Belgium E-Commerce Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The report covers Belgium Ecommerce Penetration by Country and the market is segmented by B2C E-commerce (Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverage, Furniture and Home), and B2B E-commerce.

Belgium E-Commerce Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Belgium E-Commerce Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

| Historical Data Period | 2019 – 2023 |

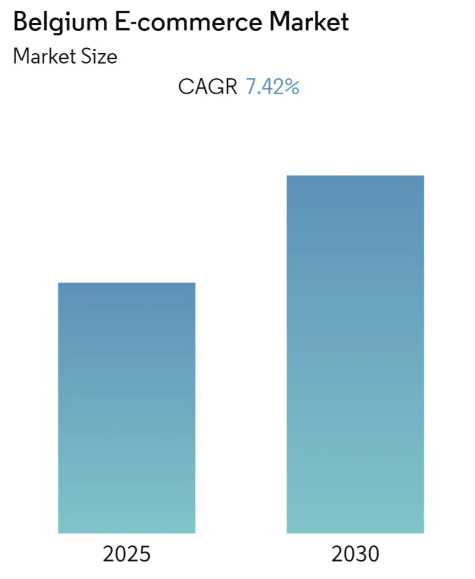

| Growth Rate | 7.42% CAGR |

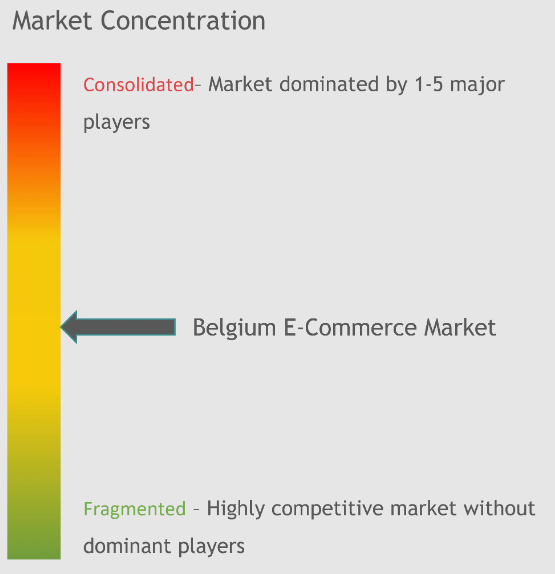

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Belgium E-commerce Market with other markets in Technology, Media and Telecom Industry

Belgium E-Commerce Market Analysis

The Belgium E-commerce Market is expected to register a CAGR of 7.42% during the forecast period.

The Belgian e-commerce landscape is experiencing rapid digital transformation, driven by high internet adoption rates and evolving consumer preferences. As of 2023, Belgium achieved an impressive 94.5% internet penetration rate, creating a robust foundation for online shopping growth. The market has witnessed significant shifts in payment preferences, with digital payment emerging as the most desired e-commerce innovation according to a 2023 Klarna survey, where 52% of consumers expressed a preference for seamless online payment solutions. This digital evolution has prompted retailers to invest heavily in payment technology infrastructure and user experience optimization, leading to increased consumer confidence in online transactions.

The rise of social commerce has fundamentally transformed the Belgian e-commerce ecosystem, with Facebook usage increasing to 70.86% in 2024 from 68.51% in 2023. This shift has led to the emergence of new business models and marketing strategies, with retailers increasingly leveraging social media platforms for direct sales and customer engagement. Major platforms like Zalando have expanded their presence through innovative programs such as Connected Retail, enabling brick-and-mortar retailers to integrate their physical stores with online platforms, creating a seamless omnichannel retail experience for customers.

The market has witnessed a significant surge in transaction volume, with BeCommerce-SafeShops.be reporting 83 million purchases made at Belgian online stores in 2023, of which 65% were product purchases and 35% were services. This growth has been accompanied by strategic partnerships and innovations in the logistics sector, exemplified by bpostgroup’s acquisition of Staci’s shares in April 2024, aimed at strengthening its position in parcelized logistics and cross-border services. The focus on last-mile delivery optimization has become paramount, with companies investing in automated solutions and sustainable delivery options.

Sustainability has emerged as a crucial differentiator in the Belgian e-commerce market, with major players implementing comprehensive environmental initiatives. Leading platforms are increasingly focusing on reducing packaging waste, optimizing delivery routes, and promoting sustainable products. For instance, in March 2024, GLS announced its commitment to science-based targets (SBT) to reduce greenhouse gas emissions across its operations, reflecting the industry’s growing emphasis on environmental responsibility. This shift towards sustainable practices is reshaping supply chain strategies and influencing consumer purchasing decisions, as Belgian shoppers increasingly prioritize environmentally conscious retailers and products.

Belgium E-Commerce Market Trends

Rising Internet Penetration and Digital Infrastructure

The robust digital infrastructure and increasing internet penetration in Belgium have been fundamental drivers of e-commerce growth. According to StatCounter, Facebook usage in the country has increased significantly, standing at 70.86% in 2024 compared to 68.51% in 2023, indicating growing digital engagement among Belgian consumers. The country’s strong telecommunications infrastructure, supported by high-speed internet connectivity and widespread broadband access, has created an ideal environment for digital commerce activities. As of March 2024, Belgium was home to 8,546,200 Facebook users, 5,254,200 Instagram users, 6,400,700 Messenger users, and 850,000 LinkedIn users, demonstrating the extensive digital connectivity that facilitates online shopping behaviors.

The advancement in mobile technology and increasing smartphone penetration have further accelerated the adoption of mobile commerce platforms. The presence of 11.28 million cellular mobile connections in Belgium in early 2023, equivalent to 96.7% of the total population, has enabled consumers to shop conveniently through mobile devices. This widespread mobile connectivity, coupled with the development of user-friendly mobile shopping applications and responsive websites by e-commerce platforms, has made online shopping more accessible and convenient for Belgian consumers. The integration of advanced technologies such as augmented reality (AR) and virtual try-on features has enhanced the mobile shopping experience, particularly in categories like fashion and home décor.

Growing Digital Payment Adoption

The increasing adoption of diverse digital payment solutions has significantly contributed to the growth of digital commerce in Belgium. According to research conducted by the Vrije Universiteit Brussel’s Department of Applied Economics, an impressive 83% of Belgians now favor digital payments over cash transactions. This shift towards digital payments is supported by the integration of various payment options such as meal tickets, eco-checks, Google Pay, and buy-now-pay-later services, providing consumers with flexible and convenient payment alternatives that enhance their online shopping experience.

The evolution of payment technologies and the introduction of innovative payment solutions have made online transactions more secure and convenient for Belgian consumers. E-commerce platforms are increasingly incorporating multiple payment options, including digital wallets, contactless payments, and installment-based payment solutions, catering to diverse consumer preferences. The adoption of Buy Now, Pay Later (BNPL) services has become particularly popular, offering flexibility and convenience for consumers while enabling quick approval and interest-free options for timely payments. This diversification of payment methods has not only improved the checkout experience but has also contributed to reducing cart abandonment rates and increasing consumer confidence in online shopping.

Expansion of E-commerce Players and Services

The Belgian e-commerce landscape has witnessed significant expansion through the entry of new players and the enhancement of existing services. Major international platforms like Amazon.com.be, launched in Belgium in October 2022, have introduced extensive product selections across more than 30 categories, while establishing the “Brands of Belgium” store to support local businesses. The presence of established players like bol.com, with its network of 50,000 sales partners and 10,000 collection points across Belgium and the Netherlands, has created a competitive environment that drives innovation and service improvements.

The continuous enhancement of delivery services and fulfillment capabilities has further strengthened the digital retail ecosystem. Companies like bpost have partnered with various e-commerce platforms to provide efficient delivery solutions, while initiatives such as Zalando’s Connected Retail program have enabled brick-and-mortar retailers to connect their stores directly to online platforms. These developments have created a more integrated shopping experience, combining the convenience of online shopping with the reliability of established retail networks. The expansion of collection points and delivery options has made online shopping more accessible to consumers across different regions of Belgium, contributing to the overall growth of the e-commerce market.

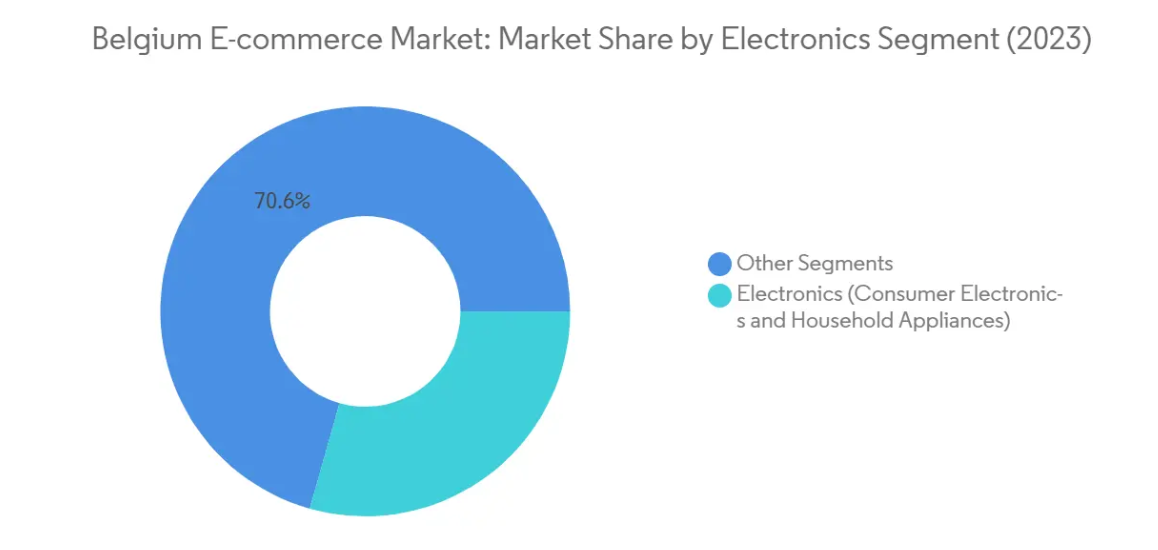

Segment Analysis: Electronics

Electronics Segment in Belgium E-commerce Market

The Electronics segment, which includes both consumer electronics and household appliances, has emerged as a dominant force in Belgium’s e-commerce market, commanding approximately 29% market share in 2024. This substantial market presence is driven by several factors, including the increasing digitalization of Belgian households, growing consumer confidence in online purchases of electronic goods, and the expansion of major digital storefront platforms like bol.com and Amazon in the region. The segment has shown remarkable resilience and growth, supported by the rising demand for smart home devices, mobile phones, laptops, and household appliances. Furthermore, the segment is projected to maintain its strong position with a steady growth rate of around 8% from 2024 to 2029, driven by technological advancements, increasing internet penetration, and the growing trend of smart home adoption in Belgium. The robust performance of this segment is also attributed to competitive pricing strategies, extensive product ranges, and improved delivery services offered by major retail e-commerce players in the Belgian market.

Segment Analysis: Clothing and Fashion

Clothing and Fashion Segment in Belgium E-commerce Market

The Clothing and Fashion segment continues to dominate the Belgium e-commerce market, holding approximately 31% market share in 2024. This segment’s leadership position is driven by the increasing adoption of online shopping platforms and the convenience they offer to fashion-conscious Belgian consumers. Major players like Zalando have strengthened their presence by launching connected retail programs, enabling brick-and-mortar retailers to connect their stores directly to online platforms. The segment’s growth is further supported by cross-border shopping trends, with Belgian consumers showing strong preference for international fashion brands including Zalando, Zara, Asos, Boohoo, H&M, and Shein. The integration of advanced technologies like virtual try-on features and augmented reality experiences has enhanced the online shopping experience, contributing to the segment’s market dominance.

Home and Furniture Segment in Belgium E-commerce Market

The Home and Furniture segment has emerged as the fastest-growing category in the Belgium e-commerce market, with a projected growth rate of approximately 12% from 2024 to 2029. This remarkable growth is driven by several factors, including the increasing adoption of virtual interior design services and 3D visualization tools that help consumers make informed purchasing decisions. Companies like Bolia and Ethnicraft are leading this growth by emphasizing sustainable materials and practices in their furniture offerings. The segment’s expansion is further supported by the rising trend of personalization, with brands like AlterEgo and Flamant offering customization options for furniture dimensions and fabric choices. The integration of augmented reality experiences offered by companies like Made.com and Ikea has significantly enhanced customer confidence in making large furniture purchases online.

Remaining Segments in Belgium E-commerce Market

The Belgium e-commerce market encompasses several other significant segments that contribute to its diverse ecosystem. The Electronics segment maintains a strong presence with comprehensive offerings of consumer electronics and household appliances. The Food and Beverages segment has gained momentum through improved delivery infrastructure and the expansion of online grocery services. Health and Beauty products have seen increased traction with the rise of personalized beauty solutions and wellness products. The Books and Media segment continues to evolve with digital transformation, while specialized segments like Sports and Leisure, Games and Toys, DIY/Decoration, Jewelry, Pharmacy, and Pet Food each serve distinct consumer needs with targeted product offerings and innovative shopping experiences.

Segment Analysis: Home and Furniture

Home and Furniture Segment in Belgium E-commerce Market

The Home and Furniture segment has emerged as a dominant force in Belgium’s e-commerce market, commanding approximately 10% of the total market share in 2024, while also demonstrating exceptional growth potential. This segment’s strong performance is driven by several key factors, including the increasing consumer preference for online furniture shopping, the convenience of doorstep delivery for large items, and the integration of advanced visualization technologies by digital storefront platforms. Major players like Bolia and Ethnicraft have significantly contributed to this growth by emphasizing sustainable materials and practices in their furniture offerings. The segment has been particularly boosted by the adoption of virtual try-on tools and augmented reality experiences offered by companies like Made.com and Ikea, which help customers visualize furniture in their spaces before purchase. Additionally, the trend towards personalization has gained momentum, with brands like AlterEgo and Flamant allowing customers to customize furniture according to their preferences, from fabric choices to dimensions. The segment’s robust performance is further supported by the seamless integration of online and offline experiences, with companies like Maison du Monde and Vente-Exclusive.com offering both digital platforms and physical showrooms to provide customers with a comprehensive shopping experience.

Segment Analysis: Food, Beverages and Groceries

Food, Beverages and Groceries Segment in Belgium E-commerce Market

The Food, Beverages and Groceries segment has established itself as a significant component of Belgium’s e-commerce landscape, commanding approximately 7% of the total market share in 2024. This segment has been driven by the increasing adoption of online grocery shopping platforms and the expansion of major retailers like Delhaize, Colruyt, and Carrefour in the digital space. These companies have played a pivotal role by enhancing their online presence and offering convenient delivery options to customers. The segment is projected to demonstrate robust growth at nearly 9% annually from 2024 to 2029, fueled by changing consumer preferences towards online shopping and advancements in logistics infrastructure. Online grocery retailers have expanded their product offerings to include a wider variety of fresh produce, specialty items, and organic options, catering to diverse consumer preferences. The growth is further supported by efficient logistics and delivery systems, including same-day or next-day delivery options, which have enhanced the overall shopping experience and encouraged more consumers to shop online for groceries.

Segment Analysis: Books and Media

Digital Content Segment in Belgium Books and Media E-commerce Market

The digital content segment has emerged as the dominant force in Belgium’s books and media e-commerce market, driven by the increasing consumer preference for digital formats and streaming services. This segment encompasses e-books, digital music downloads, and video streaming subscriptions, with major players like Bol.com, Proximus, and VRT NU leading the market transformation. The shift towards digital consumption has been particularly pronounced in urban areas, where high-speed internet penetration and smartphone usage have facilitated easier access to digital content. Content localization and cross-platform accessibility have become key differentiators for service providers, with many offering content in multiple languages to cater to Belgium’s diverse linguistic landscape. The integration of advanced features like personalized recommendations and seamless device synchronization has further strengthened the appeal of digital content among Belgian consumers.

Streaming Services Segment in Belgium Books and Media E-commerce Market

The streaming services segment is demonstrating remarkable growth potential in Belgium’s books and media e-commerce landscape, with platforms like Netflix, Spotify, and Kindle Unlimited gaining significant traction. This growth is being fueled by changing consumer preferences towards subscription-based models that offer unlimited access to vast content libraries. Service providers are increasingly investing in original content production and exclusive licensing agreements to differentiate their offerings in the competitive market. The segment’s expansion is further supported by the integration of advanced technologies like AI-powered recommendations and cross-device synchronization capabilities. Belgian consumers’ growing appetite for on-demand entertainment, coupled with the convenience of accessing content across multiple devices, continues to drive the segment’s robust growth trajectory.

Remaining Segments in Belgium Books and Media E-commerce Market

The traditional books and physical media segments continue to maintain their relevance in Belgium’s e-commerce landscape, albeit with evolving business models. Physical bookstores with online presence are adapting by offering hybrid services that combine digital convenience with traditional retail experiences. The audiobook segment is carving out its own niche, appealing to consumers who prefer listening to content during their daily activities. Educational and academic content providers are leveraging digital platforms to reach students and researchers, while specialty publishers focus on niche markets with customized content offerings. These segments are increasingly adopting innovative approaches like print-on-demand services and bundled physical-digital offerings to maintain their market presence.

Segment Analysis: Health and Beauty

Personal Care and Cosmetics Segment in Belgium E-commerce Health and Beauty Market

The personal care and cosmetics segment has emerged as the dominant force in Belgium’s e-commerce health and beauty market, driven by increasing consumer preference for premium beauty products and personalized skincare solutions. Major digital storefront platforms like Farmaline and bol.com have expanded their offerings in this segment, providing a wide range of skincare, cosmetics, and personal care products to meet growing consumer demand. The segment’s growth is further supported by the rising trend of social media influence on beauty purchases, with platforms like Instagram and TikTok playing a crucial role in shaping consumer preferences and driving online sales. Additionally, the integration of virtual try-on features and augmented reality technology by retail e-commerce retailers has enhanced the online shopping experience, allowing customers to visualize products before making purchases.

Health and Wellness Segment in Belgium E-commerce Health and Beauty Market

The health and wellness segment is experiencing rapid growth in Belgium’s e-commerce health and beauty market, with an increasing focus on preventive healthcare and wellness products. This growth is driven by rising health consciousness among Belgian consumers and their growing preference for natural and organic products. E-commerce platforms are expanding their offerings to include a comprehensive range of health supplements, vitamins, and wellness products, while also leveraging data analytics and AI technologies to provide personalized health solutions and product recommendations. The segment’s expansion is further supported by the integration of telemedicine services and digital health solutions, enabling consumers to access health advice and products through unified online platforms.

Remaining Segments in Health and Beauty E-commerce Market

The remaining segments in Belgium’s health and beauty e-commerce market include specialized categories such as men’s grooming, mother and baby care, and professional beauty products. These segments contribute significantly to the market’s diversity and growth, with each addressing specific consumer needs and preferences. The men’s grooming segment has gained prominence with dedicated product lines and targeted marketing strategies, while the mother and baby care segment focuses on safe and natural products for specific consumer needs. Professional beauty products have also found a strong foothold in the B2C e-commerce space, catering to both professional beauticians and consumers seeking salon-quality products for home use.

Segment Analysis: Sports and Leisure/Hobby

Sports and Leisure/Hobby Segment in Belgium E-commerce Market

The Sports and Leisure/Hobby segment has established itself as a significant component of Belgium’s e-commerce landscape, commanding approximately 1% of the total market share in 2024. This segment has been driven by increasing health consciousness among Belgian consumers and their growing interest in fitness and recreational activities. The segment benefits from the convenience of online shopping platforms that offer a wide range of sports equipment, activewear, and fitness accessories. The growth is further supported by social media platforms that play a vital role in shaping trends and driving sales through effective advertising, influencer partnerships, and user-generated content. Additionally, technological advancements in shopping cart software platforms, including virtual try-on features and augmented reality technology, have enhanced the online shopping experience for sports and leisure products. The segment is also witnessing a surge in demand for sustainable and eco-friendly sports products, as Belgian consumers become more environmentally conscious in their purchasing decisions.

Growth Trajectory in Sports and Leisure/Hobby E-commerce

The Sports and Leisure/Hobby segment in Belgium’s e-commerce market is demonstrating robust growth potential, with a projected growth rate of approximately 9% from 2024 to 2029. This growth is being fueled by several key factors, including the increasing adoption of digital platforms for purchasing sports equipment and leisure items. The segment is benefiting from the rising trend of health and wellness activities among Belgian consumers, who are increasingly investing in home fitness equipment and sports accessories. E-commerce retailers are expanding their offerings to include a variety of health-focused products, such as fitness equipment, sports apparel, and recreational gear. The growth is further supported by the integration of advanced technologies in online retail platforms, making it easier for consumers to make informed purchase decisions. Additionally, the segment is seeing increased traction due to the popularity of subscription-based models for sports and leisure products, providing consumers with regular deliveries and automatic replenishment of their fitness and hobby supplies.

Segment Analysis: Games and Toys

Games and Toys Segment in Belgium E-commerce Market

The Games and Toys segment has emerged as a significant player in Belgium’s e-commerce market, accounting for approximately 2% of the total market value in 2024. This segment has shown remarkable growth driven by increasing demand for interactive and tech-driven toys, including robotics, augmented reality (AR), and educational gadgets. The segment is experiencing robust expansion with a projected growth rate of nearly 11% from 2024 to 2029, making it one of the fastest-growing categories in the Belgian e-commerce landscape. This growth is particularly fueled by a unique market dynamic where both children and adults are active consumers, with adults increasingly purchasing items like Lego sets, Pokémon cards, and collectible figurines. The segment’s success is further bolstered by the integration of advanced technologies in toys, making them more engaging and educational. E-commerce platforms in Belgium have responded to this trend by expanding their toy offerings and implementing features that enhance the online shopping experience for both young and adult consumers. The market has also seen a notable shift towards educational and STEM-based toys, reflecting parents’ growing interest in products that combine entertainment with learning opportunities.

Segment Analysis: DIY/Decoration

DIY/Decoration Segment in Belgium E-commerce Market

The DIY/Decoration segment has established itself as a significant component of Belgium’s e-commerce market, accounting for approximately 5% of the total market value in 2024. This segment has been driven by the increasing trend of home improvement projects and growing consumer interest in personalized home decor solutions. E-commerce retailers in this space are leveraging technology to offer virtual interior design services, allowing consumers to visualize and plan their home decor projects remotely. The segment has particularly benefited from the integration of augmented reality tools and virtual visualization technologies, enabling customers to make more informed purchasing decisions. Major e-commerce platforms are expanding their DIY and decoration product offerings, including a wide range of tools, materials, and home decoration items, while also providing educational resources and tutorials to help customers successfully complete their projects. The focus on sustainability and eco-friendly products has also become a key driver, with consumers increasingly seeking environmentally conscious DIY and decoration options.

Segment Analysis: Jewelry

Luxury Jewelry Segment in Belgium E-commerce Market

The luxury jewelry segment has emerged as a dominant force in Belgium’s e-commerce jewelry market, driven by the increasing consumer confidence in purchasing high-value pieces online. This segment’s growth is supported by advanced technological integrations like virtual try-on features and augmented reality tools that enable customers to visualize jewelry pieces before making purchases. E-commerce platforms are investing heavily in secure payment systems and authentication processes to build trust among luxury jewelry buyers. The segment’s expansion is further bolstered by the rising demand for branded jewelry pieces and the convenience of doorstep delivery for premium products. Major online retailers are expanding their luxury jewelry collections and implementing sophisticated digital marketing strategies to capture this high-value market.

Personalized Jewelry Segment in Belgium E-commerce Market

The personalized jewelry segment is demonstrating remarkable growth potential in Belgium’s e-commerce market, with a strong focus on customization options and bespoke designs. This segment is revolutionizing the online jewelry shopping experience by offering customers the ability to create unique pieces that reflect their individual style and preferences. E-commerce platforms are investing in advanced customization tools that allow customers to select materials, designs, and engravings, creating a more engaging shopping experience. The segment’s growth is further driven by the increasing demand for meaningful, personalized gifts and the rising trend of self-expression through jewelry. Online retailers are expanding their customization capabilities and improving their digital interfaces to make the personalization process more intuitive and user-friendly.

Remaining Segments in Belgium E-commerce Jewelry Market

The Belgium e-commerce jewelry market encompasses several other significant segments, including costume jewelry, fashion jewelry, and traditional jewelry pieces. The costume jewelry segment is particularly noteworthy for its appeal to fashion-conscious consumers seeking affordable yet stylish options, with rings, bracelets, and earrings being the most popular categories. The fashion jewelry segment caters to trend-driven consumers who prioritize contemporary designs and seasonal collections. Traditional jewelry continues to maintain its presence in the market, appealing to consumers who value classic designs and cultural significance. These segments are complemented by emerging categories such as sustainable jewelry and smart jewelry, which are gaining traction among environmentally conscious and tech-savvy consumers respectively.

Segment Analysis: Pharmacy

Pharmacy Segment in Belgium E-commerce Market

The Pharmacy segment has emerged as a significant player in Belgium’s e-commerce market, capturing approximately 3% of the total market share in 2024. This segment has shown remarkable momentum driven by the increasing adoption of online pharmacy services and digital health solutions. The growth is primarily fueled by the integration of telemedicine services, enabling consumers to consult healthcare professionals remotely and receive prescriptions electronically. The segment is experiencing robust expansion with a projected growth rate of nearly 12% from 2024 to 2029, making it one of the fastest-growing segments in the Belgian e-commerce landscape. This growth is supported by factors such as the rising emphasis on health and wellness, increasing demand for convenient access to medications, and the expansion of e-commerce platforms offering a wide range of health-related products. Companies like Newpharma have established themselves as significant market providers for online non-prescription medications, while regulatory frameworks supporting B2B e-commerce in the pharmacy sector have helped build consumer trust and drive market growth.

Digital Health Solutions in Belgium E-commerce Market

The digital health solutions component within the pharmacy segment has become increasingly prominent in Belgium’s e-commerce landscape. This subsector is characterized by the integration of advanced technologies such as AI-powered health monitoring systems, personalized medication management platforms, and digital prescription services. E-commerce platforms are leveraging data analytics and AI technologies to offer personalized health solutions, including tailored recommendations for medications, vitamins, and supplements based on individual health profiles and preferences. The growth in this sector is further supported by the Belgian government’s initiatives to promote digital healthcare solutions, including the establishment of special approval processes for digital health applications through the mHealth pyramid framework. The segment has seen significant developments with major online pharmacies expanding their digital service offerings, implementing secure online transaction systems, and enhancing their delivery capabilities to meet the growing demand for digital health solutions.

Remaining Segments in Belgium E-commerce Pharmacy Market

The Belgium e-commerce pharmacy market encompasses several other important segments beyond traditional online pharmacies and digital health solutions. These include over-the-counter medications, health and wellness products, medical supplies, and personal care items. The wellness products segment has gained significant traction with the increasing focus on preventive healthcare and lifestyle management. Medical supplies and equipment for home use represent another crucial segment, catering to the growing demand for convenient access to healthcare products. Personal care and hygiene products have also become an integral part of the online pharmacy marketplace, driven by changing consumer preferences and the convenience of home delivery. These segments collectively contribute to the diverse ecosystem of the online pharmacy market, offering consumers a comprehensive range of healthcare products and services through digital platforms.

Segment Analysis: Pet Food and Accessories

Premium Pet Food Segment in Belgium E-commerce Market

The premium pet food segment has emerged as the dominant force in Belgium’s e-commerce pet care market, driven by increasing consumer preference for high-quality, organic, and natural pet food options. This segment’s growth is fueled by the rising trend of pet humanization, where pets are increasingly considered family members, leading to higher spending on premium nutrition products. E-commerce platforms like zooplus.be and maxizoo.be have expanded their premium pet food offerings to meet this growing demand, featuring products that emphasize natural ingredients, grain-free options, and specialized dietary formulations. The segment’s success is further supported by the increasing awareness among Belgian pet owners about the importance of proper nutrition for their pets’ health and well-being, leading to a shift away from conventional pet food options towards premium alternatives.

Personalized Nutrition Segment in Belgium E-commerce Market

The personalized nutrition segment is experiencing remarkable growth in Belgium’s e-commerce pet care market, leveraging advanced data analytics and AI technologies to provide tailored nutritional solutions. E-commerce retailers are increasingly adopting sophisticated algorithms to analyze factors such as breed, age, weight, and dietary preferences to offer customized pet food recommendations. This technological integration allows for more precise nutritional targeting, enabling pet owners to make informed decisions about their pets’ dietary needs. The segment’s growth is further accelerated by the rising demand for specialized diets addressing specific health conditions, allergies, and lifestyle requirements of pets, with online platforms providing detailed nutritional information and expert guidance to help pet owners make appropriate choices.

Remaining Segments in Pet Food and Accessories Market

Beyond premium food and personalized nutrition, the Belgian e-commerce pet care market encompasses several other significant segments, including pet accessories, grooming supplies, and wellness products. The accessories segment includes a wide range of products from toys and behavioral enrichment items to essential supplies like beds, carriers, and feeding equipment. The grooming supplies segment caters to the increasing demand for professional-grade grooming products for home use, while the wellness segment focuses on supplements and preventive care products. These segments are complemented by subscription-based services that offer regular deliveries of pet supplies, providing convenience and cost savings for pet owners while ensuring consistent access to essential products.

Belgium E-Commerce Industry Overview

Top Companies in Belgium E-commerce Market

The Belgium e-commerce market features prominent players including bol.com, Alibaba, Amazon, Zalando, and Temu, who are driving innovation across multiple dimensions. These companies are increasingly focused on technological advancement through investments in artificial intelligence, augmented reality for virtual try-ons, and enhanced logistics capabilities to improve delivery speeds. Operational agility is being achieved through the development of omnichannel retail strategies, integration of multiple payment solutions, and optimization of warehouse management systems. Strategic initiatives include expanding product categories, forming partnerships with local retailers, and implementing sustainability practices across operations. Market expansion efforts are characterized by localization of services, including multi-language support in French and Dutch, development of mobile commerce capabilities, and establishment of strategic logistics partnerships to enhance last-mile delivery services.

Mixed Market Structure with Growing Consolidation

The Belgian e-commerce landscape exhibits a semi-consolidated structure with a mix of global powerhouses and specialized local players competing for market share. Global conglomerates like Amazon and Alibaba leverage their extensive resources and advanced technological capabilities to maintain strong market positions, while regional specialists such as bol.com focus on deep local market understanding and customized offerings. The market is characterized by increasing consolidation through strategic partnerships and acquisitions, as evidenced by initiatives like Zalando’s Connected Retail program enabling brick-and-mortar retailers to integrate with their e-commerce platform.

The competitive dynamics are shaped by both horizontal and vertical integration strategies, with companies expanding across product categories and deepening their involvement in the value chain. Major players are increasingly investing in logistics infrastructure, payment systems, and customer service capabilities to strengthen their market presence. The market shows a trend toward ecosystem development, where players are building comprehensive platforms that integrate various services including shopping, entertainment, and financial services, creating higher barriers to entry for new competitors.

Innovation and Localization Drive Future Success

Success in the Belgian e-commerce market increasingly depends on companies’ ability to balance technological innovation with local market adaptation. Incumbent players must focus on developing sophisticated data analytics capabilities to personalize customer experiences, while also investing in sustainable practices and ethical sourcing to meet growing consumer demands. The integration of emerging technologies like voice commerce and augmented reality, combined with robust cybersecurity measures, will be crucial for maintaining a competitive advantage. Companies must also navigate the complex regulatory landscape, particularly regarding data privacy and consumer protection, while maintaining operational efficiency.

For contenders seeking to gain market share, success will hinge on identifying and serving underserved market niches, developing innovative last-mile delivery solutions, and building strong partnerships with local retailers and service providers. The ability to offer unique value propositions through specialized product categories or superior customer service will be crucial for differentiation. Companies must also focus on building trust through transparent practices and strong customer support, while maintaining flexibility to adapt to changing consumer preferences and regulatory requirements. The development of mobile-first strategies and integration of social commerce capabilities will be particularly important for capturing younger consumer segments. Additionally, leveraging advanced e-commerce software can enhance operational efficiency and customer engagement.

Belgium E-Commerce Market Leaders

-

- bol.com

- Coolblue

- Amazon

- Zalando

- Vanden Borre NV

- *Disclaimer: Major Players sorted in no particular order

Belgium E-Commerce Market News

- April 2022 – ViaEurope, an e-commerce logistics company, has launched a fully automatic sorting belt in its Liege E-Hub. This new system can handle over 3.500 parcels per hour, scan barcodes on five sides of the package, weigh it, measure it, and capture pictures. This system launch was according to the company’s commitment to operational safety and efficiency.

- February 2022 – Amazon has announced its plan to build its first fulfillment center by the end of 2020 at Antwerp’s new Blue Gate area. This center enables the company to supply parcels to small and medium-sized local delivery companies.

Belgium E-Commerce Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter’s Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Key Market Trends and Share of E-commerce of Total Retail Sector

- 4.4 Impact of COVID-19 on the E-commerce Sales

5. MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Internet Penetration Across the Country

- 5.1.2 Increased Adoption of Smartphones

- 5.2 Market Challenges

- 5.2.1 Lack of digital skills/ knowledge

- 5.3 Analysis of Key Demographic Trends and Patterns Related to E-commerce Industry in Belgium (Coverage to include Population, Internet Penetration, ecommerce Penetration, Age & Income etc.)

- 5.4 Analysis of the Key Modes of Transaction in the E-commerce Industry in Belgium (coverage to include prevalent modes of payment such as cash, card, bank transfer, wallets, etc.)

- 5.5 Analysis of Cross-border E-commerce Industry in Belgium (Current market value of cross-border & key trends)

- 5.6 Current Positioning of Belgium in the E-commerce Industry in Europe

6. MARKET SEGMENTATION

- 6.1 By B2C E-commerce

- 6.1.1 Market size (GMV) for the period of 2017-2027

- 6.1.2 Market Segmentation – by Application

- 6.1.2.1 Beauty & Personal Care

- 6.1.2.2 Consumer Electronics

- 6.1.2.3 Fashion & Apparel

- 6.1.2.4 Food & Beverage

- 6.1.2.5 Furniture & Home

- 6.1.2.6 Others (Toys, DIY, Media, etc.)

- 6.2 By B2B E-commerce

- 6.2.1 Market size for the period of 2017-2027

7. COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 bol.com

- 7.1.2 Coolblue

- 7.1.3 Amazon

- 7.1.4 Zalando

- 7.1.5 Vanden Borre NV

- 7.1.6 Brico Group

- 7.1.7 BIRKENSHOP

- 7.1.8 Birbante

- 7.1.9 Qpon

- 7.1.10 Veepee

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. FUTURE OUTLOOK OF THE MARKET

Belgium E-Commerce Industry Segmentation

B2 B E-commerce and B2C E-commerce segment the Belgium e-commerce market. By B2C E-commerce, the market studied is further subdivided into beauty & personal care, consumer electronics, fashion & apparel, food & beverage, and furniture & home. The report studies the impact of covid-19 on the studied market.

| By B2C E-commerce | Market size (GMV) for the period of 2017-2027 | ||

| Market Segmentation – by Application | Beauty & Personal Care | ||

| Consumer Electronics | |||

| Fashion & Apparel | |||

| Food & Beverage | |||

| Furniture & Home | |||

| Others (Toys, DIY, Media, etc.) | |||

| By B2B E-commerce | Market size for the period of 2017-2027 | ||

Belgium E-Commerce Market Research FAQs

The Belgium E-commerce Market is projected to register a CAGR of 7.42% during the forecast period (2025-2030)

bol.com, Coolblue, Amazon, Zalando and Vanden Borre NV are the major companies operating in the Belgium E-commerce Market.

The report covers the Belgium E-commerce Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Belgium E-commerce Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.