Biological Seed Treatment Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Biological Seed Treatment Market Report is Segmented by Function (Seed Protection, Seed Enhancement, and Other Functions), Crop Type (Grains and Cereal, Oil Seeds, Vegetables, and Other Crop Types), Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa). The Report Offers Market Size and Forecasts in Terms of Value (USD) for all the Above Segments.

Biological Seed Treatment Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Biological Seed Treatment Market Size

| Study Period | 2019 – 2030 |

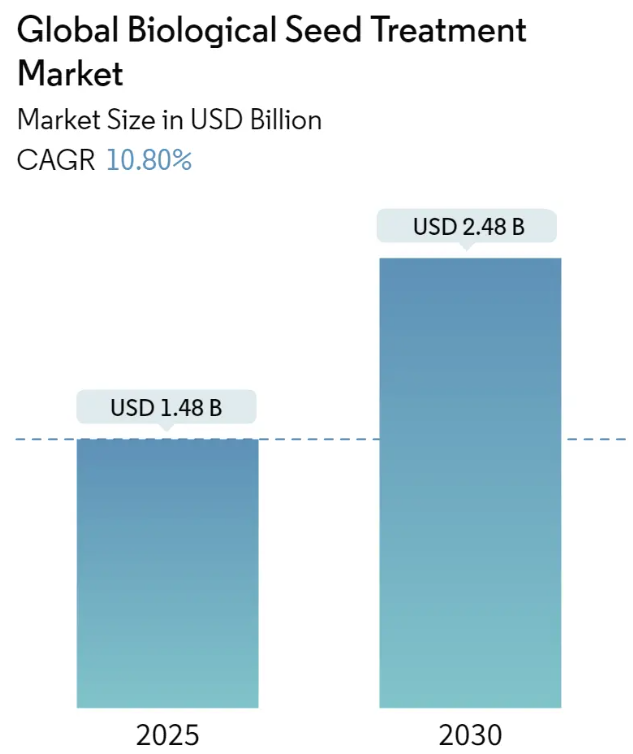

| Market Size (2025) | USD 1.48 Billion |

| Market Size (2030) | USD 2.48 Billion |

| CAGR (2025 – 2030) | 10.80 % |

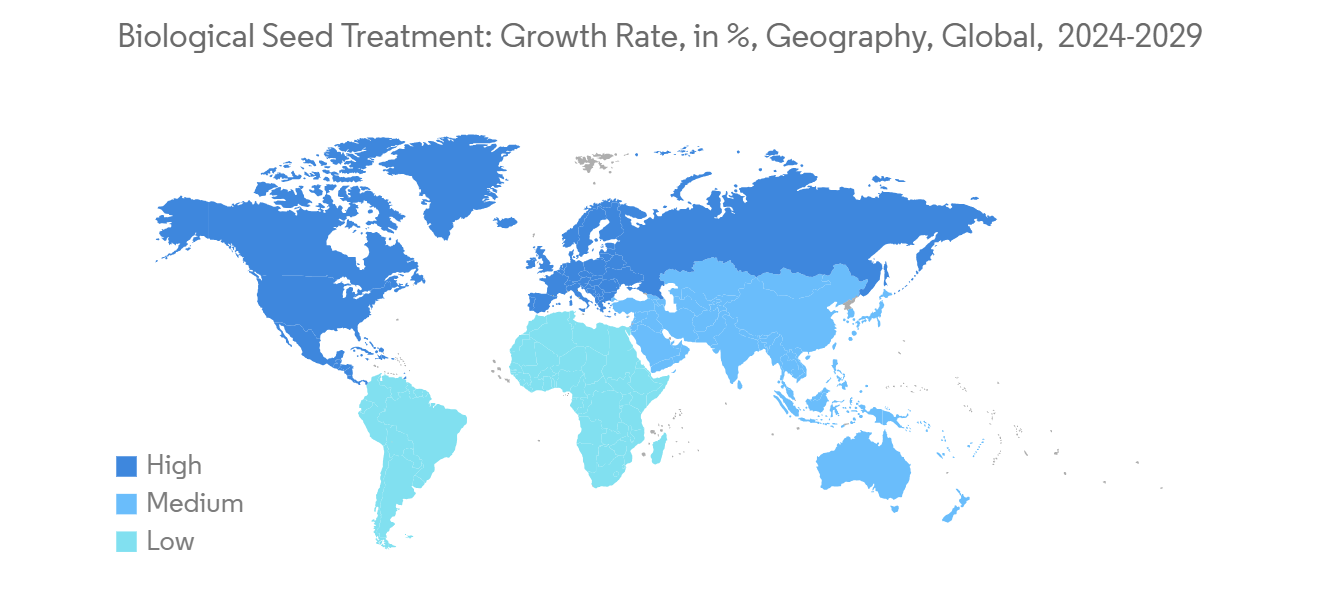

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Europe |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Global Biological Seed Treatment Market with other markets in Agriculture Industry

Seeds

Crop Protection

Fertilizers

Agricultural Commodities

Agriculture Services

Agricultural Machinery and Technology

Biological Seed Treatment Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 10.80% (2025 – 2030) |

| Countries/ Region Covered: | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Major Players: | Syngenta AG, Bayer CropScience Limited, BASF SE, Novozymes, Koppert B.V. |

Biological Seed Treatment Market Analysis

The Global Biological Seed Treatment Market size is estimated at USD 1.48 billion in 2025, and is expected to reach USD 2.48 billion by 2030, at a CAGR of 10.8% during the forecast period (2025-2030).

The biological seed treatment market has experienced notable growth in recent years. Natural treatment methods are increasingly viewed as environmentally friendly options for seed treatment. With rising concerns about the environmental impact of chemical fertilizers and pesticides, biological seed treatments provide a more sustainable, eco-friendly alternative. Consumers and governments are focusing more on reducing chemical residues in food production, aiding the usage of biological seed treatments. In 2024, the United States Department of Agriculture (USDA) started increasing its support for organic farmers through new programs, partnerships, grant awards, and an additional USD10 million in funding. These programs aim to develop better markets for domestic organic products, offer hands-on training for producers transitioning to organic production, and ease the financial burden of obtaining organic certification. This shift towards organic farming further encourages the adoption of biological seed treatments.

Biological seed treatments, which are designed to protect seeds, offer targeted control of specific pests and fungal diseases during the early seedling stage. Additionally, these treatments are used on various crops, such as grains, cereals, oilseeds, and vegetables, to manage a range of pests. The increasing use of bio-priming techniques to improve productivity and reduce input costs is supporting the widespread adoption of biological seed treatments. For instance, a 2022 study by researchers from the University of Agriculture and Technology, India indicated that bio-priming in sustainable agriculture is more cost-effective and environmentally benign. Therefore, the growing adoption of eco-friendly options, the trend towards organic farming, a favourable regulatory environment, and supportive initiatives are expected to drive the growth of the market during the forecast period.

Biological Seed Treatment Market Trends

Grains and Cereal segment leads the market

The adoption of biological seed treatments in cereals and grains is increasing, offering a sustainable alternative to chemical methods. This trend is driven by the global push for environmentally friendly farming practices and the rising demand for organic produce. As the demand for plant-based proteins grows, particularly in cereals and grains like wheat, soy, and corn, biological treatments are being utilized to maximize yields and improve crop quality. Additionally, crops such as wheat, barley, and corn are prone to various soil-borne diseases, including Fusarium head blight, seedling blight, and root rot. Biological seed treatments, which include Trichoderma, Bacillus species, and Pseudomonas species, protect against these pathogens, resulting in healthier crops and reducing the need for chemical fungicides.

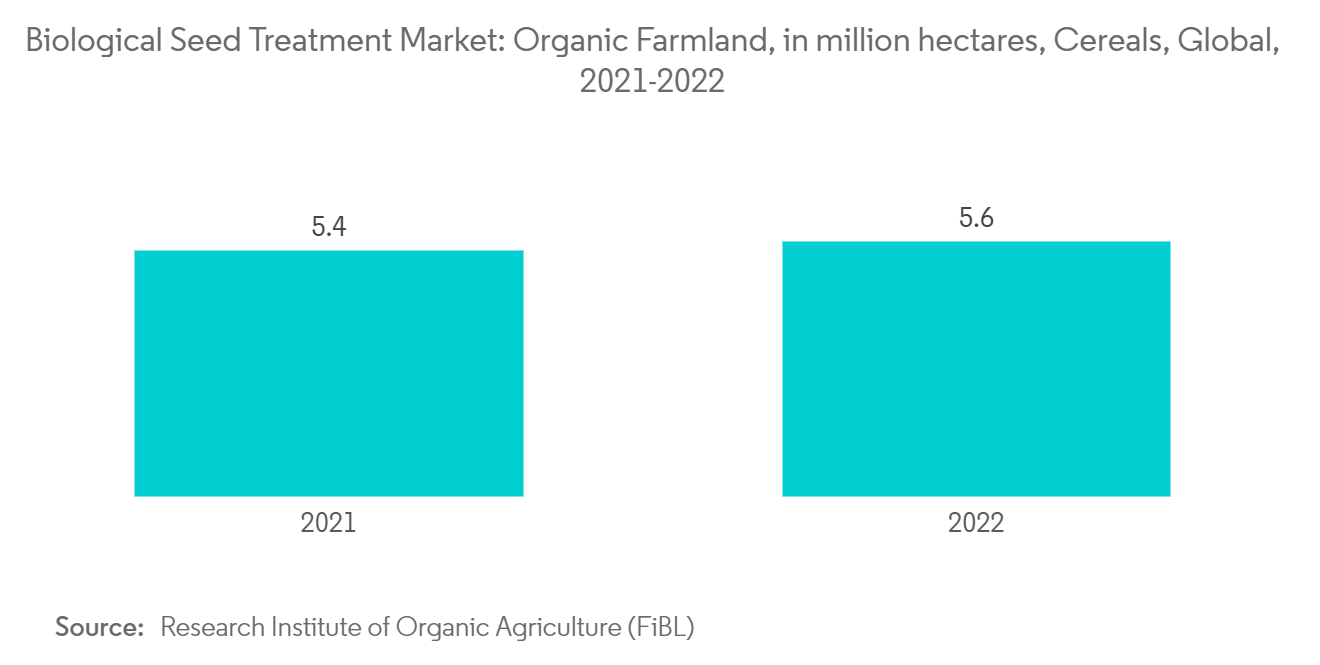

During the study period, there has been a notable increase in the area under organic cereal farming. According to the Research Institute of Organic Agriculture (FiBL), the global organic area under cereal cultivation was 5.4 million hectares in 2021, which increased to 5.6 million hectares in 2022. The growing popularity of organic farming for cereal crops and integrated pest management (IPM) has made biological seed treatments a key component in reducing chemical use, thereby supporting their usage in the segment.

Ongoing research and development efforts are focused on improving the efficacy, shelf life, and cost-effectiveness of biological treatments. New microbial strains and innovative delivery methods are enhancing the performance of biological seed treatments. In 2024, Indigo Ag launched its ground-breaking CLIPS device. This automatic hands-free system saves time, eliminates the hassle in the seed treatment process, and has the potential to revolutionize standard biological seed treatment applications. CLIPS was designed in collaboration with 3BarBio, the first biological Contract Development and Manufacturing Organization focused on the agriculture industry. Therefore, the rising importance of organic produce, coupled with the expanding area of cereal farming and technological advancements, is driving market growth during the forecast period.

Europe Dominates the Market

Europe is a crucial market for biological seed treatments, driven by a strong focus on sustainability, environmental protection, and reducing chemical inputs in agriculture. The European Union (EU) leads in promoting eco-friendly farming practices, significantly increasing the demand for biological seed treatments. The EU has implemented stringent regulations on pesticide use to reduce chemical residues in food and minimize environmental impact. The EU Green Deal and the Farm to Fork Strategy aim to make the EU climate-neutral by 2050. These strategies emphasize sustainable food production and reducing reliance on chemical pesticides and fertilizers, encouraging the adoption of biological and organic farming practices and boosting the demand for biological seed treatments.

European consumers increasingly demand food produced with fewer chemicals and more environmentally friendly practices. According to the Research Institute of Organic Agriculture (FiBL), organic retail sales in Europe grew from USD 50.3 billion in 2019 to USD 55.8 billion in 2022. This demand for organic produce pushes farmers to adopt sustainable farming techniques, including biological seed treatments. The shift toward organic food, particularly in Germany, France, and the UK, has driven the adoption of biological solutions in both large-scale and small-scale farming operations.

Furthermore, strategies for developing new products in the market support growth. In 2023, Syngenta Biologicals and Unium Bioscience collaborated to bring breakthrough biological seed treatment solutions based on NUELLO iN to farmers across northwest Europe. The product naturally improves a plant’s ability to convert and use nitrogen readily available in the atmosphere, potentially reducing nitrogen use by more than 10 percent. This innovation lowers the environmental impact of farming while increasing crop yield, promoting plant and soil health, and offering farmers greater flexibility in their nitrogen management strategies. Therefore, growing government support for sustainability, coupled with the demand for organic produce and supportive strategies, aids market growth during the forecast period.

Biological Seed Treatment Industry Overview

The Biological Seed Treatment Market is moderately consolidated, with major players such as, Syngenta, Bayer Crop Science, BASF, Novozymes, and Koppert B.V. in the market studied. The players are investing in the improvisation of products, partnerships, expansions, and acquisitions for business expansions.

Biological Seed Treatment Market Leaders

- Syngenta AG

- Bayer CropScience Limited

- BASF SE

- Novozymes

- Koppert B.V.

- *Disclaimer: Major Players sorted in no particular order

Biological Seed Treatment Market News

- February 2024: Locus Agriculture expanded its Rhizolizer Duo product line with the introduction of six new biological treatments. The latest additions encompass three in-furrow biologicals tailored for corn, cotton, and legumes, alongside three seed treatments designed for wheat and cereals, soybeans, and corn. These innovations cater to the dynamic requirements of row crop farmers, seed treatment firms, and agricultural retailers and distributors.

- December 2023: Syngenta Seedcare has enhanced its focus on biologicals and expanded its leadership in seed treatment by opening its first biologicals service center at The Seedcare Institute in Maintal, Germany. This center, equipped with state-of-the-art technologies, meets the increasing demand from farmers across the EU for biological seed treatment solutions, providing exceptional service and application support for its customers.

- February 2023: DPH Biologicals has unveiled BellaTrove Companion Maxx ST, a multi-action fungicide seed treatment designed to bolster seedlings against pathogens and promote robust root systems. BellaTrove Companion Maxx ST is crafted from DPH Biologicals’ exclusive strain of a plant-stimulating rhizobacterium. This EPA-registered and OMRI-certified biofungicide and bactericide not only enhance a plant’s innate defenses against pathogens but also boost nutrient absorption and root vitality.

Global Biological Seed Treatment Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Trend of Organic Farming

- 4.2.2 Use of Bio-Priming Techniques for Improved Efficiency

- 4.2.3 Players Investing More in R&D Activities

- 4.3 Market Restraints

- 4.3.1 High Costs and Low Availability

- 4.3.2 Government Regulatory Barriers

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Function

- 5.1.1 Seed Protection

- 5.1.2 Seed Enhancement

- 5.1.3 Other Functions

- 5.2 Crop Type

- 5.2.1 Grains and Cereal

- 5.2.2 Oil Seeds

- 5.2.3 Vegetables

- 5.2.4 Other Crop Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Thailand

- 5.3.3.5 Vietnam

- 5.3.3.6 Australia

- 5.3.3.7 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Bayer Cropscience AG

- 6.3.3 Verdesian Life Sciences LLC

- 6.3.4 Syngenta AG

- 6.3.5 Floridienne Group

- 6.3.6 Germains Seed Technology

- 6.3.7 Koppert Biological Systems

- 6.3.8 Novozymes

- 6.3.9 Bioceres Crop Solutions Corp

- 6.3.10 Locus AG

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Biological Seed Treatment Industry Segmentation

Biological seed treatments include active ingredients such as microbes (fungi and bacteria), plant extracts, and algae extracts. These treatments are applied to seeds in either powder or liquid form before planting. The Biological Seed Treatment Market is segmented by Function (Seed Protection, Seed Enhancement, and Other Functions), Crop Type (Grains and Cereal, Oil Seeds, Vegetables, and Other Crop Types), Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa). The report offers market size and forecasts in terms of value (USD) for all the above segments.

| Function | Seed Protection | |

| Seed Enhancement | ||

| Other Functions | ||

| Crop Type | Grains and Cereal | |

| Oil Seeds | ||

| Vegetables | ||

| Other Crop Types | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| France | ||

| Germany | ||

| Russia | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Thailand | ||

| Vietnam | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa |

Global Biological Seed Treatment Market Research Faqs

The Global Biological Seed Treatment Market size is expected to reach USD 1.48 billion in 2025 and grow at a CAGR of 10.80% to reach USD 2.48 billion by 2030.

In 2025, the Global Biological Seed Treatment Market size is expected to reach USD 1.48 billion.

Syngenta AG, Bayer CropScience Limited, BASF SE, Novozymes and Koppert B.V. are the major companies operating in the Global Biological Seed Treatment Market.

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the Europe accounts for the largest market share in Global Biological Seed Treatment Market.

In 2024, the Global Biological Seed Treatment Market size was estimated at USD 1.32 billion. The report covers the Global Biological Seed Treatment Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Global Biological Seed Treatment Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.