Boron Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Boron Market is Segmented by Application (Glass, Ceramics, Agriculture, Detergent and Cleaning, and Other Applications) and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Size and Forecasts for the Boron Market are Provided in Volume (tons) for all the Above Segments.

Boron Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Boron Market Size

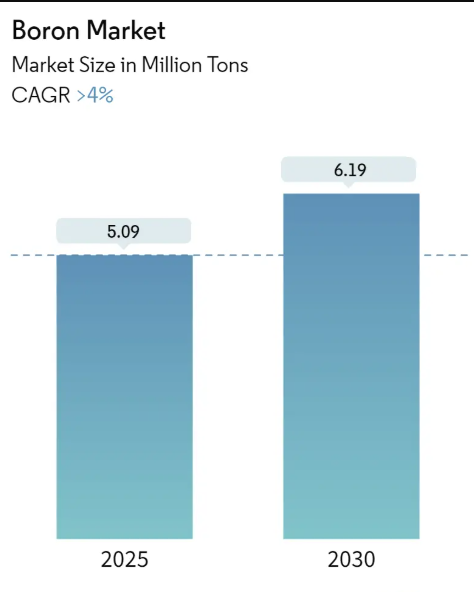

| Study Period | 2019 – 2030 |

| Market Volume (2025) | 5.09 Million tons |

| Market Volume (2030) | 6.19 Million tons |

| CAGR | 4.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Boron Market with other markets in Chemicals & Materials Industry

Plastics, Polymers, and Elastomers

Adhesives and Sealants

Commodity Chemicals

Water and Wastewater Treatment

Advanced Materials

Construction Chemicals and Materials

Graphene Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 41.22% (2025 – 2030) |

| Countries/ Region Covered: | Asia Pacific, North America, Europe, South America, Middle East and Africa, Global |

| Major Players: | NanoXplore Inc., The Sixth Element (Changzhou) Materials Technology Co. Ltd, NeoGraf, Morsh (Ningbo Moxi Technology Co. Ltd), Xiamen Knano Graphene Technology Co. Ltd |

Boron Market Analysis

The Boron Market size is estimated at 5.09 million tons in 2025, and is expected to reach 6.19 million tons by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The boron industry continues to evolve amid shifting global supply dynamics and technological advancements across end-user industries. Turkey maintains its position as the dominant force in global boron production, with its state-owned enterprise Eti Maden controlling approximately 73% of world reserves and accounting for 48% of global production capacity. In 2022, the country’s refined boron production reached 2.54 million tonnes, with an impressive 96% of this output being exported to international markets. This concentration of resources has led to an increased focus on supply chain diversification and strategic partnerships among major consuming nations.

The construction and infrastructure sectors remain significant consumers of boron-based products, particularly in developed economies. In the United States, construction spending reached USD 1704.4 billion in February 2022, reflecting a 0.5% increase from the previous month. This growth has been accompanied by increasing demand for advanced building materials incorporating boron compounds, especially in energy-efficient construction applications and sustainable building solutions. The integration of boron-based materials in modern construction practices continues to expand, driven by stringent building codes and environmental regulations.

The glass and ceramics industries have demonstrated robust growth in their utilization of boron compounds. According to Glass Alliance Europe, European glass production reached 39.53 million tonnes in 2022, with Germany accounting for approximately one-fifth of the total output. The ceramics sector has similarly shown strong performance, with global ceramic tile output increasing by 7.2% to reach 18,339 million square meters. This growth has been particularly pronounced in Asia, where technological advancements in manufacturing processes have led to increased efficiency in boron utilization.

The electronics and semiconductor industries are emerging as increasingly important consumers of high-purity boron products. China’s electronic information manufacturing sector demonstrated strong performance in 2022, with value-added growth exceeding 7.6% compared to the previous year. This growth has been accompanied by significant investments in semiconductor manufacturing capabilities across major economies, with countries like the United States, South Korea, and Japan announcing substantial funding initiatives for domestic chip production. The demand for ultra-high purity boron products in these applications continues to drive innovation in refining and processing technologies.

Boron Market Trends

Growing Adoption of Fiberglass in Various End-User Industries

The increasing adoption of fiberglass across multiple industries is driving substantial demand for boron products, as boron compounds are essential in fiberglass manufacturing. In the glass industry, manufacturers add 5-20% boric oxide to the silica base to achieve critical properties, including a lower melting temperature, reduced viscosity, and prevention of crystallization. This addition transforms standard glass products into materials with enhanced heat resistance, chemical resistance, and improved durability, making them ideal for various industrial applications. The glass manufacturing sector demonstrates the scale of this demand, with 650 glass container manufacturers operating across 1,200 sites producing 95 million tonnes annually, while 320 flat glass manufacturers across 560 sites produce 106 million tonnes of flat glass each year.

The construction sector represents a major growth driver for fiberglass adoption, particularly in emerging economies where infrastructure development is accelerating. For instance, the construction industry in China continues to expand significantly, with construction output reaching CNY 31.2 trillion in 2022, demonstrating the massive scale of potential fiberglass applications in building materials and insulation. The automotive and electronics industries are also driving increased demand for fiberglass components, with manufacturers utilizing boron-enhanced glass products for various applications, including reinforced plastics, electronic components, and specialized technical glass. The versatility of boron-modified fiberglass is evident in its expanding applications across sectors, from thermal insulation in buildings to reinforcement in composite materials used in automotive and aerospace applications.

Increasing Demand from the Agriculture Industry

The agricultural sector’s growing recognition of boron’s essential role in crop nutrition and development is driving significant market demand. Boron serves as a crucial micronutrient that supports various physiological processes in plants, including cell division, development in growth regions, and proper functioning of reproductive structures. The compound is particularly vital for pollen tube growth during flower pollination, making it essential for seed set and fruit development. This increasing understanding of boron’s importance in agriculture has led to its widespread incorporation in fertilizer formulations and soil enhancement products, particularly in regions with boron-deficient soils.

The agricultural industry’s modernization and focus on yield optimization have further amplified the demand for boron-based products. Farmers are increasingly adopting sophisticated fertilization techniques that include boron supplementation to address specific crop needs and soil deficiencies. The compound’s ability to enhance crop quality and yield has made it an indispensable component in modern farming practices, particularly in intensive agriculture systems. Boron’s versatility in agricultural applications extends beyond traditional soil treatments, with growing adoption in foliar sprays and irrigation systems, allowing for more precise and efficient delivery of this essential nutrient to crops. This trend is particularly evident in the cultivation of high-value crops and in regions where soil conditions necessitate careful nutrient management strategies.

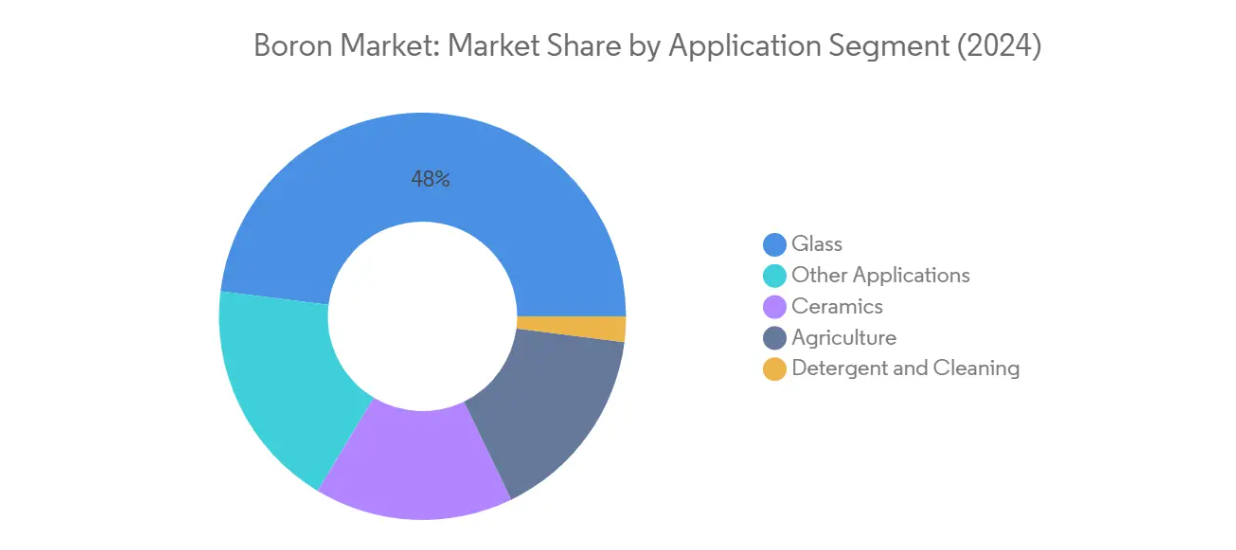

Segment Analysis: Application

Glass Segment in Boron Market

The glass segment dominates the global boron market, commanding approximately 48% of the total market share in 2024. This segment’s prominence is primarily driven by the extensive use of boron in the manufacturing of borosilicate glass, textile-type fiberglass, and insulation-type fiberglass. The addition of boron significantly enhances the fluidity, surface hardness, and durability of glass products. Glass manufacturers typically incorporate 5-20% boric oxide into the silica base to substantially reduce melting temperature and viscosity, prevent crystallization, regulate thermal expansion, and prevent devitrification. The segment’s growth is further bolstered by increasing demand from the construction sector, particularly in the production of energy-efficient buildings requiring high-performance glass and insulation materials. The segment is also experiencing robust growth with a projected growth rate of around 4.3% from 2024 to 2029, driven by expanding applications in flat-panel displays, pharmaceutical containers, and advanced optical technologies.

Remaining Segments in Application

The ceramics segment plays a vital role in the boron market, with applications in porcelain enamels and ceramic glazes, while the agriculture segment utilizes boron as an essential micronutrient for crop nutrition and development. The detergent and cleaning segment employs borates to enhance cleaning action and reduce dirt redeposition, resulting in brighter and cleaner clothes. Other applications include metallurgical uses, nuclear applications, and specialty chemicals. These segments collectively contribute to the market’s diversity, with ceramics and agriculture segments particularly benefiting from increasing construction activities and growing agricultural productivity demands, respectively. The detergent segment continues to evolve with new formulations incorporating boron for improved performance, while other applications demonstrate steady growth across various industrial applications.

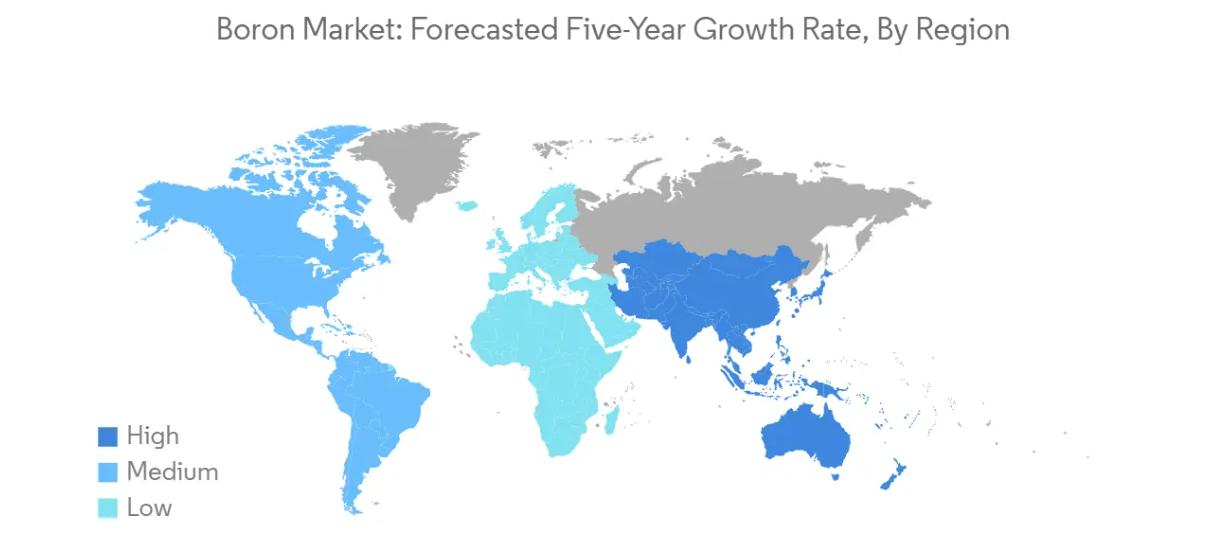

Boron Market Geography Segment Analysis

Boron Market in Asia-Pacific

The Asia-Pacific region represents the dominant force in the global boron market, driven by robust industrial growth across multiple sectors. China leads the regional boron market with its massive manufacturing base and growing demand from the construction, automotive, and electronics industries. Other key markets include India, Japan, and South Korea, each contributing significantly through their respective industrial applications. The region’s growth is primarily supported by increasing investments in infrastructure development, rising automotive production, and expanding electronics manufacturing capabilities.

Boron Market in China

China maintains its position as the powerhouse of the Asia-Pacific boron market, accounting for approximately 71% of the regional market share. The country’s dominance is reinforced by its position as a global manufacturing hub, particularly in the electronics and automotive sectors. China’s construction sector continues to drive substantial demand through various mega-projects and urban development initiatives. The country’s glass and ceramics industries represent major consumption centers for boron products. Additionally, China’s focus on developing its semiconductor industry and expanding electronic manufacturing capabilities further strengthens its position in the regional boron market.

Boron Market in India

India emerges as the fastest-growing market in the Asia-Pacific region, with a projected growth rate of approximately 5% during 2024-2029. The country’s rapid industrialization and expanding manufacturing sector create substantial opportunities for boron applications. India’s automotive sector, particularly the electric vehicle segment, shows promising growth potential for boron-based products. The government’s push for infrastructure development and focus on renewable energy installations further drive market growth. Additionally, the country’s growing electronics manufacturing sector and increasing agricultural activities contribute significantly to the rising demand for boron-based products.

Boron Market in North America

North America represents a mature boron market, characterized by advanced industrial applications and technological innovations. The region benefits from the presence of major boron reserves and established manufacturing infrastructure. The United States dominates the regional landscape, followed by Canada and Mexico. The market is primarily driven by demand from the glass, ceramics, and electronics industries, along with growing applications in the agricultural sector. The region’s focus on sustainable practices and technological advancements continues to create new opportunities for boron applications.

Boron Market in United States

The United States maintains its leadership position in the North American boron market, commanding approximately 67% of the regional market share. The country’s strong manufacturing base and technological advancement drive consistent demand for boron products. The US market benefits from significant domestic production capabilities and a diverse range of end-use applications. The country’s robust aerospace industry, expanding electronics sector, and growing focus on renewable energy applications continue to support market growth. Additionally, the agricultural sector remains a key consumer of boron-based products.

Boron Market in Canada

Canada demonstrates strong growth potential in the North American boron market, with an expected growth rate of approximately 4% during 2024-2029. The country’s market is primarily driven by its expanding construction sector and growing industrial applications. Canada’s automotive manufacturing industry represents a significant consumer of boron-based products. The country’s focus on sustainable development and environmental regulations creates opportunities for boron applications in various sectors. Additionally, Canada’s agricultural sector continues to drive demand for boron-based fertilizers and micronutrients.

Boron Market in Europe

The European boron market demonstrates a well-established industrial ecosystem with diverse applications across multiple sectors. Germany leads the regional market, followed by France, Italy, and the United Kingdom. The region’s market is characterized by stringent quality standards and environmental regulations that influence product development and applications. The automotive and construction sectors remain key drivers of demand, while emerging applications in renewable energy and electronics create new growth opportunities.

Boron Market in Germany

Germany maintains its position as the largest boron market in Europe, supported by its robust industrial base and technological advancement. The country’s automotive sector represents a major consumer of boron products, particularly in glass and ceramic applications. Germany’s focus on renewable energy and sustainable development creates additional demand for boron-based materials. The country’s strong chemical industry and research capabilities continue to drive innovation in boron applications.

Boron Market in France

France emerges as the fastest-growing market in Europe, driven by increasing industrial applications and technological advancements. The country’s aerospace industry represents a significant consumer of boron-based products. France’s focus on sustainable development and environmental protection creates opportunities for innovative boron applications. The country’s construction sector and growing electronics industry further support market expansion.

Boron Market in South America

The South American boron market benefits from significant natural reserves and growing industrial applications. Brazil emerges as both the largest and fastest-growing market in the region, followed by Argentina. The region’s market is primarily driven by agricultural applications and growing industrial sectors. The construction industry’s expansion and increasing automotive production create additional demand for boron products. The region’s focus on modernizing its manufacturing capabilities and expanding agricultural productivity continues to support market growth.

Boron Market in Middle East & Africa

The Middle East & Africa region demonstrates growing potential in the global boron market, with diverse applications across multiple sectors. South Africa emerges as the largest country market, while the rest of the Middle East & Africa shows the fastest growth potential. The region’s market is primarily driven by construction activities and growing industrial applications. Agricultural applications represent another significant segment, particularly in countries focusing on improving agricultural productivity. The region’s ongoing industrialization and infrastructure development projects continue to create new opportunities for boron applications.

Boron Industry Overview

Top Companies in Boron Market

The global boron market is characterized by companies focusing on continuous product innovation and technological advancement across their mining and processing operations. Leading players are investing heavily in research and development to develop high-purity boron products while simultaneously expanding their product portfolios to include value-added derivatives. Operational excellence is being achieved through the implementation of automation and artificial intelligence in mining operations, alongside sustainable practices like renewable energy adoption. Companies are strengthening their positions through vertical integration strategies, moving from basic mining operations to manufacturing downstream products. Strategic expansion moves include establishing global distribution networks, developing new mining sites, and forming partnerships to enhance market presence. The industry is witnessing a growing emphasis on environmentally responsible mining practices and sustainable product development to meet evolving customer demands.

Consolidated Market with Strong Regional Players

The boron market exhibits a highly consolidated structure dominated by state-owned enterprises and established multinational corporations with integrated operations. The market leadership is particularly concentrated in regions with abundant boron reserves, with Turkish and American companies holding significant market positions due to their geographical advantages. The competitive landscape is characterized by high entry barriers due to the capital-intensive nature of operations and the need for sophisticated technology and expertise in mining and processing.

The industry has witnessed limited merger and acquisition activity due to the concentrated nature of boron reserves and strong government control in key producing regions. Local players in emerging markets are gradually gaining prominence through technological partnerships and government support, though their market share remains relatively small. The competitive dynamics are influenced by long-term supply contracts with major end-users, established distribution networks, and the ability to provide consistent product quality while maintaining environmental compliance.

Innovation and Sustainability Drive Future Success

Success in the boron market increasingly depends on companies’ ability to develop innovative products while maintaining sustainable operations. Market leaders are focusing on developing specialized grades for emerging applications in electronics and clean energy sectors, while simultaneously optimizing their production processes to reduce environmental impact. The ability to establish strong relationships with end-users in high-growth industries, particularly in the Asia-Pacific region, has become crucial for maintaining market position. Companies are also investing in research and development to find new applications and improve existing products to counter potential substitution threats.

For contenders looking to gain market share, the focus needs to be on developing niche products for specific applications while building strong regional distribution networks. Success factors include the ability to comply with increasingly stringent environmental regulations, maintain cost competitiveness through operational efficiency, and develop sustainable mining practices. Companies must also consider the growing importance of supply chain resilience and the need to maintain stable relationships with key customers in industries like glass, ceramics, and agriculture. The development of circular economy solutions and the ability to adapt to changing regulatory landscapes will be crucial for long-term success in the market. Notably, companies such as Rio Tinto Boron are setting benchmarks in sustainable practices and innovation, influencing the broader boron industry.