materials across the supply chain, enabling timely delivery of finished goods to distributors or end customers and storing & supplying the raw materials to clients for just-in-time manufacturing.

- Maritime Fleet Load Carrying Capacity – Maritime fleet load carrying capacity depicts the development state of an economy’s maritime infrastructure & trade. It is influenced by factors like volume of production, international trade, major end user industries, maritime connectivity, environmental regulations, investments in port infrastructure development, port container cargo handling capacity etc. This industry trend represents the maritime fleet load carrying capacity by type of ship viz. container ships, oil tankers, bulk carriers, general cargo, among other types alongwith the influencing factors for the geography studied (country/ region as per scope of the report), over the review period.

- Modal Share – Freight Modal Share is influenced by factors like modal productivity, government regulations, containerization, distance of shipment, temperature control requirements, type of goods, international trade, terrain, speed of delivery, shipment weight, bulk shipments, etc. Also, modal share by tonnage (tons) and modal share by freight turnover (ton-km) differ as per average distance of shipments, weight of major commodity groups transported in the economy and number of trips. This industry trend represents the distribution of freight transported by mode of transport (tons as well as ton-km), for the study base year.

- Oil and Gas, Mining and Quarrying – This end user industry segment captures the external (outsourced) logistics expenditure incurred by the extraction industry players. The end user players considered are the establishments that extract naturally occurring mineral solids, such as coal and ores; liquid minerals, such as crude petroleum; and gases, such as natural gas. Logistics Service Providers (LSPs) covers entire phases from upstream to downstream and plays a crucial role in the transportation of machinery, drilling equipments, extracted minerals, crude oil & natural gas and refined/ processed products from one place to another.

- Other End Users – Other end user segment captures the external (outsourced) logistics expenditure incurred by the financial services (BFSI), real estate, educational services, healthcare, and professional services (administrative, waste management, legal, architectural, engineering, design, consulting, scientific R&D). Logistics Service Providers (LSPs) plays a crucial role in the reliable movement of supplies and documents to/from these industries such as transporting any equipment or resources required, shipping confidential documents and files, movement of medical goods & supplies (surgical supplies and instruments, including gloves, masks, syringes, equipment) to name a few.

- Other Services – Other Services segment captures revenue earned through (1) Value added services (VAS) for freight transportation by road, rail, air and sea & inland waterways, (2) VAS for marine cargo transportation (operation of terminal facilities such as harbours and piers, operation of waterway locks, navigation, pilotage and berthing activities, lighterage, salvage activities, lighthouse activities, among other miscellaneous support activities), (3) VAS for land freight transportation (operation of terminal facilities such as railway stations, stations for the handling of goods, operation of railroad infrastructure, switching and shunting, towing and road side assistance, liquefaction of gas for transportation purposes, among other miscellaneous support activities), (4) VAS for air cargo transportation (operation of terminal facilities such as airway terminals, airport and air-traffic-control activities, ground service activities on airfields, runway maintenance, inspection/ ferrying/ maintenance/ testing of aircrafts, aircraft fuelling services, among other miscellaneous support activities), (5) VAS for warehousing and storage service (operation of grain silos, general merchandise warehouses, refrigerated warehouses, storage tanks etc., storage of goods in foreign trade zones, blast freezing, crating goods for shipping, packing and preparing goods for shipping, labelling and/or imprinting the package, kit assembling and packaging services, among other miscellaneous support activities), and (6) VAS for courier, express and parcel service (pickup, sorting).

- Port Calls and Performance – The performance of ports is key to an economy’s freight movement, trade, global connectivity, successful growth strategies, investment attractiveness for production & distribution systems, and thus affects GDP, employment, per capita income and industrial growth. Hence, the port perfomance parameters like median time spent by vessels in the ports; average age, size, cargo carrying capacity, container carrying capacity, of vessels entering the ports, port calls, and container port throughput have been analysed and presented in this industry trend.

- Port Liner Shipping Connectivity Index – It reflects a port’s position in the global liner shipping network, wherein a higher value of index is associated with better connectivity. Efficient and well-connected ports (1) contribute towards minimizing transport costs, linking supply chains and supporting international trade, (2) pave the way for economies of scale and development of expertise by permitting producers to better exploit possibilities in domestic as well as foreign markets. Hence the major ports of strategic importance, in the country/ region as per scope of the report, have been analyzed and presented in “Liner Shipping Connectivity” industry trend.

- Port Throughput – It reflects the amount of cargo or number of vessels a port handles annually. It can be related to (1) cargo tonnage, (2) container TEU, and (3) vessel calls. Port throughput in terms of total containers handled (TEU’s), has been presented in the “Port Calls and Performance” industry trend.

- Producer Price Inflation – It indicates inflation from viewpoint of the producers viz. the average selling price received for their output over a period of time. Annual change (YoY) of producer price index is reported as wholesale price inflation in the “Inflation” industry trend. As WPI captures dynamic price movements in most comprehensive way, it is widely used by governments, banks, industry, business circles and is deemed important in formulation of trade, fiscal and other economic policies. The data has been used in adjunction to consumer price inflation for better understanding the inflationary environment.

- Segmental Revenue – Segmental Revenue has been triangulated or computed and presented for all the major players in the market. It refers to the freight and logistics market specific revenue earned by the company, over the base year of study, in the geography studied (country or region as per the scope of report). It is computed through the study and analysis of major parameters like financials, service portfolio, employee strength, fleet size, investments, number of countries present in, major economies of concern, etc. that have been reported by the company in its annual reports, webpage. For companies having scarce financial disclosures, paid databases like D&B Hoovers, Dow Jones Factiva have been resorted to and verified through industry/expert interactions.

- Transport and Storage Sector GDP – Value and growth of Transport and Storage Sector GDP has a direct relation to the freight and logistics market size. Hence, this variable has been studied and presented over the review period, in value terms (USD) and as share % of total GDP, in this industry trend. The data has been supported by concise and relevant commentary around the investments, developments, and current market scenario.

- Trends in E-Commerce Industry – Enhanced internet connectivity and boom in smartphone penetration, coupled with increasing disposable incomes, has led to a phenomenal growth in the e-commerce market globally. Online shoppers require fast and efficient delivery of their orders leading to an increase in the demand for logistics services especially e-commerce fulfilment services. Hence, the Gross Merchandise Value (GMV), historial and projected growth, breakup of major commodity groups in e-commerce industry for the studied geography (country or region as per scope of the report) have been analysed and presented in this industry trend.

- Trends in Manufacturing Industry – Manufacturing industry involves the transformation of raw materials into finished products, while logistics industry ensures the efficient flow of raw materials to the factory, and the transport of manufactured products to the distributors & consumers. Demand-Supply of both industries are highly cross-linked and critical for a seamless supply chain. Hence, the Gross Value Added (GVA), breakup of GVA into major manufacturing sectors, and growth of manufacturing industry over the review period have been analysed and presented, in this industry trend.

- Trucking Fleet Size By Type – Market share of truck types is influenced by factors like geographical preferences, major end user industries, truck prices, local production, truck repair & maintenance service peneteration, customer support, technological disruptions (like electric vehicles, digitalization, autonomous trucks) etc. Hence, the distribution (share % for base year of study) of truck parc volume by type of truck, market disruptors, truck manufacturing investments, truck specifications, truck use & import regulations, and market anticipation over the forecast period have been presented in this industry trend.

- Trucking Operational Costs – The prime reasons for measuring/ benchmarking logistics performance of any trucking company are to reduce operational costs and increase profitability. On the other hand, measuring operational costs helps to identify whether and where to make operational changes to control expenses and identify areas for improved performance. Hence, in this industry trend, trucking operational costs and the variables involved viz. driver wages & benefits, fuel prices, repairs & maintenance costs, tyre costs etc. have been studied over the base year of study, and presented for the geography studied (country or region as per the scope of report).

- Warehousing and Storage – Warehousing and storage segment captures revenue earned through the operation of general merchandise, refrigerated and other types of warehousing & storage facilities. These establishments take responsibility for storing the goods and keeping them secure in lieu of charges. Value added services (VAS) they may provide are considered to be a part of the “other services” segment. Here VAS refer to a range of services, related to the distribution of a customer’s goods and can include labelling, breaking bulk, inventory control & management, light assembly, order entry & fulfillment, packaging, pick & pack, price marking & ticketing and transportation arrangement.

- Wholesale and Retail Trade – This end user industry segment captures the external (outsourced) logistics expenditure incurred by the wholesalers and retailers. The end user players considered are the establishments primarily engaged in wholesaling or retailing merchandise, generally without transformation, and rendering services incidental to the sale of merchandise. Logistics Service Providers (LSPs) plays a crucial role in the reliable movement of supplies to and finished products from production houses to the distributors and finally to the end customer covering activites like material sourcing, transportation, order fulfillment, warehousing & storage, demand forecasting, inventory management etc.