Electric Trucks in Europe Market Size – Industry Report on Share, Growth Trends & Forecasts Analysis (2025 – 2030)

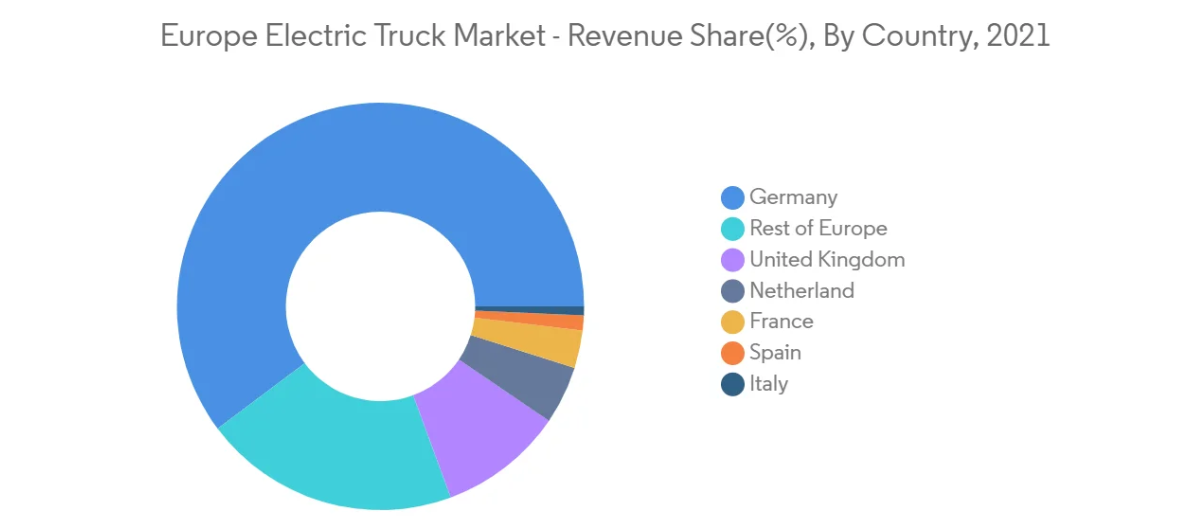

The Report covers Electric Trucks in Europe and the Market has been segmented by Propulsion type (Plug-in Hybrid, Fuel Cell Electric, and Battery Electric), Truck (Light Truck, Medium-duty Truck, and Heavy-duty Truck), Application (Logistics, Municipal, and Other Applications), and Country (Germany, United Kingdom, France, Italy, Netherland, Spain and the Rest of Europe).

Electric Trucks in Europe Market Size – Industry Report on Share, Growth Trends & Forecasts Analysis (2025 – 2030)

Electric Trucks Europe Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

| Market Size (2025) | USD 1.76 Billion |

| Market Size (2030) | USD 16.86 Billion |

| CAGR (2025 – 2030) | 57.13 % |

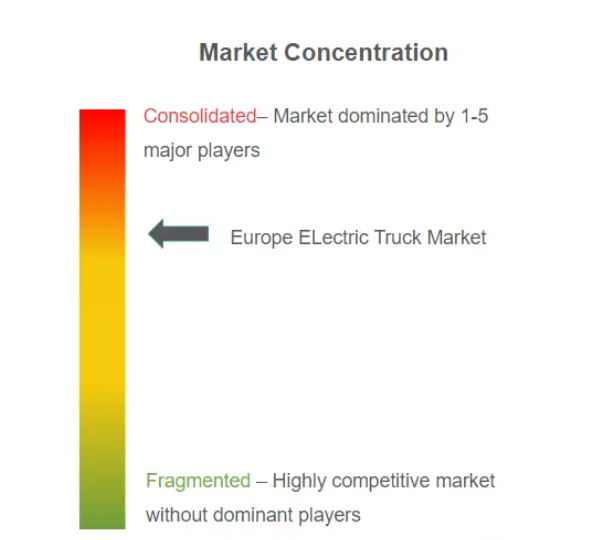

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Europe Electric Truck Market with other markets in Automotive Industry

Automotive Materials & Coatings

Automotive Technology

Vehicles

Automotive Services

Auto Parts

Automotive Equipment

Electric Trucks in Europe Market Size – Industry Report on Share, Growth Trends & Forecasts Analysis (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 57.13% (2025 – 2030) |

| Countries/ Region Covered: | Germany, United Kingdom, France, Italy, Spain |

| Major Players: | Volvo Group, Renault Trucks, Scania AB, Daimler, MAN trucks |

Electric Trucks Europe Market Analysis

The Europe Electric Truck Market size is estimated at USD 1.76 billion in 2025, and is expected to reach USD 16.86 billion by 2030, at a CAGR of 57.13% during the forecast period (2025-2030).

The COVID-19 pandemic hindered the growth of the electric truck market due to trade and travel restrictions imposed by governments across the region. However, the sales of electric trucks decreased notably in the first half of 2020 and recovered significantly in the latter half.

Over the medium-term, electric trucks are expected to become the preferred choice over diesel trucks owing to their remarkable advantages such as gobs of torque, noise pollution, lower maintenance cost, and others.

However, as restrictions eased, e-commerce and logistic providers witnessed revenue growth, increasing demand for electric trucks. The current situation is further expected to be driven by the development of alternative-fueled trucks, specifically commercial battery-electric trucks, across the European region, in the wake of its notable environmental targets. For instance, Switzerland is encouraging fuel cell electric truck growth through its road tax on diesel truck operations, making alternative fuels more attractive for large Swiss retail associations.

- The European Commission launched the ‘Alternative Fuels Infrastructure Facility’ in October 2021. The USD 1.5 billion funds support building zero-emission infrastructure such as fast charging and hydrogen refueling stations. The fund brings European countries closer to reaching their goal of 1 million recharging stations by 2025 and 3.5 million by 2030.

- The German government also pledged an additional USD 6.6 billion to incentivize commercial fleets to replace or upfit their diesel vehicles. The funding covers the purchase of N1 (similar to US class 2), N2 (similar to US class 3-6), and N3 (similar to US class 7-8) zero-emissions vehicles, as well as the conversion to zero-emission drives in N2 and N3 vehicles. The program also includes funding for expanding the zero-emission infrastructure required to power the new vehicles. Countries such as Belgium, Denmark, France, and Spain are expected to follow Germany’s example in the future.

Enactment of stringent emission norms on the use of IC engine-powered vehicles and rising government incentives and subsidies focusing on improving the penetration rate of commercial electric vehicles, especially trucks, are expected to drive the market during the forecast period. Development of self-driving technology, lightweight components, and materials to offer new opportunities for players in the market.

Besides these, increasing investments in research and development efforts by key market players and notable developments across autonomous trucks/self-driving trucks are other factors expected to drive the overall Europe electric truck market forward in the future.

Electric Trucks Europe Market Trends

Battery Electric Truck Gaining Momentum

With the growing environmental concerns, governments and environmental agencies are enacting stringent emission norms and laws that may increase the manufacturing cost of electric drivetrains and fuel-efficient diesel engines during the forecast period.

Further, innovative government legislative policies focusing on spurring the penetration of electric trucks are expected to propel demand in the market during the forecast period. For instance, in February 2022, EU member states adopted new legislation which states that all EU member states have until 2023 to implement a new road toll system that gives big incentives for zero-emissions trucks.

- By May 2023, haulers operating zero-emissions trucks, i.e., battery electric or hydrogen, must be given at least 50% discounts on distance-based road tolls. Member states could opt to levy extra CO2-based charges on fossil fuel lorries instead or implement both measures. With road tolls costing haulers up to EUR 25,000 per truck annually, switching to zero-emissions vehicles may cut their overheads considerably.

- The new law also requires countries to apply truck air pollution charges from 2026. From 2024, new time-based road charges for trucks, less fair than distance-based tolling, may be restricted to limited circumstances. If time-based charges remain on major highways after April 2024, they must be varied according to the truck’s CO2 emissions. Countries with toll roads under concession contracts may exempt these tolls from both CO2- and air pollution-based charging, but only until these contracts are renewed or substantially amended.

Green transportation is swiftly growing around the world, owing to which the goods transportation companies are also converting their existing fleet into electric propulsion-based vehicles. As the demand for electric trucks is growing, vehicle manufacturers are planning to launch more electric trucks. For instance,

- In June 2022, Swedish Company Scania introduced the “next level of battery-electric trucks (BEV).” With R or S sleeper cabs, the charging capability of the new e-trucks could be up to 375 kW, which means that an hour of charging will add some 270 to 300 km of range, and the power output level for a Scania 45 R or S is 410 kW (equivalent to some 560 hp).

Furthermore, in the wake of growing e-commerce and logistic activities, several companies operating across these sectors are widely depending on the trucking industry to transport goods across the nation. The demand for increases in shipping speed is fueled by huge online competitors, such as Amazon and other retailers that use their trucks and drivers as part of their e-commerce supply chain. For instance,

- In 2021, European e-commerce increased by 13 % to EUR 718 billion. The growth rate has remained stable, though it has risen slightly compared to 2020. According to the e-commerce Europe and euro commerce report 2022, Western Europe is, by far, the strongest region in B2C e-commerce turnover, holding 63% of the total turnover for 2021. Southern Europe follows in second place with just 16% of total turnover, Central Europe and Northern Europe come in third and fourth (10% and 9% respectively), and Eastern Europe (2%) in last place.

Based on the aforementioned factors, consistent launches of new electric trucks, growing investment in electric truck manufacturing, and the government’s EV-supporting policies around the world are likely to drive the battery-electric truck market over the forecast period.

United Kingdom to Exhibit a Significant Growth Rate During the Forecast Period

The United Kingdom is expected to account for a significant share of the total sales of electric trucks during the forecast period. The United Kingdom is investing heavily in infrastructure development for electric mobility. It opened a new electric highway for hybrid electric trucks that overhead electric lines will power. It is constantly focusing on encouraging electric mobility and its policies are intended to push electric trucks into the country, expected to drive demand in the market.

Country’s pollution laws are constantly changing, and diesel-powered trucks may be phased out entirely in the future. They would be replaced by electric counterparts, taking advantage of the electric construction vehicle industry.

Additionally, the British government has extended its electric van and truck subsidy scheme for another two years until 2025. New weight classes will be eligible for the subsidy beginning in April. According to the government, the subsidy is designed to help businesses convert their fleets in time and be “one step ahead” of the combustion engine’s demise in 2030. Since the scheme’s inception in 2012, plug-in van and truck grants have aided in the purchase of over 26,000 electric vans and trucks in the United Kingdom.

- By the end of 2021, the government had already cut the subsidy rates for electric vehicles. The large vans and small electric trucks were also subject to changes from April 1, 2022. The lower weight requirement for electric trucks rises from 3.5 to 4.25 tones, while the highest limit remains at 12 tones. These automobiles will be subsidized by 20% of the purchase price, up to a maximum of £16,000 per vehicle. Furthermore, the grant threshold for small electric trucks up to 16,000 pounds would be lifted from 3.5 tons to 4.25 tons. Electric trucks weighing up to 4.25 tons will be eligible for a £5,000 subsidy.

With the growing e-commerce sector, the demand from Logistics and delivery companies in the country has increased. To commercialize the market share, these companies started designing plans to deploy more electric commercial vehicles in their fleet in the coming years. For instance,

- In May 2022, Volvo Trucks and Deutsche Post DHL Group have agreed to collaborate to expedite the transition to zero-emission vehicles. DHL plans to accelerate its shift to big electric vehicles by deploying 44 new electric Volvo trucks on European routes. The planned order includes 40 Volvo FE and Volvo FL electric trucks, which will be utilized for package deliveries in urban areas. Electric trucks for longer routes are also included in the scope, and DHL has opted to start employing Volvo trucks for regional haulage, beginning with four Volvo FM Electric trucks in the United Kingdom.

- In December 2021, Tesco announced its plans to launch the first fully-electric HGVs used commercially in Britain to serve its distribution center in Wales. The vehicles can travel about 100 miles on a single charge, and these two 37-tonne trucks will transport goods from a rail freight terminal in Cardiff to the company’s hub in Magor.

Therefore, in line with the abovementioned instances and developments associated with electric trucks in the country, the UK electric truck market is expected to capture a significant share in the overall market.

Electric Trucks Europe Industry Overview

The European electric truck market is characterized by major players, such as Daimler, Scania, MAN, Renault Trucks, Volvo Trucks, etc. The market is highly competitive, as major and local players compete to gain a larger market share. Companies are entering into mergers, acquisitions, joint ventures, and collaboration agreements to strengthen their position in the market. For instance,

In May 2022, Volvo Trucks and Bucher Municipal joined in electrifying sewer cleaner trucks. Bucher Municipal aims to provide up to 80 fully electric sewer cleaner vehicles to European communities by the end of 2023. By the end of 2023, Bucher Municipal anticipates that up to 80 sewer trucks, or 50% of their cleaning vehicle production, maybe Volvo zero-emission trucks.

In March 2022, Renault Trucks announced the launch of a new project with Geodis, the Oxygen 16-ton e-truck. Renault Trucks announced its E-Tech portfolio, which includes some critical services that may assist customers in their transition to electric vehicles. The Renault Trucks T E-Tech for regional transport and the Renault Trucks C E-Tech for the construction industry will be available in 2023.

In June 2021, Volta Trucks revealed the first running prototype chassis of the Volta Zero – the world’s first purpose-built full electric 16-tonne commercial vehicle designed specifically for inner-city logistics. The Volta Zero will be Europe’s first commercial vehicle to use an innovative e-Axle for increased efficiency and vehicle range. Full-scale production of customer-specification vehicles will then follow at the end of 2022.

In June 2021, Proton Motor Fuel Cell GmbH signed a “Memorandum of Understanding” (MoU) with UK company “Electra Commercial Vehicles Limited” to develop the zero-emission fuel cell truck market in the UK and Ireland. Under the MoU, Electra will act as a system integrator to integrate Proton Motor Fuel Cell’s fuel cell systems into their existing electric truck portfolio.

Thus, based on the abovementioned instances and developments in the region, market players anticipated exploring new opportunities to capture the majority market share in the Europe electric truck market.

Electric Trucks Europe Market Leaders

- Volvo Group

- Renault Trucks

- Scania AB

- Daimler

- MAN trucks

- *Disclaimer: Major Players sorted in no particular order

Electric Trucks Europe Market News

In June 2022, Swedish commercial vehicle maker Scania debuted its regional long-haul electric truck that would be available in Europe as both a rigid truck and a tractor-trailer. The truck would achieve full charge in less than 90 minutes, half the length of a driver’s mandated 45-minute rest period for every 4.5 hours of driving in Europe at 375 kW. Both the Scania 45 R and S series feature a 410 kW powertrain.

In June 2022, Plastic Omnium announced that it had agreed with ACTIA Group to acquire 100% of ACTIA Power Division for an enterprise value of EUR 52.5 million, with a closing scheduled in the third quarter of 2022. ACTIA Power, based in the United Kingdom, specializes in designing and manufacturing onboard batteries, power electronics, and electrification systems for electric vehicles in heavy mobility: trucks, buses, coaches, trains, and construction equipment.

In June 2022, Mercedes Benz Trucks, a Daimler trucks subsidiary, announced its new eActros long-haul electric truck for long-distance transport at the IAA Transportation 2022 in Hanover. However, before its launch, the company revealed that the truck could achieve a 20% to 80% charge in 30 minutes.

In May 2022, Mercedes-Benz Trucks announced that it is systematically pressing ahead with introducing additional battery-electric models for this and the future. For the important long-haul segment, the eActros LongHaul, with a range of around 500 kilometers on one battery charge, is scheduled to be ready for series production in 2024. Mercedes-Benz Trucks aims to increase the share of locally CO2-neutral new vehicles in Europe to more than 5 % by 2030.

In April 2022, Volta Trucks unveiled the small 7.5 and 12 -ton iterations of the Volta Zero 16-ton. Both the new trucks would be visually similar to the 16-ton from the front, with the 12-ton having a long chassis design and an extra wheel to cater to the payload.

Electric Trucks Europe Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness – Porter’s Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Size in Value USD Million)

- 5.1 By Propulsion Type

- 5.1.1 Plug-In Hybrid

- 5.1.2 Fuel Cell Electric

- 5.1.3 Battery-Electric

- 5.2 By Truck Type

- 5.2.1 Light Truck

- 5.2.2 Medium-Duty Truck

- 5.2.3 Heavy-Duty Truck

- 5.3 By Application

- 5.3.1 Logistics

- 5.3.2 Municipal

- 5.3.3 Other Applications

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Netherland

- 5.4.6 Spain

- 5.4.7 Rest of Europe

- 5.4.8

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 AB Volvo

- 6.2.2 Volta Trucks

- 6.2.3 Daimler Trucks (Mercedes Benz Group AG )

- 6.2.4 DAF Trucks NV (PACCAR Inc.)

- 6.2.5 E-Trucks Europe BE

- 6.2.6 Renault Trucks

- 6.2.7 Tesla Motors Inc.

- 6.2.8 Einride AB

- 6.2.9 Tevva Motors Limited

- 6.2.10 BYD Co. Ltd

- 6.2.11 Scania AG

- 6.2.12 MAN SE (Volkaswagen AG)

- 6.2.13 IVECO SpA

- 6.2.14 E-Force One AG

- 6.2.15

7. MARKET OPPORTUNITIES AND FUTURE TREND

Electric Trucks Europe Industry Segmentation

Electric trucks can be defined as commercial vehicles powered by a pack of batteries, and they are used for the transportation of cargo. In electric trucks, motors inside have fewer parts moving compared to a diesel truck and don’t need multi-speed transmissions, reducing the vehicle’s maintenance cost and improving reliability with almost zero noise pollution.

The European electric truck market covers the latest trends and technological development in the electric bus market in European countries. The report’s scope covers segmentation based on propulsion type, truck, application, and country. By Propulsion type, the market is segmented into a plug-in hybrid, fuel cell electric, and battery electric. By truck type, the market is segmented into light truck, medium-duty truck, and heavy-duty truck. By application, the market is segmented into logistics, municipal, and other applications. By country, the market is segmented into Germany, the United Kingdom, France, Italy, the Netherland, Spain, and the Rest of Europe. For each segment, market sizing and forecasting are based on value (USD million).

| By Propulsion Type | Plug-In Hybrid |

| Fuel Cell Electric | |

| Battery-Electric | |

| By Truck Type | Light Truck |

| Medium-Duty Truck | |

| Heavy-Duty Truck | |

| By Application | Logistics |

| Municipal | |

| Other Applications | |

| By Country | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Netherland | |

| Spain | |

| Rest of Europe | |

Electric Trucks Europe Market Research FAQs

The Europe Electric Truck Market size is expected to reach USD 1.76 billion in 2025 and grow at a CAGR of 57.13% to reach USD 16.86 billion by 2030.

In 2025, the Europe Electric Truck Market size is expected to reach USD 1.76 billion.

Volvo Group, Renault Trucks, Scania AB, Daimler and MAN trucks are the major companies operating in the Europe Electric Truck Market.

In 2024, the Europe Electric Truck Market size was estimated at USD 0.75 billion. The report covers the Europe Electric Truck Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Europe Electric Truck Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.