Europe Heavy Duty Truck Rental Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The report covers Europe Medium and Heavy-Duty Truck Rental/Leasing Companies and is Segmented by Booking Type (Offline Booking and Online Booking), Rental Type (Short-term and Long-term Leasing), and Country (Germany, United Kingdom, France, Spain, Italy, and the Rest of Europe). The report offers market size and forecast for the European medium and heavy-duty truck rental/leasing market in value (USD billion) for all the above segments.

Europe Heavy Duty Truck Rental Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Europe Medium & Heavy-Duty Truck Rental Market Size

| Study Period | 2020 – 2030 |

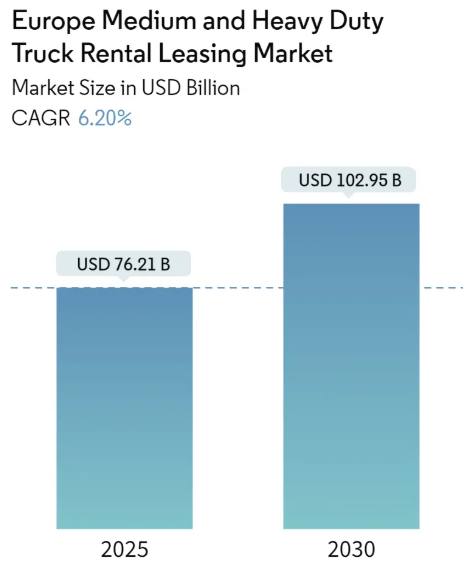

| Market Size (2025) | USD 76.21 Billion |

| Market Size (2030) | USD 102.95 Billion |

| CAGR (2025 – 2030) | 6.20 % |

| Fastest Growing Market | Europe |

| Largest Market | Europe |

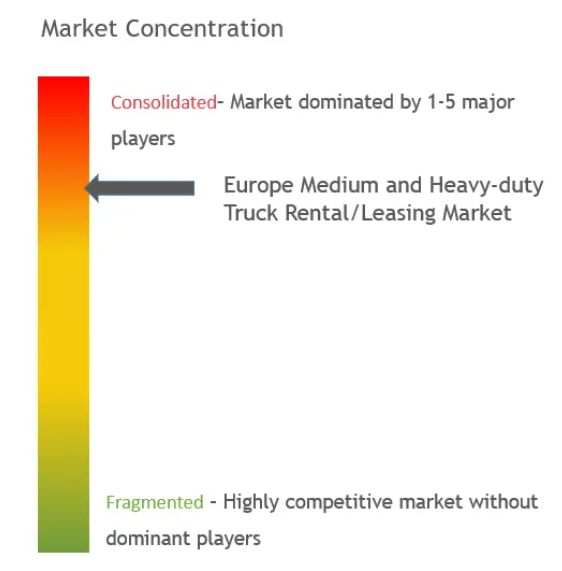

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Europe Medium and Heavy Duty Truck Rental Leasing Market with other markets in Automotive Industry

Automotive Materials & Coatings

Automotive Technology

Vehicles

Automotive Services

Auto Parts

Automotive Equipment

Europe Heavy Duty Truck Rental Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2020 – 2030 |

| CAGR: | 6.20% (2025 – 2030) |

| Countries/ Region Covered: | Germany, United Kingdom, France, Spain, Italy |

| Major Players: | Fraikin, Penske Truck Leasing, MAN Financial Services, Paccar Leasing GmbH, TIP Trailer Services Germany GmbH |

Europe Medium & Heavy-Duty Truck Rental Market Analysis

The Europe Medium and Heavy Duty Truck Rental Leasing Market size is estimated at USD 76.21 billion in 2025, and is expected to reach USD 102.95 billion by 2030, at a CAGR of 6.2% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the market’s growth across the European region as lockdowns and shutdowns of manufacturing facilities in 2020 resulted in disruptions in the transportation sector and the closure of small and medium-scale industries. However, as restrictions eased, several logistic companies shifted their focus on renting and leasing medium and heavy-duty trucks instead of buying new ones to avoid high initial costs. Such trends in the market are likely to continue and offer long-term positive growth for the market.

Over the long term, one of the other notable factors driving the market growth is the exceptional rental offers and aggressive advertising by the players in the market. Increasing regulations on vehicle emissions, advancements in vehicle safety, and rapidly growing logistics, retail, and e-commerce sectors have significantly driven the demand for new advanced trucks in the EU market over the past years. Truck rental companies have also been equally impacted by the factors mentioned above.

The strict emission control regulations implemented by the governments of key European countries positively influence the growth of the truck rental market as it reduces the number of sales of owned and road vehicles. The recently published heavy-duty vehicle certification data for 2021 from the European Union found that while the fuel consumption values across the different truck subgroups oscillated between 24 L/100 km and 33 L/100 km, the specific CO2 emissions showed greater variation. Urban delivery trucks with a 42 axle configuration (4-UD) emitted on average 307 gCO2/t-km, which is over five times as much as long-haul tractor-trailers (5-LH) with emissions of 57 gCO2/t-km.

Europe Medium & Heavy-Duty Truck Rental Market Trends

Rising Emission Standards in Europe

There are nearly 6 million trucks on EU roads. Almost 98.3% of them run on diesel, 1% on gasoline, and the remainder on other fuels. In May 2018, the European Commission presented a legislative proposal for setting up the first-ever CO2 emission standards for heavy-duty vehicles. A provisional agreement was reached on the same in February 2019. As a first step, these standards are proposed for large lorries, which account for 65-70% of all emissions from heavy-duty vehicles.

Major European Union countries, including Germany, France, and the United Kingdom, have strictly prohibited older diesel trucks from operating in a few cities. Such bans have had a significant impact on transportation services in EU countries. As a result, companies in retail and logistics have begun to prefer trucks with improved emission standards, as well as eco-friendly trucks, such as hybrid and electric trucks, in their business operations.

Renting and leasing behemoths in Europe, such as Penske, have invested tens of millions of dollars in transportation management platforms to assist shippers in optimizing their supply chains, reducing waste, identifying areas for improvement, reducing cycle time, and reducing inventory, all of which reduce overall costs. For instance, in July 2021, Penske Truck Rental introduced its first-ever mobile app for consumer truck rental customers. It could provide do-it-yourself movers with the ability to manage their moves more efficiently and effectively. Additionally, the Penske Truck Rental app incorporates insurance bundling options.

Rest of Europe is witnessing significant growth

The countries considered in the rest of Europe are the Netherlands, Russia, Sweden, Poland, and Belgium, among others.

In Greece, companies are not permitted to lease trucks without a driver. Businesses in the country frequently buy used trucks from other countries to meet their transportation needs. As a result, Greece’s average truck age is approaching 20 years.

The United Kingdom also held a significant market share in terms of revenue in 2021 and is expected to grow during the forecast period. Several major players are investing in the R&D of advanced technology to attract customers, overcome the growing problem of driver shortages, and gain market share.

Following the three-year plan, the association launched a ‘Plug-in Pledge,’ aiming to register 300,000 plug-in vehicles by 2025. As a result, the rental industry is expected to adopt electric trucks. Manufacturers such as Magtec, Daimler, and Renault have electric trucks in their portfolios for the UK market.

Based on such developments, the market is expected to witness considerable growth during the forecast period.

Europe Medium & Heavy-Duty Truck Rental Industry Overview

Some prominent truck rental leasing service providers include Penske Truck Leasing Inc., Paccar Leasing GmbH, Fraikin, Tip Trailer Services Germany GmbH, Man Financial Services/euro-leasing, and others. The intensity of competition in the market studied is high, as truck rental firms, as well as truck OEMs that offer rental services, have been rigorously promoting their fleet management services to customers.

In April 2022, Free2move acquired the first metasearch for van and truck rental Comparateur-location-utilitaire.fr to expand and improve its rental services of commercial vehicles to private customers and B2B clients.

In April 2021, United Rentals Inc. signed an agreement to acquire General Finance Corporation for USD 19 per share in cash, representing a total enterprise value of approximately USD 996 million, including the assumption of USD 400 million net debt. This acquisition stabilizes its geographical presence by expanding rental services in the region.

Europe Medium & Heavy-Duty Truck Rental Market Leaders

- Fraikin

- Penske Truck Leasing

- MAN Financial Services

- Paccar Leasing GmbH

- TIP Trailer Services Germany GmbH

- *Disclaimer: Major Players sorted in no particular order

Europe Medium & Heavy-Duty Truck Rental Market News

- Sept 2022: GATE Green and Advanced Transport Ecosystem, a long-term, an all-inclusive rental model for electric trucks and vans, was announced by Iveco Group. The new entity will provide a comprehensive service based on a pay-per-use model, giving customers access to tomorrow’s propulsion.

- Apr 2022: Hylane GmbH was scheduled to receive fuel-cell electric trucks from Hyzon Motors. Fleet owners can deploy Hyzon vehicles in their operations through a rental agreement with Hylane, which will cover maintenance and downtime costs to minimize risk for customers while accelerating the rate at which zero-emission vehicles replace diesel.

- Apr 2022: Hylane GmbH (Hylane), a provider of climate-friendly mobility, officially launched as a subsidiary of Cologne-based DEVK Versicherung. Hylane could place environmental protection at the heart of its exclusively climate-friendly vehicle rental service. The company could offer hydrogen trucks with different superstructures and installations.

Europe Medium & Heavy-Duty Truck Rental Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness – Porter’s Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Size by Value – USD Billion)

- 5.1 By Booking Type

- 5.1.1 Offline Booking

- 5.1.2 Online Booking

- 5.2 By Rental Type

- 5.2.1 Short-term Leasing

- 5.2.2 Long-term Leasing

- 5.3 By Country

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 Rest of Europe

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Truck Rental Firms

- 6.2.1.1 Tip Trailer Services Germany GmbH

- 6.2.1.2 United Rentals Inc.

- 6.2.1.3 Penske Truck Leasing

- 6.2.1.4 Paccar Leasing Gmbh (paccar Inc.)

- 6.2.1.5 Heisterkamp Truck Rental

- 6.2.1.6 Easy Rent Truck and Trailer GmbH

- 6.2.1.7 Man Financial Services/Euro-leasing

- 6.2.1.8 Ryder Group

- 6.2.1.9 Fraikin

- 6.2.2 Truck Manufacturers

- 6.2.2.1 PACCAR Inc.

- 6.2.2.2 Mercedes Benz Group AG

- 6.2.2.3 AB Volvo

- 6.2.2.4 Traton SE

- 6.2.2.5 ISUZU Motors Ltd

- 6.2.2.6 IVECO SpA

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Europe Medium & Heavy-Duty Truck Rental Industry Segmentation

Truck rental is a hire or lease business of trucks, which serves companies or agencies that do not own their truck fleets but undertake freight transport. A commercial truck rental service allows consumers to utilize the vehicle for a short period in exchange for paying a higher daily cost or monthly cost.

The Medium and Heavy-duty Truck Rental/Leasing Market in Europe is Segmented by Booking Type (Offline Booking and Online Booking), Rental Type (Short-term and Long-term Leasing), and Country (Germany, United Kingdom, France, Spain, Italy, and the Rest of Europe). The report offers market size and forecast for the European medium and heavy-duty truck rental/leasing market in value (USD billion) for all the above segments.

| By Booking Type | Offline Booking |

| Online Booking | |

| By Rental Type | Short-term Leasing |

| Long-term Leasing | |

| By Country | Germany |

| United Kingdom | |

| France | |

| Spain | |

| Italy | |

| Rest of Europe |

Europe Medium & Heavy-Duty Truck Rental Market Research FAQs

The Europe Medium and Heavy Duty Truck Rental Leasing Market size is expected to reach USD 76.21 billion in 2025 and grow at a CAGR of 6.20% to reach USD 102.95 billion by 2030.

In 2025, the Europe Medium and Heavy Duty Truck Rental Leasing Market size is expected to reach USD 76.21 billion.

Fraikin, Penske Truck Leasing, MAN Financial Services, Paccar Leasing GmbH and TIP Trailer Services Germany GmbH are the major companies operating in the Europe Medium and Heavy Duty Truck Rental Leasing Market.

Europe is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the Europe accounts for the largest market share in Europe Medium and Heavy Duty Truck Rental Leasing Market.

In 2024, the Europe Medium and Heavy Duty Truck Rental Leasing Market size was estimated at USD 71.48 billion. The report covers the Europe Medium and Heavy Duty Truck Rental Leasing Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Europe Medium and Heavy Duty Truck Rental Leasing Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.