Driving Simulator Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Global Automotive Driving Simulator Market is segmented by Vehicle Type (Passenger Car and Commercial Vehicle), Application Type (Training and Testing and Research), Simulator Type (Compact Simulator, Full-scale Simulator, and Advanced Simulator), and Geography (North America, Europe, Asia-Pacific, and Rest of the World).

Driving Simulator Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Driving Simulator Market Size

| Study Period | 2019 – 2030 |

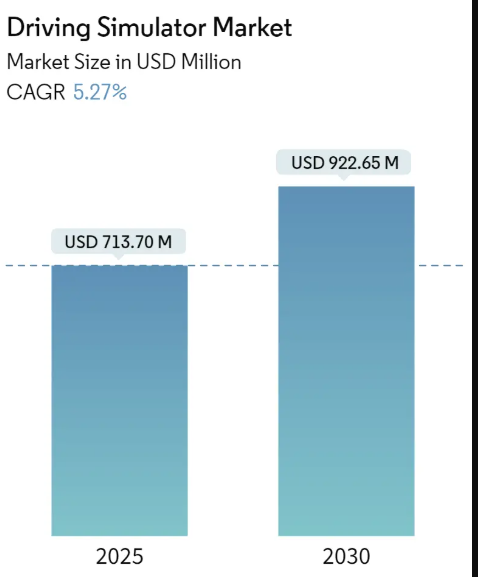

| Market Size (2025) | USD 713.70 Million |

| Market Size (2030) | USD 922.65 Million |

| CAGR (2025 – 2030) | 5.27 % |

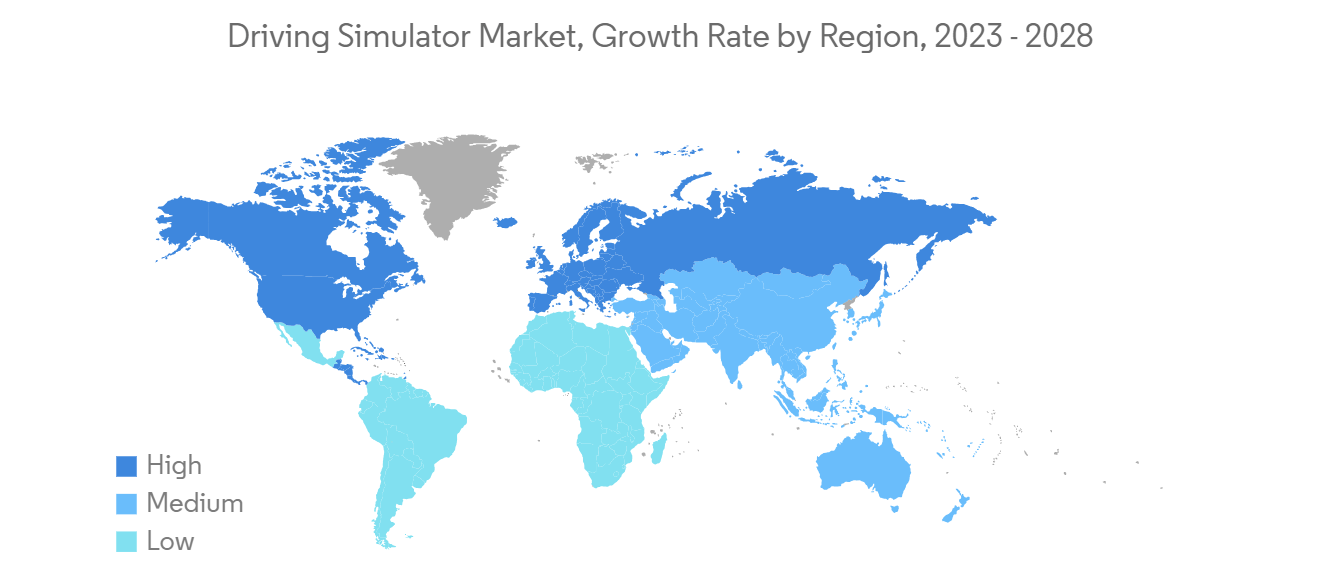

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Europe |

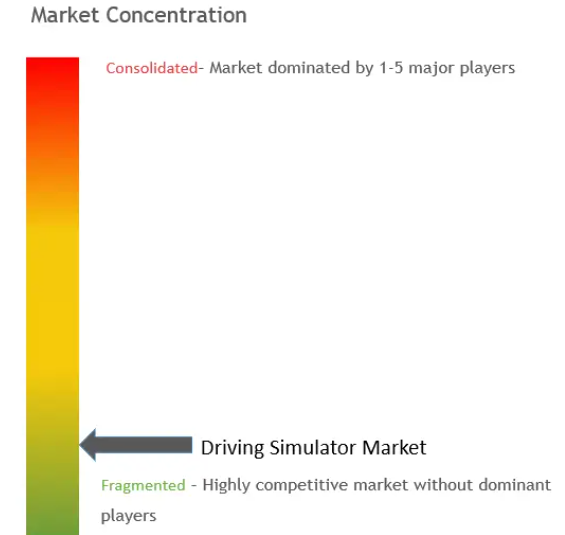

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Driving Simulator Market with other markets in Automotive Industry

Automotive Materials & Coatings

Automotive Technology

Vehicles

Automotive Services

Auto Parts

Automotive Equipment

Driving Simulator Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 5.27% (2025 – 2030) |

| Countries/ Region Covered: | North America,Europe,Asia-Pacific |

| Major Players: | AVSimulation, VI-grade Gmbh, IPG Automotive GmbH, AB Dynamics PLC, FAAC Incorporated |

Driving Simulator Market Analysis

The Driving Simulator Market size is estimated at USD 713.70 million in 2025, and is expected to reach USD 922.65 million by 2030, at a CAGR of 5.27% during the forecast period (2025-2030).

Due to the COVID-19 pandemic outbreak and the subsequent lockdowns (with all the restrictions followed), the driver simulator market witnessed a decline. Like any other industry, the pandemic showed a negative impact on the driving simulator market as well. Major countries with a large market share are negatively impacted by the pandemic, reducing the installation of driving simulators. However, as the economies slowly returned to a state of normalcy, the market is picking up pace and is expected to grow positively during the forecast period.

As technologies in automobiles are improving day by day, there is also a significant need for safety features in them. Most accidents happen due to human errors, lack of driving skills, etc. To avoid such situations, driving simulators are the best way to enhance driver skills virtually, where a real-time environment is created artificially. This system helps the driver in managing the situation in a controlled manner. Thus, a driving simulator is more efficient and improves safety to a great extent.

The adoption of driving simulators and analysis technology has experienced an increase in the railways, aviation, marine, defense, and automotive sectors, as it helps in testing and analyzing the designs of products in a virtual environment. Especially in the automobile sector, there is a consistent increase in the demand for advanced safety features in compact and mid-sized automobiles, as most countries are bringing in new laws to improve vehicular safety. Moreover, increasing stringency of safety and environmental regulations has compelled manufacturers and authorities to invest in driving simulators with innovative designs for training. This drastically decreases the research and development cost of the advanced features in a new vehicle.

Simulators are one of the crucial aspects of the development and testing of new vehicles. The simulator’s result helps engineers make important decisions by running virtual simulations while building the prototype and testing the vehicle on the track.

Additionally, the electrification of automotive components, the advent of semi-autonomous and autonomous vehicles, and the increasing influence of technology companies in the automotive industry are growth factors for the driving simulator market. The automotive industry is heading toward autonomous vehicles.

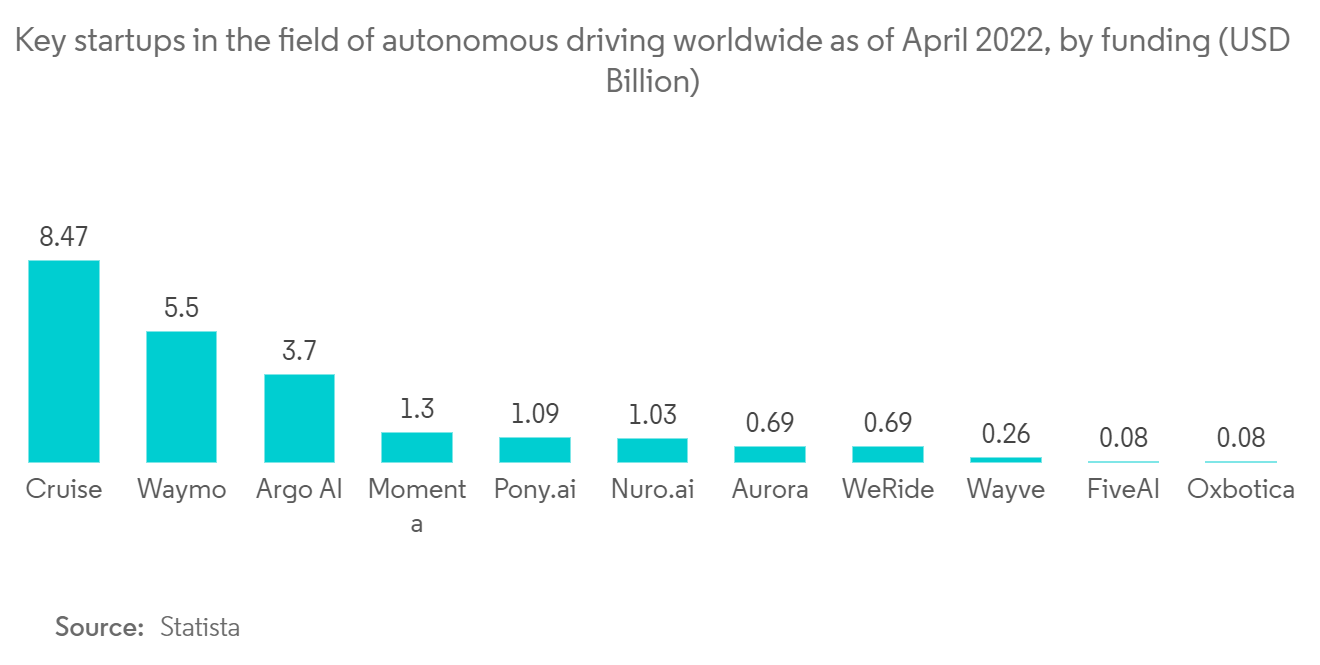

Most vehicle manufacturers are working on autonomous vehicle technology, which is not possible without simulators, and in the future, new players are likely to enter the field of autonomous vehicles, which may drive market growth in the forecast period. Major automaker companies, technology giants, and specialist start-ups have invested more than USD 50 billion over the past five years to develop autonomous vehicle (AV) technology, with 70% of the money coming from other than the automotive industry. At the same time, public authorities see that AVs offer substantial potential economic and social benefits.

Driving Simulator Market Trends

Autonomous Vehicle Acts as a Growth Engine for the Market

Autonomous vehicle makers are working hard to address the issue of autonomous vehicle safety when they are deployed on public roads. These players believe that autonomous vehicles will be far safer drivers than human drivers. This standard necessitates a large increase in existing testing installations.

However, while testing of driverless vehicles on actual roads has expanded in recent years, safety worries about autonomous vehicles are prompting market firms to engage in simulator testing for autonomous vehicles, as autonomous vehicles require a massive amount of data collection and processing. The data is shared among IoT-connected automobiles and wirelessly transferred to a cloud system to be examined and utilized to improve automation.

Several key market companies are substantially investing in the development of testing simulation systems and software for autonomous cars for these vehicles to be released on the road with considerably higher safety ratings. For instance,

At the most recent CommunicAsia 2022 trade show, MORAI, a Korean company that creates simulation technology for autonomous vehicles, demonstrated its MORAI SIM Drive, a “true-to-life autonomous vehicle driving simulator.’ As an autonomous vehicle and autonomous system, MORAI develops simulation tools and solutions.

The realistic driving simulator for autonomous vehicles, MORAI SIM Drive, can verify autonomous vehicles and offer simulation environments, sensor data, and vehicle models that are exact replicas of the real thing. MORAI SIM Drive automates building virtual environment and offers accurate network representation with HD map and a high-performance 3D graphic engine (Unity).

Vehicle manufacturers are investing heavily in autonomous car technology and entering partnerships to develop the best autonomous vehicle, as autonomous vehicles require enormous data collecting and processing. The entire data is shared between IoT-connected cars and uploaded wirelessly to a cloud system to be analyzed and used to improve automation.

- In December 2021, Honda R&D Co. extended its long-term relationship with Ansible Motion after commissioning the latest advanced Delta S3 DIL simulator. With its larger motion space and increased dynamic range, the versatile simulator would enable the efficient development of future road and race vehicles and their associated technologies at its Sakura engineering facility.

- In March 2021, Volvo Group signed an agreement with NVIDIA to jointly develop the decision-making system of autonomous commercial vehicles and machines. Utilizing NVIDIA’s end-to-end artificial intelligence platform for training, simulation, and in-vehicle computing, the resulting system is expected to be designed to handle fully autonomous driving on public roads and highways safely.

- In January 2021, General Motors announced they had entered a long-term strategic relationship with Microsoft to accelerate the commercialization of self-driving vehicles. The companies are expected to bring together their software and hardware engineering excellence, cloud computing capabilities, manufacturing know-how, and partner ecosystem to transform transportation.

With OEM’s focus on automated driving soon and subsequent growth of electric vehicles is anticipated to drive the demand for driving simulators, especially for testing and research by the OEMs operating in the market.

Europe is Expected to Lead the Market

Europe is led by Germany, one of the global most technologically superior markets. There is rapid growth for Level 2 and Level 3 autonomous cars in this region, equipped with advanced driver assistance systems like collision detection, lane departure warning, and adaptive cruise control.

From driver instructor academies to the race track, driving simulators are increasingly used as strategic tools in training education for drivers and racers. Moreover, the driving simulator will be deployed to assess ride and handling, NVH (Noise, Vibration, and Harshness), human-machine interface, and hardware in the loop in the hope of accelerating the rate of innovation in the overall vehicle development process while reducing the number of physical prototypes, and development time and costs.

The German driving simulator market is booming due to various investments and purchases ensured by utility partners. For instance,

- In April 2022, Simulation and driving simulator developer VI-grade announced that an extended version of its DiM250 Dynamic simulator had been adopted by long-standing customer Honda. Honda’s newly acquired DiM is the second VI-grade Dynamic simulator within the Honda Group, with the company’s R&D site in Offenbach, Germany, relying on a version of the DiM250 simulator for vehicle development and testing since 2018.

- In February 2022, Bosch could expand its expertise in automated driving and strengthen its market position by acquiring Atlatec, a developer of high-definition maps for autonomous driving and simulation.

Several utility platforms and companies understand the deep readiness of driving simulators and thus actively invest in research and technologies to come up with advanced and reliable stimulation solutions. For instance:

- In May 2022, Thales, based in France, completed its acquisition of Switzerland’s RUAG Simulation and Training (RUAG S&T). All 500 RUAG Simulation and Training (RUAG S&T) employees have transferred to Thales, which employs approximately 900 people. Thales is now one of Europe’s leading companies in the development and supply of simulation and training for the military, as brought to users by Uniwest. RUAG S&T made around €90 million (US$94.5 million) in sales last year.

Thales claims that the consolidation will expand its footprint in the land market while maintaining its expertise in helicopters and military aircraft solutions. This acquisition also allows it to strengthen its local footprint in France, Switzerland, Germany, and the United Kingdom, while expanding its presence in the United Arab Emirates and Australia.

Considering these ongoing developments and purchases for driving simulators in Germany, demand for the same is expected to witness a high growth rate during the forecast period.

Driving Simulator Industry Overview

The driving simulator market is dominated by several active players’ presence, which includes major existing companies and new startups. Some of the major players in the market are Cruden BV, AutoSim AS, AVSimulation, and Ansible Motion. utility partners and OEMs are heavily investing in developing advanced driving simulator technology for their vehicle testing and its on-road dynamics. Players are carrying strategic alliances for the same. For instance:

- In September 2022, AB Dynamics PLC acquired Ansible Motion Limited, a leading provider of advanced simulators to the global automotive market. The acquisition was announced for a total fee of Pound 31.2 Million, which comprises a Pound 19.2 Million initial consideration and a Pound 12 Million payment subject to meeting certain performance criteria.

- In June 2022, WIMI Hologram Academy, which is a research institute in Hong Kong, announced that it is deeply working in close partnership with Holographic Science Innovation Center in order to felicitate the ongoing demand for virtual reality technology in vehicle driving systems.

- In May 2022, Ansible Motion unveiled all the specifications for the production Delta series S3 Driver-in-the-Loop (DIL) simulator, which is intended to validate the technologies required to enable the emerging electrification trends, autonomy, driver assistance, as well as HMI and vehicle dynamics.

- In July 2021, Dynisma Ltd of the United Kingdom announced the release of its new advanced driving simulators. These Dynisma Motion Generators (DMGs) were specifically designed for automotive manufacturers and suppliers for advanced vehicle development and testing.

Driving Simulator Market Leaders

- AVSimulation

- VI-grade Gmbh

- IPG Automotive GmbH

- AB Dynamics PLC

- FAAC Incorporated

- *Disclaimer: Major Players sorted in no particular order

Driving Simulator Market News

- In May 2023, BharatBenz launches India’s first truck driver training simulator. Daimler India Commercial Vehicles (DICV), the parent company of BharatBenz, has launched a truck driver training simulator specifically designed for heavy truck drivers, in a first for the Indian market.

- In December 2022, Tecknotrove Simulator System Pvt. Ltd launched the TechnoSIM forklift training simulator at a logistic and material handling expo in Chennai, India.

- In June 2022, Continental AG (Continental) joined the CITY project, an automated driving initiative in urban areas involving 15 companies, academic institutions, and research organizations. Continental developed solutions for human-machine interaction, intelligent crossings, specific driving features for inner-city intersections, and bottlenecks.

- In April 2022, VI-grade announced its complete installation and commissioning of one of the compact simulators at the Ford Motor Research and Engineering Center in Nanjing, China. In addition, the simulator tracks the 3D virtual data that simulates Ford China’s test tracks in Nanjing which will soon get integrated into the driving simulator. Furthermore, the simulator will also enable Ford engineers to evaluate vehicle real-time dynamics performance which primarily includes steering and handling capability.

- In March 2021, Volvo Group signed an agreement with NVIDIA to jointly develop the decision-making system of autonomous commercial vehicles and machines. Utilizing NVIDIA’s end-to-end artificial intelligence platform for training, simulation, and in-vehicle computing, the resulting system is expected to be designed to handle fully autonomous driving on public roads and highways safely.

Driving Simulator Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness – Porter’s Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Size in Value – USD Million)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 By Application Type

- 5.2.1 Training

- 5.2.2 Testing and Research

- 5.3 By Simulator Type

- 5.3.1 Compact Simulator

- 5.3.2 Full-scale Simulator

- 5.3.3 Advanced Simulator

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 Other Countries

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 AutoSim AS

- 6.2.2 AVSimulation

- 6.2.3 VI-grade GmbH

- 6.2.4 Ansible Motion Ltd

- 6.2.5 Cruden BV

- 6.2.6 Tecknotrove Simulator System Pvt. Ltd

- 6.2.7 IPG Automotive GmbH

- 6.2.8 AB Dynamics PLC

- 6.2.9 Virage Simulation

- 6.2.10 XPI Simulation

- 6.2.11 FAAC Incorporated

7. MARKET OPPORTUNITIES AND FUTURE TREND

Driving Simulator Industry Segmentation

Driving simulators are used in driver’s education classes provided in educational institutions and by private firms such as driving schools. In the automotive sector, they are also used to create and assess new cars or new advanced driver assistance systems. They are also used for study in the fields of human factors and medical research to monitor driver behavior, performance, and attention.

The driving simulator market is segmented by vehicle type, Application type, simulator type, and Geography.

Based on the vehicle type, the market is segmented into passenger cars and commercial vehicles.

Based on application type, the market is segmented into training, testing, and research.

Based on the simulator type, the market is segmented into compact simulators, full-scale simulators, and advanced simulators.

Based on geography, the market is segmented into North America, Europe, Asia-Pacific, and the rest of the world.

For each segment, the market sizing and forecast have been done based on the value (USD Million).

| By Vehicle Type | Passenger Car | |

| Commercial Vehicle | ||

| By Application Type | Training | |

| Testing and Research | ||

| By Simulator Type | Compact Simulator | |

| Full-scale Simulator | ||

| Advanced Simulator | ||

| By Geography | North America | United States |

| Canada | ||

| Rest of North America | ||

| By Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Rest of Europe | ||

| By Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| By Geography | Rest of the World | Brazil |

| United Arab Emirates | ||

| Other Countries |

Driving Simulator Market Research FAQs

The Driving Simulator Market size is expected to reach USD 713.70 million in 2025 and grow at a CAGR of 5.27% to reach USD 922.65 million by 2030.

In 2025, the Driving Simulator Market size is expected to reach USD 713.70 million.

AVSimulation, VI-grade Gmbh, IPG Automotive GmbH, AB Dynamics PLC and FAAC Incorporated are the major companies operating in the Driving Simulator Market.

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the Europe accounts for the largest market share in Driving Simulator Market.

In 2024, the Driving Simulator Market size was estimated at USD 676.09 million. The report covers the Driving Simulator Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Driving Simulator Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Driving Simulator Industry Report

The Global Automotive Driving Simulator Market encompasses various segments such as Vehicle Type, Application Type, Simulator Type, and Geography. The industry report provides a comprehensive market forecast, detailing the market share, market size, and revenue growth rate. This industry analysis includes a historical overview and extends to a market forecast outlook.

The market forecast highlights the expected trends in the driving simulator industry, while the market share and market size offer insights into the industry’s scale and distribution. The industry analysis delves into the factors driving market growth and identifies key market leaders. The market research also covers the market segmentation and market value, providing a detailed market overview.

The industry reports include industry outlooks, industry research, and industry statistics that are crucial for understanding the market dynamics. The market data and market predictions are essential for stakeholders to make informed decisions. The market review and market trends offer a snapshot of the current state and future direction of the market.

The industry information and industry sales are pivotal for evaluating the market’s performance. The report example and report pdf provide a tangible representation of the industry insights. Research companies play a significant role in compiling this comprehensive market report.

This report summary integrates all the necessary elements, ensuring a holistic view of the Global Automotive Driving Simulator Market.