Commercial Helicopters Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Commercial Helicopter Market Report is Segmented by Maximum Take-Off Weight (Light Helicopters, Medium Helicopters, and Heavy Helicopters), Number of Engines (Single-Engine and Multi-Engine), End-User (Commercial, Private, and Other End-Users), and Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa). The Market Sizes and Forecasts are Provided in Terms of Value in USD for all the Above Segments.

Commercial Helicopters Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Commercial Helicopter Market Size

| Study Period | 2019 – 2030 |

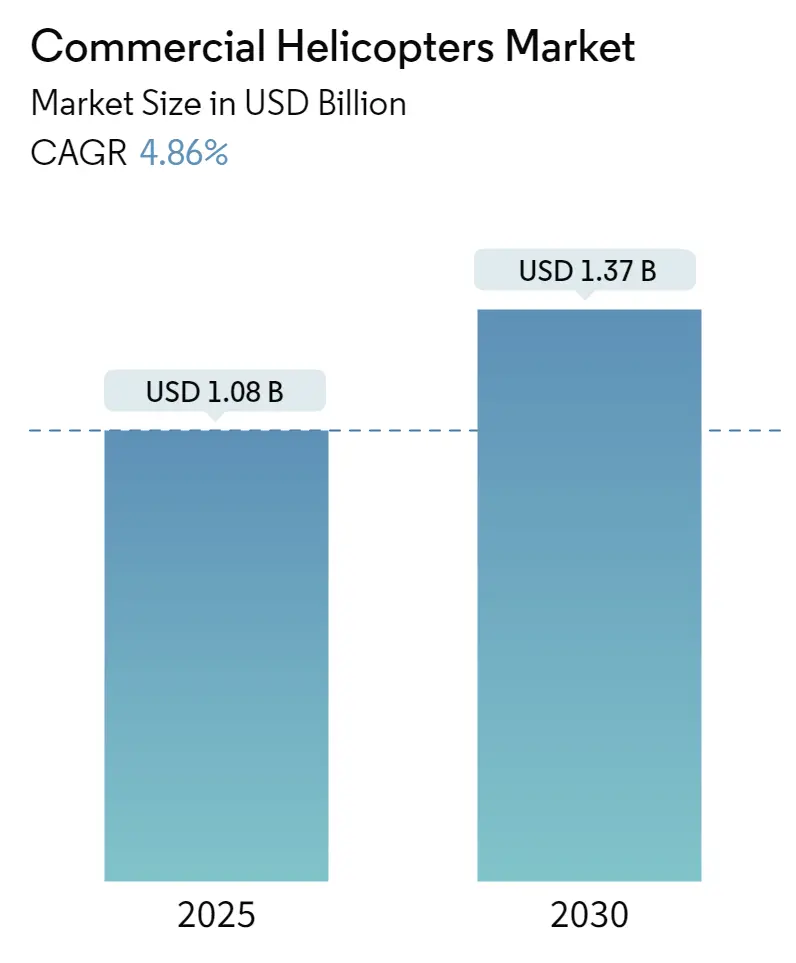

| Market Size (2025) | USD 1.08 Billion |

| Market Size (2030) | USD 1.37 Billion |

| CAGR (2025 – 2030) | 4.86 % |

| Fastest Growing Market | Middle East and Africa |

| Largest Market | Europe |

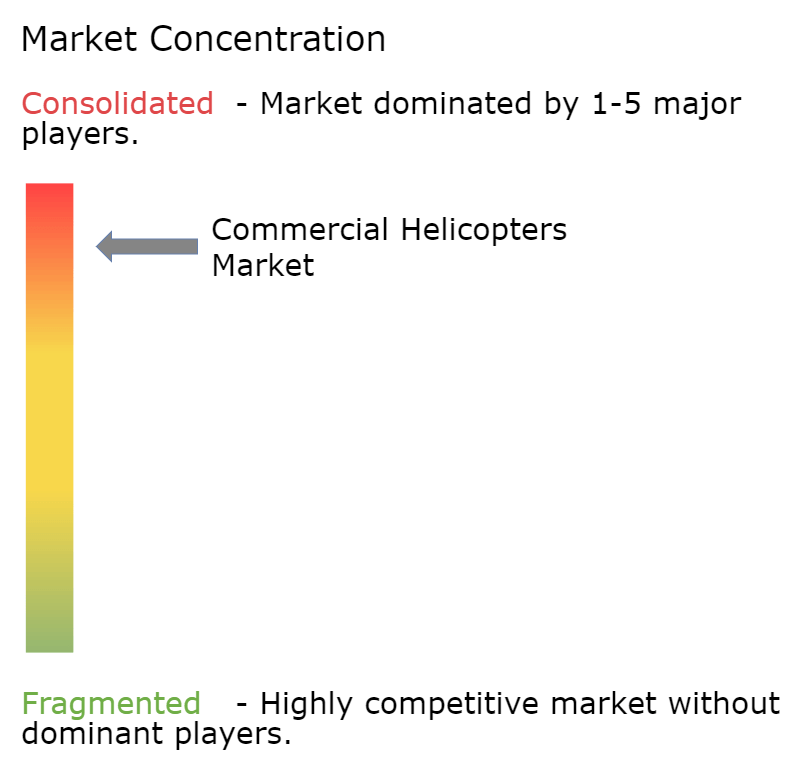

| Market Concentration | High |

Major Players

|

Compare market size and growth of Commercial Helicopters Market with other markets in Aerospace & Defense Industry

Defense

Airport Operations

Aviation

Aerospace & Defense Technology

Air Taxi

Aircraft Parts

Commercial Helicopters Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 4.86% (2025 – 2030) |

| Countries/ Region Covered: | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Major Players: | Airbus SE, Textron Inc., Rostec (Russian Helicopters), Kawasaki Heavy Industries Ltd., Leonardo S.p.A |

Commercial Helicopter Market Analysis

The Commercial Helicopters Market size is estimated at USD 1.08 billion in 2025, and is expected to reach USD 1.37 billion by 2030, at a CAGR of 4.86% during the forecast period (2025-2030).

Commercial helicopters are rotorcraft designed and used for various business and non-military purposes. They offer versatility and flexibility in transportation, logistics, and other operations, such as firefighting, film and photography, utility, and survey work. Thus, they are employed in multiple industries and applications. The growing demand for rotorcraft, such as helicopters, for various applications and end-user industries, like oil and gas and law enforcement, is expected to drive market growth.

The intensive use of helicopters for various applications has simultaneously increased the need to incorporate advanced technologies to facilitate their use for contra-distinct purposes. Technological developments like engine performance enhancement, improvement of their performance capabilities, etc., have made them more suitable for functioning in harsh and challenging environments. Market players are focusing on enhancing the ergonomics and safety aspects of helicopters. However, the market might witness significant resilience from the rapid growth of the drone industry as they can act as potential substitutes for helicopters, particularly in specific applications for end users.

The commercial helicopter market is susceptible to regional economic conditions and their subsequent impact on levels of capital investment and consumer spending. Factors such as the economic downturn can lead to reduced investments, changes in government spending levels, reduced customers’ and suppliers’ access to credit, hamper consumer confidence, and increase buyers’ propensity for cheaper substitutes in specific applications.

Commercial Helicopter Market Trends

Search and Rescue Segment Will Showcase Remarkable Growth During the Forecast Period

Search and rescue (SAR) teams employ helicopters to support operation logistics by transporting rescuers. The speed afforded by helicopter transport can reduce time and rescuer fatigue, both vital considerations in many rescue operations. Features of helicopters, like their ability to reach inaccessible regions, smaller size, and applications in emergency operations, make helicopters the most desirable form of rescue in many countries. For instance, in December 2023, massive rainfall flooded villages and towns in the southern areas of Tamil Nadu, India. Locals and disaster response teams mobilized resources to rescue stranded residents. In rescue, the Indian navy’s helicopters conducted the relief operations and dropped 3.2 tons of relief material in Tamil Nadu’s flood-affected areas.

The incorporation of innovative technology in regular search and rescue helicopters is increasing. Military SAR operations are usually conducted in combat zones, and focusing on market giants in their expansion will further stimulate market growth. In November 2023, to strengthen bilateral relations and boost the Philippine Coast Guard (PCG) capabilities, the Indian government offered at least seven helicopters for use in the Philippines’ rescue and humanitarian efforts during disasters. The helicopters provided to the PCG are built for India’s Navy and Coast Guard and can be used for security operations and carrying more people and loads.

In August 2023, Bristow Ireland Limited, a subsidiary of Bristow Group Inc., signed a contract with the Irish Department of Transport to provide rotary and fixed-wing aviation services for the Irish Coast Guard. Bristow will shift to the new contract in the fourth quarter of 2024. The company will operate six specialized SAR-configured AW189 helicopters from four dedicated Sligo, Shannon, Waterford, and Dublin Weston bases. Thus, the growing procurement of helicopters for search and rescue operations drives the segment growth during the forecast period.

Middle East and Africa is Projected to Show Highest Growth During the Forecast Period

The increase in the demand for helicopters for commercial applications like agriculture, aerial photography, tourism, offshore applications, and air ambulance in the United Arab Emirates, Saudi Arabia, Turkey, and others drives the market’s growth.

Saudi Arabia has a large geographical area with many remote and difficult-to-access locations. Helicopters are one of the most essential modes of transportation for these areas, especially during emergencies or when time is of the essence. Helicopters with medical equipment, such as stretchers and oxygen supplies, help provide emergency medical assistance to those in need. They transport patients from remote areas to hospitals and medical facilities in urban areas. For instance, in February 2024, Leonardo was awarded a contract by the THC (The Helicopter Company), which is owned by the Public Investment Fund (PIF) in the Kingdom of Saudi Arabia, to deliver 20 AW139 intermediate twin-engine helicopters to strengthen the country’s emergency medical service (EMS), and search and rescue (SAR).

The United Arab Emirates is home to several government agencies and para-public bodies that rely on helicopters. Emergency medical services are another critical use of helicopters in the United Arab Emirates. For instance, in January 2022, Falcon Aviation Services and Response Plus Holdings signed a partnership agreement to provide air ambulance services in the United Arab Emirates using their two specially fitted helicopters for air ambulance needs. Thus, the growing use of helicopters for various commercial applications such as search and rescue, transportation, offshore, and medical services is expected to boost market growth across the region.

Commercial Helicopter Industry Overview

The commercial helicopter market is consolidated. Market players, such as Airbus SE, Textron Inc., Rostec, Kawasaki Heavy Industries Ltd., and Leonardo S.p.A, hold a major market share. Other small and domestic companies occupy a minimal market share.

Key players in the market are highly investing in research and development and introducing advanced commercial helicopters. For instance, Leonardo SpA launched its VIP helicopters and travel services under a related new name, “Agusta,” and unveiled the heliport called “Casa Agusta” in 2020. The company provides a range of helicopters for the commercial markets, including all the main weight categories, from 1.8-tonne single-engine to 16-tonne three-engine helicopters.

Commercial Helicopter Market Leaders

- Airbus SE

- Textron Inc.

- Rostec (Russian Helicopters)

- Kawasaki Heavy Industries Ltd.

- Leonardo S.p.A

Commercial Helicopter Market News

- May 2023: Air Corporate (Italy) awarded a contract for 43 Airbus helicopters to Airbus. This contract represents the most significant aircraft order in Italy. It was expected to deliver helicopters for several private and corporate passenger services and utility operations. The helicopters include 40 single-engine helicopters (H125/H130) plus three ACH160s from Airbus Corporate Helicopters.

- March 2023: Abu Dhabi Aviation signed a contract with Leonardo S.p.A to procure six AW139 intermediate twin-engine helicopters. The helicopters are expected to be delivered between 2024 and 2026 and will be used for offshore transport missions. These latest helicopters are expected to allow ADA to achieve compliance with the latest OGP guidelines.

Commercial Helicopters Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Maximum Take-off Weight

- 5.1.1 Light Helicopters

- 5.1.2 Medium Helicopters

- 5.1.3 Heavy Helicopters

- 5.2 Number of Engines

- 5.2.1 Single-engine

- 5.2.2 Multi-engine

- 5.3 End-Users

- 5.3.1 Commercial

- 5.3.2 Private

- 5.3.3 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Colombia

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Turkey

- 5.4.5.4 South Africa

- 5.4.5.5 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Airbus SE

- 6.2.2 Textron Inc.

- 6.2.3 Lockheed Martin Corporation

- 6.2.4 Leonardo S.p.A

- 6.2.5 MD Helicopters Inc.

- 6.2.6 Robinson Helicopter Company

- 6.2.7 Enstrom Helicopter Corporation

- 6.2.8 Rostec (Russian Helicopters)

- 6.2.9 Schweizer RSG

- 6.2.10 Kaman Corporation

- 6.2.11 Kawasaki Heavy Industries Ltd.

- 6.2.12 Aviation Industry Corporation of China Ltd.

- 6.2.13 Hindustan Aeronautics Limited

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Commercial Helicopter Industry Segmentation

Commercial helicopters are rotorcraft designed and used for various business and non-military purposes. They are employed in multiple industries and applications, offering versatility and flexibility in transportation, logistics, and other operations.

The commercial helicopter market is segmented by maximum take-off weight, number of engines, end-user, and geography. By maximum take-off weight, the market is segmented into light, medium, and heavy. By number of engines, the market is segmented into single-engine and multi-engine. By end-user, the market is classified into commercial, private, and other end-users. The others segment includes government agencies and departments and law enforcement agencies. The report offers the market size and forecasts for major countries across the regions. For each segment, the market sizing and forecasts were made based on value (USD).

| Maximum Take-off Weight | Light Helicopters | |

| Medium Helicopters | ||

| Heavy Helicopters | ||

| Number of Engines | Single-engine | |

| Multi-engine | ||

| End-Users | Commercial | |

| Private | ||

| Other End-Users | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| France | ||

| Germany | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Colombia | ||

| Rest of Latin America | ||

| Geography | Middle East and Africa | Saudi Arabia |

| United Arab Emirates | ||

| Turkey | ||

| South Africa | ||

| Rest of Middle East and Africa |

Commercial Helicopters Industry Report

The Commercial Helicopter Market Report offers a comprehensive industry analysis, covering various segments such as maximum take-off weight and application. The report provides detailed industry information, including market size, market share, and market segmentation across different geographies like North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. This industry report is essential for understanding the market trends and market growth in the commercial helicopter sector.

The report includes a market forecast outlook, offering insights into the market value and market predictions up to the future. By examining historical data and current market conditions, the report provides a thorough market overview and market review. It highlights the market leaders and their roles in shaping the industry outlook, supported by industry statistics and industry research.

Additionally, the report features a sample of industry analysis as a free report PDF download, making it a valuable resource for research companies and stakeholders interested in market data and market trends. The industry reports also delve into the market growth rate, providing a clearer picture of the market outlook and industry size.

Overall, this report serves as a crucial tool for understanding the commercial helicopter market, offering a detailed market analysis and valuable industry insights.