Europe Liquid Fertilizer Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The European Liquid Fertilizer Market Report is Segmented by Complex, Straight (Micronutrients, Nitrogenous, Phosphatic, Potassic, and Secondary Macronutrients), Mode of Application (Fertigation and Foliar Application, Crop Type (Field Crops, Horticultural Crops, and Turf and Ornamental Crops), and Geography (France, Italy, Germany, Netherlands, Russia, Spain, Ukraine, United Kingdom, and Rest of Europe). For Each Segment, The Market Sizing and Forecasts Have Been Done Based On Value (USD).

Europe Liquid Fertilizer Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Europe Liquid Fertilizer Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

| Market Size (2025) | USD 3.48 Billion |

| Market Size (2030) | USD 4.55 Billion |

| CAGR (2025 – 2030) | 5.50 % |

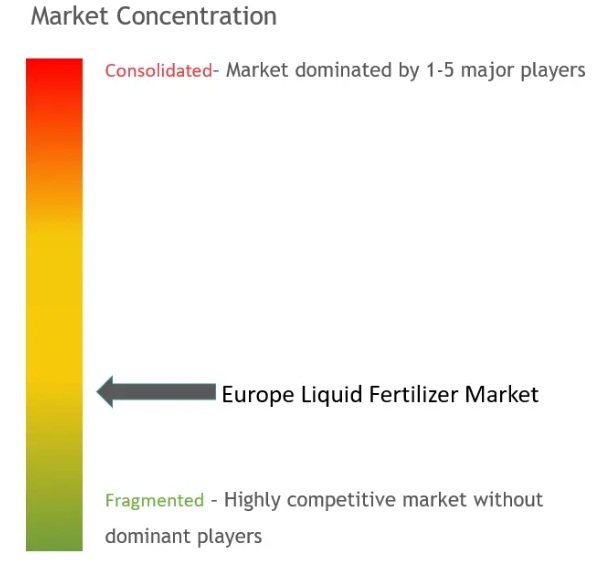

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Europe Liquid Fertilizers Market with other markets in Agriculture Industry

Seeds

Crop Protection

Fertilizers

Agricultural Commodities

Agriculture Services

Agricultural Machinery and Technology

Europe Liquid Fertilizer Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 5.5% (2025 – 2030) |

| Countries/ Region Covered: | France, Germany, Italy, Netherlands, Russia, Spain, United Kingdom, Ukraine |

| Major Players: | Yara International ASA, ICL Group Ltd., Grupa Azoty S.A., CF Industries Holdings, Inc., Sociedad Quimica y Minera de Chile SA (SQM) |

Europe Liquid Fertilizer Market Analysis

The Europe Liquid Fertilizers Market size is estimated at USD 3.48 billion in 2025, and is expected to reach USD 4.55 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

The European liquid fertilizer market has experienced steady growth, propelled by the increasing demand for efficient and sustainable agricultural practices. Liquid fertilizers, valued for their ease of application and rapid nutrient absorption, are becoming a preferred choice for farmers in the region. The need to enhance crop yields, improve soil fertility, and meet the rising food demand of the growing population has further accelerated the adoption of these fertilizers. According to the United Nations, Department of Economic and Social Affairs, Germany’s population increased to 84.6 million in 2023 from 84.1 million in 2022, creating a significant need for liquid fertilizers to boost productivity and satisfy consumer demand. Additionally, the market benefits from technological advancements in precision agriculture, which promote the precise application of liquid fertilizers, reducing wastage and environmental impact.

Countries such as Ukraine, Germany, France, and the United Kingdom dominate the European liquid fertilizer market due to their advanced agricultural sectors and higher adoption rates of modern farming techniques. For instance, according to FAOSTAT data, France’s urea ammonium nitrate fertilizer consumption reached 1.9 million metric tons in 2022, an increase of 5.5% from the previous year. Key crops contributing to the market demand include cereals, oilseeds, fruits, and vegetables, all of which benefit from the nutrient efficiency offered by liquid fertilizers.

Furthermore, a research study conducted in November 2022 demonstrated that the application of Urea Ammonium Nitrate (UAN), a liquid nitrogenous fertilizer in potato cultivation resulted in a 6.4% increase in marketable potato yield and up to a 12.2% increase in total yield in Russia. In 2023, Eurostat reported that small-scale farmers constituted nearly 70% of all farms in the European region, underscoring their pivotal role in Europe’s agricultural landscape. Typically spanning under 10 hectares, these farms are essential for fostering rural entrepreneurship and upholding traditional farming practices. Hence, liquid fertilizer is the most effective option for better yield for these farmers.

Sustainability has become a central focus in the European agricultural sector, influencing the growth of the liquid fertilizer market. Stricter environmental regulations and the European Union’s Green Deal initiatives encourage the use of environmentally friendly fertilizers with reduced carbon footprints. Many liquid fertilizers are now developed to align with these goals, incorporating bio-based or organic ingredients to support sustainable farming. This shift not only meets regulatory requirements but also addresses consumer demand for eco-friendly farming practices. Therefore, due to the continued demand for high-efficiency fertilizers to boost production while minimizing harmful impacts on the environment, coupled with the active participation and involvement of players, the segment is anticipated to grow gradually during the forecast period.

Europe Liquid Fertilizer Market Trends

Rising Importance of Precision Farming and Consumer Demand

In Europe, the liquid fertilizers market is evolving significantly, influenced by factors such as technological innovations, and precision agriculture techniques. Rising food security concerns due to changing climatic conditions, increasing population, and decreasing arable land availability are the primary factors bolstering the adoption of precision farming practices in the region. This, in turn, drives the market for liquid fertilizers as they provide an array of benefits to modern farmers that lead to improved crop response to the availability of nutrients and better productivity.

Urea ammonium nitrate (UAN) fertilizer, a liquid powerhouse of plant nutrition, blends urea and ammonium nitrate in an aqueous solution used precisely for efficient plant nutrient management. The International Plant Nutrition Institute highlights its nitrogen potency, typically ranging from 28% to 32%, hence it is an important liquid fertilizer used in precision farming in the region. Moreover, the European urea ammonium nitrate fertilizer market has witnessed the implementation of various strategies by industry participants, including strategic partnerships, to maintain market competitiveness. In 2022, Brineflow, a liquid fertilizer manufacturer headquartered in Great Yarmouth, established a strategic joint venture with HELM AG, a prominent German fertilizer producer. HEML AG, which possesses substantial liquid nitrogen (UAN) manufacturing capabilities in Trinidad, aims to enhance the security of fertilizer supply for the United Kingdom through this collaborative arrangement. This partnership exemplifies the industry’s efforts to strengthen supply chains and maintain a competitive edge in the European market.

Furthermore, Europe has experienced a gradual reduction in arable land due to urbanization. This trend compels farmers to maintain or increase crop yields from a diminishing area, thereby increasing their reliance on fertilizers to optimize productivity. According to FAOSTATS data, the harvested area of cereal grains in Europe has reached 116.7 million hectares, a reduction of 3.42% from the previous year. Turkey has faced significant challenges in maintaining food security due to a decrease in arable land, exacerbated by urbanization, and industrialization. To mitigate these issues, in 2023, Turkey recorded the highest usage of chemical fertilizers in its history, with nearly 14 million metric tons applied across the country, according to the Ministry of Agriculture and Forestry, Turkey. This increase is part of a broader effort to counteract the decline in available agricultural land and ensure sufficient food production.

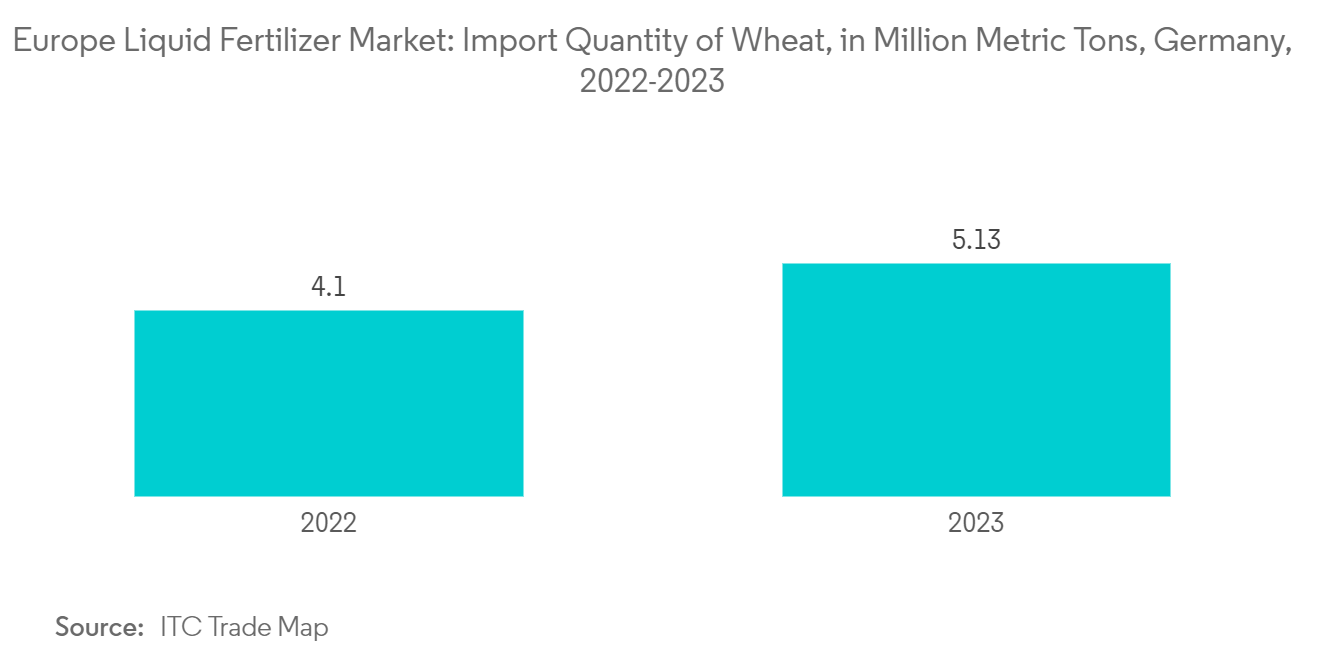

The growing import of agricultural produce further shows the growing demand and insufficient production in the region. For instance, according to the ITC Trade Map, in Germany, the import of wheat in 2023 reached 5.13 million metric tons which was 4.10 million metric tons in 2022. The reduction in arable land, increasing import, and growing adoption of precision agriculture, coupled with the need for increased agricultural productivity, is anticipated to drive the liquid fertilizer market in the forecast period.

Russia Dominates the European Liquid Fertilizers Market

Russia plays a critical role in the European liquid fertilizer market, driven by its strong agricultural base and extensive production of fertilizers. The country is a major producer of nitrogen-based liquid fertilizers, including urea ammonium nitrate (UAN) solutions, which are essential for European agricultural productivity. For instance, according to the data of PhosAgro, a leading fertilizer producer in Russia, the country has produced 60 million metric tons of fertilizers, with PhosAgro contributing 11 million metric tons in 2023.

Additionally, another Russian company Life Force LLC offers Life Force Acti Grow Fe/B/Zn/Mn, a liquid fertilizer featuring an innovative formula of active phytocomponents. As agricultural land in Russia continues to decrease due to urbanization and environmental initiatives, liquid fertilizers’ role becomes even more significant. For instance, in 2022 the harvested area for rice was 169.6 thousand hectares in Russia with a reduction of 8.94% compared to the previous year. Using liquid fertilizer, that enables precise nutrient application, the country is aiming to boost crop yields on limited land.

Russia’s agricultural export capacity, particularly in fertilizers, allows it to cater to both domestic and European needs. As European farmers seek to improve their crop yields with shrinking land, Russia’s export-oriented strategy positions the country as a critical player in the regional and global fertilizer market. For instance, the export quantity of the liquid mixture of urea and ammonium nitrate in 2023 from Russia was 2,025,979 metric tons which was 30.9% value share worldwide according to the ITC trade map. According to Rosstat, the largest buyers of Russian fertilizers in the EU were Poland, France, and Germany. Poland increased its imports 2.7-fold year-on-year, and France increased its imports by 18% in 2023.

However, the ongoing conflict with other nations has disrupted both domestic and international supply chains, creating uncertainty in the availability of fertilizers. Despite these challenges, Russia continues to remain at the forefront of the European liquid fertilizer market, focusing on innovation and sustainability to maintain its critical role in feeding Europe’s growing agricultural demands.

Europe Liquid Fertilizer Industry Overview

The European liquid fertilizer market is fragmented, intensifying competition among major players to maintain a stable customer base and capture significant market shares. Some of the most notable companies in the market are Yara International ASA, ICL Group Ltd., Grupa Azoty S.A., CF Industries Holdings, Inc., and Sociedad Quimica y Minera de Chile SA (SQM) among others. The companies have focused on facility expansions and developing new products to enhance their portfolio and strategize their hold in the European liquid fertilizer market.

Europe Liquid Fertilizer Market Leaders

- Yara International ASA

- ICL Group Ltd.

- Grupa Azoty S.A.

- CF Industries Holdings, Inc.

- Sociedad Quimica y Minera de Chile SA (SQM)

- *Disclaimer: Major Players sorted in no particular order

Europe Liquid Fertilizer Market News

- September 2024: Grupa Azoty S.A. launched an improved version of its RSM (urea-ammonium nitrate solution), a widely used urea-ammonium nitrate solution. This new formulation, called RSM OPTIMA, is enriched with copper, boron, and molybdenum.

- April 2024: Yara International ASA launched YaraVita B-Phos, a novel foliar liquid fertilizer for legumes, in Germany. This product contains phosphorus and boron nutrients along with bioactive compounds, including alkanolamine salts and algae extracts rich in phytohormones.

- April 2024: Grupa Azoty S.A. has finalized contracts in the Agro segment for the 2024/2025 season. The company has signed 66 agreements with its authorized distribution network for the domestic fertilizer market. Through this partnership, the company aims to increase the supply of liquid fertilizers in the European and global markets.

Europe Liquid Fertilizers Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Importance of Precision Farming

- 4.2.2 Decreasing Arable Land

- 4.2.3 Growing Government Support and Initiative

- 4.3 Market Restraints

- 4.3.1 Increase in Adoption of Oragnic Farming

- 4.3.2 Comparative High Cost

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Complex

- 5.2 Straight

- 5.2.1 Micronutrients

- 5.2.2 Nitrogenous

- 5.2.3 Phosphatic

- 5.2.4 Potassic

- 5.2.5 Secondary Macronutrients

- 5.3 Mode of Application

- 5.3.1 Fertigation

- 5.3.2 Foliar Application

- 5.4 Cop Type

- 5.4.1 Field Crops

- 5.4.2 Horticultural Crops

- 5.4.3 Turf and Ornamental Crops

- 5.5 Geography

- 5.5.1 France

- 5.5.2 Germany

- 5.5.3 Italy

- 5.5.4 Netherlands

- 5.5.5 Russia

- 5.5.6 Spain

- 5.5.7 United Kingdom

- 5.5.8 Ukraine

- 5.5.9 Rest of Europe

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Yara International ASA

- 6.3.2 ICL Group Ltd

- 6.3.3 Grupa Azoty S.A.

- 6.3.4 BMS Micro-nutrients NV

- 6.3.5 CF Industries Holdings, Inc.

- 6.3.6 Nordfert

- 6.3.7 YILDIRIM Group

- 6.3.8 Sociedad Quimica y Minera de Chile SA (SQM)

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TREND

Europe Liquid Fertilizer Industry Segmentation

Liquid fertilizers are concentrates or water-soluble powders of synthetic chemicals of nitrogen, phosphorus, potassium, secondary macronutrients, and other micronutrient. The European liquid fertilizer market is segmented by Complex, Straight (Micronutrients, Nitrogenous, Phosphatic, Potassic, and Secondary Macronutrients), Mode of Application (Fertigation and Foliar application, Crop Type (Field crops, Horticultural crops, and Turf and Ornamental crops), and Geography (France, Italy, Germany, Netherlands, Russia, Spain, Ukraine, United Kingdom, and Rest of Europe). For each segment, the market sizing and forecasts have been done based on value (USD).

| Straight | Micronutrients |

| Nitrogenous | |

| Phosphatic | |

| Potassic | |

| Secondary Macronutrients | |

| Mode of Application | Fertigation |

| Foliar Application | |

| Cop Type | Field Crops |

| Horticultural Crops | |

| Turf and Ornamental Crops | |

| Geography | France |

| Germany | |

| Italy | |

| Netherlands | |

| Russia | |

| Spain | |

| United Kingdom | |

| Ukraine | |

| Rest of Europe |

Europe Liquid Fertilizers Market Research Faqs

The Europe Liquid Fertilizers Market size is expected to reach USD 3.48 billion in 2025 and grow at a CAGR of 5.5% to reach USD 4.55 billion by 2030.

In 2025, the Europe Liquid Fertilizers Market size is expected to reach USD 3.48 billion.

Yara International ASA, ICL Group Ltd., Grupa Azoty S.A., CF Industries Holdings, Inc. and Sociedad Quimica y Minera de Chile SA (SQM) are the major companies operating in the Europe Liquid Fertilizers Market.

In 2024, the Europe Liquid Fertilizers Market size was estimated at USD 3.29 billion. The report covers the Europe Liquid Fertilizers Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Europe Liquid Fertilizers Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.