Commercial Aircraft Avionics Systems Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Report Covers Global Aircraft Avionics Market Revenue & Forecast. The Market is Segmented by Subsystem (Health Monitoring Systems, Flight Management, and Control Systems, Communication and Navigation, Cockpit Systems, Visualizations, and Display Systems, and Other Subsystems), Aircraft Type (Narrowbody, Widebody, and Regional Aircraft), Fit (Line fit and Retrofit), and Geography (North America, Europe, Asia-Pacific, Latin America, and Middle-East and Africa). The market size and forecast are provided in terms of value (USD billion) for all the above segments.

Commercial Aircraft Avionics Systems Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Commercial Aircraft Avionics Systems Market Size

| Study Period | 2019 – 2030 |

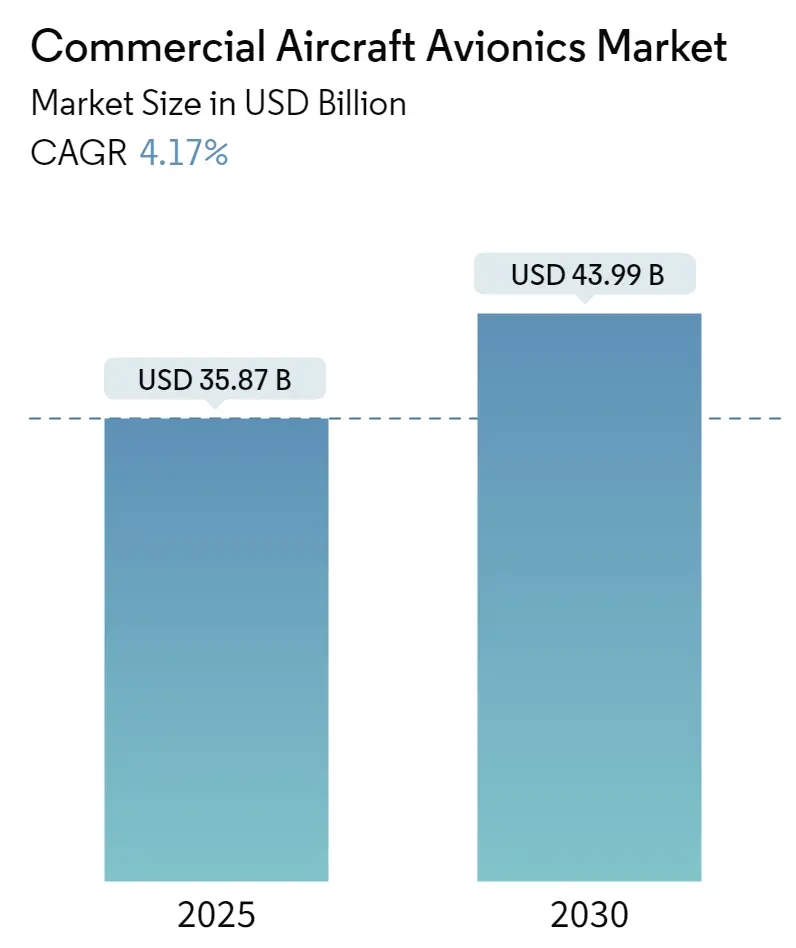

| Market Size (2025) | USD 35.87 Billion |

| Market Size (2030) | USD 43.99 Billion |

| CAGR (2025 – 2030) | 4.17 % |

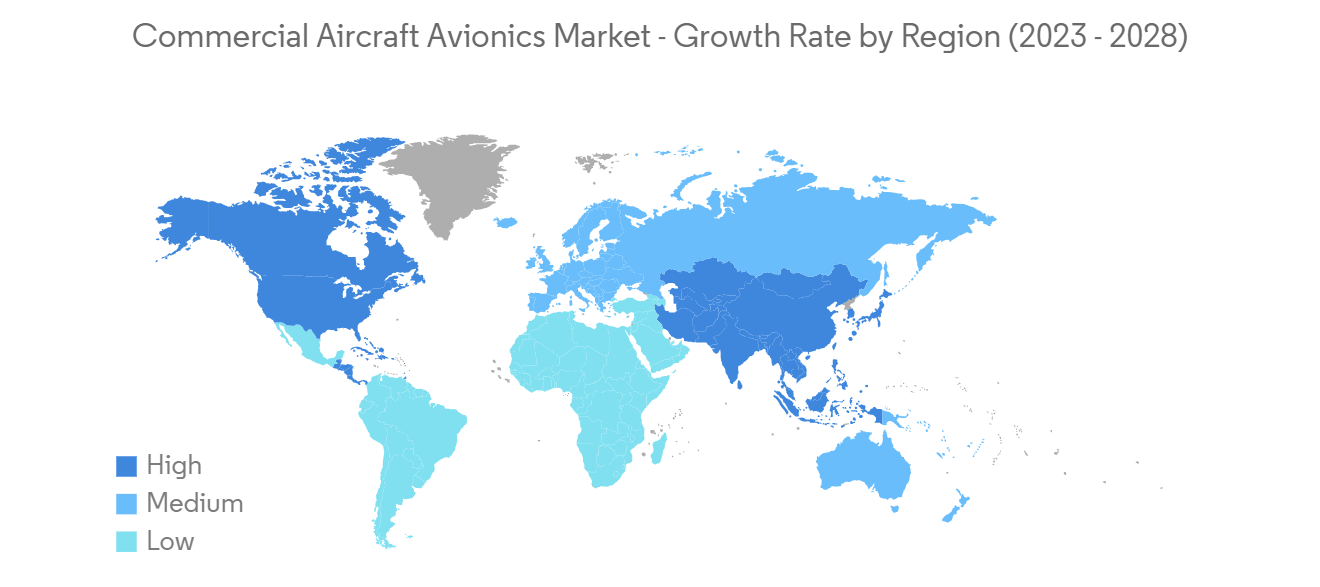

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

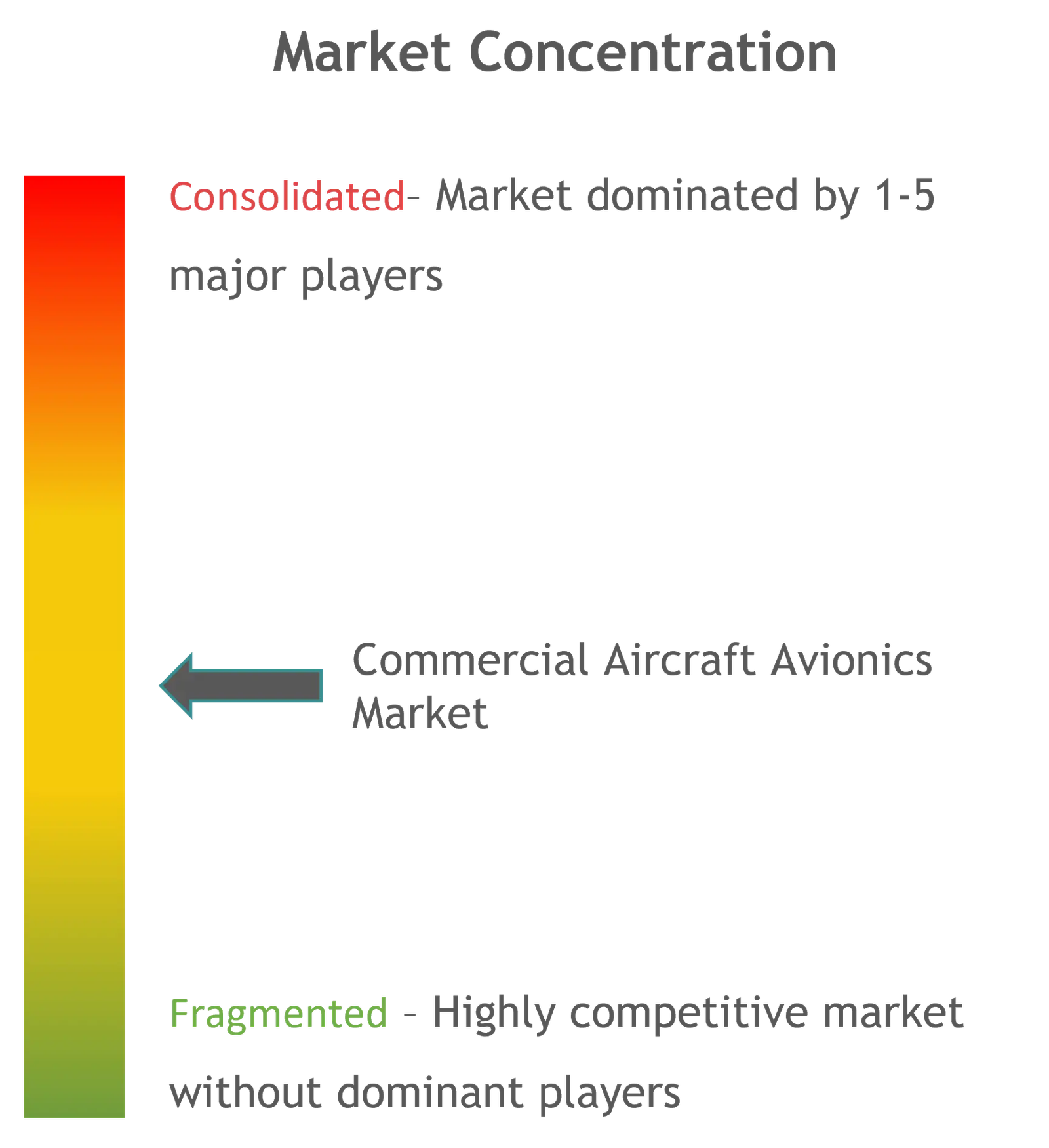

| Market Concentration | Low |

Major Players

|

Compare market size and growth of Commercial Aircraft Avionics Market with other markets in Aerospace & Defense Industry

Defense

Airport Operations

Aviation

Aerospace & Defense Technology

Air Taxi

Aircraft Parts

Commercial Aircraft Avionics Systems Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 4.17% (2025 – 2030) |

| Countries/ Region Covered: | North America,Europe,Asia-Pacific,Middle East and Africa,Latin America |

| Major Players: | Honeywell International Inc., General Electric Company, Raytheon Technologies Corporation, THALES, Safran |

Commercial Aircraft Avionics Systems Market Analysis

The Commercial Aircraft Avionics Market size is estimated at USD 35.87 billion in 2025, and is expected to reach USD 43.99 billion by 2030, at a CAGR of 4.17% during the forecast period (2025-2030).

- The global aviation sector underwent an unprecedented disruption due to the COVID-19 pandemic, resulting in a drastic reduction in passenger traffic that negatively impacted aircraft demand. Though the sector showed signs of improvement in 2021, the deliveries of commercial aircraft were significantly lower than the pre-COVID levels. Furthermore, the commercial aviation sector is expected to recover slowly, as travel demand is projected to normalize to pre-COVID levels by 2023, which is expected to challenge the growth of the commercial aircraft avionics market.

- The aviation sector is governed by stringent regulations that stipulate all aspects of aircraft design, including structures and electronics. Prominent aviation regulatory agencies, such as the Federal Aviation Administration (FAA), have issued strict guidelines for adherence by aircraft OEMs and third-party service providers regarding avionics systems fitment and repair.

- The market is driven by the recovering demand for new commercial aircraft as part of the fleet expansion and modernization programs initiated by airlines operating in the region. Additionally, the increasing partnership between aircraft maintenance, repair, and operations (MRO) providers is expected to drive their technical capabilities, enabling them to service new-generation aircraft procured by airlines. However, the early retirement of widebody jets due to COVID-19 is anticipated to impact the avionics retrofit sector since the size and installation costs of avionics systems on a widebody are much higher than a narrowbody aircraft.

Commercial Aircraft Avionics Systems Market Trends

Narrowbody Segment to Dominate the Market During the Forecast Period

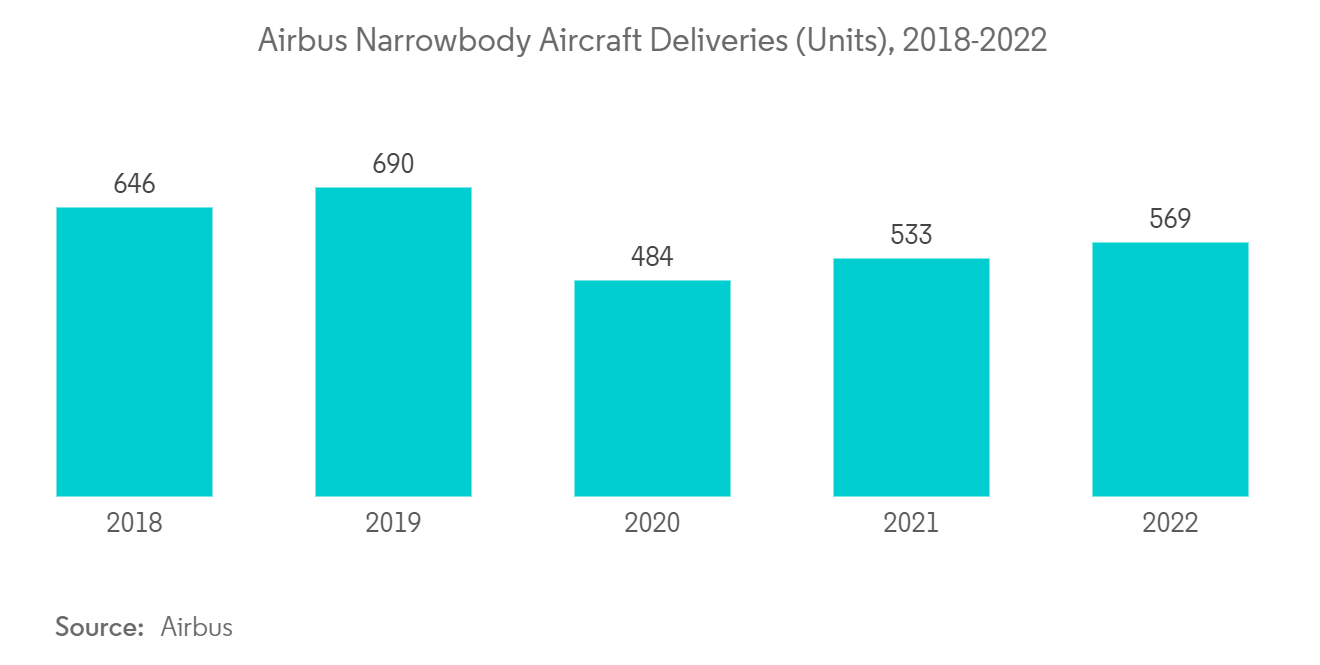

- The narrowbody segment dominated the commercial aircraft avionics market. The demand for such aircraft is anticipated to increase as most low-cost carriers (LCCs) are trying to modernize their existing fleets to exploit new market opportunities and match the competencies of successive aircraft versions. Airbus, a commercial aircraft manufacturer, delivered 661 commercial aircraft in 2022, up from 609 in 2021. Also, Boeing delivered 480 commercial aircraft in 2022.

- For instance, in December 2021, Air France-KLM announced an order for 100 Airbus A320 neo family aircraft, along with options for an additional 60 planes. The order consists of a mix of A320 neo and A321 neo aircraft, with the first deliveries expected in the second half of 2023. On the other hand, though the B737 MAX fiasco has hampered the market prospects for The Boeing Company, the successful recertification from the FAA has started driving back the demand for B737 MAX aircraft. Several airlines have started resuming operations on the 737 MAX jets and ordering new 737 MAX aircraft.

- For instance, in January 2022, Boeing announced that it had won a major order from Qatar Airways for 25 737 Max 10 jets, along with options to buy 25 more aircraft. The airline also signed an order for 34 of the upcoming 777X, as well as options for 16 more jets. Companies like GE Aviation, Collins Aerospace, L3Harris Technologies Inc., Honewywell International Inc., and Cobham PLC provide avionic components for the Boeing 737 and 777 families of aircraft. The quicker recovery of domestic air passenger traffic is also anticipated to rake in new orders for the narrowbody aircraft, which may drive the growth prospects of avionics systems providers associated with the narrowbody programs.

North America Held Highest Shares in the Market

- The aerospace industry in the region is mature and strongly supported by a robust aviation base. Higher air traffic has resulted in the procurement of several aircraft by regional and international airline operators. Boeing, one of the major aircraft original equipment manufacturers (OEMs) based in the United States, generates a huge demand for avionics systems.

- Factors such as the availability of raw materials, political stability, and low production costs have driven the establishment of new aerospace manufacturing facilities in the region. Also, fluctuations in aviation fuel prices have triggered a surge in demand for fuel-efficient new-generation aircraft in North America. Hence, aircraft OEMs have started increasing their production capabilities to cope with the ever-increasing demand.

- Airbus announced that it would increase the production rate of the A220 aircraft to around six per month in early 2022. It aims to increase the A220 production rate to 14 by 2025, i.e., 10 aircraft produced each month at its Mirabel facility and four at Mobile. Four United States-based customers, namely JetBlue, Delta Air Lines, Breeze Airways, and Air Lease Corporation, constitute more than half of the backlog of the A220 program. Raytheon Technologies Corporation provides a majority of avionics subsystems integrated into the A220, including onboard computers, weather mapping radar, and electronic flight instrument systems. Other airlines in the region are also looking for post-pandemic growth.

- For instance, in December 2022, United Airlines announced its largest widebody aircraft order by a US carrier in commercial aviation history, for 100 new 787 Dreamliners plus options to add 100 more. With this order, the airline is now expecting new deliveries of 700 new narrowbody and widebody aircraft by 2032, on an average of 2 aircraft per week in 2023 and 3 aircraft per week in 2024. Such developments render a positive outlook for the market in North America during the forecast period.

Commercial Aircraft Avionics Systems Industry Overview

The commercial aircraft avionics market is moderately fragmented in nature due to the presence of a large number of avionics systems providers. Raytheon Technologies Corporation, General Electric Company, Honeywell International Inc., Safran, and THALES are some of the prominent players in the market. The market share of the active players is boosted by the high delivery volumes of commercial aircraft. The market dominance of key OEMs is supported through relentless R&D of high-performance avionic components and subsystems that render their products superior and ensure adherence to required safety standards. The availability of several variants and continuous product development cycles enables the enhanced operating life of such systems.

For instance, in June 2023, at the Paris Air Show, Embraer Services & Support launched the next-generation version of its aircraft health analysis and diagnosis (AHEAD) system for its E-Jets. This AHEAD system will integrate and analyze trends from several systems, such as landing gear, navigation, pneumatics, etc., and can detect anomalies and identify potential issues before they become critical.

Commercial Aircraft Avionics Systems Market Leaders

- Honeywell International Inc.

- General Electric Company

- Raytheon Technologies Corporation

- THALES

- Safran

Commercial Aircraft Avionics Systems Market News

- June 2023: United Airlines and Panasonic Avionics Corporation signed an agreement for Panasonic’s new Astrova in-flight engagement (IFE) solution, making United Airlines the first customer for this IFE in the United States. The airlines plan to install this IFE solution on new Boeing 787 and Airbus A321XLR starting in 2025. With this agreement, the United Airlines program represents the largest-ever investment in Panasonic Avionics’ IFE by any airline.

- July 2022: Universal Avionics Systems Corporation, a subsidiary of Elbit Systems Ltd., received a contract worth USD 33 million from AerSale Corporation to supply Enhanced Flight Vision Systems (EFVS) for Boeing 737NG aircraft. The contract will be executed through 2023.

Commercial Aircraft Avionics Systems Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Subsystem

- 5.1.1 Health Monitoring Systems

- 5.1.2 Flight Management and Control Systems

- 5.1.3 Communication and Navigation

- 5.1.4 Cockpit Systems

- 5.1.5 Visualizations and Display Systems

- 5.1.6 Other Subsystems

- 5.2 Aircraft Type

- 5.2.1 Narrowbody

- 5.2.2 Widebody

- 5.2.3 Regional Aircraft

- 5.3 Fit

- 5.3.1 Linefit

- 5.3.2 Retrofit

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 United Arab Emirates

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 Qatar

- 5.4.4.4 Rest of Middle-East and Africa

- 5.4.5 Latin America

- 5.4.5.1 Brazil

- 5.4.5.2 Mexico

- 5.4.5.3 Rest of Latin America

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Share Analysis

- 6.2 Company Profiles

- 6.2.1 Honeywell International Inc.

- 6.2.2 General Electric Company

- 6.2.3 THALES

- 6.2.4 BAE Systems plc

- 6.2.5 Cobham Limited

- 6.2.6 Esterline Technologies Corporation (TransDigm Group)

- 6.2.7 Diehl Stiftung & Co. KG

- 6.2.8 L3Harris Technologies Inc.

- 6.2.9 Raytheon Technologies Corporation

- 6.2.10 Meggitt PLC

- 6.2.11 Teledyne Technologies Incorporated

- 6.2.12 Safran

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Commercial Aircraft Avionics Systems Industry Segmentation

Avionics is an assembly of electronics subsystems integrated onboard an aircraft to carry out several mission and flight management tasks. These systems include engine controls, flight control systems, navigation, communications, flight recorders, lighting systems, fuel systems, electro-optic (EO/IR) systems, weather radar, and performance monitoring systems. The scope of the study is exclusive of freighter aircraft, military aircraft, business jets, and other private-owned, chartered, and unscheduled aircraft.

The commercial aircraft avionics market is segmented by subsystem, aircraft type, fit, and geography. By subsystem, the market is segmented into health monitoring systems, flight management and control systems, communication and navigation, cockpit systems, visualizations and display systems, and other subsystems. The other subsystems include emergency systems, fire safety systems, electronic flight bags (EFBs), and weather systems. By aircraft type, the market is segmented into narrowbody, widebody, and regional jet. By fit, the market is segmented into line fit and retrofit. By geography, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle-East and Africa.

The market sizing and forecasts have been provided in value (USD).

| Subsystem | Health Monitoring Systems | |

| Flight Management and Control Systems | ||

| Communication and Navigation | ||

| Cockpit Systems | ||

| Visualizations and Display Systems | ||

| Other Subsystems | ||

| Aircraft Type | Narrowbody | |

| Widebody | ||

| Regional Aircraft | ||

| Fit | Linefit | |

| Retrofit | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Middle-East and Africa | United Arab Emirates |

| Saudi Arabia | ||

| Qatar | ||

| Rest of Middle-East and Africa | ||

| Geography | Latin America | Brazil |

| Mexico | ||

| Rest of Latin America |

Commercial Aircraft Avionics Systems Market Research FAQs

The Commercial Aircraft Avionics Market size is expected to reach USD 35.87 billion in 2025 and grow at a CAGR of 4.17% to reach USD 43.99 billion by 2030.

In 2025, the Commercial Aircraft Avionics Market size is expected to reach USD 35.87 billion.

Honeywell International Inc., General Electric Company, Raytheon Technologies Corporation, THALES and Safran are the major companies operating in the Commercial Aircraft Avionics Market.

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the North America accounts for the largest market share in Commercial Aircraft Avionics Market.

In 2024, the Commercial Aircraft Avionics Market size was estimated at USD 34.37 billion. The report covers the Commercial Aircraft Avionics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Commercial Aircraft Avionics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.