Global Feed Antibiotics Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Global Feed Antibiotics Market is Segmented by Type (Tetracyclines, Penicillin, Sulfonamides, Macrolides, Aminoglycosides, Cephalosporins, and Others), by Animal Type (Ruminant, Poultry, Swine, Aquaculture, and Others), and By Geography (North America, Europe, Asia-Pacific, South America, and Middle-East & Africa). The report offers the market size and estimation in USD Million for the above-mentioned segments.

Global Feed Antibiotics Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Feed Antibiotics Market Size

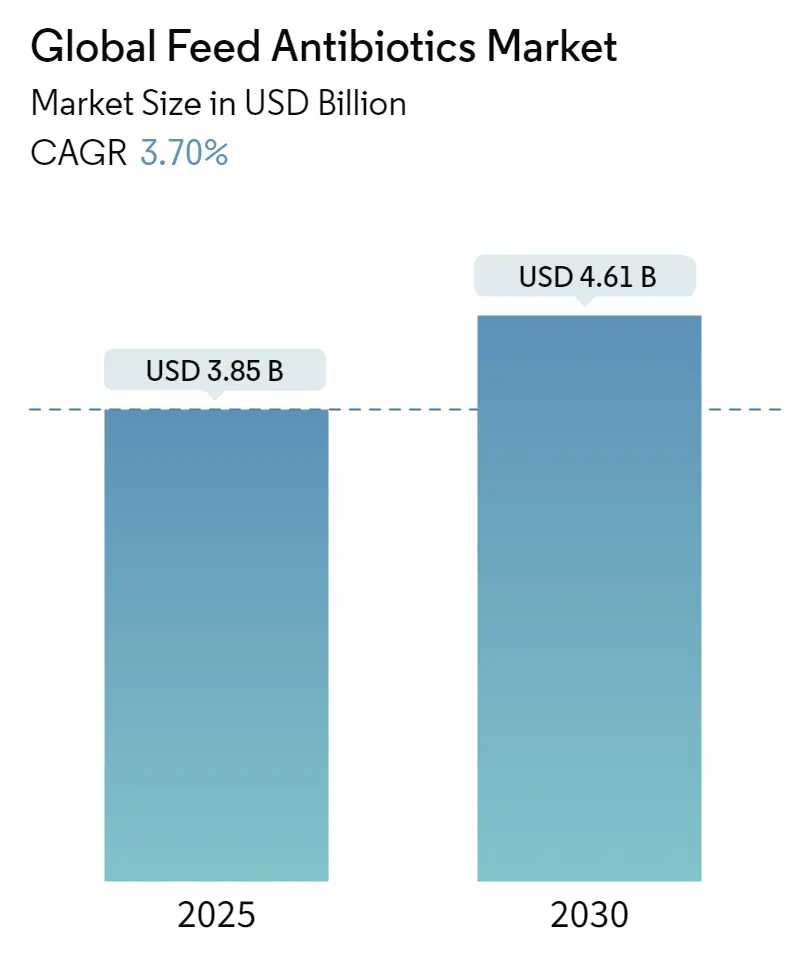

| Study Period | 2019 – 2030 |

| Market Size (2025) | USD 3.85 Billion |

| Market Size (2030) | USD 4.61 Billion |

| CAGR (2025 – 2030) | 3.70 % |

| Fastest Growing Market | Middle East and Africa |

| Largest Market | Asia Pacific |

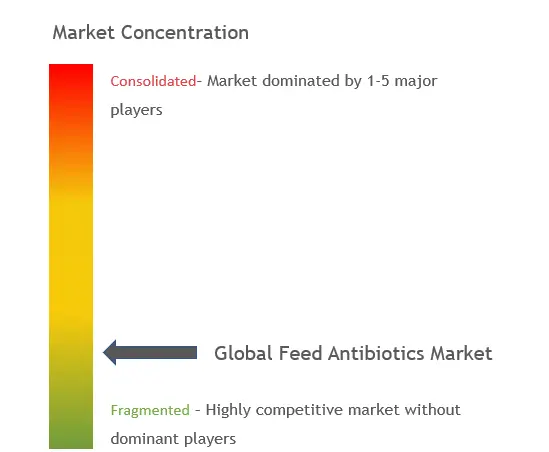

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Global Feed Antibiotics Market with other markets in Animal Nutrition & Wellness Industry

Compound Feed

Feed Additives

Pet Care

Animal Farm Services

Global Feed Antibiotics Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 3.70% (2025 – 2030) |

| Countries/ Region Covered: | North America,Europe,Asia Pacific,South America,Middle East and Africa |

| Major Players: | Merck, Elanco, Zoetis, Virbac, Phibro Animal Health |

Feed Antibiotics Market Analysis

The Global Feed Antibiotics Market size is estimated at USD 3.85 billion in 2025, and is expected to reach USD 4.61 billion by 2030, at a CAGR of 3.7% during the forecast period (2025-2030).

As an impact of COVID-19, the global consumption of meat and other animal products is on the verge of a declining phase as consumer preference for plant-based foods is rapidly rising. In addition, animal products without any traces of synthetic compounds are anticipated to grow in the forecast period. Hence the preference for animal feed with chemical ingredients including antibiotics is projected to decline during the forecast period.

The feed antibiotics are used in the livestock industry to obtain high feed efficiency rate and to prevent and treat disease in the herds of animals or in an individual animal. Tetracyclines, Penicillins, sulfonamide, and macrolides are some of the major antibiotics used in the livestock industry. The feed antibiotics, apart from being used for their anti-microbial properties are being used as growth-promoting agents and performance enhancers.

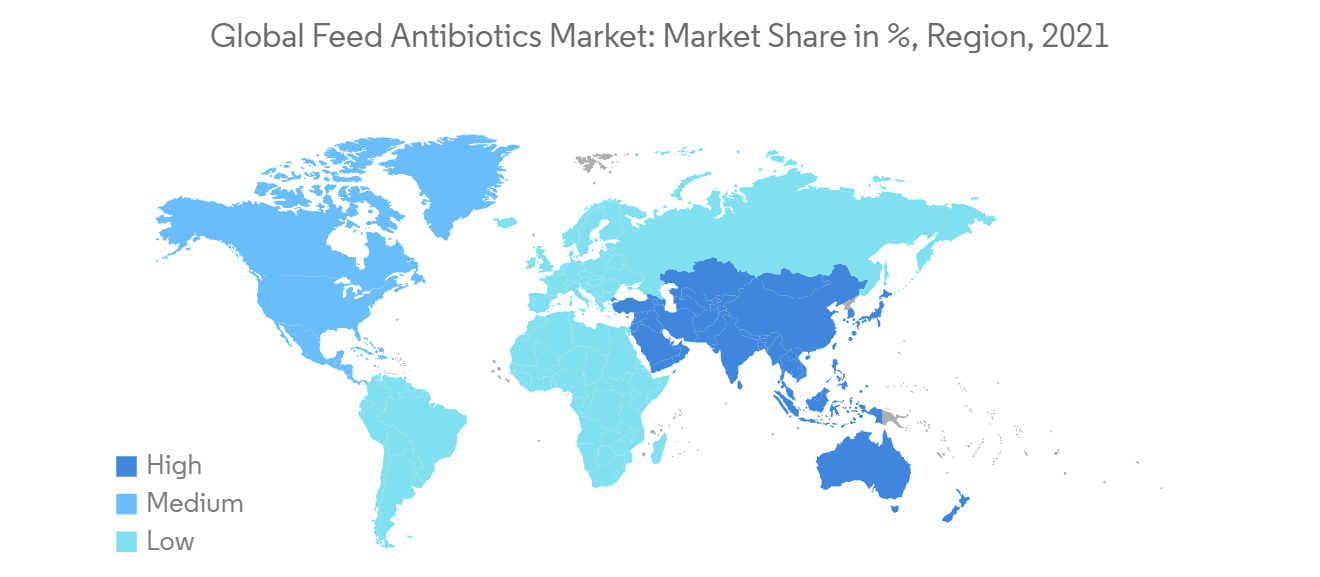

Asia-Pacific is projected to be the largest market. Industrialization, increasing animal disease, expansion of the meat market, and changing demographics are some of the factors driving the market. The Chinese animal feed antibiotics industry currently is heavily influenced by governmental initiatives. The country’s efforts to modernize and find efficiencies in its structure and practices and the increasing demand for meat and animal products to meet the protein needs of the growing population are among the major factors driving the growth of the animal feed antibiotics market.

Feed Antibiotics Market Trends

Rising Demand for Animal Derived Food Products

Animal-originated food products such as veal, beef, lamb, buffalo meat, goat meat, pork, milk and dairy products, poultry meat, and eggs. Despite the growing global concern regarding antimicrobial resistance in humans owing to the use of antibiotics in livestock, meat demand is increasing every year. According to FAO, global consumption of meat proteins over the next period is estimated to rise by 14% by 2030 compared to 2018-2020, propelled largely by population growth and income. Protein availability from poultry, beef, pork, and sheep meat is expected to grow by 17.8%, 5.9%, 13.1%, and 15.7%, respectively, by 2030.

Further, South Asia is one of the major regions for dairy production and accounted for 20-25% of the global milk production in 2019. In this region, India was the biggest producer and consumer of milk, followed by China and Pakistan. In 2020, the utilization of meat in India was over 3.9 million ton; by 2030, this is projected to increase to 145.7 million ton (by FAO).

Further, according to the American Meat Institute, ingesting the meat of the animal treated with antibiotics causes antimicrobial resistance in humans (resistance to those antibiotics). Governments of various countries are following strict regulations to monitor and regulate the usage of antibiotics by educating farmers and so on. This abolishes the misconception of use in livestock, leading to an increase in meat demand, raising the need for quality meat production with the help of antibiotics. Thus, the demand for antibiotics for feeding will grow owing to the surge in demand for animal-derived food products.

Asia Pacific is the Largest Market

In the Asia-Pacific region, Japan and Australia are the fastest growing countries whereas China has the largest market revenue share. In February 2020, a study conducted by Dongguan University of Technology, Dongguan, China, stated that in-feed antibiotic use changed the behaviors of oxytetracycline, sulfamerazine, and ciprofloxacin and related antibiotic resistance genes during swine manure composting.

According to the Food and Agricultural Materials Inspection Center, Japan stated that polyether antibiotics accounted for 87.6 % of the total (81.2 % in the previous FY), 7.0 % for orthosomycin antibiotics (14.2 % in the previous FY), 5.0 % for phosphoglycolipid antibiotics (4.7 % in the previous FY), and 0.4 % for polypeptide antibiotics (no application in the previous FY) in FY 2020 for the specified feed additives category. The production of antibiotic feed antibiotics has constantly been declining for the past few years in the country. With the growing awareness of the negative effects of antibiotics, the demand for other feed additives such as probiotics and other products is increasing.

In 2018, the Australian Lot Feeders’ Association established Antimicrobial Stewardship Guidelines to promote responsible antimicrobial use. Since then, 62% of the industry has voluntarily adopted antibiotic stewardship plans in their businesses. The industry is currently working towards making these guidelines mandatory by 2022.

Feed Antibiotics Industry Overview

The feed antibiotics market is a fragmented market. A number of small, medium, and large companies are operating in the feed antibiotics market at a global level. Prominent companies like Merck Animal Health, Zoetis Inc, and Elanco Animal Health have a vast presence around the globe. The companies follow mergers and acquisitions, expansions, partnerships,and investments in R&D as some of the key strategies for expanding their business. Partnerships are found to be the most adopted strategy among the key players in the antibiotic feed market followed by mergers andacquisitions.

Feed Antibiotics Market Leaders

- Merck Animal Health

- Elanco Animal Inc.

- Zoetis

- Virbac

- Phibro Animal Health Corp

- *Disclaimer: Major Players sorted in no particular order

Feed Antibiotics Market News

In July 2022, Virbac launched TENOTRYL (enrofloxacin) injectable solution in the USA and increased its range of products to propose veterinarians and their customers, cattle and swine producers, a strong bench of new alternatives to improve the health of livestock and eventually their profitability.

In November 2021, Kemin launched a new solution in Europe, TOXFIN CARE, which focused on preventing loss in performance and productivity by safeguarding animal organs and tissue from potential damage caused by mycotoxins.

In February 2020, Elanco Animal Health Incorporated announced an agreement with Merck Animal Health to divest worldwide rights for Vecoxanfor USD 55 million in an all-cash deal, and it is used for the prevention and treatment of coccidiosis in calves and lambs.

Feed Antibiotics Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Tetracyclines

- 5.1.2 Penicillins

- 5.1.3 Sulfonamides

- 5.1.4 Macrolides

- 5.1.5 Aminoglycosides

- 5.1.6 Cephalosporins

- 5.1.7 Others

- 5.2 Animal Type

- 5.2.1 Ruminant

- 5.2.2 Poultry

- 5.2.3 Swine

- 5.2.4 Aquaculture

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Thailand

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Egypt

- 5.3.5.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Bayer HealthCare AG

- 6.3.2 Merck Animal Health

- 6.3.3 Zomedica

- 6.3.4 Elanco

- 6.3.5 Sanofi-Aventis SA

- 6.3.6 LG Life Sciences Limited

- 6.3.7 American Regent Inc.

- 6.3.8 ECO Animal Health

- 6.3.9 Zoetis

- 6.3.10 Alpha-Vet Animal Health

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. IMPACT OF COVID-19 ON THE MARKET

Feed Antibiotics Industry Segmentation

The Global Feed Antibiotics Market is Segmented by Type (Tetracyclines, Penicillins, Sulfonamides, Macrolides, Aminoglycosides, Cephalosporins, and Others), by Animal Type (Ruminant, Poultry, Swine, Aquaculture, and Others), and By Geography (North America, Europe, Asia-Pacific, South America, and Middle-East & Africa). The report offers the market size and estimation in USD Million for the above-mentioned segments.

| Type | Tetracyclines | |

| Penicillins | ||

| Sulfonamides | ||

| Macrolides | ||

| Aminoglycosides | ||

| Cephalosporins | ||

| Others | ||

| Animal Type | Ruminant | |

| Poultry | ||

| Swine | ||

| Aquaculture | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Russia | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| India | ||

| Japan | ||

| Thailand | ||

| Australia | ||

| Rest of Asia Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East & Africa | South Africa |

| Egypt | ||

| Rest of Middle East & Africa |

Feed Antibiotics Market Research FAQs

The Global Feed Antibiotics Market size is expected to reach USD 3.85 billion in 2025 and grow at a CAGR of 3.70% to reach USD 4.61 billion by 2030.

In 2025, the Global Feed Antibiotics Market size is expected to reach USD 3.85 billion.

Merck Animal Health, Elanco Animal Inc., Zoetis, Virbac and Phibro Animal Health Corp are the major companies operating in the Global Feed Antibiotics Market.

Middle East and Africa is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the Asia Pacific accounts for the largest market share in Global Feed Antibiotics Market.

In 2024, the Global Feed Antibiotics Market size was estimated at USD 3.71 billion. The report covers the Global Feed Antibiotics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Global Feed Antibiotics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Global Feed Antibiotics Industry Report

Statistics for the 2025 Global Feed Antibiotics market share, size and revenue growth rate, Reports. Global Feed Antibiotics analysis includes a market forecast outlook for 2025 to 2030 and historical overview.