Electric Vehicle Power Inverter Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The EV Power Inverter Market Report is Segmented by Propulsion Type (Hybrid Electric Vehicle, Plug-In Hybrid Vehicle, Battery Electric Vehicle, and Fuel Cell Electric Vehicle), Vehicle Type (Passenger Cars and Commercial Vehicles), and Geography (North America, Europe, Asia-Pacific, and the Rest of the World). The Report Offers Market Size and Forecasts in Terms of Value (USD) for all the Above Segments.

Electric Vehicle Power Inverter Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

EV Power Inverter Market Size

| Study Period | 2019 – 2030 |

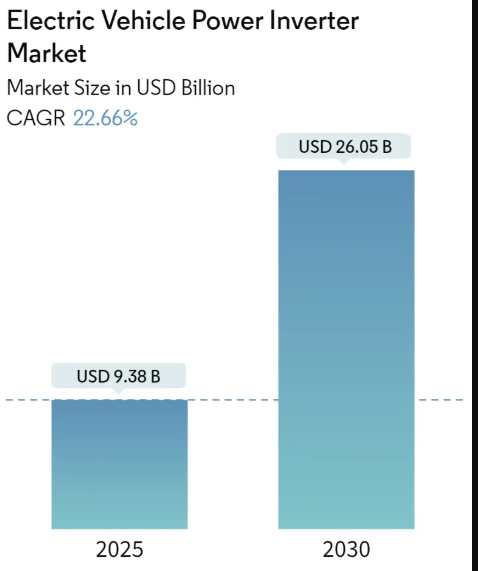

| Market Size (2025) | USD 9.38 Billion |

| Market Size (2030) | USD 26.05 Billion |

| CAGR (2025 – 2030) | 22.66 % |

| Fastest Growing Market | Europe |

| Largest Market | Asia-Pacific |

| Market Concentration | Medium |

Major Players

|

Compare market size and growth of Electric Vehicle Power Inverter Market with other markets in Automotive Industry

Automotive Materials & Coatings

Automotive Technology

Vehicles

Automotive Services

Auto Parts

Automotive Equipment

Electric Vehicle Power Inverter Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 22.66% (2025 – 2030) |

| Countries/ Region Covered: | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Major Players: | DENSOCorporation, Mitsubishi Electric Corporation, Tesla, Inc., Toyota Industries Corporation, Valeo SA |

EV Power Inverter Market Analysis

The Electric Vehicle Power Inverter Market size is estimated at USD 9.38 billion in 2025, and is expected to reach USD 26.05 billion by 2030, at a CAGR of 22.66% during the forecast period (2025-2030).

Governments in various countries are spending heavily on electric mobility projects. They are trying to provide opportunities for electric vehicle power inverter manufacturers. The governments are also encouraging automobile manufacturers and customers to produce and adopt electric vehicles. The rise in the demand for electric vehicles is also expected to increase the sales of the components used in electric vehicles, such as power inverters.

With growing stringent emission standards globally, automakers are gradually shifting their production from conventional engine vehicles to hybrid and electric vehicles. In addition, governments initiated incentives, such as a cut down in vehicle tax, bonus payments, and premiums, for buyers of electric vehicles in the respective countries to support electric vehicle sales growth. The increasing charging station facilities in the regions, especially in Europe, North America, and Asia-Pacific, particularly in Japan and China, further supported the growing electric vehicle sales.

Several manufacturers raised the bar to go beyond the announcements related to electric vehicles with an outlook beyond 2025. More than ten of the largest OEMs declared electrification targets for 2030 and beyond. Significantly, some OEMs plan to reconfigure their product lines to produce only electric vehicles. For instance, in the first trimester, General Motors announced its plans to raise its spending on electric and autonomous vehicles to USD 20 billion by 2025. The company launched 20 new electric models by the end of 2023 and aimed to sell more than 1 million electric cars a year in the United States and China over the forecast period.

EV Power Inverter Market Trends

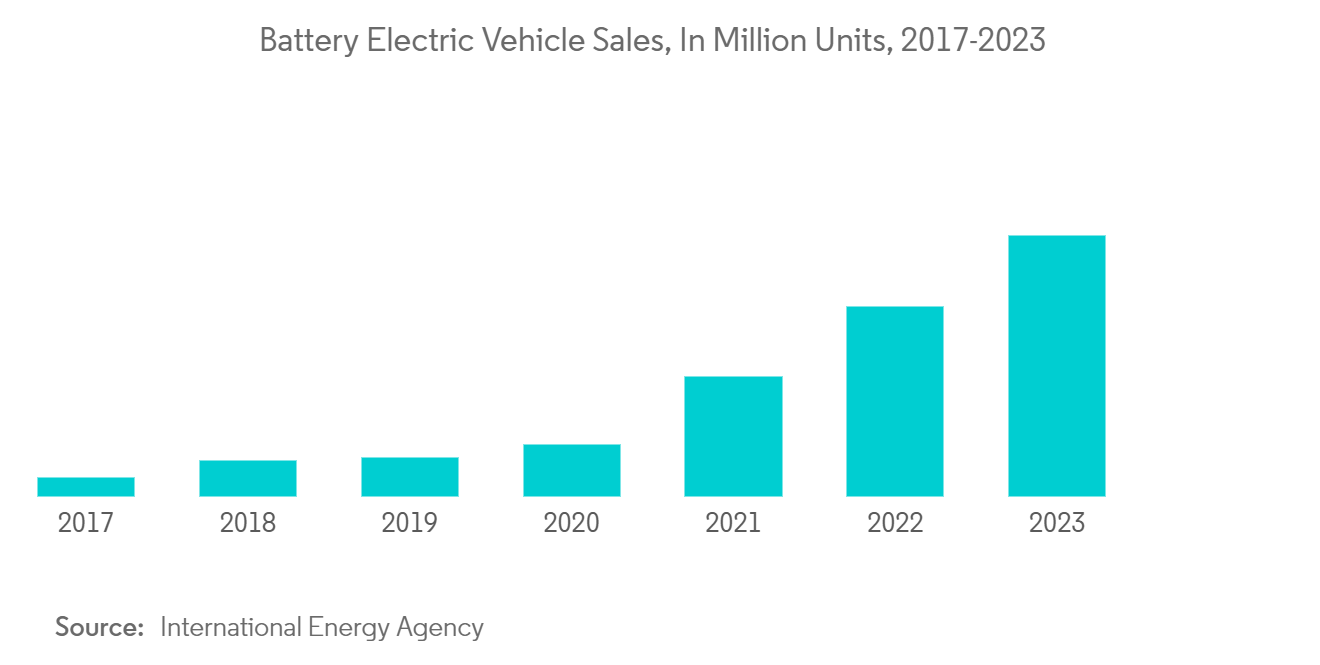

Growing Sales of Electric Vehicles

Electric vehicles have become an integral part of the automotive industry, and they represent a pathway toward achieving energy efficiency, along with reduced emissions of pollutants and other greenhouse gases. The increasing environmental concerns, coupled with favorable government initiatives, are some of the major factors driving the market’s growth.

In 2023, global sales of battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) surged by 35%, reaching 14 million units. Among these, 10 million were pure electric BEVs, while 4 million were PHEVs. The movement to accelerate the adoption of light-duty passenger electric cars (EVs) and phase out traditional vehicles with internal combustion engines is gaining traction around the world. The increase in average fuel prices reflects the fact that Europe holds a higher share of new electric car registrations than other parts of the world. Hence, mass adoption of electric vehicles, owing to rising fuel prices, is expected to increase business globally.

Rising government investment in the development of charging infrastructure worldwide is likely to promote the sale of electric vehicles. For instance,

- The UK government aims to expand the quantity of public electric vehicle charging stations by over a hundredfold, reaching 300,000 by 2030, to match the rising demand for electric vehicles.

- In February 2023, BP revealed intentions to inject USD 1 billion by 2030 into electric vehicle (EV) charge points across the United States. It marked a significant stride in the company’s evolution toward becoming an integrated energy company.

Moreover, the high cost associated with batteries necessitated the improvement of inverters and other power electronics, along with improving the performance of vehicles.

For instance, shifting customer preference toward electric vehicles is an evident sign of future decarbonization and is simultaneously decisive for charging stations. However, the penetration of EVs is subjected to various attributes, including consumer behavior, infrastructure, and certain regional clusters. The increase in electric vehicle sales is anticipated to proportionally fuel the demand for charging stations. Prominent players in the market have pinpointed consumer sentiment and thus are focusing on catering to it by offering fast-charging technologies across the country.

Though the change did not result in a slump in IC engine vehicle sales, it created a promising market for electric vehicles in the present and future. The above trend propelled some of the automakers to increase their expenditure on R&D in electric vehicles and associated components, like power inverters. While others, on the other hand, started focusing on launching new products to capture the market share, eventually pushing the demand in the market.

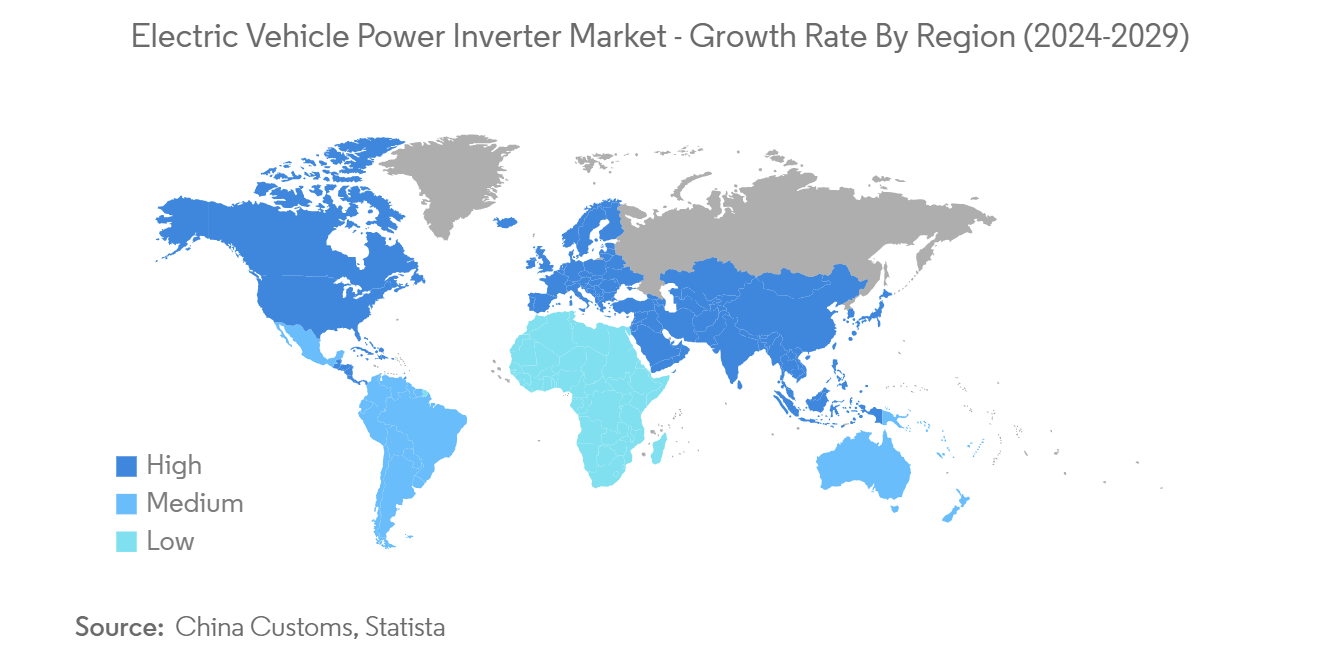

Asia-Pacific is leading the Electric Vehicle Power Inverter Market

The Asia-Pacific electric vehicle market has witnessed substantial growth in recent years, driven by a combination of environmental awareness, government initiatives, and advancements in electric vehicle (EV) technology. With a rising concern for air quality and a commitment to reducing greenhouse gas emissions, countries in the region have implemented supportive policies and incentives to promote the adoption of electric vehicles.

- In April 2023, several startups in Southeast Asia, like Indonesia’s ION Mobility and Vietnam’s VinFast, raised significant funding and launched new electric vehicle models, indicating a growing interest in regional EV production.

China, as a major player in the Asia-Pacific region, has emerged as the largest market for electric vehicles. The Chinese government’s robust support, including generous subsidies, incentives, and the establishment of a comprehensive charging infrastructure, has propelled the rapid growth of electric vehicles in the country. Additionally, China’s push toward becoming a global leader in electric mobility has spurred innovation and investment in electric vehicle manufacturing.

- In July 2023, Chinese EV giant BYD overtook Tesla as the world’s leading electric vehicle seller in the first half of 2023, highlighting the growing strength of Chinese players in the global EV market.

Countries like Japan and South Korea have also played pivotal roles in the Asia-Pacific electric vehicle market. Japan, home to renowned automakers, has seen a steady increase in electric vehicle adoption, driven by technological advancements and a strong commitment to sustainable transportation. In South Korea, government incentives and investments in research and development have contributed to the growth of the electric vehicle market, with a focus on enhancing battery technology and expanding charging infrastructure.

- In March 2023, the Japanese government revised its EV subsidy program, extending it and increasing benefits for eligible electric vehicles to further promote EV adoption.

- In February 2023, LG Energy Solution and Honda announced a joint venture to establish a battery cell production plant in the United States, catering to the growing demand for EVs in North America and potentially supplying the Asia-Pacific market as well.

India, with its ambitious plans for electrification, is gradually becoming a significant player in the Asia-Pacific electric vehicle landscape. The Indian government’s initiatives, such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, aim to incentivize electric vehicle adoption and support the development of charging infrastructure. This, coupled with increasing consumer awareness, is fostering a positive environment for the electric vehicle power inverter market.

In May 2023, the Indian EV market experienced a surge in sales, registering the highest number of electric vehicles sold in a single year, driven by rising fuel prices and increasing awareness of environmental benefits.

EV Power Inverter Industry Overview

A few players, such as Continental AG, Robert Bosch GmbH, DENSO Corporation, and Mitsubishi Electric Corporation, dominate the electric vehicle power inverter market. Companies are expanding their business by opening new production plants and making joint ventures so that they can gain an edge over their competitors. For instance,

- June 2024: NXP Semiconductors NV and ZF Friedrichshafen AG collaborated on advanced SiC-based traction inverter solutions for EVs, utilizing NXP’s GD316x HV isolated gate drivers. These solutions aim to expedite the adoption of 800-V and SiC power devices, enhancing EV range, reducing charging stops, and lowering costs for OEMs.

- January 2024: BorgWarner, in partnership with Shaanxi Fast Auto Drive Group, is focusing on high-voltage inverter solutions for electric commercial vehicles in China.

- November 2023: Diamond Foundry Inc. developed an electric car inverter using diamond wafer technology, which was significantly smaller than Tesla 3’s unit and delivered more efficient power.

EV Power Inverter Market Leaders

- DENSOCorporation

- Mitsubishi Electric Corporation

- Tesla, Inc.

- Toyota Industries Corporation

- Valeo SA

EV Power Inverter Market News

- June 2024: Cissoid is supplying SiC-based inverter modules to Applied EV for its autonomous electric vehicles in industrial settings.

- June 2024: ABB launched the AMXE250 motor and HES580 three-level inverter package tailored for electric buses, designed to minimize motor losses by up to 12% compared to previous technologies over typical drive cycles.

- January 2024: Mitsubishi Electric Corporation introduced six new J3-Series power semiconductor modules for xEVs, featuring SiC-MOSFET or RC-IGBT designs, enhancing efficiency and scalability in EV and PHEV inverters.

EV Power Inverter Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Demand for Electric Vehicles Is Expected to Increase the Demand

- 4.2 Market Restraints

- 4.2.1 Infrastructure Challenges May Possess Operational Challenges

- 4.3 Industry Attractiveness – Porter’s Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Size in Value – USD)

- 5.1 By Propulsion Type

- 5.1.1 Hybrid Electric Vehicles

- 5.1.2 Plug-in Hybrid Electric Vehicle

- 5.1.3 Battery Electric Vehicle

- 5.1.4 Fuel Cell Electric Vehicle

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Vitesco Technologies

- 6.2.2 Robert Bosch GmbH

- 6.2.3 DENSO Corporation

- 6.2.4 Toyota Industries Corporation

- 6.2.5 Hitachi Astemo Ltd

- 6.2.6 Meidensha Corporation

- 6.2.7 Aptiv PLC (Borgwarner Inc.)

- 6.2.8 Mitsubishi Electric Corporation

- 6.2.9 Marelli Corporation

- 6.2.10 Valeo Group

- 6.2.11 Lear Corporation

- 6.2.12 Infineon Technologies AG

- 6.2.13 Eaton Corporation

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of Bidirectional Charging

EV Power Inverter Industry Segmentation

The electric power inverter is a device installed in an electric vehicle to convert high-power DC to AC. The converter current is further utilized by motors to run several other AC-compatible devices and sensors.

The electric vehicle power inverter market is segmented by propulsion type, vehicle type, and geography. By propulsion type, the market is segmented into hybrid electric vehicles, plug-in hybrid vehicles, battery electric vehicles, and fuel cell electric vehicles. By vehicle Type, the market is segmented into passenger cars and commercial vehicles. By Geography, the market is segmented into North America, Europe, Asia-Pacific, and the rest of the world. The report offers market size and forecasts in terms of value (USD) for all the above segments.

| By Propulsion Type | Hybrid Electric Vehicles | |

| Plug-in Hybrid Electric Vehicle | ||

| Battery Electric Vehicle | ||

| Fuel Cell Electric Vehicle | ||

| By Vehicle Type | Passenger Cars | |

| Commercial Vehicles | ||

| Geography | North America | United States |

| Canada | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | South America |

| Middle East and Africa |

EV Power Inverter Market Research FAQs

The Electric Vehicle Power Inverter Market size is expected to reach USD 9.38 billion in 2025 and grow at a CAGR of 22.66% to reach USD 26.05 billion by 2030.

In 2025, the Electric Vehicle Power Inverter Market size is expected to reach USD 9.38 billion.

DENSOCorporation, Mitsubishi Electric Corporation, Tesla, Inc., Toyota Industries Corporation and Valeo SA are the major companies operating in the Electric Vehicle Power Inverter Market.

Europe is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the Asia-Pacific accounts for the largest market share in Electric Vehicle Power Inverter Market.

In 2024, the Electric Vehicle Power Inverter Market size was estimated at USD 7.25 billion. The report covers the Electric Vehicle Power Inverter Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Electric Vehicle Power Inverter Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Power Inverter in Electric Vehicle Industry Report

The report on the Global EV Inverter Market Manufacturers provides a comprehensive market overview, covering various propulsion types such as Hybrid Electric Vehicle, Plug-in Hybrid Vehicle, Battery Electric Vehicle, and Fuel Cell Electric Vehicle. It also segments the market by vehicle type, including Passenger Cars and Commercial Vehicles, and by geography, encompassing North America, Europe, Asia-Pacific, and the Rest of the World.

The market size and market share are thoroughly analyzed, offering valuable insights into the market trends and market growth. The market report includes a detailed market forecast outlook, extending to the coming years. This industry report also provides a historical overview, ensuring a well-rounded understanding of the market dynamics.

In terms of market analysis, the report delves into the industry analysis and industry outlook, shedding light on the industry trends and market data. It also includes a market review and market segmentation, highlighting the market value and market predictions for the electric vehicle power inverter market.

The industry research and industry information provided in the report are crucial for understanding the market leaders and their strategies. The market forecast and market outlook are key components of the report, offering a glimpse into the future market growth and industry sales.

For those interested in a deeper dive, the report example and report PDF are available for further exploration. The research companies involved in this study have ensured that the industry statistics and market segmentation are accurately represented, providing a clear picture of the market landscape.

Overall, this report is an essential resource for anyone looking to understand the power inverter market in electric vehicles, offering detailed insights and forecasts that are critical for making informed business decisions.