Autonomous Tractor Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Global Autonomous Tractors Market is Segmented by Horsepower (Up to 30HP, 31HP to 100HP, and Above 100HP), Automation (Fully Automated and Semi-automated), and Geography (North America, Europe, Asia-Pacific, South America, and Africa). The report offers market estimation and forecasts in terms of value in USD million for the above-mentioned segments.

Autonomous Tractor Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Autonomous Tractors Market Size

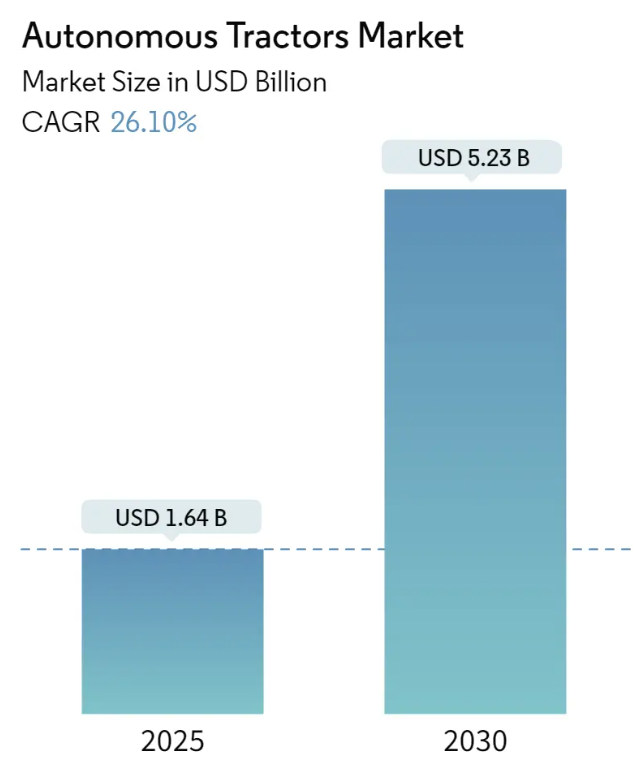

| Study Period | 2019 – 2030 |

| Market Size (2025) | USD 1.64 Billion |

| Market Size (2030) | USD 5.23 Billion |

| CAGR (2025 – 2030) | 26.10 % |

| Fastest Growing Market | North America |

| Largest Market | Asia-Pacific |

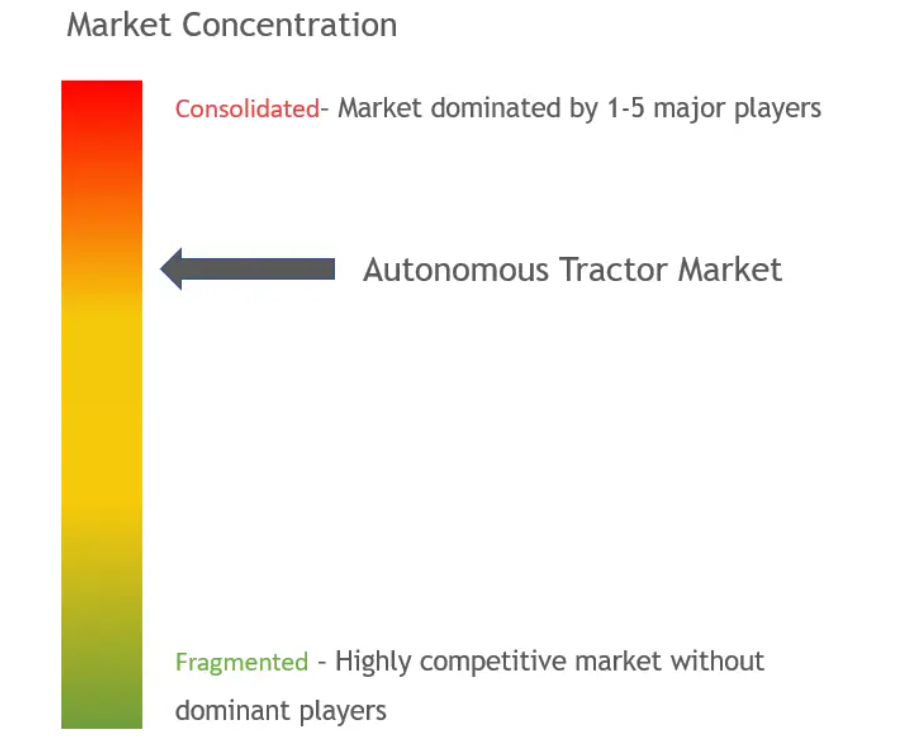

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Autonomous Tractors Market with other markets in Agriculture Industry

Seeds

Crop Protection

Fertilizers

Agricultural Commodities

Agriculture Services

Agricultural Machinery and Technology

Autonomous Tractor Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 26.10% (2025 – 2030) |

| Countries/ Region Covered: | North America,Europe,Asia-Pacific,South America,Africa |

| Major Players: | Kubota, Yanmar, AGCO, Deere & Company, CNH Industrial |

Autonomous Tractors Market Analysis

The Autonomous Tractors Market size is estimated at USD 1.64 billion in 2025, and is expected to reach USD 5.23 billion by 2030, at a CAGR of 26.1% during the forecast period (2025-2030).

- Agricultural labor is decreasing due to the cost of farm labor rising. Farmers are increasingly adopting agricultural mechanization as a substitute for manual labor and offering more cost-effective, easily available, and efficient agricultural operations. Tractors are the primary source of power for driving agricultural machinery. This is observed to contribute to market growth over the long term.

- The semi-autonomous systems operate independently enough within reasonable distances that the farmer can intervene if any problems occur, and therefore, they are more viable than fully autonomous equipment. Because of the operator’s presence in agricultural vehicles, the safety of such a semi-autonomous system can be easily ensured without the incorporation of costly sensors and complicated sensor fusion algorithms, making them the most feasible for farmers to purchase, especially in developing countries.

Autonomous Tractors Market Trends

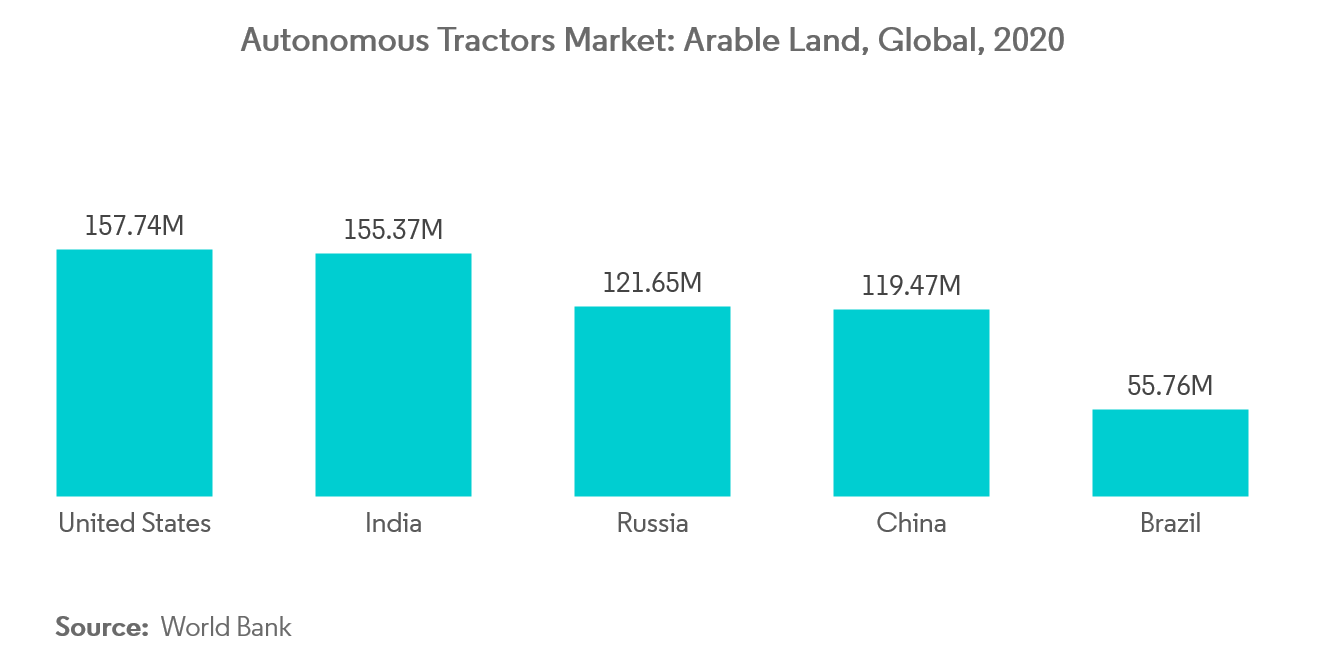

Shortage of Farm Labor and Declining Arable Land

- Due to decreasing agricultural labor, the prices of farm labor are rising. The cost of farm labor directly relates to the percentage of a country’s total population employed in agriculture, considering simple demand-supply economics, thereby affecting the agricultural tractors market.

- On average, developing economies have larger percentages of the population dependent on agriculture. However, the percentages have decreased as many people migrate yearly to urban areas. According to the World Bank’s database, agricultural employment out of total employment fell drastically from 29.43% in 2014 to 26.75% in 2019 globally.

- As technologically assisted agriculture needs skilled labor, of which there is an acute shortage, farmers are adopting technologies such as autonomous tractors that can be productive, considering the current challenge. This scenario is one of the major factors that drive the market forward.

- According to the Indian Council of Food and Agriculture (ICFA), the percentage of agriculture workers in India is estimated to decline by 25.7% in 2050. As agriculture needs skilled laborers with an acute shortage of availability, farmers are adopting technologies such as autonomous tractors that can be productive, considering the current challenge. This scenario is one of the major factors that drive the market forward.

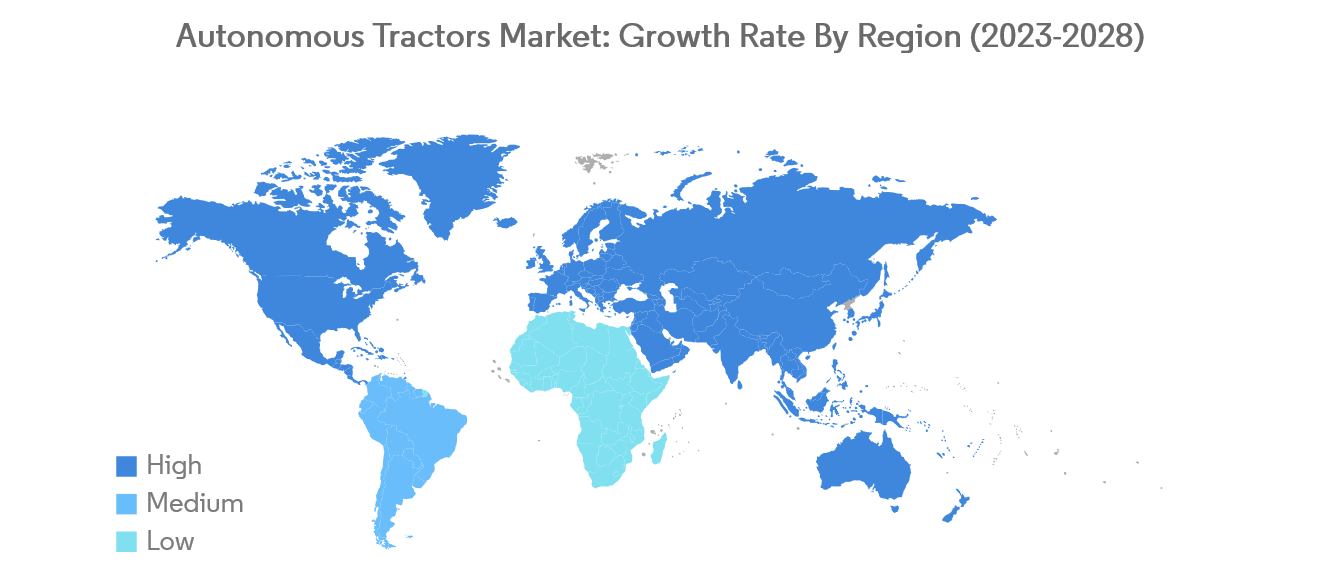

North America Projected to be Fastest-Growing Market

- North America accounted for the largest market share in 2022 while also rapidly advancing in the market growth over the forecast period(2023-2028). The higher disposable incomes of farmers, lack of trained farm labor, and well-developed technology are expected to be the primary reasons for the future expansion of the North American autonomous tractors market.

- Since North America is a developed region, farms are usually large, and customer loyalty is high. The demand for high-powered tractors in the US is starting to gain traction. The US is the largest market for autonomous tractors in the North American region.

- The government’s support for sustainable production techniques, such as precision farming, involving the integration of the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) is boosting the demand for automated technologies. Therefore, this may result in the significant growth of the autonomous tractors market in the US during the forecast period.

- Further, Canadian farmers are also showing interest in adopting autonomous tractors as they would save time and decrease operating costs. Therefore, this may indicate a positive sign for market growth over the coming years.

Autonomous Tractors Industry Overview

The autonomous tractors market is fairly consolidated. The major players in this market are focused on innovation and launching new products globally. Since the market’s inception is very recent, it is considered a consolidated market with a few players holding most of the market share. The top players in the market are Deere and Co, CNH Industrial, AGCO Corporation, Kubota, and Yanmar. The companies were involved in various strategic activities such as product innovations, expansions, partnerships, and mergers and acquisitions.

Autonomous Tractors Market Leaders

- Kubota Corporation

- Yanmar Co. Ltd.

- AGCO Corporation

- John Deere

- CNH Industrial

- *Disclaimer: Major Players sorted in no particular order

Autonomous Tractors Market News

- January 2022: Deere & Co. stated that it developed a fully autonomous tractor designed for large-scale farming and sold the machine later that year.

- March 2021: CNH Industrial has completed a minority investment in a US-based agriculture technology company Monarch Tractor. Monarch pioneered tractor technology incorporating electrification, autonomous use, and data management and developed an electric tractor platform that combines a fully-electric powertrain with autonomous technologies to help advance farming operations.

Autonomous Tractors Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Horsepower

- 5.1.1 Up to 30 HP

- 5.1.2 31 HP to 100 HP

- 5.1.3 Above 100 HP

- 5.2 Automation

- 5.2.1 Fully Automated

- 5.2.2 Semi-automated

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Russia

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AGCO

- 6.3.2 John Deere

- 6.3.3 Mahindra and Mahindra Ltd

- 6.3.4 Autonomous Tractor Corporation

- 6.3.5 CNH Industrial

- 6.3.6 Kubota Corporation

- 6.3.7 Dutch Power Company

- 6.3.8 Yanmar Co. Ltd

- 6.3.9 Zimeno Inc. (DBA Monarch Tractor)

- 6.3.10 AutoNext Automation

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Autonomous Tractors Industry Segmentation

An autonomous tractor is mainly a driverless tractor that uses several components like GPS, sensors, laser diodes, and other devices for agricultural tasks. It is either fully automated or semi-automated, whereby the tractor is managed using a remote control from a distance.

The autonomous tractors market is segmented by horsepower (Up to 30HP, 31HP to 100HP, and Above 100HP), automation (fully automated and semi-automated), and Geography (North America, Europe, Asia-Pacific, South America, and Africa).

The report offers market estimation and forecast of the autonomous tractor market in terms of value in USD million for the above-mentioned segments.

| Horsepower | Up to 30 HP | |

| 31 HP to 100 HP | ||

| Above 100 HP | ||

| Automation | Fully Automated | |

| Semi-automated | ||

| Geography | North America | US |

| Canada | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| Spain | ||

| France | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | India |

| China | ||

| Japan | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Africa | South Africa |

| Rest of Africa |

Autonomous Tractors Market Research FAQs

The Autonomous Tractors Market size is expected to reach USD 1.64 billion in 2025 and grow at a CAGR of 26.10% to reach USD 5.23 billion by 2030.

In 2025, the Autonomous Tractors Market size is expected to reach USD 1.64 billion.

Kubota Corporation, Yanmar Co. Ltd., AGCO Corporation, John Deere and CNH Industrial are the major companies operating in the Autonomous Tractors Market.

North America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the Asia-Pacific accounts for the largest market share in Autonomous Tractors Market.

In 2024, the Autonomous Tractors Market size was estimated at USD 1.21 billion. The report covers the Autonomous Tractors Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Autonomous Tractors Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.