Europe Precision Farming Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Europe Precision Farming Market Report is Segmented by Technology(Guidance Systems, Remote Sensing, Variable Rate Technology, Drones and UAVs, and Other Technologies), Components(hardware, Software, and Services), Application(yield Monitoring, Variable Rate Application, Field Mapping, Soil Monitoring, Crop Scouting, Other Application), and Geography (Germany, United Kingdom, Italy, France, and the Rest of Europe). The Market Size and Estimation Will Be Provided in Terms of Value (USD) for the Above-Mentioned Segments.

Europe Precision Farming Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Europe Precision Farming Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2025 – 2030 |

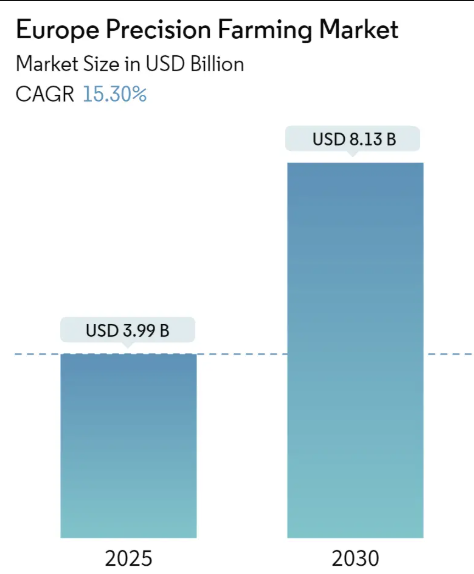

| Market Size (2025) | USD 3.99 Billion |

| Market Size (2030) | USD 8.13 Billion |

| CAGR (2025 – 2030) | 15.30 % |

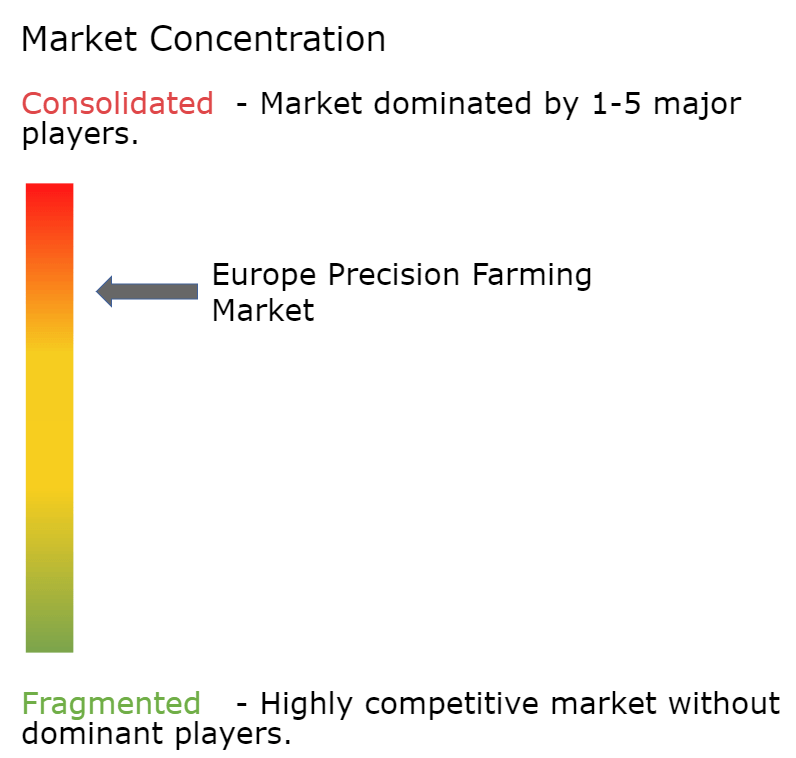

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Europe Precision Farming Market with other markets in Agriculture Industry

Seeds

Crop Protection

Fertilizers

Agricultural Commodities

Agriculture Services

Agricultural Machinery and Technology

Europe Precision Farming Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 15.30% (2025 – 2030) |

| Countries/ Region Covered: | Germany, France, United Kingdom, Italy |

| Major Players: | John Deere, Bayer, AGCO Corporation, CLAAS KGaA mbH (365FarmNet), Corteva (Granular Inc.) |

Europe Precision Farming Market Analysis

The Europe Precision Farming Market size is estimated at USD 3.99 billion in 2025, and is expected to reach USD 8.13 billion by 2030, at a CAGR of 15.3% during the forecast period (2025-2030).

- The precision farming market in Europe is experiencing rapid growth, propelled by technological advancements and an increased focus on sustainable agricultural practices. Farmers are utilizing tools such as GPS, drones, and IoT devices to improve crop yields and manage resources more efficiently.

- Government support plays a crucial role in the market’s expansion. The European Union’s Horizon Europe Programme (2021-2027), with a budget of about USD 104 billion, promotes the adoption of precision farming. This initiative encourages innovation and collaboration, facilitating the development and implementation of precision farming technologies across the region.

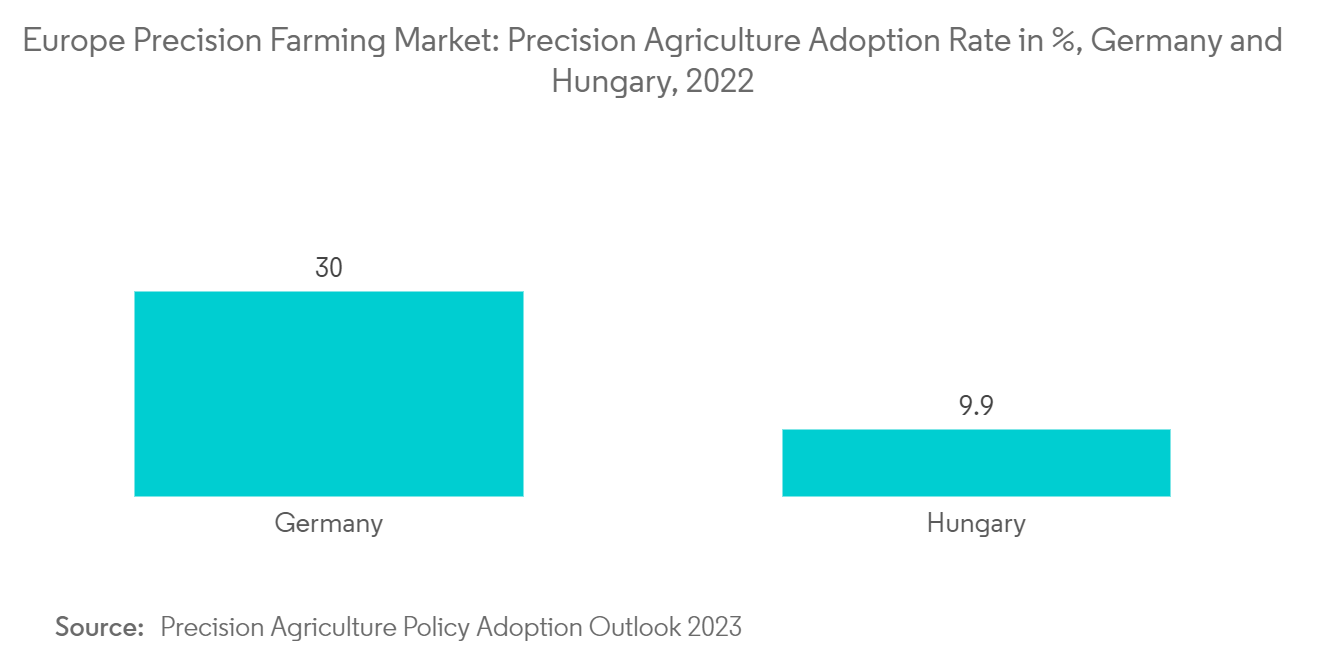

- Key technologies in the market include guidance systems, remote sensing, and variable rate technology. These tools enhance crop monitoring, soil health assessments, and farm productivity. Integrating real-time data and advanced analytics enables farmers to make more informed decisions tailored to their specific crop requirements. According to the European Union Precision Agriculture Policy & Adoption Outlook 2023, the United Kingdom leads in precision agriculture adoption in the region, with Scotland at 85% adoption within the UK, followed by 43% of Irish farmers. Germany and Denmark are also major adopters of these technologies.

- The growing consumer interest in sustainable food production aligns with precision farming practices, which reduce environmental impact through efficient resource use. This trend addresses market demands and presents opportunities for farmers in premium, eco-friendly markets. With ongoing technological progress and strong policy support for sustainable agriculture, the future of precision farming in Europe appears promising.

Europe Precision Farming Market Trends

Labor Shortages Drive Precision Farming Adoption in European Agriculture

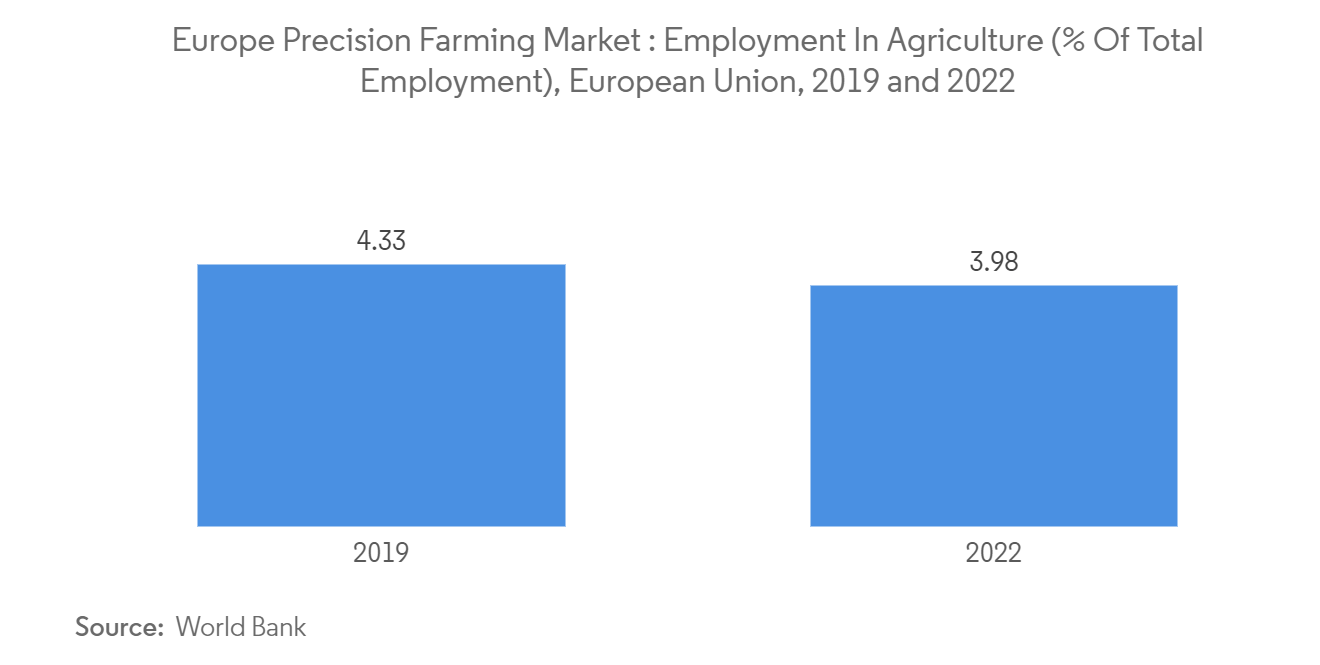

- The European Union’s fruit and vegetable sector relies heavily on non-national labor from both EU and non-EU countries. Germany, Italy, Spain, France, and Poland employ significant numbers of seasonal migrant workers. With about 9.1 million farms across 157 million hectares of agricultural land, the EU faces increasing labor shortages due to stricter immigration policies and declining availability of seasonal workers. This situation has accelerated the adoption of precision farming technologies, which offer automated solutions to reduce labor dependency while improving efficiency, productivity, and sustainability in the agricultural sector.

- The EU is experiencing a declining labor force, particularly in rural areas where agriculture plays a key economic role. The EU agricultural labor force index decreased by about 15.8%, indicating an overall downward trend in the number of available workers. This demographic challenge has made it increasingly difficult to find sufficient labor for tasks such as planting, harvesting, and processing. Consequently, farmers are increasingly adopting precision farming technologies to address these labor shortages.

- In 2023, the European government initiated a digitalization program for agriculture and rural areas, promoting the integration of digital technologies and data-driven approaches in farming. This initiative benefits over 274,000 farms, aiming to enhance efficiency and productivity through advanced digital tools. The program directly supports the growth of the Europe Precision Farming Market by encouraging the adoption of precision technologies such as GPS, sensors, and data analytics. This shift towards automation not only helps alleviate the labor shortage but also improves efficiency and sustainability in agriculture.

Growing adoption of precision farming in Germany

- The increasing use of modern farming techniques by German growers highlights a significant shift towards precision farming. Germany boasts about 11.6 million hectares of agricultural land as of 2022, positioning it as one of Europe’s largest farming regions. This extensive agricultural landscape offers a significant opportunity for the adoption of precision farming technologies. Moreover, many farmers are adopting data-driven methods, such as GPS-based area measurements and soil sampling, although more advanced techniques like site-specific sowing and fertilizing are still less common.

- In Germany, precision farming is increasingly becoming a crucial part of agricultural contractor services, particularly on farms exceeding 500 hectares. This technology plays a significant role in monitoring soil conditions and plant health, leading to improved growth management. The rising interest in drone applications for specific farm areas is projected to further promote the adoption of modular precision farming tools, contributing to market growth. The German Julius Kühn-Institut (JKI) is renowned for its stringent standards in professional nozzle testing, a certification that is mandatory for agricultural drones in the country. For instance, DJI T30 drones received approval in 2022 for mountain vineyard operations in Germany.

- The growing focus on food security and better nutrient management is driving the widespread adoption of precision farming technologies across the nation. Germany’s commitment to sustainable agriculture, reinforced by initiatives such as the “Digital Farming 2025” program, is accelerating the use of digital tools in farming practices. These advancements are critical for addressing challenges like labor shortages and environmental sustainability, while also enhancing crop yields and reducing input costs through the use of technologies such as soil sensors and drones.

Europe Precision Farming Industry Overview

The European precision farming market is highly concentrated. Deere & Company, Bayer Crop Science, Agco corporation, CLAAS KGaA mbH and Corteva. are the key players in the market. The companies operating in Europe are focusing on R&D and product launches, along with innovations and partnerships.

Europe Precision Farming Market Leaders

- John Deere

- Bayer

- AGCO Corporation

- CLAAS KGaA mbH (365FarmNet)

- Corteva (Granular Inc.)

- *Disclaimer: Major Players sorted in no particular order

Europe Precision Farming Market News

- April 2024: AGCO Corporation has established a joint venture with Trimble, creating a new company named PTx Trimble. Trimble’s established presence in multiple European countries brings significant experience and market reach to this collaboration, enhancing efforts to promote precision farming technologies across the region.

- December 2023: NIK, a Bulgarian precision farming technology company, has collaborated with Bayer to introduce the FieldView Spray Kit. This new tool aims to enhance farming operations by optimizing processes, reducing expenses, and improving sustainability. The kit achieves these goals through real-time monitoring capabilities, precise calibration features, and advanced data analytics.

- April 2023: AGCO Corporation partnered with Bosch BASF Smart Farming to introduce and promote Smart Spraying technology on Fendt Rogator sprayers. The collaboration also involves joint efforts to develop new innovative features.

Europe Precision Farming Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Support and Subsidies

- 4.2.2 Technological Advancements

- 4.2.3 Increasing Demand for Sustainable Agriculture

- 4.3 Market Restraints

- 4.3.1 Regulatory and Standardization Challenges

- 4.3.2 High Initial Cost

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Bargaining Power Of Suppliers

- 4.4.2 Bargaining Power Of Buyers

- 4.4.3 Threat Of New Entrants

- 4.4.4 Threat Of Substitute Products And Services

- 4.4.5 Degree Of Competition

5. MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Guidance System

- 5.1.1.1 Global Positioning System (GPS)/ Global Satellite Navigation System (GNSS)

- 5.1.1.2 Global Information System (GIS)

- 5.1.2 Remote Sensing

- 5.1.3 Variable Rate Technology

- 5.1.3.1 Variable Rate Fertilizer

- 5.1.3.2 Variable Rate Seeding

- 5.1.3.3 Variable Rate Pesticide

- 5.1.4 Drones and UAVs

- 5.1.5 Other Technologies

- 5.2 Components

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 Application

- 5.3.1 Yield Monitoring

- 5.3.2 Variable Rate Application

- 5.3.3 Field Mapping

- 5.3.4 Soil Monitoring

- 5.3.5 Crop Scouting

- 5.3.6 Other Application

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 United Kingdom

- 5.4.4 Italy

- 5.4.5 Rest of Europe

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AGCO Corporation

- 6.3.2 TopCon Corporation

- 6.3.3 Corteva (Granular Inc.)

- 6.3.4 CNH Industrial N.V. (Raven)

- 6.3.5 Deere & Company

- 6.3.6 Teejet Technologies

- 6.3.7 CLAAS KGaA mbH (365FarmNet)

- 6.3.8 AG Leader Technology Inc.

- 6.3.9 Pottinger Landtechnik Gmbh group (MaterMacc)

- 6.3.10 Bayer Cropscience AG

- 6.3.11

- 6.3.12

- 6.3.13

7. MARKET OPPORTUNITIES AND FUTURE TREND

Europe Precision Farming Industry Segmentation

Precision farming is the adoption of a highly precise set of practices that uses technology to cater to the needs of individual plots and crops. It is a farming management concept based on observing, measuring, and responding to inter and intra-field variability in crops.

The market is segmented by Technology(Guidance systems, Remote sensing, Variable Rate Technology, Drones and UAVs, and Other technologies), Components(Hardware, Software, and Services), Application(Yield monitoring, Variable Rate Application, Field Mapping, Soil Monitoring, Crop Scouting, Other Application), and Geography (Germany, United Kingdom, Italy, France, and the Rest of Europe). The market size and estimation will be provided in terms of value (USD) for the above-mentioned segments.

| Technology | Guidance System | Global Positioning System (GPS)/ Global Satellite Navigation System (GNSS) |

| Global Information System (GIS) | ||

| Technology | Remote Sensing | |

| Variable Rate Technology | Variable Rate Fertilizer | |

| Variable Rate Seeding | ||

| Variable Rate Pesticide | ||

| Drones and UAVs | ||

| Other Technologies | ||

| Components | Hardware | |

| Software | ||

| Services | ||

| Application | Yield Monitoring | |

| Variable Rate Application | ||

| Field Mapping | ||

| Soil Monitoring | ||

| Crop Scouting | ||

| Other Application | ||

| Geography | Germany | |

| France | ||

| United Kingdom | ||

| Italy | ||

| Rest of Europe |

Europe Precision Farming Market Research Faqs

The Europe Precision Farming Market size is expected to reach USD 3.99 billion in 2025 and grow at a CAGR of 15.30% to reach USD 8.13 billion by 2030.

In 2025, the Europe Precision Farming Market size is expected to reach USD 3.99 billion.

John Deere, Bayer, AGCO Corporation, CLAAS KGaA mbH (365FarmNet) and Corteva (Granular Inc.) are the major companies operating in the Europe Precision Farming Market.

In 2024, the Europe Precision Farming Market size was estimated at USD 3.38 billion. The report covers the Europe Precision Farming Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Europe Precision Farming Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.