Drip Irrigation Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Report Covers Drip Irrigation Market Analysis and It is Segmented by Application (Surface Drip Irrigation and Subsurface Drip Irrigation), Crop Type (Field Crops, Vegetable Crops, Orchard Crops, Vineyards, and Other Crops), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East & Africa). The Market Size and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

Drip Irrigation Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Drip Irrigation Market Size

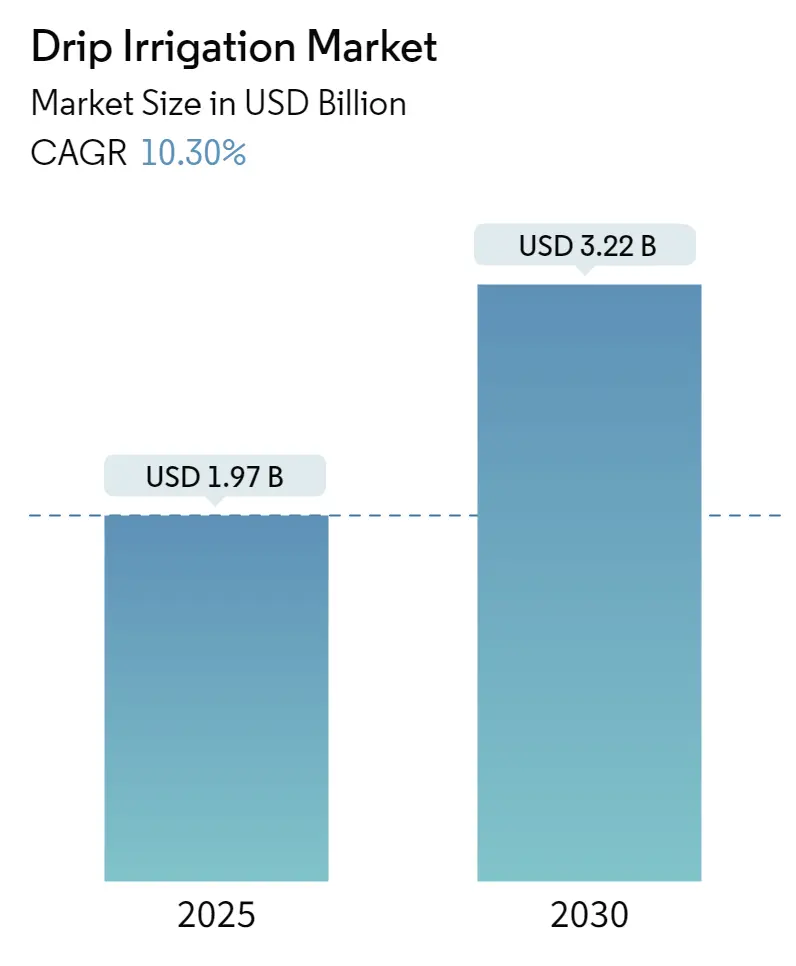

| Study Period | 2019 – 2030 |

| Market Size (2025) | USD 1.97 Billion |

| Market Size (2030) | USD 3.22 Billion |

| CAGR (2025 – 2030) | 10.30 % |

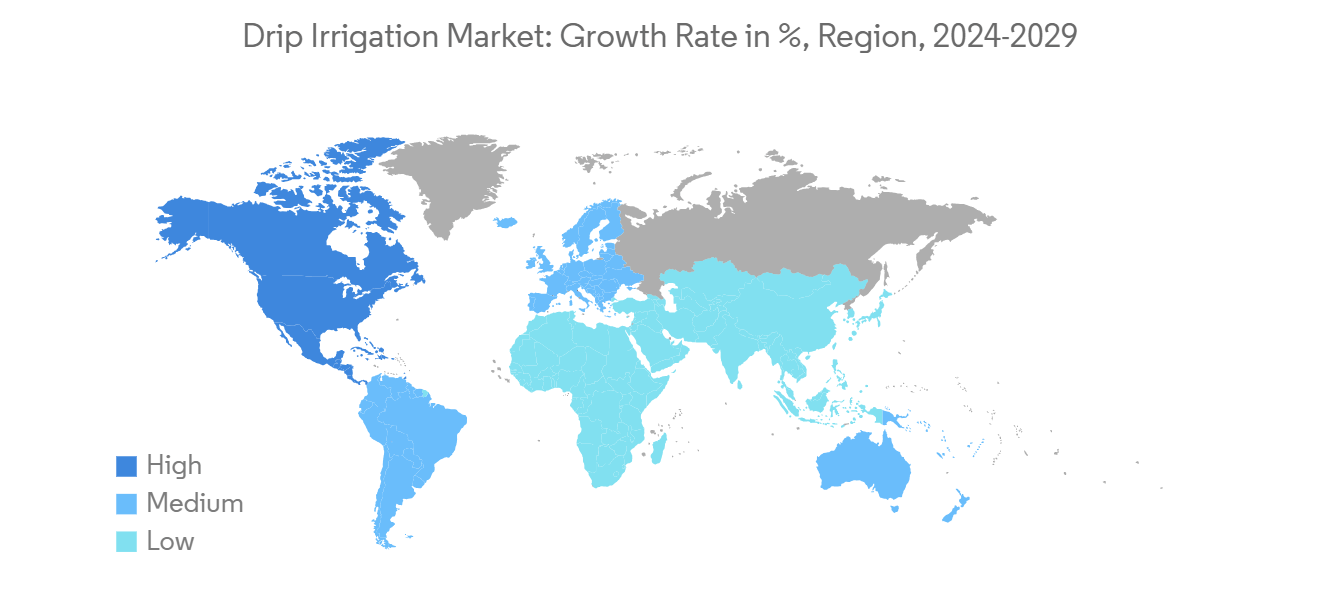

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

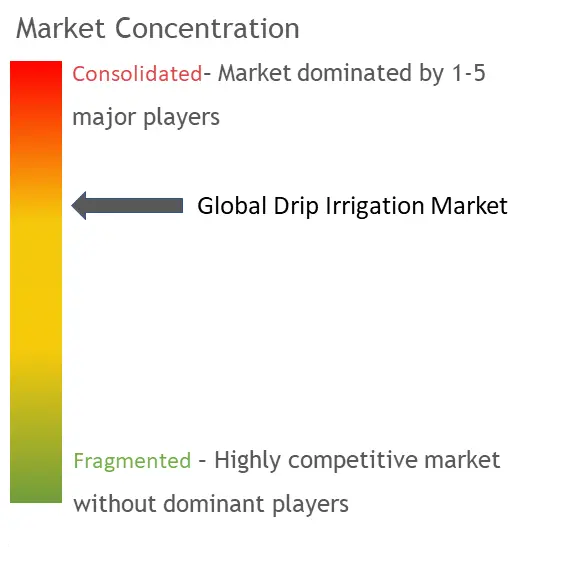

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Drip Irrigation Market with other markets in Agriculture Industry

Seeds

Crop Protection

Fertilizers

Agricultural Commodities

Agriculture Services

Agricultural Machinery and Technology

We’ve received your request. Our team will be reaching out to you shortly.

Drip Irrigation Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 10.30% (2025 – 2030) |

| Countries/ Region Covered: | North America, Europe, Asia-Pacific, South America, Middle East and Africa |

| Major Players: | Jain Irrigation Systems Ltd, Netafim, The Toro Company, Rain Bird Corporation, Hunter Industries |

Drip Irrigation Market Analysis

The Drip Irrigation Market size is estimated at USD 1.97 billion in 2025, and is expected to reach USD 3.22 billion by 2030, at a CAGR of 10.3% during the forecast period (2025-2030).

- Irrigation is a critical component of agriculture and crop production. Manufacturers have created equipment and techniques to provide farmers with paramount drip irrigation systems. Factors such as government subsidies and policies, technological innovations, and increasing concern over water scarcity drive the market.

- The drip irrigation system is witnessing high demand as water has increasingly become scarce. Farmers have been seeking novel ideas to grow more crops with the same quantity of water. This is anticipated to augment the growth of the market studied. For instance, the adoption of drip irrigation is growing across Canada, particularly in provinces with water scarcity and high water usage for agricultural production. According to Statistics Canada, Canadian farmers increased their water usage for crop irrigation by 23% in 2022 compared to 2020, which is majorly attributed to the drier climatic conditions in various regions throughout the country.

- In recent years, drip irrigation implementation has increased in different regions. The Asia-Pacific has the largest market for the drip irrigation industry. India is the largest market in Asia-Pacific for drip irrigation. In February 2021, the Ministry of Agriculture and Farmers Welfare, India, showed that the net irrigated area in the country is 68,649 thousand ha. The agricultural land covered under micro-irrigation is 12,908.44 thousand ha, in which drip irrigation is 6,112.05 thousand ha and sprinkler irrigation is 6,796.39 thousand ha. This means that out of the total irrigated land in the country, only 19% is under micro-irrigation. Up to 60% of water used for sugarcane, banana, okra, papaya, bitter gourd, and a few other crops could be saved if a drip irrigation system is employed for cultivation.

- The major market players operating in the drip irrigation systems market include Jain Irrigation Systems Limited, Netafim Limited, the Toro Company, etc., making the global drip irrigation market a consolidated marketplace. These market players are involved in several strategic planning, product development activities, and mergers and acquisitions, catalyzing the market’s growth. Recently, in June 2022, Rivulis Irrigation India Ltd and Jain Irrigation Systems Limited merged their business and will be one of the largest global drip irrigation system providers.

Drip Irrigation Market Trends

Field Crops is the Significant Segment by Crop Type

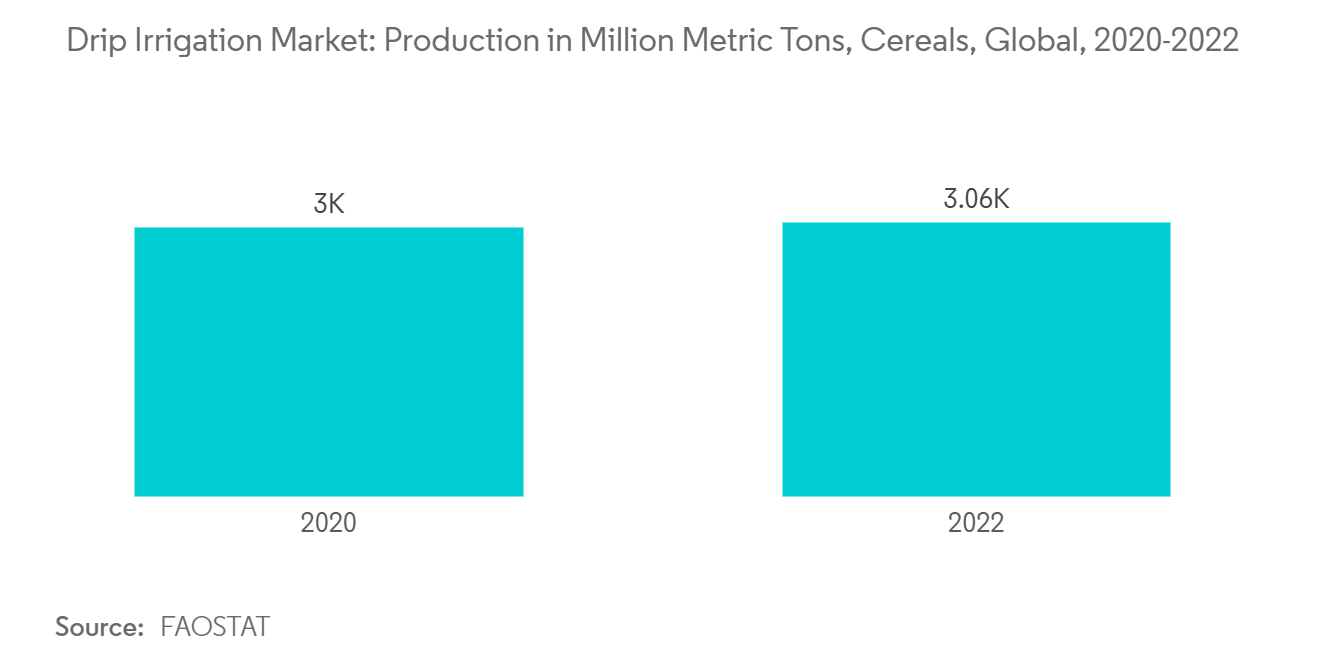

According to the FAO, about 70% of the cultivated land was used to grow cereals, as most cereals, such as rice and maize, are water-intensive crops. The increasing global population is pressuring farmers to enhance cereal production worldwide, thus leading to the increased use of precision irrigation in this segment. As per the FAO report, world cereal production in 2022 reached a record high of 3,059.6 million metric tons from 3,003.6 million metric tons in 2020.

Rice, wheat, and maize account for the prominent cereal crops cultivated around the globe. Though these crops were grown as rainfed traditionally, results of various field trials and studies conducted to evaluate the positive impacts of irrigating these crops have strengthened the demand for irrigation systems. For instance, in a study conducted in Poland in 2023, the average yield of maize was increased by 25% compared to traditional irrigation methods. In the same experiment, fertigation through drip was also practiced, increasing the average yield by 2.35 metric tons per hectare, concluding the significance of this method’s efficiency.

Advances in science and technology led to the application of IoTs and automation in drip systems at the field level. These moments attract farmers, creating a scope for drip irrigation suppliers and companies where the point of attraction is easier irrigation with no labor and time boundness. Governments are also taking initiatives for sustainable growth practices by conserving water. Recently, in India, Pradhan Mantri Krishi Sinchayi Yojana (PMKSY) is a special scheme that promotes precision irrigation practices by subsidizing and improving farmers’ awareness of water use efficiency. Besides, in 2022, Netafim started an introductory rice cultivation project in dry fields in Japan using drip irrigation. The system reduces water and fertilizer waste and encourages a shift to sustainable production that reduces methane gas emissions.

Asia-Pacific Dominates the Market

The drip irrigation usage in the Asia Pacific agriculture sector witnessed significant growth during recent years, which is majorly due to the growing area under irrigation due to the expansion of micro-irrigation projects, which can reduce water consumption. In 2022-2023, the area under irrigation was expected to reach 73 million hectares, accounting for 52% of the total agricultural land, which is 41% higher than in 2016, according to the Niti Aayog. Likewise, according to the National Bureau of Statistics of China, the irrigated area in China accounted for 69.61 million hectares in 2021 and had risen by 70.36 million hectares in 2022, thereby delivering high demand for drip irrigation in the market.

Besides, the area under drip irrigation was higher in Andra Pradesh, followed by Maharashtra, Gujarat, and Punjab. To encourage a conductive farming environment and implement the successful drip irrigation model across these states, Netafim is providing drip irrigation systems. In 2023, under the initiative, Netafim provided drip irrigation systems for tomato growers through four Better Life Farming (BLF) Centers present in the Khajuri, Kolaras, and Pohari regions of the Shivpuri district in Madhya Pradesh. This initiative increased the tomato crop yield by 40%, resulting in higher adoption of drip irrigation systems in Maharashtra.

China is one of the world’s largest markets and consumers of drip irrigation equipment. This is mainly attributed to the government’s aim to equip farms with highly efficient water-saving irrigation technology and systems as part of its five-year plans to equip at least 75% of the total irrigated area with micro-irrigation systems by 2030. Further, The government often works with drip irrigation companies to increase the availability of water-saving equipment to farmers. For instance, in November 2022, the Local Government of Yuanmou in Yunnan Province partnered with Dayu Irrigation Group Co. Ltd, which will work together in a PPP (Public-Private Partnership) Project mode for the distribution of drip irrigation pipes of over 3.33 million meters and 1.2 million drippers till 2038.

Drip Irrigation Industry Overview

The global drip irrigation market is consolidated, with major players occupying most of the market share. Some key players in the market include Netafim Limited, Jain Irrigation Systems Limited, The Toro Company, Hunter Industries, and Rain Bird Corporation. The most adopted strategy is broadening the product portfolio by introducing new and innovative products into the market. The other prominent players are strengthening their position through partnerships and mergers.

Drip Irrigation Market Leaders

- Jain Irrigation Systems Ltd

- Netafim

- The Toro Company

- Rain Bird Corporation

- Hunter Industries

- *Disclaimer: Major Players sorted in no particular order

Drip Irrigation Market News

- February 2024: Hunter Industries Inc. partnered with Saudi Drip Irrigation Company to manufacture agricultural, residential, commercial, and golf irrigation systems products. This partnership between Saudi Drip and Hunter Industries was a testament to their commitment to sustainable practices by focusing on developing water and energy-saving solutions, including drip irrigation management.

- January 2024: Rain Bird Corporation Partnered with Pinehurst Resort to manufacture equipment and provide service and support for the irrigation system. The Rain Bird Corporation was recognized as the resort’s Official Irrigation Partner through this partnership. In addition to using Rain Bird Irrigation equipment at Pinehurst Resort, the agreement allowed the two entities to partner on other industry growth initiatives.

- October 2023: Netafim Limited launched an inventive irrigation system in India with anti-clogging technology, guaranteeing the best distribution of nutrients and water. The company has 35,000 farmers nationwide using the new system on 25,000 hectares nationwide by 2025.

Drip Irrigation Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Threat of Water Scarcity

- 4.2.2 Favorable Policies and Subsidies from the Government

- 4.2.3 Increasing Adaptation of Fertigation

- 4.3 Market Restraints

- 4.3.1 High Initial Capital Investments

- 4.3.2 Damages in Drip Irrigation Due to the Complex Set-up

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Surface Drip Irrigation

- 5.1.2 Subsurface Drip Irrigation

- 5.2 Crop Types

- 5.2.1 Field Crops

- 5.2.2 Vegetable Crops

- 5.2.3 Orchard Crops

- 5.2.4 Vineyards

- 5.2.5 Other Crops

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of the Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Jain Irrigation Systems Ltd

- 6.3.2 The Toro Company

- 6.3.3 Netafim Limited

- 6.3.4 Rain Bird Corporation

- 6.3.5 Chinadrip Irrigation Equipment Co. Ltd

- 6.3.6 Antelco Pty Ltd

- 6.3.7 T-L Irrigation

- 6.3.8 Sistema Azud

- 6.3.9 Metzer Group

- 6.3.10 Hunter Industries Inc.

7. MARKET OPPORTUNITIES AND FUTURE TREND

Drip Irrigation Industry Segmentation

Drip irrigation is a method of crop irrigation that helps save water and nutrients by allowing water to drip slowly to the roots of plants, either from above the soil surface or buried below the surface through a system of pipes, valves, tubing, and emitters. The Drip Irrigation Market is Segmented by Application (Surface Drip Irrigation and Subsurface Drip Irrigation), Crop Type (Field Crops, Vegetable Crops, Orchard Crops, Vineyards, and Other Crops), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East & Africa). The report offers market size and forecasts in terms of value (USD) for all the above segments.

| Application | Surface Drip Irrigation | |

| Subsurface Drip Irrigation | ||

| Crop Types | Field Crops | |

| Vegetable Crops | ||

| Orchard Crops | ||

| Vineyards | ||

| Other Crops | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Russia | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | India |

| China | ||

| Japan | ||

| Rest of the Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East & Africa | United Arab Emirates |

| Saudi Arabia | ||

| Rest of the Middle East & Africa |

Drip Irrigation Market Research FAQs

The Drip Irrigation Market size is expected to reach USD 1.97 billion in 2025 and grow at a CAGR of 10.30% to reach USD 3.22 billion by 2030.

In 2025, the Drip Irrigation Market size is expected to reach USD 1.97 billion.

Jain Irrigation Systems Ltd, Netafim, The Toro Company, Rain Bird Corporation and Hunter Industries are the major companies operating in the Drip Irrigation Market.

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the Asia Pacific accounts for the largest market share in Drip Irrigation Market.

In 2024, the Drip Irrigation Market size was estimated at USD 1.77 billion. The report covers the Drip Irrigation Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Drip Irrigation Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.