Agricultural Inoculants Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Global Agricultural Inoculants Application Market is Segmented by Function (Crop Nutrition and Crop Protection), Microorganism (Bacteria, Fungi, and Other Microorganisms), Mode of Application (Seed Inoculation and Soil Inoculation), Crop Type (Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, and Other Crop Types), and Geography (North America, Europe, Asia-Pacific, South America, and Africa). The report offers market size and forecast by value (USD million) for the above segments.

Agricultural Inoculants Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Agricultural Inoculants Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2025 – 2030 |

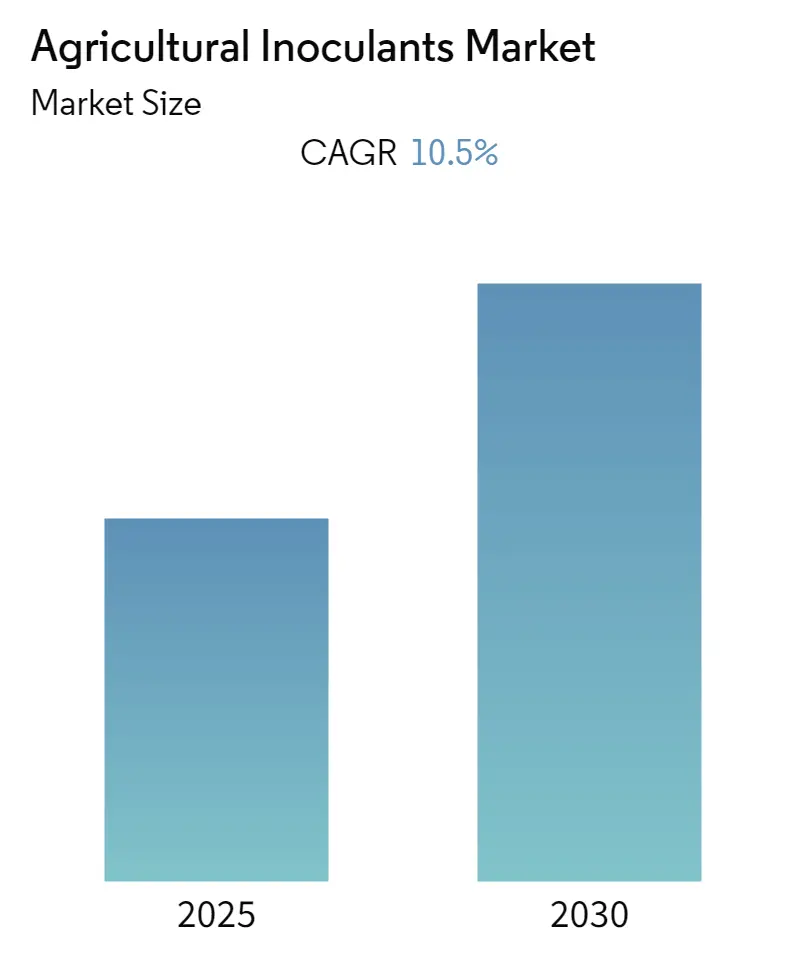

| CAGR | 10.50 % |

| Fastest Growing Market | South America |

| Largest Market | North America |

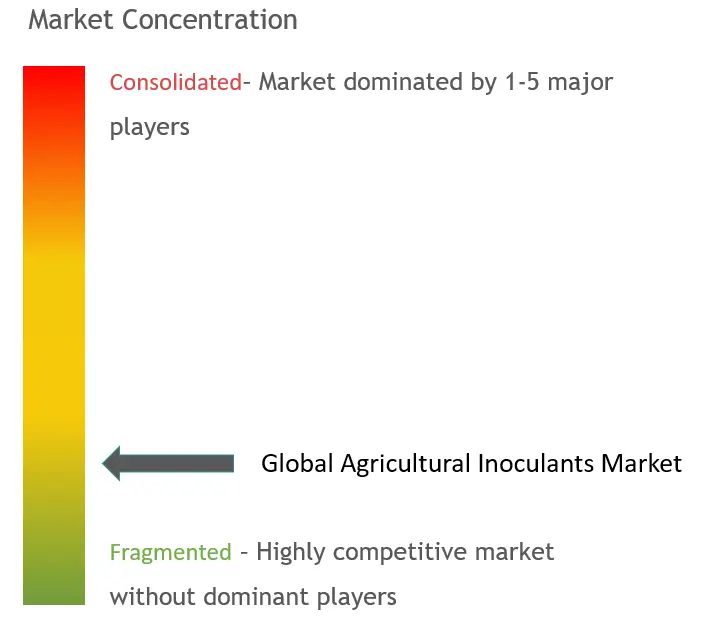

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Agricultural Inoculants Market with other markets in Agriculture Industry

Seeds

Crop Protection

Fertilizers

Agricultural Commodities

Agriculture Services

Agricultural Machinery and Technology

Autonomous Tractor Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 26.10% (2025 – 2030) |

| Countries/ Region Covered: | North America,Europe,Asia-Pacific,South America,Africa |

| Major Players: | Kubota, Yanmar, AGCO, Deere & Company, CNH Industrial |

Agricultural Inoculants Market Analysis

The Agricultural Inoculants Market is expected to register a CAGR of 10.5% during the forecast period.

- Current agricultural practices depend heavily on chemical inputs, such as fertilizers, pesticides, and herbicides, which cause a deleterious effect on the nutritional value of farm products and the health of farm workers and consumers. Excessive and indiscriminate use of these chemicals has resulted in food contamination, weed and disease resistance, and adverse environmental outcomes, significantly impacting human health. Applying these chemical inputs promotes the accumulation of toxic compounds in soils.

- Several synthetic fertilizers contain acid radicals, such as hydrochloride and sulfuric radicals, increasing soil acidity and adversely affecting soil and plant health. Highly recalcitrant compounds can also be absorbed by some plants. Continuous consumption of such crops can lead to systematic disorders in humans.

- Therefore, the increasing awareness of health challenges due to the consumption of poor-quality crops has led to a quest for new and improved technologies to improve the quantity and quality of produce without jeopardizing human health.

- A reliable alternative to chemical inputs is microbial inoculants that can act as biofertilizers, bioherbicides, biopesticides, and biocontrol agents. They are beneficiary microorganisms applied to the soil or the plant to improve productivity and crop health. They are also widely used to control pests and improve the quality of the ground and crops.

- Moreover, government initiatives to promote the adoption of organic farming are anticipated to fuel the market growth during the study period. For instance, under the Green Deal’s Farm to Fork strategy, the European Commission set a target of at least 25% of the EU’s agricultural land under organic farming and a significant increase in organic aquaculture by 2030.

Agricultural Inoculants Market Trends

Adoption of Organic and Eco-friendly Farming Practices

- Agricultural practices are witnessing a trend shift from conventional to organic farming. This shift can be attributed to growing awareness about the adverse impact of traditional farming methods on human health and environmental safety.

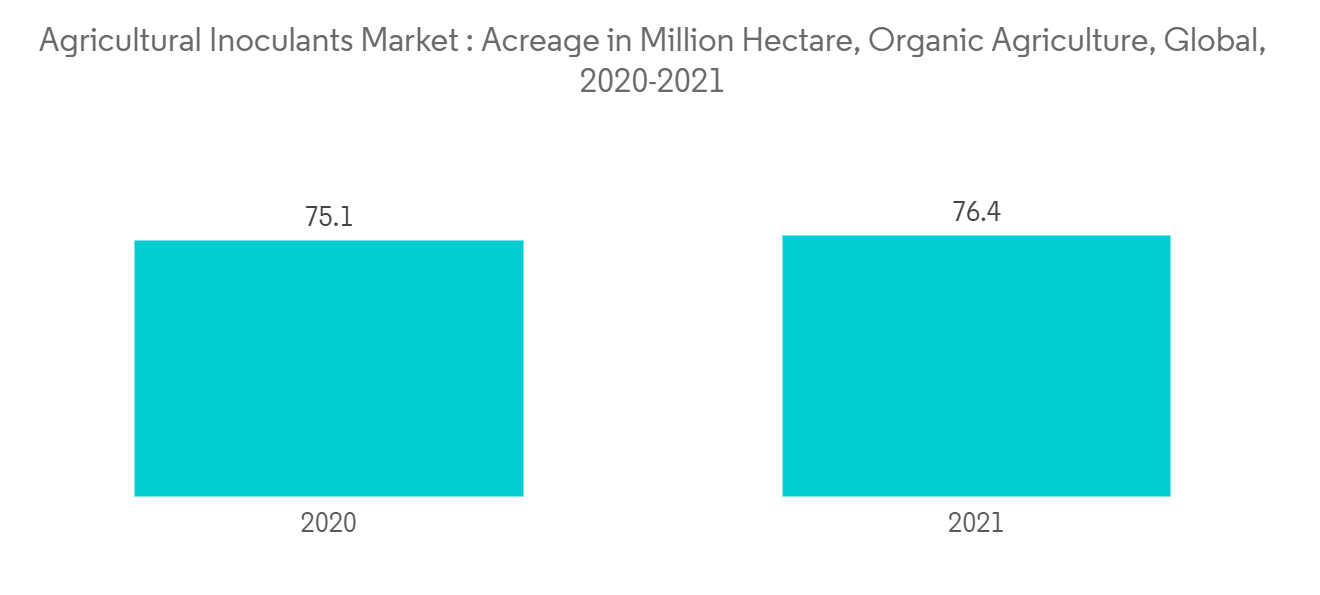

- According to the Research Institute of Organic Agriculture (German: Forschungsinstitut für biologischen Landbau (FiBL)), the area under organic cultivation increased from 70.9 million ha in 2018 to 76.4 million ha in 2021, with 187 countries practicing organic agriculture. This increases the demand for organic solutions such as inoculants and investments in localized research by private and public sectors.

- Microbial inoculants offer a natural and sustainable alternative to synthetic inputs, as they can improve soil health, increase nutrient availability, and protect against diseases. Additionally, microbial inoculants help reduce the environmental impact of synthetic inputs and promote more sustainable farming practices.

- As a result, the demand for microbial inoculants is increasing among farmers looking for ways to reduce their environmental footprint and produce healthier, more sustainable crops. Moreover, rising acreage and growing consumer demand for organic products will positively influence the agricultural inoculants market during the forecast period.

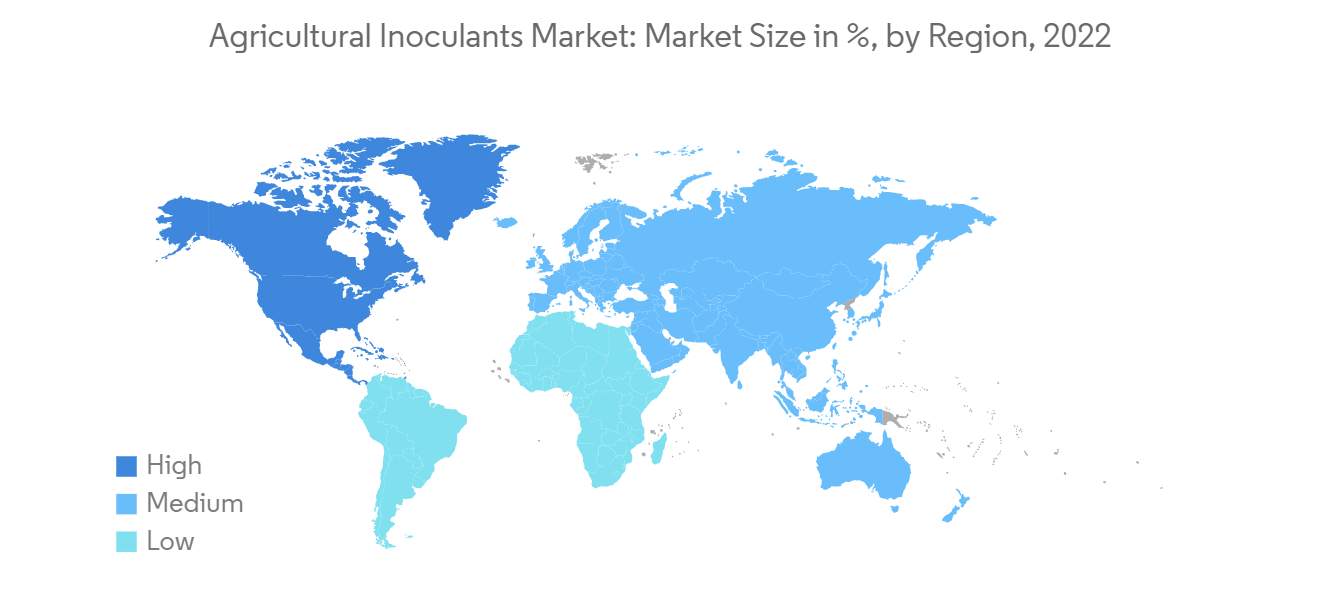

North America is the Largest Market

- North America is the largest market for agricultural inoculants, with the United States holding the majority of the share. The United States, with its highly evolved agricultural sector, has been adopting the natural and organic way of farming lately. The increasing cost of chemical inputs, their adverse effect on soil mass and the environment, and increasing awareness regarding balanced plant nutrition are the major factors driving the market in the country.

- Moreover, certain companies and research institutions emphasize introducing new products to gain a competitive advantage. For instance, developed by the Winnipeg bioresearch company XiteBio Technologies, XiteBio OptiPlus is a revolutionary proprietary liquid inoculant for soybeans powered by market-proven AGPT (Advanced Growth Promoting Technology).

- It combines the nitrogen-fixing bacteria Bradyrhizobium japonicum with patented phosphate-solubilizing plant growth-promoting rhizobacteria (PGPR), registered in Canada in February 2021, designed explicitly for soybeans. Such developments are anticipated to create demand for agricultural inoculants in the region and influence the global market during the study period.

Agricultural Inoculants Industry Overview

The agricultural inoculants market is fragmented, with international players occupying a major market share. The major players focus on R&D activities, extensive product portfolios, geographical expansions, acquisitions, and aggressive promotional strategies to uphold their position in the market. Some of the leading players are Novozymes, Lesaffre, BioceresCrop Solutions, Premier Tech, and BASF SE.

Agricultural Inoculants Market Leaders

- Novozymes

- BASF SE

- Premier Tech

- Bioceres Crop Solutions

- Lesaffre

- *Disclaimer: Major Players sorted in no particular order

Agricultural Inoculants Market News

- January 2023: VerdesianLife Science launched Accolade, a new biological growth enhancement liquid for crops containing Azospirillum Brasilense, a fixing bacterium that can increase root development and secondary lateral root systems, leading to increased nutrient uptake and higher yields.

- September 2022: Syngenta Seedcare and Bioceres Crop Solutions collaborated to bring innovative biological seed treatments, including inoculants, to the market. Through this partnership, Syngenta SeedCare became the exclusive global commercialization distributor of Bioceres’ biological solutions, except in Argentina.

- September 2021: In the United States, Novozymes launched five biological solutions, including three biological inoculants, namely BioniQ, TagTeam BioniQPro, and TagTeam BioniQChickpea.

Agricultural Inoculants Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of Organic and Eco-friendly Farming Practices

- 4.2.2 Declining Area of Arable Land and Rising Food Security Concerns

- 4.3 Market Restraints

- 4.3.1 High Demand for Conventional and Synthetic Products

- 4.3.2 Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Function

- 5.1.1 Crop Nutrition

- 5.1.2 Crop Protection

- 5.2 Microorganism

- 5.2.1 Bacteria

- 5.2.1.1 Rhizobacteria

- 5.2.1.2 Azotobacter

- 5.2.1.3 Phosphobacteria

- 5.2.1.4 Other Bacteria

- 5.2.2 Fungi

- 5.2.2.1 Trichoderma

- 5.2.2.2 Mycorrhiza

- 5.2.2.3 Other Fungi

- 5.2.3 Other Microorganisms

- 5.3 Mode of Application

- 5.3.1 Seed Inoculation

- 5.3.2 Soil Inoculation

- 5.4 Crop Type

- 5.4.1 Grains and Cereals

- 5.4.2 Pulses and Oilseeds

- 5.4.3 Commercial Crops

- 5.4.4 Fruits and Vegetables

- 5.4.5 Other Applications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Russia

- 5.5.2.6 Italy

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Rest of Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Premier Tech

- 6.3.3 Lallemond Inc.

- 6.3.4 Novozymes

- 6.3.5 Mapleton Agri Biotec Pty Ltd

- 6.3.6 New Edge Microbials Pty Ltd

- 6.3.7 T.Stanes & Company Limited

- 6.3.8 AEA Investors (Verdesian Life Sciences LLC)

- 6.3.9 Lesaffre

- 6.3.10 Bioceres Crop Solutions

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Agricultural Inoculants Industry Segmentation

Microbial inoculants are microorganisms applied to the soil or the plant to improve productivity and crop health.

The agricultural inoculants market is segmented by function (crop nutrition and crop protection), microorganism (bacteria, fungi, and other microorganisms), mode of application (seed inoculation and soil inoculation), crop type (grains and cereals, pulses and oilseeds, commercial crops, fruits and vegetables, and other crop types), and geography (North America, Europe, Asia-Pacific, South America, and Africa).

The market sizing has been done in value terms in USD for all the abovementioned segments.

| Function | Crop Nutrition | |

| Crop Protection | ||

| Microorganism | Bacteria | Rhizobacteria |

| Azotobacter | ||

| Phosphobacteria | ||

| Other Bacteria | ||

| Microorganism | Fungi | Trichoderma |

| Mycorrhiza | ||

| Other Fungi | ||

| Microorganism | Other Microorganisms | |

| Mode of Application | Seed Inoculation | |

| Soil Inoculation | ||

| Crop Type | Grains and Cereals | |

| Pulses and Oilseeds | ||

| Commercial Crops | ||

| Fruits and Vegetables | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Spain | ||

| Russia | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Africa | South Africa |

| Rest of Africa |

Agricultural Inoculants Market Research FAQs

The Global Agricultural Inoculants Market is projected to register a CAGR of 10.5% during the forecast period (2025-2030)

Novozymes, BASF SE, Premier Tech, Bioceres Crop Solutions and Lesaffre are the major companies operating in the Global Agricultural Inoculants Market.

South America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the North America accounts for the largest market share in Global Agricultural Inoculants Market.

The report covers the Global Agricultural Inoculants Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Global Agricultural Inoculants Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Microbial Inoculants in Agriculture Industry Report

The Global Agricultural Inoculants Application Market is segmented by various factors including function, microorganism, mode of application, crop type, and geography. The industry analysis provides insights into the market trends, highlighting the importance of crop nutrition and crop protection. The market trends suggest a significant focus on microorganisms such as bacteria and fungi, which are essential for seed inoculation and soil inoculation.

The market research indicates that grains, cereals, pulses, oilseeds, commercial crops, fruits, and vegetables are the primary crop types benefiting from agricultural inoculants. The market overview reveals that North America, Europe, Asia-Pacific, South America, and Africa are key regions driving market growth. The industry reports offer a comprehensive market forecast, projecting future market value and market segmentation.

In the global market, industry leaders are leveraging market data to enhance market growth and capture market share. The market report includes detailed market analysis and industry information, providing a thorough understanding of the market size and market outlook. The industry research highlights the significance of market predictions and market review for strategic planning.

The report example and report pdf serve as valuable resources for understanding the market statistics and market forecast. The industry outlook emphasizes the role of industry trends in shaping the future of agricultural inoculants. The industry sales and industry size are crucial metrics for evaluating market performance.

Overall, the market segmentation and market value are critical components of the market analysis, offering insights into the market dynamics and industry trends. The market forecast and market overview provide a clear picture of the market’s future trajectory, supported by comprehensive industry research and market data.

.webp)