Asia Pacific Compound Feed Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Asia-Pacific (APAC) Compound Feed Market report is Segmented by Ingredients (Cereals, Oilseeds, Oil, Molasses, Supplements, and Other Ingredients), Supplements (Vitamins, Amino Acids, Antibiotics, Enzymes, Antioxidants, Acidifiers, Probiotics & Prebiotics, and Other Supplements), Animal Type (Ruminant, Swine, Poultry, Aquatic, and Other Animal Types), and Geography (China, India, Thailand, Japan, South Korea, and Australia). The market size is provided in terms of value USD for the above segment.

Asia Pacific Compound Feed Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Asia-Pacific Compound Feed Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

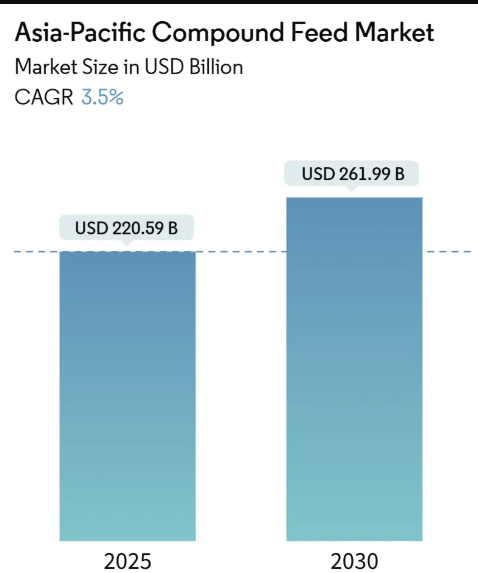

| Market Size (2025) | USD 220.59 Billion |

| Market Size (2030) | USD 261.99 Billion |

| CAGR (2025 – 2030) | 3.50 % |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Asia-Pacific Compound Feed Market with other markets in Animal Nutrition & Wellness Industry

Compound Feed

Feed Additives

Pet Care

Animal Farm Services

Asia Pacific Compound Feed Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 3.5% (2025 – 2030) |

| Countries/ Region Covered: | China, India, Japan, Thailand, Vietnam, Australia |

| Major Players: | Cargill Inc., Charoen Pokphand Foods, Alltech Inc., Japfa Group, New Hope Liuhe Group |

Asia-Pacific Compound Feed Market Analysis

The Asia-Pacific Compound Feed Market size is estimated at USD 220.59 billion in 2025, and is expected to reach USD 261.99 billion by 2030, at a CAGR of 3.5% during the forecast period (2025-2030).

- Livestock production has increased across Asian countries and animal categories to meet changing dietary preferences, particularly in developing markets. Although Asia’s livestock sector has predominantly industrialized, small-scale and marginal farmers continue to operate, especially in Southeast Asian countries. Fish and shrimp contribute significantly to human nutrition by providing essential nutrients. This has increased the focus on cultivating aquatic species like fish and shrimp for human consumption.

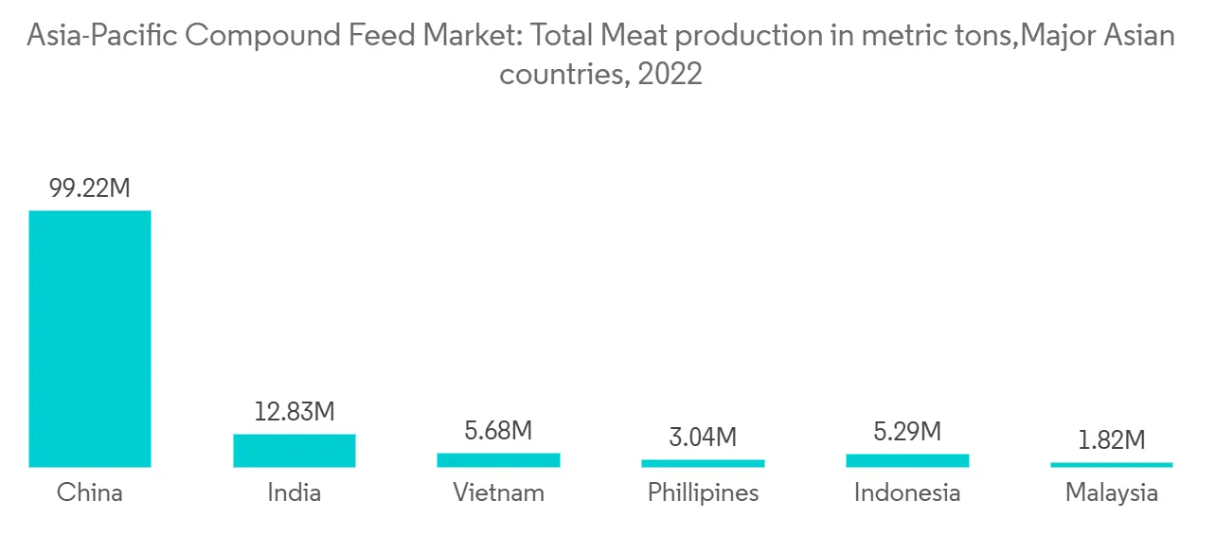

- Asia Pacific is the world’s largest region for both the production and consumption of compound feed, significantly impacting the global compound feed market. The region’s expanding industrial livestock production has increased feed production capacities in its major economies. According to the FAO, Asia’s 2023 production reached 119,751,152.0 metric tons for cattle, 39,259,127 metric tons for poultry, and 819,634,883 metric tons for pig meat. These figures represent an increase from 2022’s production of 117,215,477 metric tons for cattle, 38,147,481 metric tons for poultry, and 809,644,006 metric tons for pig meat.

Asia-Pacific Compound Feed Market Trends

Surge in Meat and Seafood Consumption

- In Asia, a growing middle class and increasing income levels are reshaping dietary preferences. This shift has led to a notable rise in per capita consumption of meat and seafood. According to a report by Asia Research and Engagement (ARE) 2021, meat and seafood consumption in Asia is projected to surge by 78% by 2050.

- As affluent and health-conscious consumers in both high-income and emerging nations shift their dietary preferences, global per capita availability of protein sources is projected to increase from 83.9g per day in the base period to 88.4g per day by 2032. Heightened awareness about the significance of protein-rich diets is driving this surge, particularly in the consumption of animal protein sources.

- In the Asia- Pacific region, fisheries and aquaculture are becoming vital sources of protein, foreign exchange, and livelihoods, significantly contributing to the population’s well-being. By 2032, Asia is projected to account for over 70% of global fish production, with the bulk of this increase anticipated from the region. China, India, Indonesia, and Vietnam are anticipated to be the primary drivers of this output growth. Looking ahead, the region is set to enhance livestock and aquaculture yields through improved feed management practices and a greater reliance on compound feed.

China dominates the market

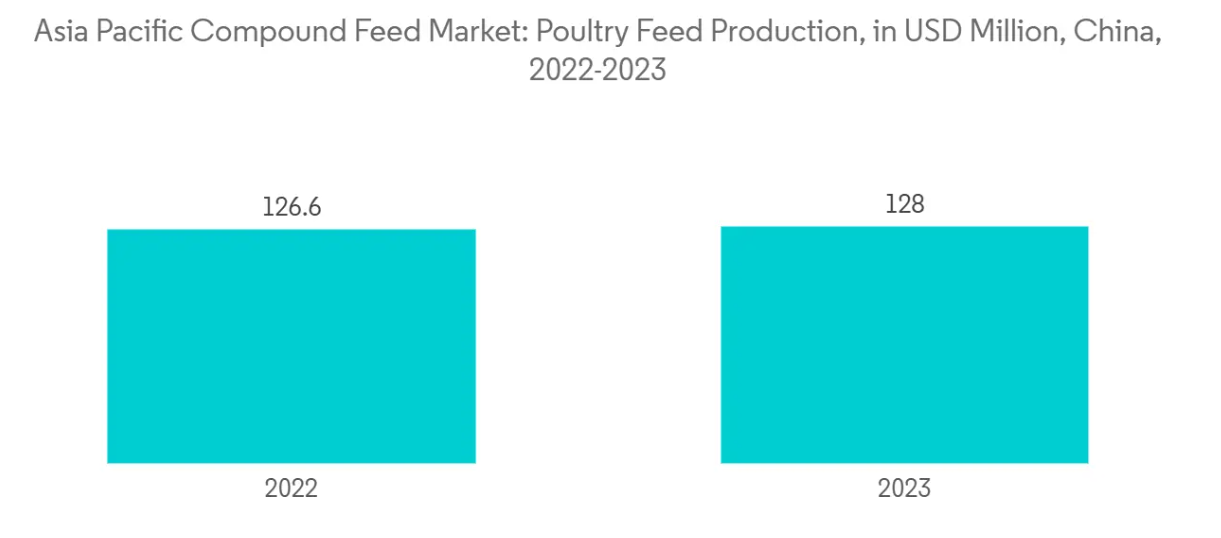

- China ranks among the world’s top producers of compound feed, driven by its soaring meat consumption and substantial animal population. Key factors fueling this feed production demand include the country’s expansive poultry farms, a growing animal populace, a quest for affordable animal protein, and poultry producers’ emphasis on boosting productivity through enhanced feed conversion ratios (FCR) via increased compound feed usage.

- In 2021, China’s poultry meat consumption reached 22,913 thousand metric tons, with projections estimating a rise to 23,311 thousand metric tons by 2028. This upward trend suggests a burgeoning poultry sector in the nation. The Food and Agriculture Organization (FAO) reported that poultry meat production in China surged to 26.4 million metric tons in 2023, up from 25.2 million metric tons in 2022.

- The US-China trade war’s aftershocks may counteract the declining trend of commercial feed prices in the US, primarily due to a shortage of feed raw materials. Furthermore, as demand for meat-based products rises, so too will the demand for compound feed in the U.S.

Asia-Pacific Compound Feed Industry Overview

Asia Pacific compound feed market is fragmented, with major companies holding a small part of the market share. Cargill Inc., Japfa Group, New Hope Liuhe Group, Charoen Pokphand Food (PCL), and Alltech Inc., are some of the major players in this region. Some companies increased their geographic presence by expanding their sales to other regions.

Asia-Pacific Compound Feed Market Leaders

- Cargill Inc.

- Charoen Pokphand Foods

- Alltech Inc.

- Japfa Group

- New Hope Liuhe Group

- *Disclaimer: Major Players sorted in no particular order

Asia-Pacific Compound Feed Market News

- May 2023: Japfa Vietnam inaugurated its animal feed mill and slaughterhouse in the Minh Hung Sikico industrial zone, Hon Quan district, Vietnam. The feed mill has a cold storage system to preserve essential vitamins and seasonings for maintaining high-quality animal feed.

- April 2023: Cargill established an animal nutrition factory in Nanping, Fujian, through a partnership with Fujian Nanxing Animal Health Products Co. Ltd. The facility spans 36,000 square meters and has an annual production capacity of 300,000 metric tons, making it Cargill’s largest feed manufacturing facility in China.

Asia-Pacific Compound Feed Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definiton

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Animal Protein

- 4.2.2 Government Support and Regulations

- 4.2.3 Technological Advancements in Feed Production

- 4.3 Market Restraints

- 4.3.1 Fluctuating Raw Material Prices

- 4.3.2 Competition from Alternative Feed Sources

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Ingredients

- 5.1.1 Cereals

- 5.1.2 Oilseeds

- 5.1.3 Oil

- 5.1.4 Molases

- 5.1.5 Supplemets

- 5.1.6 Other Ingredients

- 5.2 Supplements

- 5.2.1 Vitamins

- 5.2.2 Amino Acids

- 5.2.3 Antibiotics

- 5.2.4 Enzymes

- 5.2.5 Antioxidants

- 5.2.6 Acidifiers

- 5.2.7 Prebiotics and Probiotics

- 5.2.8 Other Supplements

- 5.3 Animal Types

- 5.3.1 Ruminant Feed

- 5.3.2 Swine Feed

- 5.3.3 Poultry Feed

- 5.3.4 Aquatic Feed

- 5.3.5 Other Animal Types

- 5.4 Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 Thailand

- 5.4.5 Vietnam

- 5.4.6 Australia

- 5.4.7 Rest of Asia Pacific

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Charoen Pokphand

- 6.3.2 Cargill Inc

- 6.3.3 Land O Lakes Purina

- 6.3.4 Alltech Inc.

- 6.3.5 Archer Daniels Midland

- 6.3.6 New Hope Liuhe Group

- 6.3.7 Miratorg Agribusiness Holding

- 6.3.8 Kyodo Shiryo Company

- 6.3.9 Sodrugestvo Group

- 6.3.10 DeKalb Feeds

- 6.3.11 De Heus

- 6.3.12 Ballance Agri-Nutrients

- 6.3.13 Heiskell & CO.

- 6.3.14 Kent Feeds

- 6.3.15 Weston Milling Animal Nutrition

- 6.3.16 Zheng DA International Group

- 6.3.17 Japfa Group

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Asia-Pacific Compound Feed Industry Segmentation

Compound feed is a mixture of raw materials and supplements fed to the livestock, sourced from either plant, animal, organic or inorganic substances, or industrial processing, whether or not containing additives. The Asia Pacific compound feed market report is segmented by ingredients (cereals, cakes, and meals, by-products, supplements, and other ingredients), supplements ( vitamins, antibiotics, amino acids, enzymes, antioxidants, acidifiers, prebiotics and probiotics, and other supplements), animal type (ruminant, swine, poultry, aquaculture, and other types), and Geography (China, India, Thailand, Japan, South Korea, Australia, and the Rest of Asia-Pacific). The Market Size is Provided in Terms of Value USD for the Above Segment.

| Ingredients | Cereals |

| Oilseeds | |

| Oil | |

| Molases | |

| Supplemets | |

| Other Ingredients | |

| Supplements | Vitamins |

| Amino Acids | |

| Antibiotics | |

| Enzymes | |

| Antioxidants | |

| Acidifiers | |

| Prebiotics and Probiotics | |

| Other Supplements | |

| Animal Types | Ruminant Feed |

| Swine Feed | |

| Poultry Feed | |

| Aquatic Feed | |

| Other Animal Types | |

| Geography | China |

| India | |

| Japan | |

| Thailand | |

| Vietnam | |

| Australia | |

| Rest of Asia Pacific |

Asia-Pacific Compound Feed Market Research FAQs

The Asia-Pacific Compound Feed Market size is expected to reach USD 220.59 billion in 2025 and grow at a CAGR of 3.5% to reach USD 261.99 billion by 2030.

In 2025, the Asia-Pacific Compound Feed Market size is expected to reach USD 220.59 billion.

Cargill Inc., Charoen Pokphand Foods, Alltech Inc., Japfa Group and New Hope Liuhe Group are the major companies operating in the Asia-Pacific Compound Feed Market.

In 2024, the Asia-Pacific Compound Feed Market size was estimated at USD 212.87 billion. The report covers the Asia-Pacific Compound Feed Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Asia-Pacific Compound Feed Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Asia-Pacific Compound Feed Industry Report

The Asia-Pacific (APAC) Compound Feed Market report provides a comprehensive industry analysis, focusing on various ingredients such as cereals, oilseeds, oil, molasses, supplements, and other ingredients. The report also delves into supplements including vitamins, amino acids, antibiotics, enzymes, antioxidants, acidifiers, probiotics & prebiotics, and other supplements. The market segmentation covers different animal types like ruminant, swine, poultry, aquatic, and other animal types, with a detailed market overview for regions including China, India, Thailand, Japan, South Korea, and Australia.

The industry trends and market trends are thoroughly examined, highlighting the market size and market value. The report example includes industry research and market research, offering insights into market growth and the growth rate. The market forecast and market predictions provide a forward-looking industry outlook and market outlook, supported by industry statistics and market data.

The report also includes a historical overview and market analysis, presenting a detailed market review and industry overview. The industry information is supported by market segmentation and industry reports, offering a clear picture of the market leaders and industry sales. The report PDF and report summary are available as a free download, providing a valuable resource for research companies and stakeholders interested in the APAC Compound Feed Market.

This market report emphasizes the market share and market leaders, showcasing the market growth and industry size. The industry outlook and market forecast are based on thorough industry research and market segmentation, ensuring a comprehensive understanding of the market dynamics. The report also includes industry trends and market trends, offering valuable insights into the future direction of the APAC Compound Feed Market.