Fiber Reinforced Polymer Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

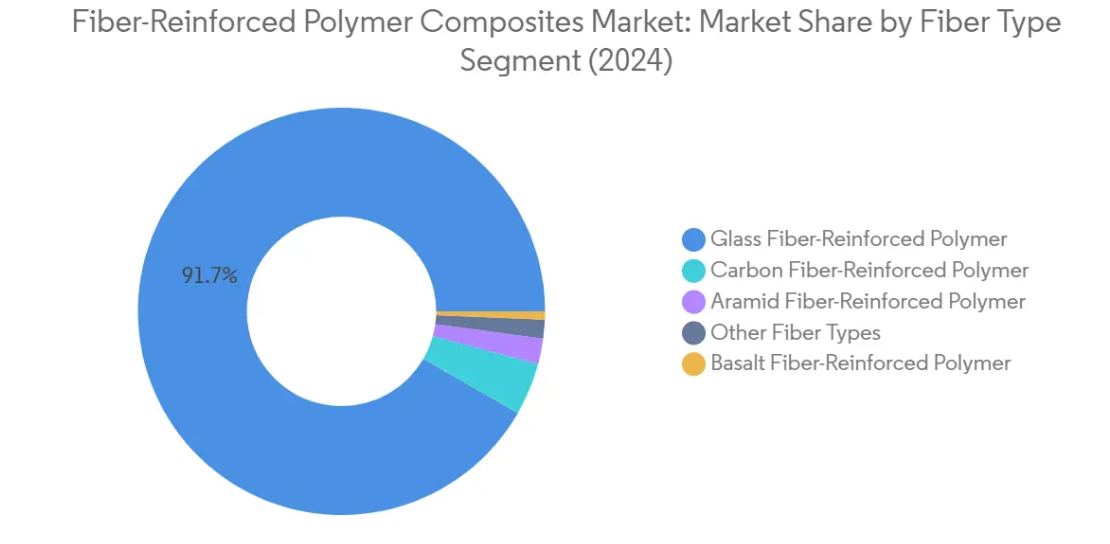

The Fiber Reinforced Polymer Composites Market is Segmented by Fiber Type (Glass Fiber-Reinforced Polymer, Carbon Fiber-Reinforced Polymer, Aramid Fiber-Reinforced Polymer, Basalt Fiber-Reinforced Polymer, and Other Fiber Types), End-User Industry (Building and Construction, Transportation, Electrical and Electronics, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and the Middle East and Africa). The Report Offers Market Size and Forecasts for Fiber-Reinforced Polymer (FRP) Composites in Value (USD) for all the Above Segments.

Fiber Reinforced Polymer Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Fiber Reinforced Polymer (FRP) Composites Market Size

| Study Period | 2019 – 2030 |

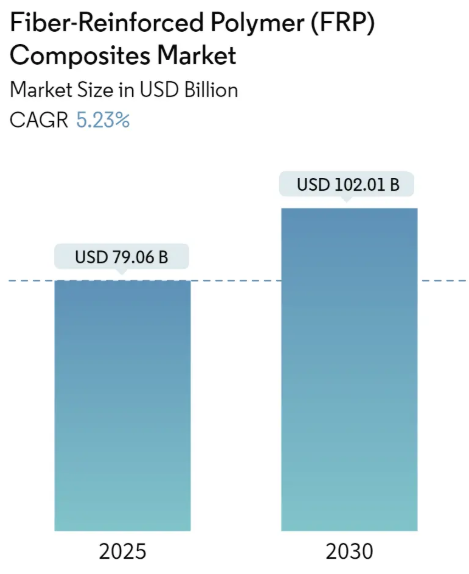

| Market Size (2025) | USD 79.06 Billion |

| Market Size (2030) | USD 102.01 Billion |

| CAGR (2025 – 2030) | 5.23 % |

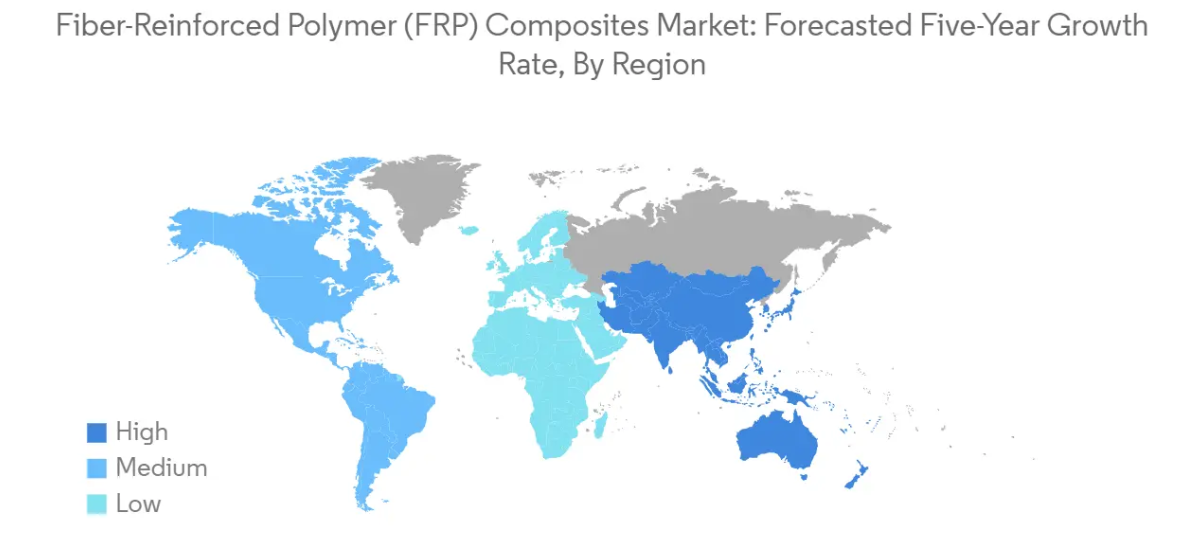

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

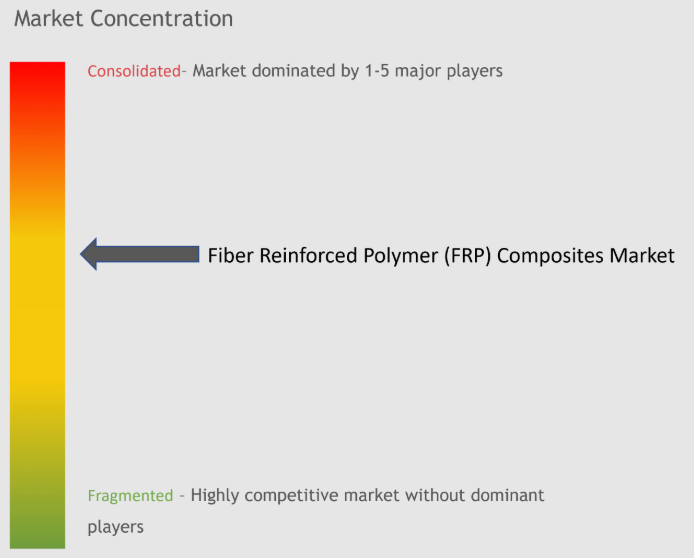

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Fiber-Reinforced Polymer (FRP) Composites Market with other markets in Chemicals & Materials Industry

Fiber Reinforced Polymer (FRP) Composites Market Analysis

The Fiber-Reinforced Polymer Composites Market size is estimated at USD 79.06 billion in 2025, and is expected to reach USD 102.01 billion by 2030, at a CAGR of 5.23% during the forecast period (2025-2030).

The fiber-reinforced polymer composites industry is experiencing significant transformation driven by technological advancements and shifting industrial demands. The emergence of new manufacturing techniques, particularly in additive manufacturing and 3D printing, has revolutionized the production processes of FRP composites. Fused Deposition Modeling (FDM) has gained prominence as a cost-effective and flexible manufacturing method, enabling the creation of complex shapes in shorter timeframes. The integration of artificial intelligence tools in non-destructive testing (NDT) and structural health monitoring (SHM) systems has enhanced quality control and maintenance procedures. These technological developments have significantly improved the efficiency and reliability of FRP composite manufacturing.

The aerospace and aviation sector continues to be a major influence on the FRP composites market’s evolution. According to Boeing Commercial Outlook 2023-2042, there is an anticipated global demand for 42,595 new commercial jets by 2042, valued at USD 8 trillion, indicating substantial growth opportunities for aerospace composites in aircraft manufacturing. The industry is witnessing increased adoption of carbon fiber reinforced polymer (CFRP) in aircraft components, driven by the need for lightweight materials and improved fuel efficiency. The development of advanced composites solutions through collaborations between major carbon-fiber-reinforced polymers manufacturers and OEMs has accelerated innovation in aerospace applications.

The automotive industry’s transformation has created new opportunities for automotive composites, particularly in electric vehicle manufacturing. According to OICA, global automotive production reached 85.01 million vehicles in 2022, demonstrating the vast potential for FRP applications. The industry’s focus on lightweight materials for improved fuel efficiency and reduced emissions has led to increased adoption of fiber-reinforced composites in vehicle components. Companies like Volta Trucks have pioneered the development of fully electric bio-based FRP composite delivery trucks, showcasing the material’s potential in sustainable transportation solutions.

The electronics and technology sector has emerged as a significant consumer of FRP composites, driven by the growing demand for advanced electronic components and devices. According to JEITA, the global electronics and IT industry’s production value reached USD 3,436.8 billion in 2022, indicating substantial opportunities for FRP applications in electronic components and housings. The development of specialized FRP materials for electronic applications, particularly in areas requiring high performance and reliability, has opened new avenues for market growth. The integration of FRP composites in emerging technologies such as 5G infrastructure and advanced computing systems has further diversified the material’s applications in the electronics sector.

Fiber Reinforced Polymer (FRP) Composites Market Trends

Increasing Demand from the Construction Sector

The construction industry has emerged as a significant driver for construction composites due to their superior properties, such as corrosion resistance, cost-efficiency, and design flexibility. These reinforced plastics are extensively used in repairing and rehabilitating existing structures, bridges, pedestrian pathways, and other infrastructure components. The growing urbanization and infrastructure development initiatives across major economies have substantially increased the demand for FRP composites. For instance, China is expected to spend nearly USD 13 trillion on buildings by 2030, while Saudi Arabia has launched various Giga project programs, representing the largest civil infrastructure engineering program globally.

The construction sector is witnessing remarkable growth through government initiatives and infrastructure development projects worldwide. In June 2022, Saudi Arabia launched 93 projects to upgrade its utility infrastructure, with an investment of USD 2.25 billion supporting water and environmental sustainability. Similarly, the Jeddah Central Development Company began construction on the USD 20 billion Jeddah Central megaproject, which includes four landmarks, ten recreational areas, 17,000 citizen houses, and over 3,000 hotels. These large-scale construction projects demonstrate the increasing adoption of glass fiber reinforced polymer composites in modern construction practices, driven by their lightweight properties and durability advantages.

Growing Demand for Energy Efficiency in the Aerospace and Automotive Industries

The automotive and aerospace industries are increasingly adopting fiber-reinforced polymer composites to achieve enhanced energy efficiency through weight reduction and improved structural performance. According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached 85.01 million units in 2022, marking a 5.99% growth from 2021. The shift toward electric vehicles has further accelerated this trend, with the World Economic Forum reporting approximately 4.3 million new battery-powered EVs and plug-in hybrid electric vehicles sold globally in the first half of 2022. This transition to electric mobility has intensified the demand for lightweight materials that can help extend vehicle range and improve overall efficiency in the automotive composites market.

The aerospace industry’s commitment to reducing carbon emissions and improving fuel efficiency has also driven the adoption of FRP composites. These materials are increasingly used in primary structures such as fuselages and wings, as well as secondary aircraft structures like control surfaces, small doors, and fairings. Compared to conventional materials, these composites can achieve weight savings of up to 20-30%. Major aircraft manufacturers have significantly increased their use of composites, with approximately 50% implementation in the Boeing 787 and 52% in the Airbus A350. The industry’s focus on developing greener aviation solutions and improving flight performance through lightweight design continues to drive innovation in the aerospace composites market.

Segment Analysis: Fiber Type

Glass Fiber-Reinforced Polymer Segment in Fiber-Reinforced Polymer (FRP) Composites Market

Glass fiber-reinforced polymer (GFRP) continues to dominate the global FRP composites market, commanding approximately 92% of the total market share in 2024. This overwhelming market leadership is attributed to GFRP’s versatile applications across construction, automotive, and marine industries. The material’s exceptional properties, including high tensile strength, corrosion resistance, and cost-effectiveness compared to other fiber types, have cemented its position as the preferred choice for manufacturers. The construction sector particularly drives demand for GFRP composites, utilizing them extensively in structural reinforcement, facades, and infrastructure applications. Additionally, the automotive industry’s growing focus on lightweight materials for improved fuel efficiency continues to boost GFRP adoption in vehicle components and body parts.

Carbon Fiber-Reinforced Polymer Segment in Fiber-Reinforced Polymer (FRP) Composites Market

Carbon fiber-reinforced polymer (CFRP) emerges as the fastest-growing segment in the FRP composites market, projected to expand at approximately 11% during 2024-2029. This remarkable growth is primarily driven by increasing demand from aerospace and high-performance automotive applications, where the material’s superior strength-to-weight ratio and exceptional mechanical properties are highly valued. The segment’s growth is further accelerated by technological advancements in manufacturing processes, making CFRP production more cost-effective and efficient. The rising adoption of electric vehicles and the aerospace industry’s continuous focus on lightweight materials for improved fuel efficiency are creating substantial opportunities for CFRP applications. Additionally, the sports and leisure industry’s growing preference for high-performance materials is contributing to the segment’s rapid expansion.

Remaining Segments in Fiber Type

The remaining segments in the FRP composites market include aramid fiber-reinforced polymer (AFRP), basalt fiber-reinforced polymer (BFRP), and other specialty fiber types. Aramid fiber-reinforced polymer composites are particularly valued in applications requiring high impact resistance and thermal stability, such as ballistic protection and aerospace components. BFRP has gained traction as an environmentally friendly alternative, offering excellent chemical resistance and thermal properties. Other specialty fiber types cater to niche applications, including natural fiber composites and hybrid combinations, addressing specific industry requirements. These segments collectively contribute to the market’s diversity and innovation, offering specialized solutions for unique application demands across various industries.

Segment Analysis: End-User Industry

Transportation Segment in Fiber-Reinforced Polymer (FRP) Composites Market

The transportation segment dominates the fiber-reinforced polymer composites market, holding approximately 28% market share in 2024. This significant market position is driven by the increasing demand for lightweight materials in automotive and aerospace applications to improve fuel efficiency and reduce emissions. The segment’s growth is further bolstered by the rising adoption of electric vehicles, where FRP composites play a crucial role in reducing vehicle weight and extending battery range. The segment is also experiencing the fastest growth rate of around 6% for the forecast period 2024-2029, primarily due to stringent fuel efficiency regulations and the automotive industry’s shift towards sustainable materials. Major automotive manufacturers are increasingly incorporating FRP composites in structural components, body panels, and interior parts, while the aerospace industry continues to expand its use of these materials in aircraft manufacturing to achieve better performance and fuel economy.

Building and Construction Segment in Fiber-Reinforced Polymer (FRP) Composites Market

The building and construction segment represents a substantial portion of the FRP composites market, driven by the material’s superior properties such as high strength-to-weight ratio, corrosion resistance, and durability. The segment’s growth is supported by increasing infrastructure development activities across both developed and developing regions, particularly in Asia-Pacific and the Middle East. The construction industry’s adoption of FRP composites extends beyond traditional applications to include innovative uses in bridges, building facades, reinforcement bars, and structural strengthening systems. The material’s ability to reduce maintenance costs and extend the lifespan of structures has made it particularly attractive for large-scale infrastructure projects. Additionally, the growing focus on sustainable construction practices and green building initiatives has further accelerated the adoption of FRP composites in the construction sector.

Remaining Segments in End-User Industry

The electrical and electronics segment plays a vital role in the FRP composites market, with applications ranging from circuit boards to housing components for electronic devices. This segment benefits from the increasing digitalization trend and the growing demand for consumer electronics worldwide. The material’s excellent electrical insulation properties and dimensional stability make it ideal for various electronic applications. Other end-user industries, including marine, wind energy, and sports equipment, collectively contribute to the market’s diversity. These sectors leverage FRP composites’ unique combination of lightweight properties, corrosion resistance, and design flexibility to create innovative products and solutions. The continued expansion of these segments is supported by ongoing technological advancements and the development of new applications for FRP composites.

Fiber-Reinforced Polymer (FRP) Composites Market Geography Segment Analysis

Fiber-Reinforced Polymer (FRP) Composites Market in Asia-Pacific

The Asia-Pacific region represents the largest and most dynamic market for fiber-reinforced plastic composites, driven by rapid industrialization and infrastructure development across major economies. China leads the regional market with its robust manufacturing base and increasing adoption across the automotive, construction, and aerospace sectors. India’s market is experiencing significant growth due to increasing investments in infrastructure and rising demand from various end-use industries. Japan and South Korea maintain strong positions in the market, particularly in high-tech applications and automotive sectors, while other emerging economies in the region continue to expand their consumption of FRP composites.

Fiber-Reinforced Polymer (FRP) Composites Market in China

China dominates the Asia-Pacific FRP composites market with approximately 50% share of the regional market. The country’s market leadership is supported by its extensive manufacturing capabilities and strong presence across various end-use industries. The automotive sector in China continues to be a major driver, with significant growth in electric vehicle production creating new opportunities for lightweight materials. The construction industry remains another key consumer of fiber-reinforced plastic composites, with ongoing infrastructure projects and sustainable building initiatives. The aerospace industry in China is also experiencing rapid growth, with increasing domestic aircraft production and component manufacturing activities.

Fiber-Reinforced Polymer (FRP) Composites Market in India

India emerges as the fastest-growing market in the Asia-Pacific region with a projected growth rate of approximately 7% during 2024-2029. The country’s fiber-reinforced plastic composites market is experiencing rapid expansion driven by increasing industrialization and infrastructure development initiatives. The automotive industry in India is showing strong adoption of FRP composites, particularly in the growing electric vehicle segment. The construction sector remains a significant consumer, supported by government initiatives for infrastructure development and affordable housing projects. Additionally, the aerospace and defense sectors are creating new opportunities for FRP composites, with increasing domestic manufacturing activities and technological advancements.

Fiber-Reinforced Polymer (FRP) Composites Market in North America

The North American FRP composites market demonstrates strong growth potential, driven by technological advancements and increasing adoption across various industries. The United States leads the regional market with its robust manufacturing base and innovative applications across the automotive, aerospace, and construction sectors. Canada maintains a significant presence in the market, particularly in infrastructure and renewable energy applications, while Mexico shows promising growth potential driven by its expanding automotive and aerospace industries. The region’s focus on lightweight materials and sustainable solutions continues to drive market expansion across all three countries.

Fiber-Reinforced Polymer (FRP) Composites Market in United States

The United States maintains its position as the dominant force in the North American market, holding approximately 74% of the regional market share. The country’s leadership is supported by its advanced manufacturing capabilities and strong presence in key end-use industries. The automotive sector continues to drive demand, particularly with the increasing focus on electric vehicles and lightweight materials. The aerospace industry remains a significant consumer of FRP composites, with major manufacturers maintaining extensive production facilities across the country. The construction sector also shows strong adoption, supported by infrastructure development initiatives and sustainable building practices.

Fiber-Reinforced Polymer (FRP) Composites Market in Canada

Canada demonstrates steady growth in the FRP composites market with a projected growth rate of approximately 4% during 2024-2029. The country’s market is characterized by strong adoption in infrastructure development and renewable energy applications. The automotive industry in Canada continues to be a significant consumer of fiber-reinforced plastic composites, particularly in light vehicle manufacturing. The aerospace sector maintains its position as a key end-user, with several major manufacturers utilizing these materials in aircraft components. Additionally, the construction industry shows increasing adoption of FRP composites in both residential and commercial projects.

Fiber-Reinforced Polymer (FRP) Composites Market in Europe

The European FRP composites market showcases strong technological advancement and innovation, particularly in high-performance applications. Germany leads the regional market with its strong automotive and aerospace sectors, while the United Kingdom, France, and Italy maintain significant market positions. The region’s focus on sustainable materials and manufacturing processes continues to drive market growth, particularly in renewable energy applications and eco-friendly construction solutions. The automotive industry remains a key driver across all major European economies, with increasing adoption in electric vehicle manufacturing.

Fiber-Reinforced Polymer (FRP) Composites Market in Germany

Germany maintains its position as the largest market for FRP composites in Europe, driven by its robust industrial base and technological leadership. The country’s automotive sector remains a key consumer, with major manufacturers increasingly adopting these materials in vehicle production. The aerospace industry continues to drive innovation in FRP applications, supported by strong research and development activities. The construction sector shows growing adoption of FRP composites, particularly in infrastructure projects and sustainable building solutions.

Fiber-Reinforced Polymer (FRP) Composites Market in United Kingdom

The United Kingdom emerges as the fastest-growing market in Europe for FRP composites, supported by increasing adoption across various industries. The aerospace sector remains a significant driver, with major manufacturers maintaining extensive production facilities in the country. The automotive industry shows strong growth potential, particularly in electric vehicle manufacturing and lightweight material applications. The construction sector demonstrates increasing adoption of FRP composites, supported by infrastructure development initiatives and sustainable building practices.

Fiber-Reinforced Polymer (FRP) Composites Market in South America

The South American FRP composites market shows promising growth potential, driven by increasing industrialization and infrastructure development across the region. Brazil emerges as both the largest and fastest-growing market in the region, supported by its strong automotive manufacturing base and growing aerospace industry. Argentina maintains a significant market presence, particularly in construction and transportation applications. The region’s focus on infrastructure development and increasing adoption of lightweight materials in various industries continues to drive market growth across all major economies.

Fiber-Reinforced Polymer (FRP) Composites Market in Middle East & Africa

The Middle East & Africa region demonstrates growing adoption of FRP composites, particularly in construction and infrastructure development projects. Saudi Arabia emerges as the largest market in the region, driven by significant investments in construction and infrastructure projects. South Africa maintains a strong market presence, while other countries in the region show increasing adoption across various industries. The region’s focus on diversifying its economy and developing sustainable infrastructure continues to create new opportunities for FRP composites across different applications.

Fiber Reinforced Polymer (FRP) Composites Industry Overview

Top Companies in Fiber-Reinforced Polymer (FRP) Composites Market

The fiber-reinforced polymer (FRP) composites market is characterized by intense innovation and strategic developments among key players like Toray Industries, Teijin Limited, Hexcel Corporation, and Mitsubishi Chemical Corporation. Companies are heavily investing in research and development to enhance product performance, particularly focusing on lightweight composite materials for automotive and aerospace applications. The industry witnesses continuous expansion through new manufacturing facilities, especially in Asia-Pacific and North America, to meet growing demand. Strategic partnerships and collaborations with end-user industries have become increasingly common, particularly in the electric vehicle and renewable energy sectors. Market leaders are emphasizing vertical integration, from raw material production to finished composites, while simultaneously developing sustainable and recyclable composite solutions to align with global environmental regulations.

Consolidated Market with Strong Regional Players

The FRP composites market exhibits a partially consolidated structure, dominated by large multinational corporations with diverse product portfolios and strong technological capabilities. These major players leverage their extensive distribution networks and established relationships with key end-users in the aerospace, automotive, and construction industries. The market has witnessed significant merger and acquisition activities, particularly focused on expanding geographical presence and acquiring specialized technological capabilities. Regional players maintain competitive positions in specific market segments through specialized product offerings and local market knowledge.

The competitive dynamics are shaped by high entry barriers due to substantial capital requirements and technical expertise needed for manufacturing operations. Japanese and American companies hold significant market share globally, while European players maintain strong positions in high-performance applications. The industry has seen increased participation from Chinese manufacturers, particularly in the glass fiber segment, leading to intensified competition in the Asia-Pacific region. Companies are increasingly focusing on developing proprietary technologies and establishing long-term supply agreements with key customers to maintain their market positions.

Innovation and Sustainability Drive Future Success

Success in the FRP composites market increasingly depends on developing innovative solutions that address specific industry challenges while meeting sustainability requirements. Companies must invest in advanced manufacturing technologies and automation to improve production efficiency and reduce costs. The ability to offer customized solutions for different applications while maintaining consistent quality across global operations has become crucial. Market players need to strengthen their research and development capabilities to develop new composite formulations that offer enhanced performance characteristics while meeting stringent environmental regulations.

For new entrants and smaller players, focusing on niche applications and developing specialized products for specific industry segments offers a viable path to market success. Building strong relationships with end-users through technical support and collaborative development programs helps in establishing market presence. Companies must also address the growing emphasis on circular economy principles by developing recycling technologies and incorporating recycled materials in their products. The increasing focus on environmental regulations and sustainability requirements presents both challenges and opportunities for market participants, making investment in sustainable technologies and processes essential for long-term success. The advanced composites industry is poised to benefit from these trends, as innovation and sustainability become central to market strategies.

Fiber Reinforced Polymer (FRP) Composites Market Leaders

-

- TEIJIN LIMITED

- TORAY INDUSTRIES, INC.

- Hexcel Corporation

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- Solvay

- *Disclaimer: Major Players sorted in no particular order

Fiber Reinforced Polymer (FRP) Composites Market News

- July 2022: Hexcel Corporation signed a long-term agreement with Dassault to supply carbon fiber prepreg for the Falcon 10X program. This is the first Dassault business jet program to incorporate high-performance advanced carbon fiber composites in manufacturing its aircraft wings.

- May 2022: Gurit acquired a 60% share in Fiberline Composites A/S, strengthening Gurit’s position as a full provider for the wind blade manufacturing market.

Fiber-Reinforced Polymer (FRP) Composites Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Sector

- 4.1.2 Growing Demand for Energy Efficiency in the Aerospace and Automotive Industries

- 4.2 Restraints

- 4.2.1 Fiber-reinforced Polymer (FRP) Material Shortcomings

- 4.2.2 Availability of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5. MARKET SEGMENTATION (Market Size in Value)

- 5.1 Fiber Type

- 5.1.1 Glass Fiber-reinforced Polymer

- 5.1.2 Carbon Fiber-reinforced Polymer

- 5.1.3 Aramid Fiber-reinforced Polymer

- 5.1.4 Basalt Fiber-reinforced Polymer

- 5.1.5 Other Fiber Types

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Transportation

- 5.2.3 Electrical and Electronics

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aegion Corporation

- 6.4.2 AGC Chemicals Americas

- 6.4.3 Gurit

- 6.4.4 GSC

- 6.4.5 Hexcel Corporation

- 6.4.6 Kordsa Teknik Tekstil A.Ş.

- 6.4.7 Mitsubishi Chemical Carbon Fiber and Composites Inc.

- 6.4.8 Nippon Electric Glass Co. Ltd.

- 6.4.9 Owens Corning

- 6.4.10 Park Aerospace Corp.

- 6.4.11 SGL carbon

- 6.4.12 Solvay

- 6.4.13 TEIJIN LIMITED

- 6.4.14 TORAY INDUSTRIES INC.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of New Advanced Forms of FRP Materials

- 7.2 Developments and Partnerships In the Field of Composite Material From the Transportation Industry

Fiber Reinforced Polymer (FRP) Composites Industry Segmentation

Fiber-reinforced polymer (FRP) is a composite material made of a polymer matrix reinforced with fibers. The fibers are usually glass, carbon, or aramid. FRPs are commonly used in the automotive, aerospace, marine, and construction industries, among others.

The fiber-reinforced polymer (FRP) composites market is segmented by fiber type (glass fiber-reinforced polymer, carbon fiber-reinforced polymer, aramid fiber-reinforced polymer, basalt fiber-reinforced polymer, and other fiber types), end-user industry (building and construction, transportation, electrical and electronics, and other end-user industries), and geography (Asia-Pacific, North America, Europe, South America, and the Middle East and Africa).

The report offers market size and forecasts for fiber-reinforced polymer (FRP) composites in value (USD) for all the above segments.

| Fiber Type | Glass Fiber-reinforced Polymer | ||

| Carbon Fiber-reinforced Polymer | |||

| Aramid Fiber-reinforced Polymer | |||

| Basalt Fiber-reinforced Polymer | |||

| Other Fiber Types | |||

| End-user Industry | Building and Construction | ||

| Transportation | |||

| Electrical and Electronics | |||

| Other End-user Industries | |||

| Geography | Asia-Pacific | China | |

| India | |||

| Japan | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| North America | United States | ||

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Rest of Europe | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Middle-East and Africa | Saudi Arabia | ||

| South Africa | |||

| Rest of Middle-East and Africa | |||

Fiber-Reinforced Polymer (FRP) Composites Market Research Faqs

The Fiber-Reinforced Polymer Composites Market size is expected to reach USD 79.06 billion in 2025 and grow at a CAGR of 5.23% to reach USD 102.01 billion by 2030.

In 2025, the Fiber-Reinforced Polymer Composites Market size is expected to reach USD 79.06 billion.

TEIJIN LIMITED, TORAY INDUSTRIES, INC., Hexcel Corporation, Mitsubishi Chemical Carbon Fiber and Composites, Inc. and Solvay are the major companies operating in the Fiber-Reinforced Polymer Composites Market.

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the Asia Pacific accounts for the largest market share in Fiber-Reinforced Polymer Composites Market.

In 2024, the Fiber-Reinforced Polymer Composites Market size was estimated at USD 74.93 billion. The report covers the Fiber-Reinforced Polymer Composites Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Fiber-Reinforced Polymer Composites Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.