Fertilizer Additives Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Fertilizer Additives Market Report is Segmented by Function (Inhibitors, Coating Agents, Granulation Aids, Anti-Caking Agents, and Other Functions), by Form (Solid and Liquid), and by Geography (North America, Europe, Asia-Pacific, South America, and Africa). The Report Offers Market Estimation and Forecast in Value (USD) for the Above-Mentioned Segments.

Fertilizer Additives Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Fertilizer Additives Market Size

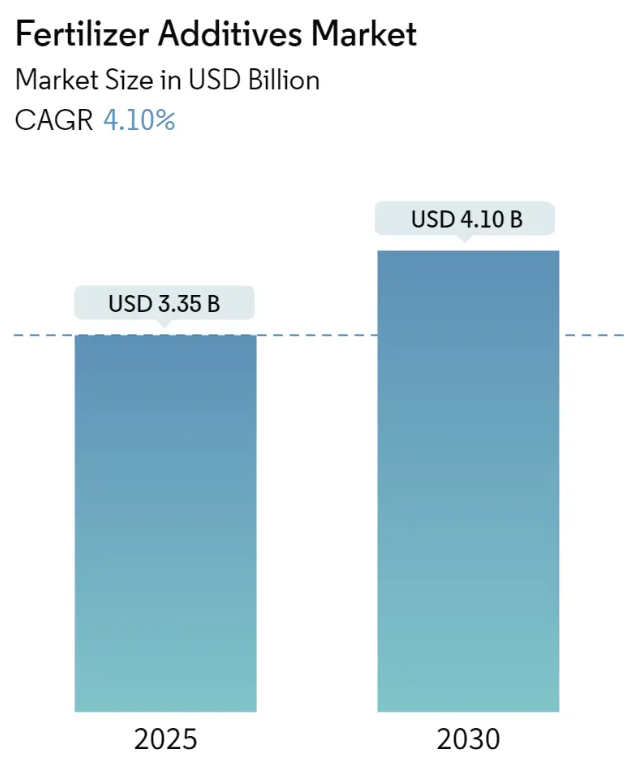

| Study Period | 2019 – 2030 |

| Market Size (2025) | USD 3.35 Billion |

| Market Size (2030) | USD 4.10 Billion |

| CAGR (2025 – 2030) | 4.10 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

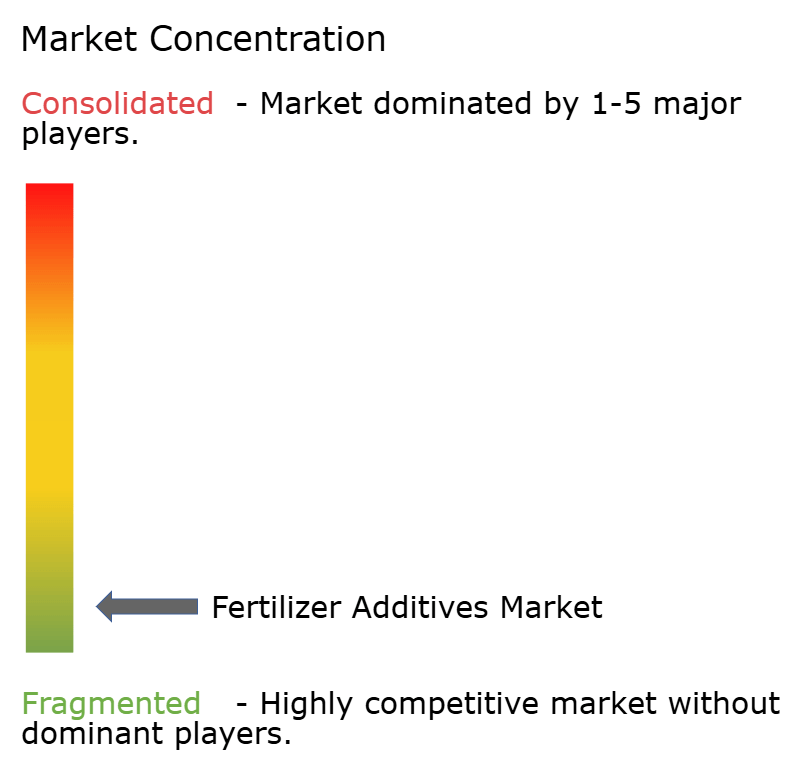

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Fertilizer Additives Market with other markets in Agriculture Industry

Seeds

Crop Protection

Fertilizers

Agricultural Commodities

Agriculture Services

Agricultural Machinery and Technology

Fertilizer Additives Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 4.10% (2025 – 2030) |

| Countries/ Region Covered: | North America, Europe, Asia Pacific, South America |

| Major Players: | Corteva Agriscience, BASF SE, Arkema (ARRMAZ), Clariant International Ltd, KAO Corporation |

Fertilizer Additives Market Analysis

The Fertilizer Additives Market size is estimated at USD 3.35 billion in 2025, and is expected to reach USD 4.10 billion by 2030, at a CAGR of 4.1% during the forecast period (2025-2030).

Fertilizer additives enhance the nutrient content of fertilizers, boost nutrient absorption by plants, and curb nutrient loss through leaching or volatilization. This underscores their vital role in optimizing fertilizer efficiency and ensuring crops receive the necessary nutrients. Furthermore, by curbing nutrient runoff, minimizing soil erosion, and enhancing nutritional efficiency, fertilizer additives play a pivotal role in promoting sustainable agriculture. The growing emphasis on sustainable practices is further fueling the demand for these additives, as they aim to elevate fertilizer performance. These additives also stabilize soil nutrients, preventing losses from leaching or volatilization. For instance, adding nitrification inhibitors to nitrogen-rich fertilizers decelerates the conversion of ammonium to nitrate, thus mitigating nitrogen loss and boosting nutrient availability for plants.

Fertilizer consumption significantly drives the fertilizer additives market. A growing global population, evolving dietary habits, rising disposable incomes, and shrinking arable land have heightened the demand for food and agricultural products. Given their crucial role in boosting crop productivity and agricultural yields, the global demand for fertilizers has surged. For instance, the International Fertilizer Industry Association reported that global nitrogenous fertilizer consumption rose from 108.2 million metric tons in 2022 to 109.7 million metric tons in 2023. This uptick in fertilizer demand has led to a worldwide increase in overall fertilizer consumption. The Agricultural and Processed Food Products Export Development Authority noted that India produced 304.3 million metric tons of cereals in 2023, with key cereals like rice, wheat, maize, and bajra accounting for 136.7 million, 112.92 million, 35.67 million, and 10.66 million metric tons, respectively. Looking ahead, as the population continues to grow, the demand for enhanced fertilizers is anticipated to rise, subsequently boosting the demand for additives in the fertilizer industry among manufacturers.

High fertilizer consumption necessitates increased storage to maintain a continuous supply. However, this can lead to issues like lump formation and caking, especially during wet seasons. Consequently, the ability of fertilizer additives to prevent such lumping and caking becomes a significant driver for market growth. Conversely, while these additives offer benefits, they also elevate crop production costs, posing a financial burden on farmers and thereby restraining market expansion. Furthermore, the cost of additives varies based on their type and quality, leading to higher prices. This price sensitivity results in limited acceptance among certain farmers, curbing the widespread adoption of these additives.

Fertilizer Additives Market Trends

Inhibitors Leads the Market

Inhibitors are compounds integrated into nitrogen-based fertilizers to minimize losses post-application. These nitrogen stabilizer additives fall into two main categories, urease inhibitors and nitrification inhibitors. Such inhibitors promote plant growth, uphold soil quality, and enhance crop quality. The agriculture industry’s surging demand for these nitrogen fertilizer additives propels the market growth. Farmers increasingly turn to urease inhibitors to curb nitrous oxide emissions and nitrification inhibitors to mitigate nitrate pollution in water. Furthermore, these additives bolster soil health and enhance plants’ access to vital water and nutrients. With the agriculture sector expanding and fertilizer additives evolving, the market for nitrogen fertilizer additives is set to see heightened consumption.

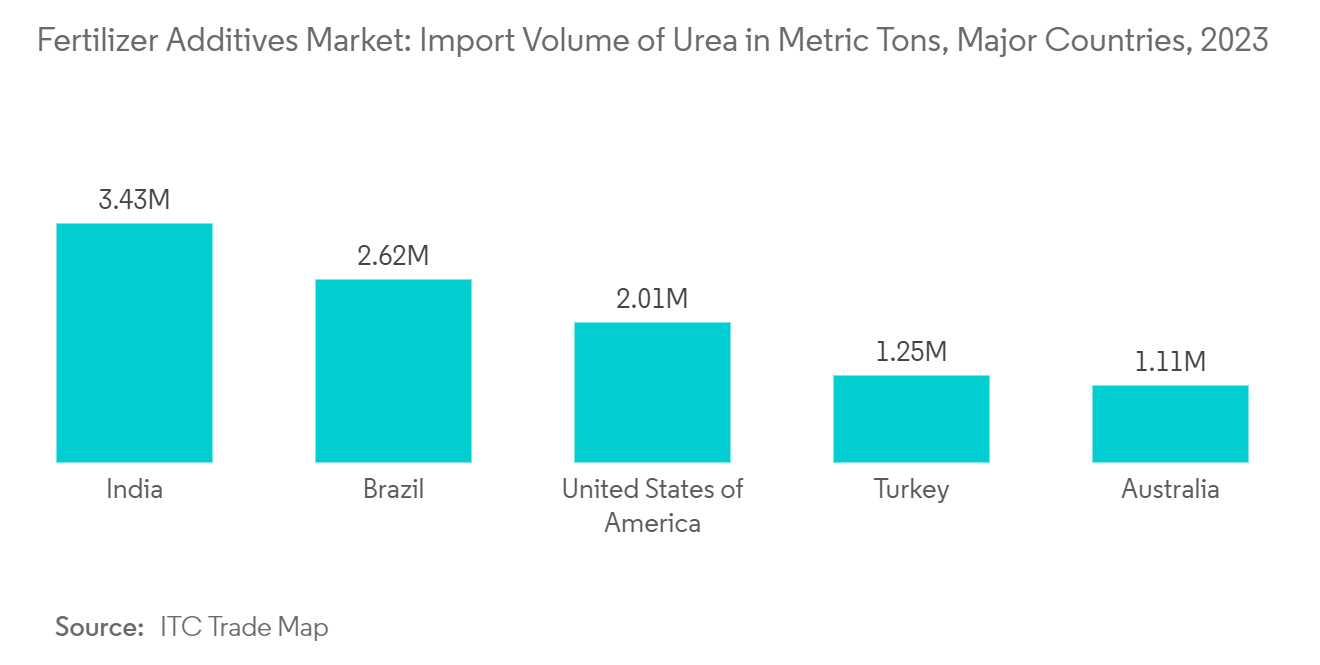

Globally, the increasing demand for urea-based fertilizers is a key driver of market growth. For instance, data from the International Fertilizers Association (IFASTAT) reveals that global urea consumption rose from 53,760.3 thousand metric tons in 2021 to 54,168.9 thousand metric tons in 2022. Urea, with the highest nitrogen content among solid fertilizers, serves as a primary nitrogen source in agriculture. Its high relative humidity enables it to withstand hot and humid conditions, making it a preferred choice over ammonium nitrate and calcium ammonium nitrate (CAN). Additionally, its versatility in both solid and liquid forms boosts its market demand. However, challenges remain,such as urea nitrogen is prone to losses through volatilization, denitrification, and leaching. In humid regions like Brazil, these losses can be substantial, with 20-30% of the applied nitrogen being lost, and in 2022, some instances even peaked at 60%. As fertilizer additives, particularly urease inhibitors, aim to reduce these volatilization losses, their rising demand further accelerates the growth of the fertilizer additive market.

Additionally, technological innovations are augmenting the growth of the market studied. According to a study by Agriculture and Agri-Food Canada, in 2022, the use of ammonium thiosulphate as a urease inhibitor with the varying surface placement of urea and urea ammonium nitrate in the production of hard red spring wheat under reduced tillage management. TIB Thio ATS, by TIB Chemicals, is one of the popular ammonium thiosulphate inhibitors sold in the North American region.

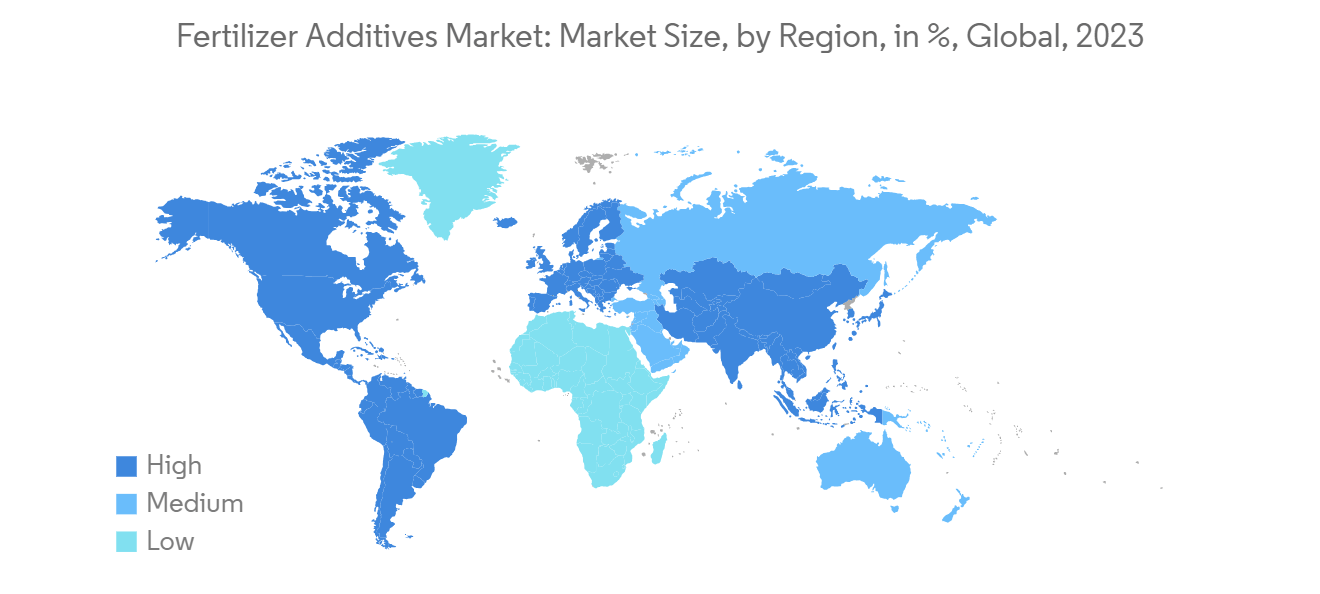

Asia-Pacific Dominates the Market

Asia-Pacific dominates the global fertilizer additives market, accounting for over half of its share. Major consumers, China and India, leverage their expansive agricultural zones. For example, the Fertilizer Association of India reported a total fertilizer consumption of 63.9 million metric tons in 2023, marking a 0.3% decline from 2022. Additionally, the all-India NPK use ratio shifted from 7.7:3.1:1 in 2022 to 11.8:4.6:1 in 2023.

Moreover, the Indian government is actively promoting fertilizer consumption through various subsidies and grants. For instance, in February 2024, the Indian government sanctioned a subsidy of USD 290.3 million for phosphatic and potassic (P&K) fertilizers. This initiative, which introduced three new grades of fertilizers, aims to assist farmers and boost the productivity of oilseeds and pulses. While this move has led to increased fertilizer usage, it has also highlighted challenges such as inefficient fertilizer uptake and volatilization losses in Indian soils. These challenges underscore the growing demand for fertilizer additive products, bolstering market growth. Consequently, the uptick in fertilizer consumption in the region is propelling the market’s expansion. Among nitrogenous fertilizers, urea stands out as the predominant choice in India, constituting over 80% of the nation’s total nitrogen fertilizer consumption.

China stands as one of the world’s foremost producers and consumers of fertilizers, driven by its expansive agricultural sector. The nation leans heavily on fertilizers to satisfy crop nutritional needs and enhance agricultural productivity. Furthermore, China’s vegetable production heavily relies on fertilizers, leading to diminished nitrogen usage efficiency in its soils. Numerous research initiatives within the country aim to bolster soil effectiveness and enhance nutrient uptake from fertilizers. For instance, in 2022 study conducted by the National Center for Biotechnology Information (NCBI), highlighted the benefits of nitrification inhibitors. The study underscored these additives’ role in boosting yield, enhancing nitrogen use efficiency, and curbing nitrous oxide emissions. Such promising findings on fertilizer additives bolster the industry’s expansion in China.

Fertilizer Additives Industry Overview

The fertilizer additive market is highly fragmented, with various small- and medium-sized companies and a few big players, resulting in stiff competition in the market. Corteva Agriscience, BASF SE, Arkema (Arrmaz), Clariant International Ltd, and KAO Corporation are some of the known players in the market. These major players are investing in new products and improvisation of products, expansions, and acquisitions for business expansions. Another major area of investment is the focus on R&D to launch new products at lower prices.

Fertilizer Additives Market Leaders

- Corteva Agriscience

- BASF SE

- Arkema (ARRMAZ)

- Clariant International Ltd

- KAO Corporation

- *Disclaimer: Major Players sorted in no particular order

Fertilizer Additives Market News

- September 2024: Innovar Ag, a U.S.-based developer of chemical fertilizer additives, has set up a representative office in Tokyo. This move aims to bolster the profitability and sustainability of the agricultural sector. Furthermore, the company’s exclusive “PENXCEL Technology” enhances fertilizer additives by enabling rapid penetration of ingredients into fertilizer granules, ensuring the production of highly concentrated and uniform fertilizers.

- August 2024: Koch Agronomic Services LLC has acquired OCI Global’s fertilizer plant located in Wever, Iowa, for a sum of USD 3.6 billion. This strategic investment bolsters Koch’s capacity to cater to its customers over the long haul, offering increased adaptability to shifting nitrogen preferences.

Fertilizer Additives Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Raising Fertilizer Consumption

- 4.2.2 Increasing Strategic Activities By The Major Players

- 4.2.3 Enhanced Fertilizer Performance

- 4.3 Market Restraints

- 4.3.1 Raising Overall Cost Of Crop Production

- 4.3.2 High Environmental Effects

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Function

- 5.1.1 Inhibitors

- 5.1.2 Coating Agents

- 5.1.3 Granulation Aids

- 5.1.4 Anti-Caking Agent

- 5.1.5 Other Functions

- 5.2 Form

- 5.2.1 Solid

- 5.2.2 Liquid

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Germany

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Corteva Agriscience

- 6.3.3 Arkema (ARRMAZ)

- 6.3.4 Dorf Ketal Company LLC

- 6.3.5 Koch Agronomic Services LLC

- 6.3.6 Clariant International Ltd

- 6.3.7 KAO Corporation

- 6.3.8 Michelman Inc.

7. MARKET OPPORTUNITIES AND FUTURE TREND

Fertilizer Additives Industry Segmentation

Fertilizer additives are used to improve the quality and stability of the soil and fertilizer. It is also used to prevent the loss of nutrients like phosphorus, sulfur, nitrogen, and potassium from the soil and environment. The fertilizer additives market is segmented by Function (Inhibitors, Coating Agents, Granulation Aids, Anti-Caking Agents, and Other Functions), by Form (Solid and Liquid), and by Geography (North America, Europe, Asia-Pacific, South America, and Africa). The report offers market estimation and forecast in value (USD) for the above-mentioned segments.

| Function | Inhibitors | |

| Coating Agents | ||

| Granulation Aids | ||

| Anti-Caking Agent | ||

| Other Functions | ||

| Form | Solid | |

| Liquid | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| France | ||

| Russia | ||

| Germany | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Africa | South Africa |

| Rest of Africa |

Fertilizer Additives Market Research Faqs

The Fertilizer Additives Market size is expected to reach USD 3.35 billion in 2025 and grow at a CAGR of 4.10% to reach USD 4.10 billion by 2030.

In 2025, the Fertilizer Additives Market size is expected to reach USD 3.35 billion.

Corteva Agriscience, BASF SE, Arkema (ARRMAZ), Clariant International Ltd and KAO Corporation are the major companies operating in the Fertilizer Additives Market.

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the Asia Pacific accounts for the largest market share in Fertilizer Additives Market.

In 2024, the Fertilizer Additives Market size was estimated at USD 3.21 billion. The report covers the Fertilizer Additives Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Fertilizer Additives Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.