Asia-Pacific Explosion Proof Equipment Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Asia-Pacific Explosion-Proof Equipment Market Report is Segmented by Type (Explosion Proof, Explosion Prevention, and Explosion Segregation), Zone (Zone 0, Zone 20, Zone 1, Zone 21, Zone 2, and Zone 22), End User (Pharmaceutical, Chemical and Petrochemical, Energy and Power, Mining, Food Processing, Oil and Gas, and Other End Users), System (Power Supply System, Material Handling, Motor, Automation System, Surveillance System, and Other Systems), and Country (China, India, Japan, and Rest of Asia-Pacific). The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

Asia-Pacific Explosion Proof Equipment Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

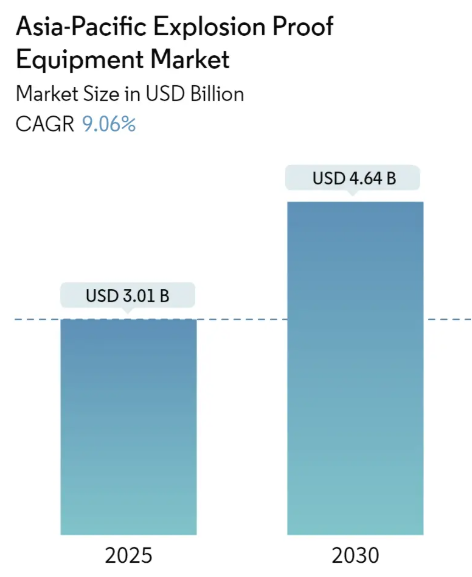

Asia-Pacific Explosion Proof Equipment Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

| Market Size (2025) | USD 3.01 Billion |

| Market Size (2030) | USD 4.64 Billion |

| CAGR (2025 – 2030) | 9.06 % |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Asia-Pacific Explosion Proof Equipment Market with other markets in Technology, Media and Telecom Industry

Asia-Pacific Explosion Proof Equipment Market Analysis

The Asia-Pacific Explosion Proof Equipment Market size is estimated at USD 3.01 billion in 2025, and is expected to reach USD 4.64 billion by 2030, at a CAGR of 9.06% during the forecast period (2025-2030).

The Asia-Pacific explosion-proof equipment industry is experiencing significant transformation driven by rapid industrialization and technological advancements in manufacturing processes. The integration of smart manufacturing solutions and Industry 4.0 technologies has led to increased adoption of automated systems and equipment in hazardous environments. This digital transformation has particularly impacted the mining sector, where the implementation of monitoring systems and asset management solutions has become crucial for operational safety. The advent of connected devices and IoT integration in hazardous locations has created new opportunities for explosion-proof equipment manufacturers to develop more sophisticated and intelligent safety solutions.

The energy sector’s evolution has become a significant catalyst for market development, particularly in renewable energy infrastructure. In Vietnam, under the draft Power Development Plan 8 (PDP 8), significant expansions are planned with gas-powered capacity projected to increase from 7 GW to 28-33 GW by 2030, while wind power capacity is expected to grow from 600 MW to over 18-19 GW. This transformation in energy infrastructure has created new requirements for explosion-proof equipment across power generation facilities, particularly in areas where traditional and renewable energy systems interface.

The manufacturing sector has witnessed substantial investments in safety infrastructure, particularly in chemical and petrochemical facilities. In November 2021, Sumitomo Chemical announced the establishment of a new production plant for polypropylene compounds in Wuxi, Jiangsu Province, China, demonstrating the ongoing industrial expansion in the region. The increasing complexity of manufacturing processes and the handling of hazardous materials have necessitated more sophisticated explosion-proof solutions, particularly in automated material handling systems and process control equipment.

Recent technological innovations have focused on enhancing the intelligence and connectivity of explosion-proof equipment. In January 2024, ABB launched a new flameproof equipment line specifically designed for applications in potentially explosive environments, featuring advanced reliability features and reduced maintenance requirements. The industry has also seen significant developments in explosion-proof surveillance systems, with manufacturers introducing advanced thermal imaging capabilities and intelligent monitoring solutions. These innovations reflect the industry’s movement toward more sophisticated, integrated safety solutions that combine traditional explosion-proof characteristics with smart technology features.

Asia-Pacific Explosion Proof Equipment Market Trends

Stricter Regulations for Handling Hazardous Areas and Substances

The implementation of increasingly stringent regulations for handling hazardous materials and areas has become a primary driver for the explosion protection equipment market. Industrial safety organizations like IEC, ATEX, and OSHA have been proactively working towards providing safe and conducive working conditions by stipulating comprehensive standards for workplaces. These regulations are centered on the mandatory use of explosion-proof equipment across major industries, particularly in sectors such as oil and gas, petrochemicals, and mining, where the risk of explosions is significantly high. The standards set by these regulatory bodies differ in terms of classifying areas and equipment in hazardous environments, with many countries operating in accordance with their own variants of the IEC standards.

The regulatory frameworks and standards undergo periodic updates to account for changes in the composition of hazardous substances and to maintain relevance in a highly dynamic environment. For instance, in China, a new regulation came into existence where most Ex-products sold must be covered by a new CCC Explosion product certification. These certification rules apply to both Ex-production quality of manufacturing done inside China and to the Ex-production quality of manufacturing done outside China. Additionally, organizations like the Central Institute of Mining & Fuel Research (CIMFR) in India, the Central Power Research Institute (CPRI), and various other testing laboratories offer product testing and certification facilities for explosion-protected equipment, further emphasizing the growing importance of compliance with safety standards.

Increasing Energy Requirements Driving the Demand for Exploration of New Mines and Oil and Gas Resources

The growing global energy demand has significantly accelerated the exploration of new mines and oil and gas resources, consequently driving the demand for explosion-proof equipment. According to the International Energy Agency (IEA), China alone is expected to account for 280 billion cubic meters of the global natural gas demand by 2040, and the country is projected to overtake the United States as the top oil consumer with net imports of 13 million barrels per day by 2040. This substantial increase in energy requirements has led to the development of new exploration sites and processing facilities, all of which require robust safety measures and explosion-proof equipment to prevent accidents and ensure worker safety.

The expansion of mining operations and oil exploration activities has also highlighted the critical need for enhanced safety measures, particularly in regions with historically poor safety records. For instance, in China’s northeastern Shandong province, recent mining accidents involving explosions and damaged communication systems have emphasized the urgent need for better safety equipment and protocols. Similarly, India’s increasing focus on oil exploration, particularly in the Arabian Sea, and China’s activities in the Juggar Basin have created new demands for explosion-proof equipment. These developments are complemented by various government initiatives and investments in the exploration processes, as evidenced by the Petroleum Planning and Analysis Cell’s projections for India’s crude oil production recovery by the end of FY2024, driven by upcoming investments in exploration processes.

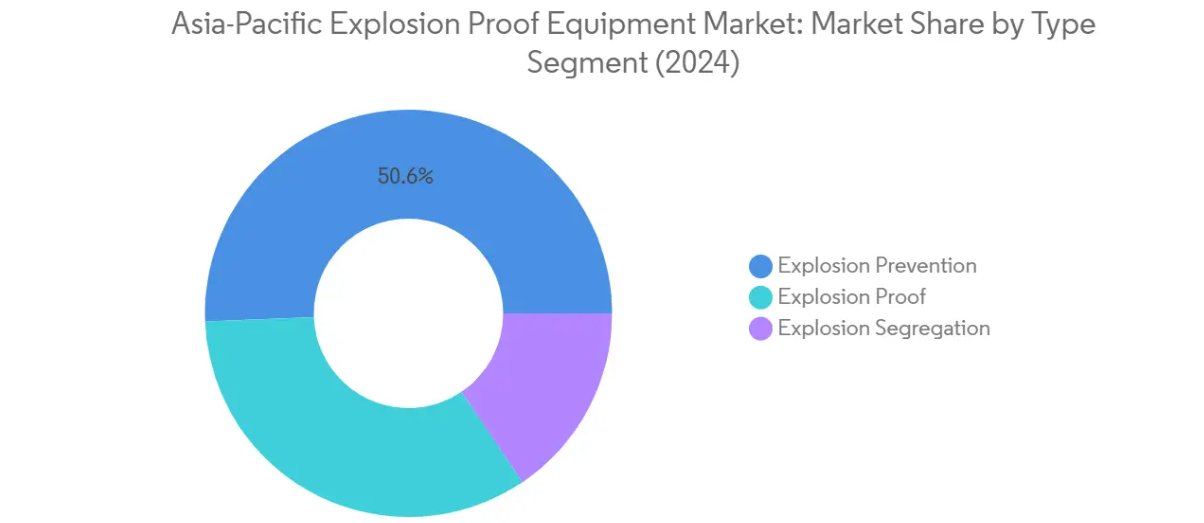

Segment Analysis: By Type

Explosion Prevention Segment in Asia-Pacific Explosion Proof Equipment Market

The explosion proof equipment segment continues to dominate the Asia-Pacific explosion-proof equipment market, holding approximately 51% of the market share in 2024. This segment’s prominence is driven by the increasing adoption of intrinsically safe and enhanced safety equipment across hazardous industrial environments. The segment encompasses various prevention methods, including inerting, which involves oxidant concentration reduction techniques to make flame propagation impossible. The widespread recognition of intrinsic safety standards, coupled with advantages like high reliability, ease of installation and maintenance, lower downtime, and cost-effectiveness, has contributed to this segment’s market leadership. Additionally, the growing implementation of pneumatics and fiber optics technologies in explosion prevention systems has further strengthened this segment’s position in the market.

Explosion Segregation Segment in Asia-Pacific Explosion Proof Equipment Market

The Explosion Segregation segment is projected to exhibit the highest growth rate of approximately 9% during the forecast period 2024-2029. This robust growth is attributed to the increasing adoption of pressurization and oil immersion techniques in hazardous environments. The segment’s growth is further fueled by the rising demand for hermetic sealing, encapsulation, and restricted breathing solutions across various industries. The reduction in hazard classification requirements, the relatively simple nature of the equipment, and the lower cost of significant equipment are key factors driving this segment’s rapid expansion. Moreover, the growing trend toward customized industrial enclosures and the increasing incorporation of smart devices and sensors in process industries are creating new opportunities for explosion segregation equipment manufacturers.

Remaining Segments in Type Segmentation

The Explosion Proof segment represents a significant portion of the market, offering critical protection in hazardous environments through specialized enclosures and equipment designs. This segment focuses on containing potential explosions within the equipment housing while preventing the propagation of flames to the external environment. The segment’s importance is particularly evident in applications requiring high power levels, unlike intrinsic safety solutions. The comprehensive range of explosion-proof solutions, including enclosures, lighting systems, and control equipment, continues to play a vital role in ensuring safety across various industrial applications, particularly in high-risk environments where explosion containment is crucial.

Segment Analysis: By Zone

Zone 2 Segment in Asia-Pacific Explosion Proof Equipment Market

Zone 2 has emerged as the dominant segment in the Asia-Pacific explosion-proof equipment market, commanding approximately 35% of the market share in 2024. This significant market position is attributed to the segment’s widespread application across industries where ignitable concentrations of flammable gas vapors or liquids are usually not present under normal operating conditions. The segment’s dominance is particularly evident in the oil and gas industry, where areas with limited presence of combustible gas are high. Zone 2 applications have also seen substantial adoption in mining, power, and chemical and petrochemical industries, owing to the nature of processes conducted. The increasing adoption of LED technology has made it relatively easier to certify lighting fixtures for Zone 2 locations, contributing to its market leadership.

Zone 21 Segment in Asia-Pacific Explosion Proof Equipment Market

The Zone 21 segment is projected to experience the highest growth rate of approximately 11% during the forecast period 2024-2029. This accelerated growth is primarily driven by the segment’s critical applications in the mining industry, chemicals and petroleum sectors, and water and wastewater treatment plants, owing to the varied kinds of impurities present in separation and purification activities. The segment’s growth is further bolstered by the increasing adoption of automation solutions, particularly in monitoring systems and material handling equipment. Zone 21 regions require at least Category 2 marked equipment, and the performance requirements for IP68 in Zone 21 hazardous areas are becoming increasingly stringent, especially in applications prone to flooding, tidal shift, or unforeseen events.

Remaining Segments in Zone Segmentation

The other zones in the market – Zone 0, Zone 20, Zone 1, and Zone 22 – each serve specific industrial applications with varying levels of hazard protection requirements. Zone 0 and Zone 20 are characterized by continuous presence of explosive atmospheres, requiring the highest level of protection equipment. Zone 1 is typically found in areas where explosive atmospheres are likely to occur in normal operation, while Zone 22 addresses areas where explosive dust atmospheres are not likely to occur in normal operation but require protection nonetheless. These segments collectively contribute to the comprehensive safety framework required across different industrial applications, from petrochemical facilities to food processing plants.

Segment Analysis: By End User

Oil and Gas Segment in Asia-Pacific Explosion Proof Equipment Market

The oil and gas industry dominates the Asia-Pacific explosion-proof equipment market, commanding approximately 28% of the market share in 2024. This significant market position is driven by the critical need for safety equipment in potentially explosive environments present throughout oil and gas operations, from extraction to processing and storage. The segment’s dominance is reinforced by stringent safety regulations requiring explosion proof apparatus in areas with flammable gases, vapors, or combustible dust. The presence of hazardous materials and the high-risk environment in oil and gas facilities necessitates comprehensive safety measures, particularly in offshore platforms, refineries, and processing plants. The segment is also experiencing the fastest growth rate of around 9% during the forecast period 2024-2029, driven by increasing energy requirements, new oil and gas exploration activities, and the expansion of LNG facilities across the Asia-Pacific region.

Remaining Segments in End-User Segmentation

The chemical and petrochemical sector represents a substantial portion of the market, driven by the handling of volatile substances and the need for safety in processing facilities. The mining sector maintains significant market presence due to the inherent risks associated with underground operations and the presence of combustible dust. The pharmaceutical segment is growing steadily due to the increasing number of manufacturing facilities and stringent safety requirements in drug production processes. The energy and power sector’s demand is primarily driven by power generation facilities and grid distribution networks, while the food processing industry requires explosion proof equipment primarily for handling combustible dust in processing and storage facilities. Each of these segments contributes uniquely to the market’s growth, with varying requirements for explosion-proof equipment based on their specific operational hazards and safety protocols.

Segment Analysis: By System

Power Supply System Segment in Asia-Pacific Explosion Proof Equipment Market

The power supply system segment dominates the Asia-Pacific explosion proof power supplies market, holding approximately 24% market share in 2024. This significant market position is driven by the segment’s crucial role in providing continuous and reliable power supply during high fluctuations across various industries like manufacturing, energy, and power. Power supply systems are installed according to strict area classifications such as Division 1 and Division 2, with most installations occurring in Zone 1 or 21. The segment’s strength is further reinforced by its flexibility with modular approaches in design and excellent maintainability when allocated to equipment. These systems are particularly vital in verticals requiring continuous power supply during high fluctuation periods, with output voltages ranging from a few hundred volts to over three hundred kilovolts and power levels from a few watts to over 50kW.

Automation System Segment in Asia-Pacific Explosion Proof Equipment Market

The automation system segment is projected to experience the highest growth rate of approximately 10% during the forecast period 2024-2029. This robust growth is primarily driven by the increasing adoption of automated systems in hazardous locations where human intervention is impossible or risky. The segment’s expansion is further fueled by the growing implementation of monitoring systems, asset management systems, and the rising trend of smart mining solutions. The advent of smart mining and the creation of Connected Mine concepts has led to increased deployment of monitoring systems and asset management solutions, all requiring explosion-proof certification. The segment’s growth is also supported by the increasing use of automated systems and equipment that enable companies to gain competitive advantages, reduce downtime, and improve product quality through enhanced accuracy and precision of operations.

Remaining Segments in System Segmentation

The other significant segments in the market include material handling systems, motors, surveillance systems, and various other specialized systems. Material handling systems play a crucial role in chemical, printing, waste management, and food & beverage industries, where gas mixtures and vapors are common byproducts. The motor segment serves as a fundamental component in major and minor equipment deployed across industries, from pumps and compressors to valves. Surveillance systems are essential in hazardous industries for monitoring and maintaining safety protocols, particularly in chemical processing plants, oil refineries, and printing industries. The remaining specialized systems category encompasses various essential components such as cable glands, lighting systems, switches, and signaling systems, each contributing to the overall safety and efficiency of explosion-proof operations. The explosion proof audible and visual signaling devices market is also a critical part of these systems, ensuring timely alerts and warnings in hazardous environments.

Asia-Pacific Explosion Proof Equipment Market Geography Segment Analysis

Asia-Pacific Explosion-Proof Equipment Market in China

China dominates the Asia-Pacific explosion-proof equipment market, commanding approximately 46% of the total market share in 2024. The country’s robust manufacturing sector, coupled with stringent safety regulations, particularly the CCC certification requirements for China explosion-proof tools, has created a strong foundation for market growth. The nation’s commitment to industrial safety is evident through its continuous monitoring and implementation of laws related to explosion-proof products, especially in hazardous locations. The expansion of smart manufacturing solutions and the integration of technologies like 5G and autonomous systems in explosion-proof equipment demonstrate China’s innovative approach to industrial safety. The country’s focus on developing intelligent monitoring devices for underground pipe networks and the implementation of advanced safety systems in various industrial sectors has further strengthened its market position. Additionally, China’s significant investments in LNG facilities and petrochemical complexes have created substantial opportunities for explosion-proof equipment manufacturers.

Asia-Pacific Explosion-Proof Equipment Market in India

India’s explosion-proof equipment market is projected to grow at nearly 8% CAGR from 2024 to 2029, driven by its rapidly expanding industrial base and increasing focus on safety regulations. The country’s position as a key manufacturing hub, supported by initiatives like ‘Make in India,’ has created significant opportunities for explosion-proof equipment manufacturers. The presence of vital resources, including a large labor market and technically skilled workforce, has made India an attractive destination for manufacturing medical drugs and products. The country’s robust power generation capacity, ranking third globally in electricity production, has necessitated extensive use of explosion-proof equipment in power facilities. The expansion of local manufacturing capabilities, particularly in hazardous area equipment, has been supported by collaborations between international certification bodies and local laboratories. The growing emphasis on safety in pharmaceutical manufacturing, coupled with the increasing number of WHO-GMP approved production premises, has further accelerated market growth.

Asia-Pacific Explosion-Proof Equipment Market in Japan

Japan’s explosion-proof equipment market is characterized by its advanced manufacturing capabilities and strong focus on technological innovation. The country’s emphasis on Industry 4.0 and IoT adoption has led to increased demand for sophisticated explosion-proof equipment in smart manufacturing facilities. Japanese manufacturers are particularly focused on developing robust design explosion-proof models with global standards, exemplified by continuous product innovations from local companies. The country’s commitment to workplace safety is reflected in its stringent regulatory framework and regular safety audits across industrial facilities. The government’s “Rebirth of Japan” plan, which aims to strengthen the manufacturing sector, has created new opportunities for explosion-proof equipment providers. The integration of advanced technologies like plant inspection robots with explosion-proof features demonstrates Japan’s innovative approach to industrial safety. The country’s focus on sustainable growth in manufacturing sectors has also influenced the development of more efficient and environmentally conscious explosion-proof solutions.

Asia-Pacific Explosion-Proof Equipment Market in Other Countries

The explosion-proof equipment market in other Asia-Pacific countries, including South Korea, Indonesia, and Australia, presents diverse growth opportunities across various industrial sectors. South Korea’s strong presence in the petrochemical industry and its position as one of Asia’s largest petroleum product exporters has created substantial demand for explosion-proof equipment. Indonesia’s significant mining sector and its focus on safety regulations in hazardous environments have driven market growth in the region. Australia’s expanding LNG output and robust food and beverage manufacturing sector have contributed to the increasing adoption of explosion-proof equipment. These countries are witnessing growing investments in infrastructure development and industrial safety measures, particularly in oil and gas, chemical processing, and manufacturing sectors. The implementation of stringent safety regulations and increasing focus on workplace safety across these nations continues to drive the demand for sophisticated explosion-proof camera solutions for the oil and gas market.

Asia-Pacific Explosion Proof Equipment Industry Overview

Top Companies in Asia-Pacific Explosion-Proof Equipment Market

The Asia-Pacific explosion-proof equipment market features established players like R. Stahl, Marechal Electric Group, ABB Limited, Pepperl+Fuchs, and Eaton Corporation leading the competitive landscape through continuous innovation and strategic initiatives. Companies are focusing on expanding their product portfolios through research and development, particularly in areas like intrinsically safe systems, explosion-proof enclosures, and automation solutions. The market is characterized by strategic partnerships and collaborations to enhance distribution networks and technical capabilities, especially in emerging economies like India and China. Operational agility is demonstrated through customized solutions for different industrial applications, while manufacturing facilities are being modernized to meet stringent quality and safety standards. Market leaders are also investing in digital transformation and Industry 4.0 capabilities to provide integrated explosion-proof solutions that align with evolving customer requirements across pharmaceutical, chemical, oil and gas, and mining sectors.

Market Structure Reflects Mix of Global-Local Players

The competitive landscape exhibits a balanced mix of global conglomerates and specialized regional manufacturers, with international players leveraging their broad product portfolios and technical expertise while local companies capitalize on market-specific knowledge and established customer relationships. Market consolidation is gradually increasing through strategic acquisitions, as evidenced by moves like Honeywell’s acquisition of RAE Systems and Pepperl+Fuchs’ acquisition of Ecom Instruments, indicating a trend toward comprehensive solution offerings. The presence of strong regional players, particularly in manufacturing hubs like China and India, creates a dynamic competitive environment where success depends on maintaining quality standards while adapting to local market requirements.

The market structure is further shaped by the increasing importance of certification compliance and safety standards, which creates significant barriers to entry but also drives collaboration between established players and local manufacturers. Companies are forming strategic alliances to combine technological capabilities with local market access, while also investing in regional manufacturing facilities to better serve specific market needs. The competitive dynamics are influenced by the growing emphasis on after-sales service and support networks, with companies establishing local presence through subsidiaries and authorized distribution partners.

Innovation and Compliance Drive Future Success

Success in the explosion-proof equipment market increasingly depends on maintaining a delicate balance between product innovation and regulatory compliance, with companies needing to invest in both technological advancement and certification processes. Market leaders are focusing on developing integrated solutions that combine explosion-proof capabilities with smart features and connectivity options, while also expanding their service offerings to include consultation and maintenance support. The concentration of end-users in specific industrial sectors necessitates deep industry knowledge and specialized solutions, while the high switching costs for customers create opportunities for long-term relationships through comprehensive service packages and technical support.

Companies looking to gain market share must focus on developing cost-effective solutions without compromising on safety standards, while also building strong local presence through strategic partnerships and distribution networks. The regulatory landscape continues to evolve, particularly in emerging economies, requiring companies to maintain flexibility in their product development and certification processes. Success factors include the ability to provide customized solutions for specific industrial applications, maintain strong relationships with certification bodies, and develop comprehensive training and support programs for end-users. The market shows limited threat of substitution due to strict safety requirements, but companies must continue to innovate in areas such as materials technology and digital integration to maintain competitive advantage. Additionally, the establishment of an explosion-proof tools factory can further enhance local production capabilities.

Asia-Pacific Explosion Proof Equipment Market Leaders

-

- R. Stahl Group

- Bartec GmbH

- Rae Systems (Acquired By Honeywell)

- ABB Limited

- Eaton Corporation Plc.

- *Disclaimer: Major Players sorted in no particular order