Biologics CDMO Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Biologics CDMO Market Report is Segmented by Type (Mammalian and Non-Mammalian (Microbial)), Product Type (Biologics (Monoclonal, Recombinant Proteins, Antisense and Molecular Therapy, Vaccines, and Other Biologics) and Biosimilars), and Geography (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa). The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

Biologics CDMO Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

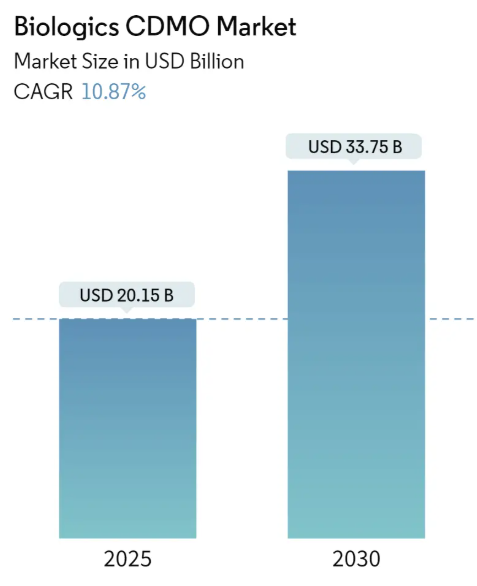

Biologics CDMO Market Size

| Study Period | 2019 – 2030 |

| Market Size (2025) | USD 20.15 Billion |

| Market Size (2030) | USD 33.75 Billion |

| CAGR (2025 – 2030) | 10.87% |

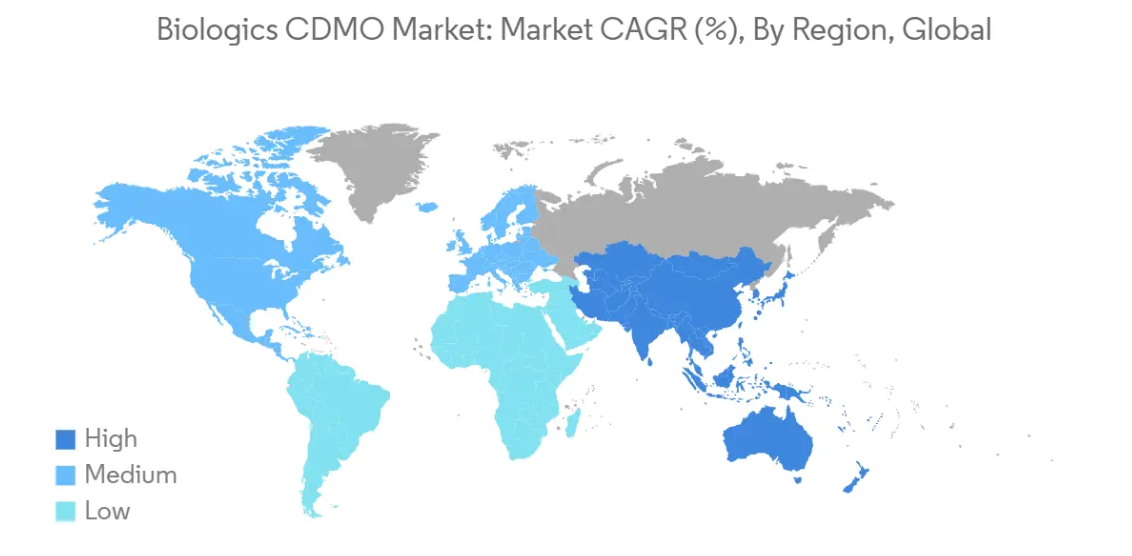

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Biologics CDMO Market with other markets in Packaging Industry

Biologics CDMO Market Analysis

The Biologics CDMO Market size is worth USD 20.15 Billion in 2025, growing at an 10.87% CAGR and is forecast to hit USD 33.75 Billion by 2030.

As the global population ages, there is a higher demand for biologics to treat age-related diseases, contributing to the growth of biologics manufacturing. Even though small molecules continue to command the prominent share of the market, large molecules, such as biologics, biosimilars, and cell and gene therapies, are expected to witness the fastest growth over the forecast period.

As global cases of cancer, autoimmune diseases, and diabetes rise, the demand for biologic therapies surges. Biologics, encompassing monoclonal antibodies, vaccines, and gene therapies, provide potent treatments for these ailments. With an aging global populace more susceptible to chronic conditions, the demand for advanced biologic therapies intensifies, bolstering the Biologics CDMO market.

Innovations in biotechnology and molecular biology, notably personalized medicine and gene therapy, are catalyzing the emergence of novel biologics. Tailoring treatments to patients’ genetic profiles amplifies the need for specialized manufacturing. Regulatory bodies, including the FDA and EMA, are approving an increasing number of biologics, heightening the demand for their manufacturing services

Samsung Biologics, a key player in the Biologics CDMO market, leverages advanced manufacturing technologies and robust investments in innovation. The company is actively rolling out new innovation platforms. For example, in September 2024, Samsung Biologics unveiled a suite of proprietary development platforms, underscoring its commitment to high-quality development and customized client services.

Biologics face rigorous scrutiny from global health authorities, including the FDA and EMA. Their approval process is notably more stringent and protracted than that of small molecule drugs, potentially inflating costs and extending timelines for CDMOs. Navigating the ever-evolving regulatory landscape poses challenges, especially as agencies refine their guidance on emerging biologics and manufacturing techniques.

Biologics CDMO Market Trends

Mammalian Type Segment is Expected to Hold Significant Market Share

Mammalian cells are widely accepted by regulatory authorities (like the FDA and EMA) for the production of therapeutic proteins, owing to their ability to produce complex post-translational modifications that are similar to those in humans. This regulatory acceptance drives their adoption in biologic manufacturing thus fuelling the Biologics CDMO market size.

Pharmaceutical companies are increasingly turning to Contract Development and Manufacturing Organizations (CDMOs) for the development and production of biologics. This shift aims to cut costs and boost efficiency. CDMOs bring essential infrastructure, expertise, and regulatory insights to the table, ensuring the production of top-tier biologics. Given the intricacies of mammalian cell culture production, many pharmaceutical firms are gravitating towards CDMOs with specialized expertise in large-scale mammalian system handling.

In February 2024, Avid Bioservices, a leading biopharmaceutical CDMO, joined forces with CRB to enhance production capacity at its Myford site in Tustin, California. Responding to the surging demand for mammalian cell culture production of both clinical and commercial biologics, Myford expanded its drug substance line (DS 2). This move underscores Avid’s dedication to being a trusted partner in delivering innovative, high-quality biopharmaceuticals.

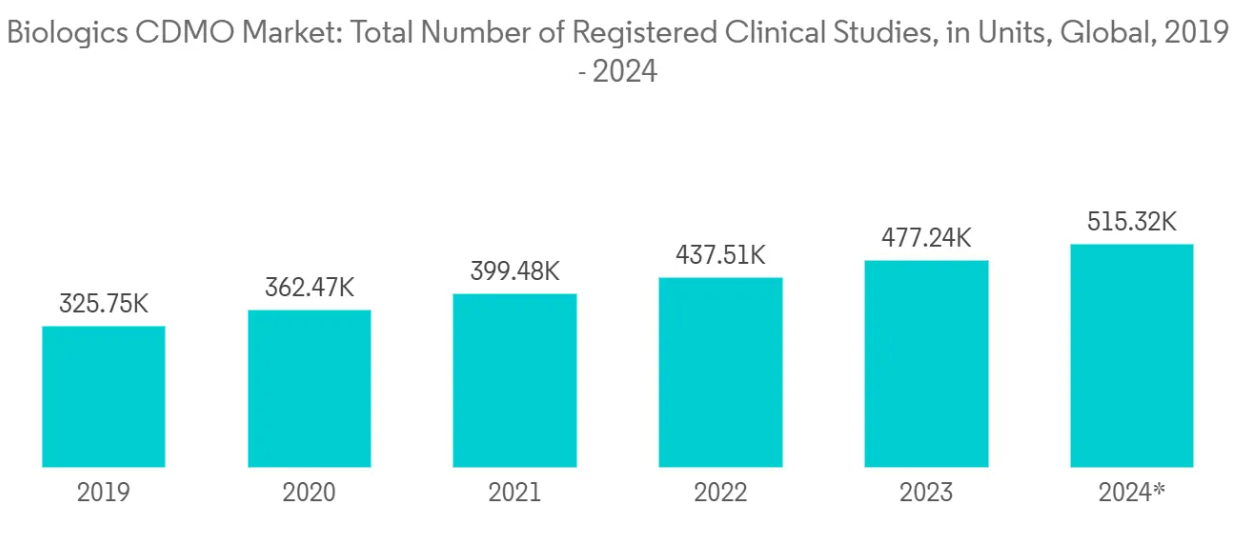

Clinical trials, as highlighted by ClinicalTrials.gov, are a cornerstone of global drug development. The trend shows a marked uptick in registered clinical trials over the years. In 2024 alone, the global tally reached nearly 515 thousand. Since 2019, the number of clinical studies has surged, and while they’ve become increasingly intricate, their importance in drug and product research and development remains undiminished.

North America to Hold Major Market Share

In 2024, North America dominates the market capturing a significant 47.55% of global Biologics CDMO market share. The global biologics market, encompassing monoclonal antibodies, gene therapies, cell therapies, and more, is growing rapidly. An aging demographic in North America is increasing the demand for biologics as older populations require more specialized treatments, particularly for chronic and complex diseases.The shift toward biologics (such as monoclonal antibodies, gene therapies, and cell-based therapies) is a major driver in the North American market.

In pursuit of swift expansion, numerous firms are setting their sights on the North American landscape. In June 2024, Asahi Kasei Medical’s U.S. arm, Bionova Scientific, a comprehensive biologics CDMO, unveiled a new service line centered on plasmid DNA. They’ve also earmarked a dedicated facility in Texas for this venture. With an eye on the future, Bionova is diversifying its portfolio, eyeing the burgeoning realms of cell and gene therapies.

Canada’s pharmaceutical sector stands as a beacon of innovation, bolstered by a government that cultivates a business-friendly atmosphere. This support empowers companies to strategically leverage their assets for both immediate and future endeavors.

In Canada, Contract Service Providers (CSPs) are emerging as preferred partners, adept at navigating intricate manufacturing processes and strategically positioned close to key markets in both Canada and the U.S. As global competition heats up, Canadian CSPs are honing in on quality and scalability to attract the attention of international pharmaceutical leaders. This momentum, fueled by ongoing expansions, is propelling the region’s market growth rate.

Biologics CDMO Industry Overview

The Biologics CDMO market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market include Boehringer Ingelheim Group, Wuxi Biologics (Cayman) Inc., Samsung Biologics, Lonza Group Ltd, and Fujifilm Diosynth Biotechnologies USA Inc. These players are vying for a stronger market presence and higher market share by implementing strategies such as innovation, research and development, expansion, and mergers and acquisitions in the global market.

Pharmaceutical firms rely on biologics CDMOs for their expertise in pre-formulation, clinical trials, and commercial production. Biologics have transformed drug delivery, offering advanced treatments for cancer, autoimmune disorders, genetic issues, and infectious diseases. Major manufacturers are channeling investments into advanced technologies, including cell and gene therapy platforms, monoclonal antibody (mAb) production, and viral vector manufacturing. To stand out from competitors, they provide innovative platforms such as single-use technologies, continuous manufacturing, and advanced purification techniques.

Biologics CDMO Market Leaders

- Boehringer Ingelheim Group

- Wuxi Biologics (Cayman) Inc.

- Samsung Biologics

- Lonza Group Ltd

- Fujifilm Diosynth Biotechnologies USA Inc.

- *Disclaimer: Major Players sorted in no particular order

Biologics CDMO Market News

- March 2024: Fujifilm Diosynth Biotechnologies has expanded its manufacturing agreement with Argenx. This collaboration focuses on producing drug products and services for efgartigimod. Efgartigimod is a monoclonal antibody (mAb) fragment designed to target the neonatal Fc receptor (FcRn), aiming to treat patients with severe autoimmune diseases.

- November 2024: Samsung Biologics, a major player in the biopharmaceutical sector, has inked multiple manufacturing agreements with a European pharmaceutical firm. In a bid to enhance its capabilities and manufacturing technologies, Samsung Biologics has been ramping up its investments. The company has strategically responded to the changing demands of its clientele, securing its foothold in the U.S., Asia, and Europe through a series of pivotal deals.

Biologics CDMO Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness – Porter’s Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Number of Global Aging Population to Drive the Market Growth

- 5.1.2 Increasing Investments in Innovations to Fuel Market Growth

- 5.2 Market Challenges/ Restraints

- 5.2.1 Stringent Government Regulations Can Be a Challenge for the Market

- 5.3 Key Trends in Biopharmaceutical Industry

- 5.4 Coverage on the Current Use of Biologics for Different Types of Disease Treatment

6. MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Mammalian

- 6.1.2 Non-mammalian (Microbial)

- 6.2 By Product Type

- 6.2.1 Biologics

- 6.2.1.1 Monoclonal (Diagnostic, Therapeutic, and Protein-based)

- 6.2.1.2 Recombinant Proteins

- 6.2.1.3 Antisense and Molecular Therapy

- 6.2.1.4 Vaccines

- 6.2.1.5 Other Biologics

- 6.2.2 Biosimilars

- 6.3 By Geography***

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7. COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Boehringer Ingelheim Group

- 7.1.2 Wuxi Biologics (Cayman) Inc.

- 7.1.3 Samsung Biologics

- 7.1.4 Lonza Group Ltd

- 7.1.5 Fujifilm Diosynth Biotechnologies USA Inc.

- 7.1.6 Toyobo Co. Ltd

- 7.1.7 Parexel International Corp.

- 7.1.8 Icon PLC

- 7.1.9 Binex Co. Ltd

- 7.1.10 Celonic Group (JRS Pharma Group)

- 7.1.11 Rentschler Biopharma SE

- 7.1.12 AGC Biologics (AGC Inc.)

- 7.1.13 Sandoz AG

- 7.1.14 Catalent Inc.

- 7.1.15 AbbVie Inc.

- *List Not Exhaustive

8. VENDOR MARKET SHARE

9. INVESTMENT ANALYSIS

10. FUTURE OUTLOOK OF THE MARKET

Biologics CDMO Industry Segmentation

A biologics contract development and manufacturing organization (CDMO) is a third-party company that helps pharmaceutical companies develop and manufacture biological drugs. CDMOs can help with research, development, manufacturing, and more. The research also examines underlying growth influencers and significant industry vendors, all of which help to support market estimates and growth rates throughout the anticipated period. The market estimates and projections are based on the base year factors and arrived at top-down and bottom-up approaches.

The biologics contract development and manufacturing organization (CDMO) market is segmented by type (Mammalian and Non-Mammalian (Microbial)), by product type (biologics [monoclonal, recombinant proteins, antisense, and molecular therapy, vaccines, and other biologics], and biosimilars), by geography (North America, Europe, Asia Pacific, Latin America, Middle East and Africa). The market sizes and forecasts are provided in terms of value in USD for all the above segments.

| By Type | Mammalian | ||

| Non-mammalian (Microbial) | |||

| By Product Type | Biologics | Monoclonal (Diagnostic, Therapeutic, and Protein-based) | |

| Recombinant Proteins | |||

| Antisense and Molecular Therapy | |||

| Vaccines | |||

| Other Biologics | |||

| Biosimilars | |||

| By Geography*** | North America | ||

| Europe | |||

| Asia | |||

| Australia and New Zealand | |||

| Latin America | |||

| Middle East and Africa | |||

Biologics CDMO Market Research FAQs

The Biologics CDMO Market size is expected to reach USD 20.15 billion in 2025 and grow at a CAGR of 10.87% to reach USD 33.75 billion by 2030.

In 2025, the Biologics CDMO Market size is expected to reach USD 20.15 billion.

Boehringer Ingelheim Group, Wuxi Biologics (Cayman) Inc., Samsung Biologics, Lonza Group Ltd and Fujifilm Diosynth Biotechnologies USA Inc. are the major companies operating in the Biologics CDMO Market.

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the North America accounts for the largest market share in Biologics CDMO Market.

In 2024, the Biologics CDMO Market size was estimated at USD 17.96 billion. The report covers the Biologics CDMO Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Biologics CDMO Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.