Africa Agrochemicals Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The African Agrochemicals Market Report is Segmented by Product Type (Fertilizer, Pesticides, Adjuvants, and Plant Growth Regulators), Application (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, and Commercial Crops), and Geography (Congo, Malawi, Mozambique, Zambia, and Rest of Africa). The Report Offers the Market Size and Forecasts in Terms of Value in USD and Volume in Metric Tons for all the Above Segments.

Africa Agrochemicals Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Africa Agrochemicals Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

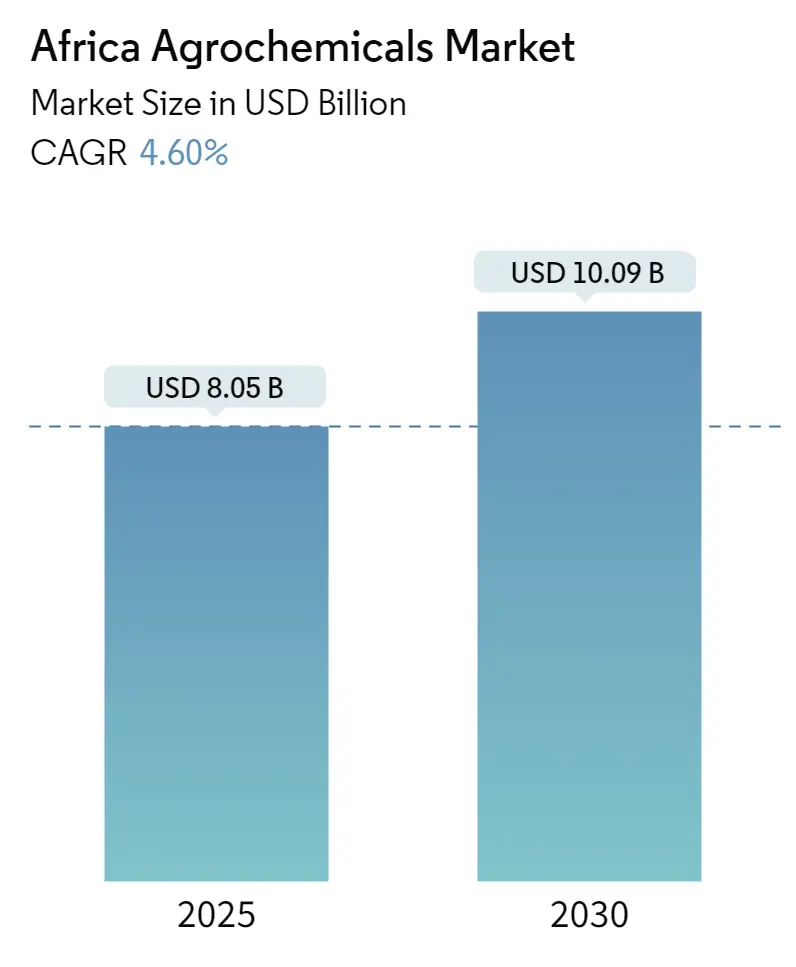

| Market Size (2025) | USD 8.05 Billion |

| Market Size (2030) | USD 10.09 Billion |

| CAGR (2025 – 2030) | 4.60 % |

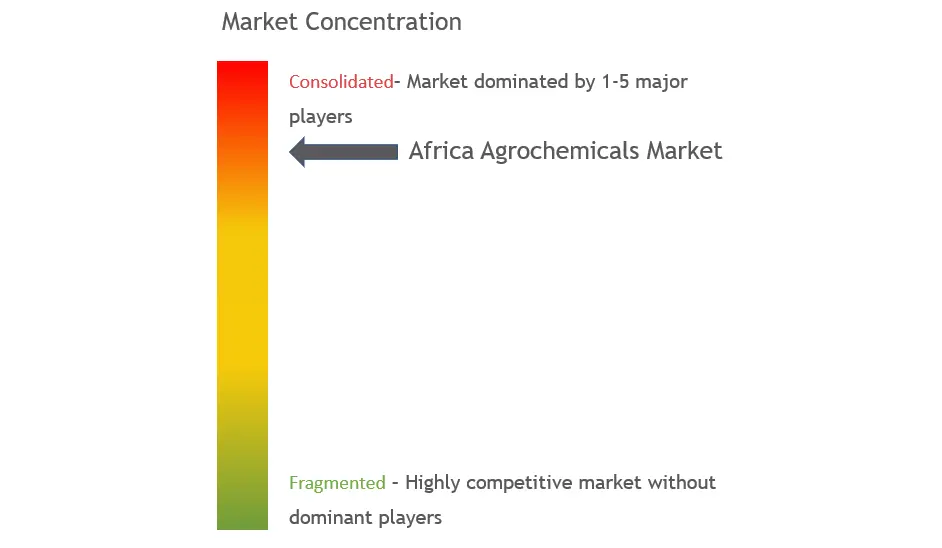

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Africa Agrochemicals Market with other markets in Agriculture Industry

Seeds

Crop Protection

Fertilizers

Agricultural Commodities

Agriculture Services

Agricultural Machinery and Technology

Africa Agrochemicals Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 4.60% (2025 – 2030) |

| Countries/ Region Covered: | NA |

| Major Players: | BASF SE, Bayer, Yara International, Syngenta, Sasol |

Africa Agrochemicals Market Analysis

The Africa Agrochemicals Market size is estimated at USD 8.05 billion in 2025, and is expected to reach USD 10.09 billion by 2030, at a CAGR of 4.6% during the forecast period (2025-2030).

- Climate change is significantly reshaping Africa’s agricultural landscape. Researchers from the Climate Hazards Center (CHC) at the University of California have highlighted that from late January to mid-March 2024, Africa experienced only half or less of its typical rainfall. These changing weather patterns, a direct consequence of climate change, are not only altering the distribution and development of insect pests but also affecting their population dynamics. Such changes may pave the way for both native and foreign species to spread more easily. For instance, during droughts, farmers ramped up pesticide use to tackle pests like aphids, a practice they didn’t adopt during regular rainfall periods. To adapt to these climatic shifts and sustain production, farmers are turning to agrochemicals more than ever.

- Access to essential agricultural inputs, such as fertilizers and pesticides, is crucial for regional farmers. In light of this, African governments are intensifying their agricultural commitments. For instance, through the Comprehensive African Agricultural Development Programme (CAADP), African nations have set a 2063 agenda aiming to combat hunger and poverty. This is to be achieved by channeling at least 10% of their national budgets into agriculture and rural development, with a target growth rate of 6% annually. Such governmental initiatives to boost productivity are directly fueling the agrochemicals market, as these inputs are essential for cultivating fertilizer-responsive crops that meet the region’s consumption demands.

Africa Agrochemicals Market Trends

Growing Food Demand With Population Growth

- Africa’s rural population is steadily increasing. According to World Bank data, from 2020 to 2023, Sub-Saharan Africa’s rural population grew by 5%, averaging an annual growth rate of 1.6%. This rising population is intensifying the demand for agricultural land. A, 2023 report from AGRA (Alliance for a Green Revolution in Africa) cautions that by 2030, Africa’s burgeoning population may face a food scarcity crisis, jeopardizing nutrition and health. Smallholder farmers, who account for 80% of the continent’s food production, are under pressure to enhance their yields. Consequently, many are turning to increased use of pesticides and agrochemicals. Notably, the Food and Agricultural Organization reported a rise in severely food-insecure individuals from 305 million in 2020 to 341.8 million in 2022, underscoring the critical nature of food production on the continent.

- By 2050, Africa’s food demand is set to more than double, aligning with a projected population of 2.5 billion, as highlighted by the International Monetary Fund. This demand surge is driven by population growth, rising incomes, swift urbanization, and a regional shift towards premium fresh and processed foods. Such increasing demand not only presents fresh opportunities for African farmers but also accelerates the adoption of pesticides in agriculture. To tackle the continent’s food security challenges, organizations like the G8’s New Alliance for Food Security and Nutrition, alongside AGRA, are intensifying their efforts.

- As Africa’s population grows, so does its demand for food. Yet, the continent grapples with a challenge, its limited arable land can’t keep pace with this surging demand. Africa holds 60% of the world’s uncultivated arable land, yet its primary cereal crops yield less than 25% of their potential. In some areas, transboundary pests and diseases further dampen agricultural productivity. These stagnant yields intensify challenges like food insecurity, poverty, and malnutrition, especially as the population continues to swell. Alarmingly, the harvested area for crucial crops, including maize, is shrinking. FAO data reveals this concerning trend: maize harvesting fell from 42.9 million hectares in 2021 to 41.7 million hectares in 2022. Such patterns highlight the urgent need to enhance land productivity.

- In response to these challenges, both national and international governments are rallying to assist small and marginal farmers. For instance in Kenya, a World Bank initiative is rolling out fertilizer e-voucher subsidies, enabling eligible farmers to purchase fertilizer at discounted rates from private retailers. This initiative has not only spurred a productivity boost of over 50% but has also championed crop diversification and bolstered the private sector. Looking ahead, the African Development Bank paints an optimistic picture, Africa’s food and agriculture market, valued at USD 280 billion in 2023, is projected to leap to a staggering USD 1 trillion by 2030. With these governmental interventions and the pressing demand for heightened agricultural productivity, Africa’s agrochemical industry stands on the brink of substantial growth in the years to come.

Africa Agrochemicals Industry Overview

In 2023, the African agrochemicals market witnessed significant consolidation, with major players commanding a dominant share. Key players such as Sasol Limited, Yara International, Bayer, Syngenta, and BASF SE led the market in terms of share. Recently, Bayer and Corteva merged, introducing innovative products in the crop protection segment. Furthermore, Bayer has partnered with Kimetic and M2i Group, signaling promising advancements in crop protection. Companies in the crop protection domain, bolstered by their R&D centers, are diligently innovating to enhance the agrochemicals sector.

Africa Agrochemicals Market Leaders

- BASF SE

- Bayer

- Yara International

- Syngenta

- Sasol

- *Disclaimer: Major Players sorted in no particular order

Africa Agrochemicals Market News

- November 2024: KBR Inc., a global frontrunner in ammonia technology, has inked a deal with AMUFERT to establish a new ammonia plant in Soyo, Angola. Under this agreement, KBR will furnish AMUFERT’s 2300 TPD (Temperature Programmed Desorption) ammonia plant with a technology license, proprietary engineering design, equipment, and catalyst solutions. This initiative aims to bolster food security and self-sufficiency in Angola and its neighboring nations.

- December 2023: EverGol, a newly introduced systemic and contact fungicide for seed treatment, has made its entry in South Africa. This fungicide is designed to combat both Fusarium spp. and Pythium spp. in maize and soybean crops.

Africa Agrochemicals Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Climate Challenges and Pest Resilience

- 4.2.1.1 Population Growth

- 4.2.1.1.1 Government Policies and Subsidies

- 4.3 Market Restraints

- 4.3.1 High Cost and Unaffordability by Marginal Farmers

- 4.3.1.1 Regulatory Challenges

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Fertilizer Market

- 5.1.2 Pesticides Market

- 5.1.3 Adjuvants Market

- 5.1.4 Plant Growth Regulators Market

- 5.2 Application

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Fruits and Vegetables

- 5.2.4 Commercial Crops

- 5.3 Geography

- 5.3.1 Congo

- 5.3.2 Malawi

- 5.3.3 Mozambique

- 5.3.4 Zambia

- 5.3.5 Rest of Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Bayer Crop Science AG

- 6.3.2 Syngenta International AG

- 6.3.3 Adama Agricultural Solutions

- 6.3.4 FMC Corporation

- 6.3.5 Corteva Agrisciences

- 6.3.6 Yara International

- 6.3.7 UPL

- 6.3.8 BASF SE

- 6.3.9 Sumitomo Corporation

- 6.3.10 Nufarm

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Africa Agrochemicals Industry Segmentation

Agrochemicals are pesticides, herbicides, or fertilizers used for the management of ecosystems in agricultural sectors. The African Agrochemicals Market is Segmented by Product Type (Fertilizer, Pesticides, Adjuvants, and Plant Growth Regulators), Application (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, and Commercial Crops), and Geography (Congo, Malawi, Mozambique, Zambia, and Rest of Africa). The report offers the market size and forecasts in terms of value in USD and volume in Metric Tons for all the above segments.

| Product Type | Fertilizer Market |

| Pesticides Market | |

| Adjuvants Market | |

| Plant Growth Regulators Market | |

| Application | Grains and Cereals |

| Pulses and Oilseeds | |

| Fruits and Vegetables | |

| Commercial Crops | |

| Geography | Congo |

| Malawi | |

| Mozambique | |

| Zambia | |

| Rest of Africa |

Africa Agrochemicals Market Research Faqs

The Africa Agrochemicals Market size is expected to reach USD 8.05 billion in 2025 and grow at a CAGR of 4.60% to reach USD 10.09 billion by 2030.

In 2025, the Africa Agrochemicals Market size is expected to reach USD 8.05 billion.

BASF SE, Bayer, Yara International, Syngenta and Sasol are the major companies operating in the Africa Agrochemicals Market.

In 2024, the Africa Agrochemicals Market size was estimated at USD 7.68 billion. The report covers the Africa Agrochemicals Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Africa Agrochemicals Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.