Canada Industrial Wood Coatings Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Canadian Industrial Wood Coatings Market Report is Segmented by Resin Type (polyurethane, Acrylic, Nitrocellulose, Alkyd, and Others), Technology (water-Borne, Solvent-Borne, Powder, and UV-Coatings), and End-User Industry (wooden Furniture, Joinery, Flooring, and Other End-User Industries). The Report Offers Market Size and Forecasts in Terms of Revenue (USD) for all the Above Segments.

Canada Industrial Wood Coatings Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

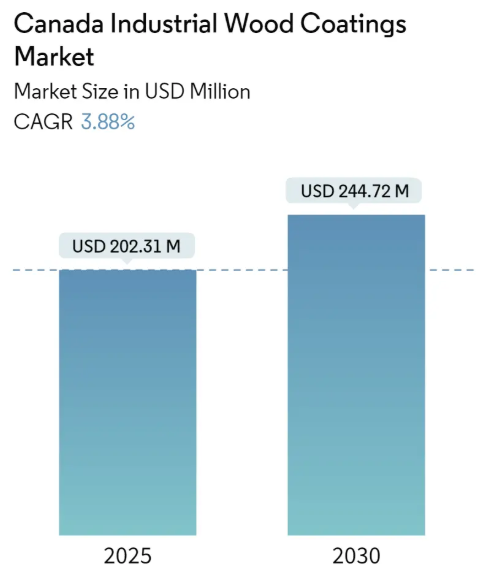

Canada Industrial Wood Coatings Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

| Market Size (2025) | USD 202.31 Million |

| Market Size (2030) | USD 244.72 Million |

| Growth Rate (2025 – 2030) | 3.88% CAGR |

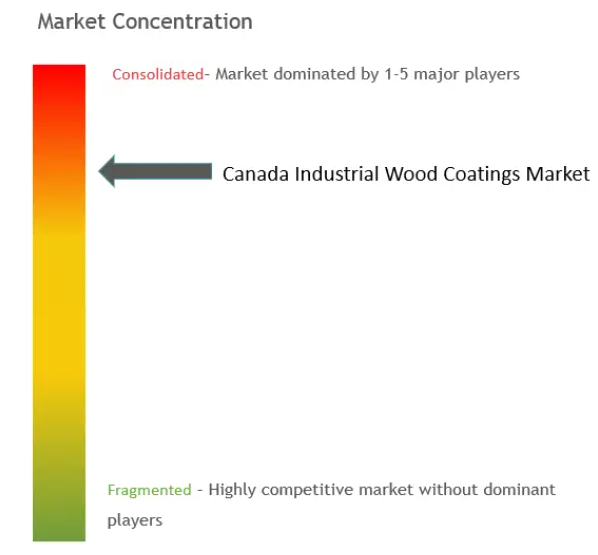

| Market Concentration | High |

Compare market size and growth of Canada Industrial Wood Coatings Market with other markets in Chemicals & Materials Industry

Canada Industrial Wood Coatings Market Analysis

The Canada Industrial Wood Coatings Market size is estimated at USD 202.31 million in 2025, and is expected to reach USD 244.72 million by 2030, at a CAGR of 3.88% during the forecast period (2025-2030).

The Canadian industrial wood coatings industry is undergoing significant transformation driven by technological advancements and environmental considerations. A notable shift towards eco-friendly coating solutions is evident, with manufacturers increasingly focusing on developing low-VOC and zero-emission formulations. This transition is particularly visible in the radiation-cured powder coatings segment, where recent innovations like Evonik Industries’ TEGO Airex 923 deaerator, introduced in November 2022, demonstrate the industry’s commitment to combining environmental compliance with enhanced performance characteristics. The advancement in UV-curable and water-based technologies has enabled manufacturers to meet stringent environmental regulations while maintaining high-quality finishing standards.

The market is witnessing substantial growth in the commercial and residential construction sectors, which directly influences the demand for industrial wood coatings. According to recent data, the construction pipeline showed remarkable activity in Q2 2023, with 275 projects encompassing 37,359 rooms under development, representing a 5% year-over-year growth. This robust construction activity has created increased demand for various wood coating applications, from flooring to architectural woodwork. The industry has also seen significant investment in manufacturing capabilities, exemplified by Polynt Group’s announcement in May 2023 to establish a coatings resin plant in Canada.

Government initiatives are playing a crucial role in shaping the wood coatings market landscape. In August 2023, the implementation of the Green Construction through Wood (GCWood) Program has encouraged the use of innovative wood-based building technologies. Additionally, the Canadian government’s investment of USD 1 million in the Wood Manufacturing Cluster of Ontario (WMCO) to support wood manufacturing SMEs demonstrates strong institutional support for the sector. These initiatives are fostering innovation in coating technologies and creating new opportunities for market expansion.

The industry is experiencing notable developments in distribution and manufacturing capabilities. The kitchen cabinet manufacturing sector, which generates an estimated USD 3.5 billion in annual sales and employs over 25,000 Canadians across approximately 4,000 SMEs, represents a significant market for industrial wood coatings. Major industry players are expanding their presence, as evidenced by Cabico&co’s USD 25 million investment in October 2022 for manufacturing facility expansion, including a 200,000 sq ft renovation and a new 50,000 sq ft plant. These developments indicate a robust and growing demand for industrial wood coatings across various applications.

Canada Industrial Wood Coatings Market Trends

Growing Usage of Wooden Furniture

The Canadian furniture industry has been experiencing significant growth, driven by increasing residential and commercial construction activities along with rising consumer spending on home furnishings. According to Statistics Canada, the furniture market registered a substantial revenue of CAD 18.03 billion in 2022, with projections indicating an annual growth rate of 5.48% between 2022 and 2026. The office furniture manufacturing sector has particularly demonstrated remarkable growth, with its GDP contribution reaching approximately CAD 1.66 billion in February 2022, representing a significant increase of over 40% compared to the previous year. This growth has been supported by various government initiatives, including the Ministry of Natural Resources of Canada’s USD 1 million contribution to the Wood Manufacturing Cluster of Ontario (WMCO) to support studies involving wood manufacturing SMEs across major industry segments.

The furniture retail sector has witnessed several strategic developments that indicate strong market momentum. In August 2023, IKEA Canada announced the opening of its second small store format in Scarborough Town, Ontario, featuring over 2,500 products focused on affordable and sustainable home furnishing solutions. Additionally, the Canadian Economic Development for Quebec Regions (CED) has made significant investments in furniture manufacturing, including a USD 350,000 repayable contribution to Maille Atelier Inc. for expanding its manufacturing workshop, and a USD 523,104 contribution to Créations Verbois for integrating new digitally controlled machinery. These investments and expansions reflect the growing demand for wooden furniture across residential and commercial sectors, subsequently driving the need for industrial wood finishes and industrial wood coatings.

Increasing Demand from the Construction Industry

The Canadian construction industry has demonstrated robust growth, particularly in wood-frame construction, which has become increasingly prevalent in residential and commercial projects. In 2022, the country recorded 261,850 new housing construction starts, indicating strong demand for construction materials and finishes, including the wood coatings market. The construction sector’s growth is further supported by various government initiatives, such as the Green Construction through Wood (GCWood) Program, launched in August 2023, which encourages the use of innovative wood-based building technologies in construction projects. This program aligns with Canada’s significant forest resources, as the country holds 9% of the world’s forest landmass, making wood a preferred choice for construction.

The industry has witnessed several significant developments that highlight the increasing adoption of wood in construction. In July 2023, the Parliament for Vancouver Granville announced a USD 3.5 million contribution to constructing 2150 Keith Drive, an innovative hybrid mass timber commercial office building. Additionally, Massive Canada announced the construction of a new mass timber manufacturing facility in Williams Lake, Canada, in June 2023, which will focus on pre-fabricating laneway homes, apartment units, townhouses, and commercial projects using mass-timber building products and systems. Furthermore, the Vancouver-based Dialog Design Architecture firm developed a groundbreaking hybrid timber floor system in June 2023, collaborating with Ontario’s EllisDon Construction to create a patented system combining cross-laminated timber panels with steel and concrete, enabling the construction of taller and more sustainable buildings. These advancements are pivotal in shaping the industrial wood sector, as they enhance the demand for industrial wood coatings and finishes.

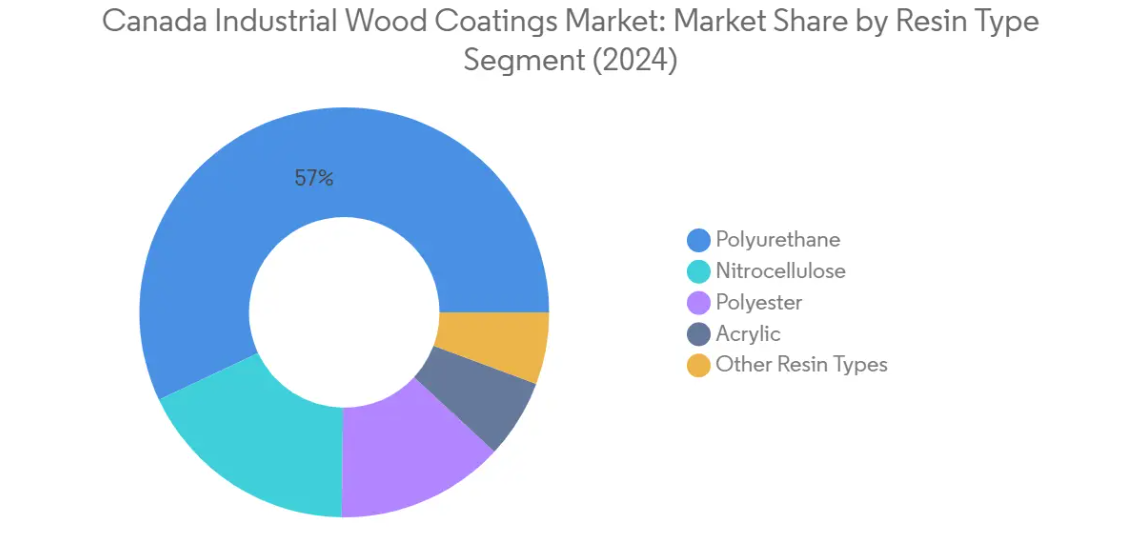

Segment Analysis: Resin Type

Polyurethane Segment in Canada Industrial Wood Coatings Market

Polyurethane resins dominate the Canadian industrial wood coatings market, commanding approximately 57% of the market share in 2024. This significant market position is attributed to polyurethane’s superior performance characteristics and versatile applications. Polyurethane-based industrial wood coatings are particularly favored for wooden furniture and surfaces subjected to rough usage, such as windows and wooden doors, due to their exceptional moisture resistance and durability. These coatings provide excellent protection against abrasion, scratches, rough handling, and chemical spills, while also offering resistance to boiling water and severe chemicals like alkalis or acids. The segment’s dominance is further strengthened by its application versatility, available in both one-component and two-component formulations, with two-component coatings delivering superior performance in terms of abrasion resistance and chemical protection.

Polyester Segment in Canada Industrial Wood Coatings Market

The polyester segment is emerging as the fastest-growing category in the Canadian industrial wood coatings market, projected to grow at approximately 4% during the forecast period 2024-2029. This growth is driven by polyester coatings’ exceptional combination of properties, including external toughness, color stability, strong chemical and mechanical resistance, high filling capacity, effective removal capabilities, and shrinkage resistance. These coatings are increasingly preferred for their cost-effectiveness and versatility in applications ranging from furniture and floorings to cabinets and shelves. The segment’s growth is further supported by the rising demand for high-gloss finishes and superior protection requirements in both residential and commercial applications, particularly in furniture manufacturing where polyester coatings create highly durable and resistant layers on interior wooden surfaces.

Remaining Segments in Resin Type

The other significant segments in the Canadian industrial wood coatings market include nitrocellulose, acrylic, and other resin types, each serving specific market needs. Nitrocellulose-based coatings are valued for their fast-drying properties and excellent ability to accentuate wood grain, making them particularly suitable for furniture applications. Acrylic resins offer superior chemical and photochemical resistance, making them ideal for both solvent and water-based industrial wood coatings. The other resin types, including alkyd, vinyl resins, and epoxy, cater to specialized applications where specific performance characteristics are required, such as exterior wood coating formulations and surface protection barriers against deterioration.

Segment Analysis: Technology

Solvent-borne Segment in Canada Industrial Wood Coatings Market

The solvent-borne coatings segment dominates the Canada industrial wood coatings market, holding approximately 55% of the market share in 2024. Solvent-based varnishes and lacquers remain the preferred choice for industrial wood applications due to their ability to produce appealing, long-lasting, and cost-effective finishes. Kitchen cabinet and furniture manufacturers particularly favor these coatings because of their fast-drying properties, easy repairability, and excellent performance under varying climate conditions. The segment’s strength lies in its significant advantage over water-based coatings, as solvent-borne coatings are less susceptible to external variables such as temperature and humidity during the curing phase. Three primary types of solvent-based coatings are predominantly used in industrial wood applications: nitrocellulose lacquers for residential furniture, pre-catalyzed lacquers for office and institutional furniture, and conversion varnishes for kitchen cabinets and home furnishings.

UV Coatings Segment in Canada Industrial Wood Coatings Market

The UV coatings segment is projected to experience the fastest growth in the Canada industrial wood coatings market during the forecast period 2024-2029, with an expected growth rate of approximately 5%. This growth is driven by the clear benefits these coatings offer over traditional wood finishing methods, including high curing speed, lower energy costs, and reduced atmospheric pollution. The segment offers three distinct UV-curable coating choices: 100% UV, water-reduced UV, and solvent-reduced UV, providing versatility in application methods. Water-borne UV resin coatings are gaining particular traction for both interior and exterior applications due to their excellent chemical and mechanical properties, combined with low VOCs and toxicity. The increasing focus on environmental regulations and the push for low-pollution coating technologies is expected to continue driving the adoption of UV-cured coatings in the Canadian market.

Remaining Segments in Technology

The water-borne and powder coatings segments complete the technology landscape in the Canadian industrial wood coatings market. Water-borne coatings are gaining prominence due to their eco-friendly nature and ability to reduce moisture and solar radiation absorption, making them particularly suitable for exterior applications. These coatings demonstrate high elasticity over time and excellent thixotropic properties, allowing for thicker application while maintaining transparency. Meanwhile, powder coatings, though representing a smaller market share, are making significant strides in medium-density fiberboard (MDF) applications, offering advantages such as zero emissions, no hazardous paint sludge generation, and lower disposal costs. Recent technological advancements in powder coatings, particularly in lower temperature curing capabilities, are expanding their potential applications in the wood coating industry.

Segment Analysis: End-User Industries

Furniture Segment in Canada Industrial Wood Coatings Market

The furniture segment dominates the Canada industrial wood coatings market, commanding approximately 48% of the total market share in 2024. This segment’s prominence is driven by the robust growth in the Canadian furniture manufacturing sector and increasing consumer demand for wooden furniture across residential and commercial applications. The segment’s growth is supported by the rising middle-class income combined with an increased desire for home décor and furniture, benefiting the demand for wooden chairs, tables, beds, sofas, shelves, and other items. Conventional high-solid formulations of solvent-based coatings are commonly used for wooden furniture and cabinetry, with solvent-borne technologies like traditional nitrocellulose-based lacquers and conversion varnish systems continuing to dominate due to their relatively lower cost, flexible application, and better performance. The segment’s strong performance is further bolstered by the growing construction of hotels in the country, with a 5% year-over-year growth in both projects and rooms in the construction pipeline, totaling 275 projects encompassing 37,359 rooms as of Q2 2023.

Remaining Segments in End-User Industries

The joinery and flooring segments represent significant portions of the Canadian industrial wood coatings market, each serving distinct applications in the construction and renovation sectors. The joinery segment encompasses applications in doors, windows, trims, and cabinets, with wooden doors being particularly preferred for their aesthetic appeal despite requiring protective coatings against fungal growth and environmental damage. The flooring segment serves various applications including living rooms, kitchens, bathrooms, staircase restorations, and high-traffic areas in offices, with coatings providing essential properties such as hardness, chemical resistance, and resistance to abrasion. Both segments benefit from the ongoing trend of wooden house construction in Canada, driven by sustainability considerations and the country’s abundant forest resources, which covers 9% of the global forest landmass. The other end-user industries segment, though smaller, caters to specialized applications such as decks and molding products, contributing to the overall market diversity.

Canada Industrial Wood Coatings Industry Overview

Top Companies in Canada Industrial Wood Coatings Market

The Canadian industrial wood coatings market is led by established players like The Sherwin-Williams Company, Akzo Nobel N.V., PPG Industries, CANLAK, and RPM International Inc. These companies are actively pursuing product innovation through extensive R&D investments, particularly in developing low-VOC and environmentally sustainable coating solutions. Operational agility is demonstrated through backward integration of manufacturing processes and optimization of distribution networks across Canadian provinces. Strategic moves include strengthening partnerships with local distributors and expanding product portfolios through brand extensions. Market leaders are focusing on expanding their manufacturing footprint, with several companies establishing new production facilities and technical centers to better serve the Canadian market. The emphasis on customized solutions for specific applications like furniture, flooring, and cabinetry showcases the industry’s commitment to meeting evolving customer demands.

Consolidated Market with Strong Global Players

The Canadian wood coatings market exhibits a highly consolidated structure dominated by global conglomerates with extensive manufacturing and distribution capabilities. These multinational companies leverage their advanced technological capabilities, established brand equity, and comprehensive product portfolios to maintain their market positions. Local players like CANLAK and Katilac Coatings maintain their competitive edge through specialized product offerings and a deep understanding of regional market dynamics. The market’s high entry barriers, including substantial capital requirements and established distribution networks, contribute to maintaining the existing competitive structure.

The industry has witnessed strategic acquisitions and partnerships aimed at expanding market presence and technological capabilities. Companies are increasingly focusing on vertical integration to ensure supply chain stability and cost optimization. The presence of well-established distribution channels and long-term relationships with key customers creates significant advantages for incumbent players. Market leaders are strengthening their positions through investments in research and development facilities, while also expanding their manufacturing capabilities to meet growing demand across different application segments.

Innovation and Sustainability Drive Future Success

Success in the Canadian industrial wood coatings market increasingly depends on developing environmentally compliant products while maintaining performance standards. Companies must invest in research and development to create innovative solutions that address stringent VOC regulations while meeting customer requirements for durability and aesthetics. Building strong relationships with furniture manufacturers, construction companies, and other end-users through technical support and customized solutions is becoming crucial. Market players need to optimize their distribution networks and maintain efficient supply chains to ensure product availability across Canada’s diverse geographical regions.

For new entrants and smaller players, focusing on niche applications and developing specialized products for specific industry segments offers opportunities for market penetration. Success factors include establishing strong technical service capabilities, developing eco-friendly product alternatives, and building relationships with regional distributors. Companies must also consider potential regulatory changes regarding environmental standards and prepare for increased emphasis on sustainable solutions. The ability to adapt to changing customer preferences, particularly the growing demand for water-based and UV-cured coatings, while maintaining cost competitiveness will be crucial for long-term success in the wood coating industry.

Canada Industrial Wood Coatings Market Leaders

-

- AkzoNobel NV

- RPM International Inc

- Axalta Coatings Systems

- The Sherwin Williams

- PPG Industries Inc.

- *Disclaimer: Major Players sorted in no particular order

Canada Industrial Wood Coatings Market News

- July 2023: The Parliament for Vancouver Granville, Minister of Natural Resources, on behalf of Jonathan Wilkinson, announced a USD 3.5 million contribution to constructing 2150 Keith Drive, an innovative hybrid mass timber commercial office building in Vancouver’s False Creek Flats neighborhood.

- February 2022: Akzo Nobel announced an in-house expansion of resin manufacturing used as a binder in coatings production. This is a step toward making the company self-sufficient and achieving its sustainability target, which would likely help in enhancing the industrial wood coatings market in Canada.

Canada Industrial Wood Coatings Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Usage of Wooden Furniture

- 4.2.2 Increasing Demand From the Construction Industry

- 4.3 Market Restraints

- 4.3.1 Regulations Related to VOC Emissions

- 4.3.2 Availability of Alternative Materials in the Market

- 4.4 Industry Value Chain Analysis

- 4.5 Porter’s Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5. MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Epoxy

- 5.1.2 Acrylic

- 5.1.3 Nitrocellulose

- 5.1.4 Polyurethane

- 5.1.5 Polyester

- 5.1.6 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 UV Coatings

- 5.2.4 Powder

- 5.3 End-user Industry

- 5.3.1 Wooden Furniture

- 5.3.2 Joinery

- 5.3.3 Flooring

- 5.3.4 Other End-user Industries

6. COMPETITIVE LANDSCAPE

- 6.1 Market Share (%) **/Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 AkzoNobel NV

- 6.3.2 Axalta Coatings Systems

- 6.3.3 Jotun

- 6.3.4 PPG Industries Inc.

- 6.3.5 RPM International Inc.

- 6.3.6 Kansai Paint Co. Ltd

- 6.3.7 Nippon Paint Holdings Co. Ltd

- 6.3.8 Henkel AG & Co. KGaA

- 6.3.9 BASF SE

- 6.3.10 Katilac Coatings

- 6.3.11 CANLAK

- 6.3.12 The Sherwin Williams

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Radiation-cured Coatings

Canada Industrial Wood Coatings Industry Segmentation

Industrial wood coatings are used for the protection of wooden products used for different industrial purposes, such as the production of wooden furniture, doors, cabinets, etc.

The Canadian industrial wood coatings market is segmented by resin type, technology, and end-user industry. By resin type, the market is segmented into polyurethane, acrylic, nitrocellulose, alkyd, and other resin types. By technology, the market is segmented into water-borne, solvent-borne, powder, and UV-coatings. By end-user industry, the market is segmented into wooden furniture, joinery, flooring, and other end-user industries. For each segment, the market sizing and forecasts have been done on the basis of revenue (USD).

| Resin Type | Epoxy |

| Acrylic | |

| Nitrocellulose | |

| Polyurethane | |

| Polyester | |

| Other Resin Types | |

| Technology | Water-borne |

| Solvent-borne | |

| UV Coatings | |

| Powder | |

| End-user Industry | Wooden Furniture |

| Joinery | |

| Flooring | |

| Other End-user Industries |

Resin Type

| Epoxy |

| Acrylic |

| Nitrocellulose |

| Polyurethane |

| Polyester |

| Other Resin Types |

Technology

| Water-borne |

| Solvent-borne |

| UV Coatings |

| Powder |

End-user Industry

| Wooden Furniture |

| Joinery |

| Flooring |