Chile Lubricants Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Chile Lubricants Market is segmented by product type (engine oils, greases, hydraulic fluids, metalworking fluids, transmission and gear oils, and other product types) and end-user industry (automotive, heavy equipment, metallurgy and metalworking, power generation, and other end-user industries). The report offers the market sizes and forecasts for volume (million liters) for all the above segments.

Chile Lubricants Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Chile Lubricants Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

| Historical Data Period | 2019 – 2023 |

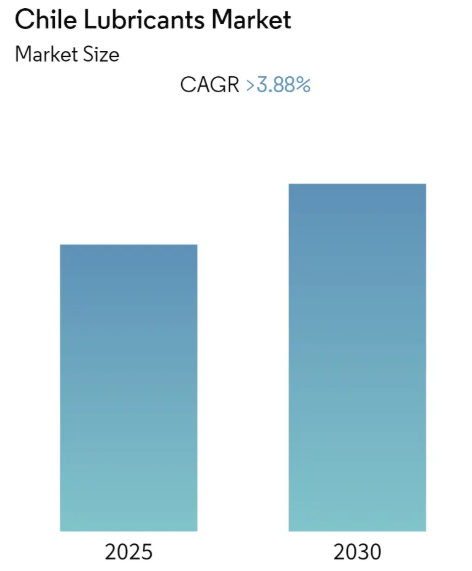

| Growth Rate | 3.88% CAGR |

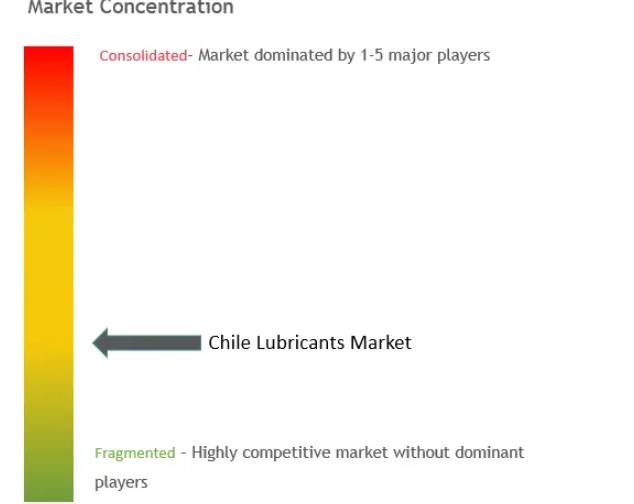

| Market Concentration | Medium |

Compare market size and growth of Chile Lubricants Market with other markets in Chemicals & Materials Industry

Chile Lubricants Market Analysis

The Chile Lubricants Market is expected to register a CAGR of greater than 3.88% during the forecast period.

Chile’s lubricants industry is undergoing a significant transformation driven by the country’s ambitious environmental goals and industrial modernization initiatives. The country has implemented stringent environmental regulations, including Law No. 20,920 enacted in 2016, which prioritizes lubricating oils for regulation to enhance waste reuse and recycling. The government’s commitment to achieving carbon neutrality by 2050 has led to the implementation of various sustainability measures across industries. As part of this transition, Chile has banned the sale of internal combustion engine vehicles from 2035, demonstrating its commitment to sustainable transportation solutions. The country has already deployed 247 publicly accessible charging outlets as of April 2022, with plans to expand this infrastructure to 1,200 stations by 2024.

The industrial sector, particularly mining and power generation, continues to be a significant contributor to industrial lubricants demand in Chile. The mining sector, which contributed USD 317 billion (15% of GDP) in 2021, remains a crucial driver of industrial lubricant consumption. The country’s power generation infrastructure, with an installed capacity of 32.038 MW as of May 2022, requires substantial lubricant usage for maintenance and operations. Chile’s commitment to renewable energy, with aims to achieve 80% renewable generation in the matrix by 2030, is reshaping the requirements for specialized industrial lubricants in power generation equipment.

The automotive sector represents a substantial portion of lubricant consumption, with approximately 5.5 million vehicles currently on Chilean roads. The market structure is characterized by the presence of both international and domestic players, with companies like Empresas Copec holding significant market positions. The country’s unique position as a market without domestic automotive production facilities has led to a highly competitive environment with multiple global brands competing through extensive distribution networks. The demand for automotive lubricants is driven by the need to maintain these vehicles efficiently.

The lubricants industry in Chile is experiencing a shift toward more sustainable and technologically advanced products. Major industry players are investing in research and development to create more efficient and environmentally friendly lubricant solutions. The market is witnessing increased adoption of synthetic lubricants, driven by their superior performance characteristics and longer service intervals. The industry’s focus on sustainability is further evidenced by the growing emphasis on recycling initiatives, with recycling centers currently handling approximately 3% of the country’s waste oil, indicating significant potential for growth in this segment. The use of base oil in the formulation of these advanced lubricants is becoming increasingly important.

Chile Lubricants Market Trends

Increasing Demand for Lubricants from the Mining Industry

The mining industry in Chile represents a significant driver for lubricant demand, with the country holding substantial mineral reserves globally. Chile possesses 22% of the world’s copper reserves, 48% of lithium reserves, 11% of molybdenum reserves, 7% of gold reserves, and 5% of silver reserves, necessitating extensive use of mining equipment that requires various lubricants. The mining sector’s contribution to the national economy is substantial, accounting for 15% of Chile’s GDP with a value of USD 315 billion in 2021, while mining exports represented 62% of the country’s total exports. This robust mining activity drives the demand for lubricants such as engine oil, hydraulic fluid, gear oil, grease, and axle oil used in heavy mining equipment like drill rigs, earthmovers, and large dozers.

The mining industry’s continued growth is evidenced by recent export performance, with mining exports reaching USD 53.5 billion in November 2022, marking a 4% increase from November 2021. The sector employs various types of heavy machinery and equipment that operate under harsh environmental conditions, including high humidity, dust, and extreme temperatures, which necessitate specialized lubricants. These lubricants play crucial roles in reducing friction, absorbing shock, preventing component wear and tear, reducing noise, eliminating corrosion, and aiding in thermal management. Heavy-duty engine oils used in mining applications require greater soot control and acid neutralization capabilities, as well as the ability to avoid particle buildup, driving the demand for high-performance lubricants in the mining sector.

Growing Demand for Lubricants in the Automotive Aftermarket

The automotive aftermarket represents a significant driver for lubricant demand in Chile, supported by increasing vehicle sales and the country’s open trade policies. Recent data shows strong growth in the automotive sector, with vehicle sales reaching 35,255 units in December 2022, representing a 6% increase from November 2022’s 32,927 units. The automotive maintenance and servicing sector has experienced substantial growth due to increasing vehicle sales, leading to higher aftermarket sales and consequently greater demand for various lubricants, including engine oils, transmission fluid, and greases. The country’s free trade agreements with nations like the United States and China have resulted in low tariffs, facilitating easier access to automotive products and creating a more competitive market for lubricants.

The automotive aftermarket’s demand for lubricants is further strengthened by Chile’s unique market structure, where all automotive accessories and parts are imported through trading partners, as the country lacks domestic automotive production facilities. This has created a robust distribution network for automotive maintenance products, including lubricants. Various types of lubricants find application in the automotive aftermarket, serving different purposes such as reducing friction between metal surfaces, preventing corrosion and rust formation, and maintaining component cleanliness. The maintenance sector particularly drives demand for engine oils, which are essential for maintaining engine cleanliness, preventing particle build-up, and ensuring optimal vehicle performance while reducing emissions and improving fuel efficiency.

Segment Analysis: Product Type

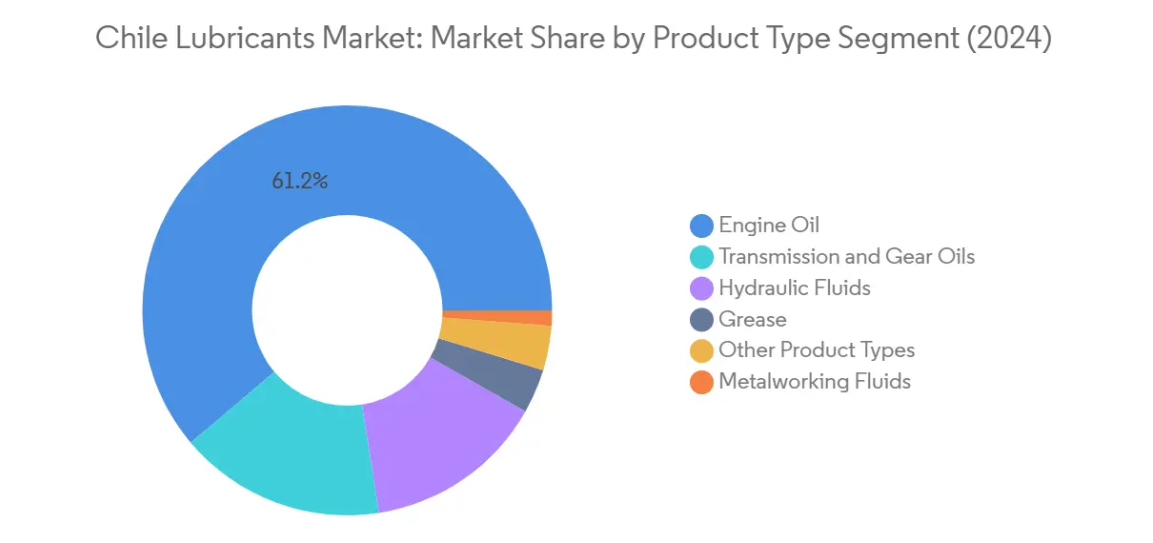

Engine Oil Segment in Chile Lubricants Market

Engine oil dominates the Chile lubricants market, commanding approximately 61% market share in 2024. This dominance is primarily driven by its extensive use in passenger vehicles (SUVs and sedans) and commercial vehicles. The segment’s prominence is attributed to the high engine oil consumption capacity of vehicles equipped with older engines that require larger quantities of engine oil. The growing automotive aftermarket sector in Chile, which saw vehicle sales reach over 415,000 units in recent years, has significantly contributed to the segment’s dominance. Additionally, the segment is experiencing the fastest growth rate in the market, supported by increasing vehicle ownership rates, rising demand from the mining sector’s heavy equipment, and the expansion of automotive maintenance and servicing facilities across the country.

Remaining Segments in Product Type

The other significant segments in the Chile lubricants market include transmission fluid and gear oils, hydraulic fluid, metalworking fluid, grease, and other specialized products. Transmission fluid and gear oils represent the second-largest segment, driven by their crucial role in automotive and industrial applications. Hydraulic fluid maintains a substantial presence due to its widespread use in mining equipment, construction machinery, and industrial systems. Metalworking fluid serves specialized applications in metal fabrication and machining processes, while grease products cater to various industrial and automotive lubrication needs. These segments collectively contribute to the market’s diversity and cater to specific requirements across different end-user industries in Chile.

Segment Analysis: End-User Industry

Automotive Segment in Chile Lubricants Market

The automotive lubricants segment dominates the Chile lubricants market, commanding approximately 66% market share in 2024. This significant market position is driven by the country’s growing vehicle fleet, which has reached around 5.5 million vehicles. The segment’s dominance is further strengthened by Chile’s extensive network of free trade agreements with 65 countries, including China and the United States, which has led to low or zero tariffs on automotive products. The country’s automotive aftermarket sector plays a crucial role in maintaining this dominance, as Operating Lease (OL) and Full-Service Leasing (FSL) of commercial vehicles have gained popularity due to tax-deductible operating costs. Additionally, the presence of over 525 models across 80 brands in the Chilean automotive market has created a diverse and competitive environment for lubricant manufacturers.

Power Generation Segment in Chile Lubricants Market

The power generation segment is emerging as the fastest-growing sector in the Chile lubricants market, with significant expansion opportunities through 2024-2029. This growth is primarily driven by Chile’s ambitious goal of achieving 80% renewable generation in the energy matrix by 2030 and a 100% zero-emissions power grid by 2050. The segment’s expansion is supported by substantial investments in wind energy and other renewable sectors, exemplified by projects like Colbún SA’s Onshore Wind Project in Antofagasta with an installed capacity of 980 MW. The country’s power generation industry operates across three different systems – the National Electric System (SEN), Aysen System (SEA), and Magallanes System (SEM), creating diverse opportunities for lubricant applications. The ongoing transition from thermal power plants to renewable sources, with plans to phase out nearly 28 thermal power plants and replace 5.5 GW capacity with renewable power sources by 2040, is further accelerating the demand for specialized lubricants in this sector.

Remaining Segments in End-User Industry

The heavy equipment, metallurgy and metalworking, and other end-user industries collectively form significant segments in the Chile lubricants market. The heavy equipment segment is particularly notable in mining applications, as Chile maintains its position as a global leader in copper production and mining operations. The metallurgy and metalworking segment serves the country’s metal processing facilities, particularly in copper and steel processing. Other end-user industries encompass various sectors including chemical manufacturing, aviation, marine, textiles, oil and gas, and pulp and paper, each contributing to the diverse application landscape of industrial lubricants in Chile. These segments benefit from the country’s robust industrial infrastructure and ongoing technological advancements in manufacturing processes.

Chile Lubricants Industry Overview

Top Companies in Chile Lubricants Market

The Chile lubricants market is characterized by strong product innovation initiatives and strategic partnerships among key players. Companies are focusing on developing specialized lubricants solutions for various industrial applications while expanding their distribution networks across the country. Major players are investing in local manufacturing capabilities and forming strategic alliances with automotive manufacturers to strengthen their market position. The industry has witnessed significant operational improvements through the digitalization of supply chains and enhanced customer service platforms. Companies are also emphasizing sustainability through the development of bio-based lubricants and environmentally friendly solutions. Market leaders are continuously expanding their product portfolios through research and development while establishing technical support centers to provide customized solutions to end-users.

Consolidated Market Led By Global Players

The Chile lubricants market exhibits a highly consolidated structure dominated by multinational corporations with an established global presence. These companies leverage their international expertise, advanced technological capabilities, and extensive research and development resources to maintain their competitive edge. The market is primarily controlled by integrated energy companies that operate across the entire value chain, from production to distribution. Local players maintain their presence through strategic partnerships with global manufacturers and by focusing on specific market segments or geographical regions.

The market has experienced notable merger and acquisition activities, particularly involving international companies acquiring local distribution networks to strengthen their market presence. Companies are increasingly focusing on vertical integration strategies to enhance operational efficiency and maintain better control over the supply chain. The competitive landscape is further shaped by long-term agreements between manufacturers and distributors, creating high entry barriers for new market entrants. Global players are also establishing local manufacturing facilities to reduce operational costs and improve market responsiveness.

Innovation and Distribution Network Drive Success

Success in the Chile lubricants market increasingly depends on companies’ ability to develop innovative products while maintaining strong distribution networks. Market leaders are investing in research and development to create specialized products for emerging industries such as renewable energy and mining. Companies are also focusing on developing value-added services, including technical support and maintenance programs, to differentiate themselves from competitors. The establishment of strategic partnerships with automotive manufacturers and industrial clients has become crucial for maintaining market share and ensuring steady demand.

For new entrants and smaller players, success lies in identifying and serving niche market segments while building strong relationships with local distributors. Companies need to focus on developing environmentally sustainable products to address growing environmental concerns and potential regulatory changes. The ability to provide customized solutions for specific industrial applications, combined with efficient logistics and technical support services, will be crucial for future growth. Market players must also consider the increasing influence of digital technologies in distribution and customer service while adapting their business models accordingly. Additionally, the development of industrial lubricants and specialty lubricants, including synthetic lubricants, is becoming more prominent as companies aim to meet the diverse needs of various sectors.

Chile Lubricants Market Leaders

-

- Empresas Copec

- Shell plc

- TotalEnergies SE

- Petrobras

- Valvoline Inc. (Saudi Arabian Oil Co.).

- *Disclaimer: Major Players sorted in no particular order

Chile Lubricants Market News

- October 2022: TotalEnergies SE signed an agreement with MG Motor to develop a new range of lubricants in Chile. The new product is expected to be named MG Oil, the first MG Motor oil specially formulated for automobiles. This new product is expected to be manufactured entirely in Chile, which will likely help TotalEnergies strengthen its geographical presence.

- September 2022: AMSOIL Inc. launched two synthetic lubricants for UTV and ATV. AMSOIL Synthetic ATV and UTV motor oil is available in 5W-40 and SAE 10W-30 viscosity grades. AMSOIL 10W-30 Synthetic ATV and UTV motor oil is used in applications that require SAE 10W-30 viscosity grade oil. 5W-40 Synthetic ATV and UTV motor oil are used in applications that need an SAE 5W-40 viscosity grade oil. AMSOIL Synthetic ATV and UTV motor oil help fight corrosion and rust to extend equipment life. It is expected to help the company strengthen its product portfolio.

Chile Lubricants Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Lubricants from the Mining Industry

- 4.1.2 Growing Demand for Lubricants in the Automotive Aftermarket

- 4.2 Restraints

- 4.2.1 Growing Adoption of Electric Vehicles

- 4.3 Industry Value Chain Analysis

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5. MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Product Type

- 5.1.1 Engine Oil

- 5.1.2 Greases

- 5.1.3 Hydraulic Fluids

- 5.1.4 Metalworking Fluids

- 5.1.5 Transmission & Gear Oil

- 5.1.6 Other Product Types

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Heavy Equipment

- 5.2.3 Metallurgy and Metalworking

- 5.2.4 Power Generation

- 5.2.5 Other End-user Industries

6. COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMSOIL INC.

- 6.4.2 BP PLC

- 6.4.3 Carl Bechem GmbH

- 6.4.4 Chevron Corporation (Esmax)

- 6.4.5 Empresas Copec

- 6.4.6 FUCHS

- 6.4.7 Kluber Lubrication

- 6.4.8 Motul

- 6.4.9 Petrobras

- 6.4.10 Shell PLC (ENEX)

- 6.4.11 TotalEnergies SE

- 6.4.12 Valvoline Inc. (Saudi Arabian Oil Co.)

- 6.4.13 YPF

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Recycled Lubricants

Chile Lubricants Industry Segmentation

Any substance physically integrated to reduce friction between two or more moving surfaces is called a lubricant. On metallic surfaces, lubricants aid in preventing material degradation, erosion, corrosion, and rust development. Lubricants are typically made up of 90% petroleum-based oil and various additives to give them desirable properties specific to a given purpose. The Chile lubricants market is segmented by product type and end-user industry. By product type, the market is segmented into engine oils, greases, hydraulic fluids, metalworking fluids, transmission and gear oils, and other product types. By end-user industry, the market is segmented into automotive, heavy equipment, metallurgy and metalworking, power generation, and other end-user industries. For each segment, the market sizing and forecasts have been done based on volume (million liters).

| Product Type | Engine Oil |

| Greases | |

| Hydraulic Fluids | |

| Metalworking Fluids | |

| Transmission & Gear Oil | |

| Other Product Types | |

| End-user Industry | Automotive |

| Heavy Equipment | |

| Metallurgy and Metalworking | |

| Power Generation | |

| Other End-user Industries |

Product Type

| Engine Oil |

| Greases |

| Hydraulic Fluids |

| Metalworking Fluids |

| Transmission & Gear Oil |

| Other Product Types |

End-user Industry

| Automotive |

| Heavy Equipment |

| Metallurgy and Metalworking |

| Power Generation |

| Other End-user Industries |

Chile Lubricants Market Research FAQs

What is the current Chile Lubricants Market size?

The Chile Lubricants Market is projected to register a CAGR of greater than 3.88% during the forecast period (2025-2030)

Who are the key players in Chile Lubricants Market?

Empresas Copec, Shell plc, TotalEnergies SE, Petrobras and Valvoline Inc. (Saudi Arabian Oil Co.). are the major companies operating in the Chile Lubricants Market.

What years does this Chile Lubricants Market cover?

The report covers the Chile Lubricants Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Chile Lubricants Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.