GCC Construction Machinery Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The GCC Construction Machinery Market Report is Segmented by Machinery Type (Cranes, Excavators, Loaders and Backhoes, Motor Graders, Telescopic Handlers, and Other Machinery Types), Application Type (Concrete Construction Equipment, Road Construction Equipment, Earth Moving Equipment, and Material Handling Equipment), by Propulsion Type (Internal Combustion Engine (ICE) and Electric/Hybrid), and by Country (Saudi Arabia, The United Arab Emirates, Kuwait, Qatar, and Bahrain). The Report Offers Market Size and Forecasts for all the Above Segments in Value Terms (USD).

GCC Construction Machinery Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

GCC Construction Machinery Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2025 – 2030 |

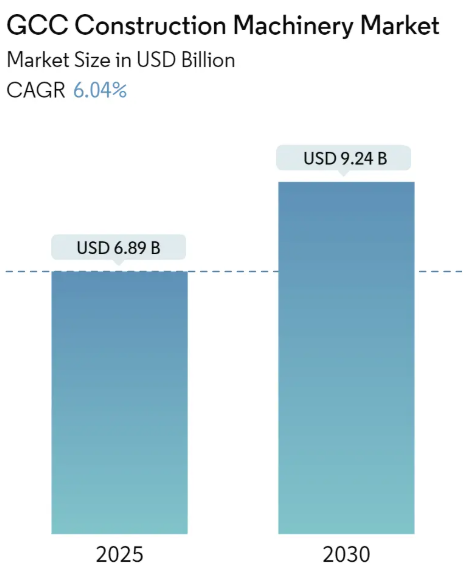

| Market Size (2025) | USD 6.89 Billion |

| Market Size (2030) | USD 9.24 Billion |

| CAGR (2025 – 2030) | 6.04 % |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of GCC Construction Machinery Market with other markets in Automotive Industry

Automotive Materials & Coatings

Automotive Technology

Vehicles

Automotive Services

Auto Parts

Automotive Equipment

GCC Construction Machinery Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 6.04% (2025 – 2030) |

| Countries/ Region Covered: | Saudi Arabia, United Arab Emirates, Kuwait, Qatar, Oman, Bahrain |

| Major Players: | Caterpillar, Komatsu, Liebherr International AG, Volvo Construction Equipment Corp., Kobelco Construction Machinery |

GCC Construction Machinery Market Analysis

The GCC Construction Machinery Market size is estimated at USD 6.89 billion in 2025, and is expected to reach USD 9.24 billion by 2030, at a CAGR of 6.04% during the forecast period (2025-2030).

Over the medium term, the market is likely to grow due to factors like the GCC’s expanding construction industry, rising crane demand, and the growing trend toward automation and telematics for market expansion. However, the region’s sales and growth of new construction equipment may be hampered by rising demand for rental services.

The electrification of construction equipment in GCC countries such as Saudi Arabia and the United Arab Emirates has emerged as a significant trend within the construction industry. This shift toward electric machinery is driven by a variety of factors, including environmental concerns, government initiatives, and the desire for increased efficiency in infrastructure development.

Due to the numerous building and water projects underway in countries like Oman and the United Arab Emirates, cranes are anticipated to dominate the machinery market. After experiencing significant pressure as a result of a prolonged decline in oil prices, the construction industries in Saudi Arabia and the United Arab Emirates are now recovering. However, the construction industry is expected to benefit from the government’s increased infrastructure investment and the increased launch of development projects in the upcoming years. Private sector developers may also be encouraged to advance their projects, which will further boost the demand for construction machinery.

GCC Construction Machinery Market Trends

Growth of the Construction Industry Likely to Drive Demand for the Construction Equipment Market

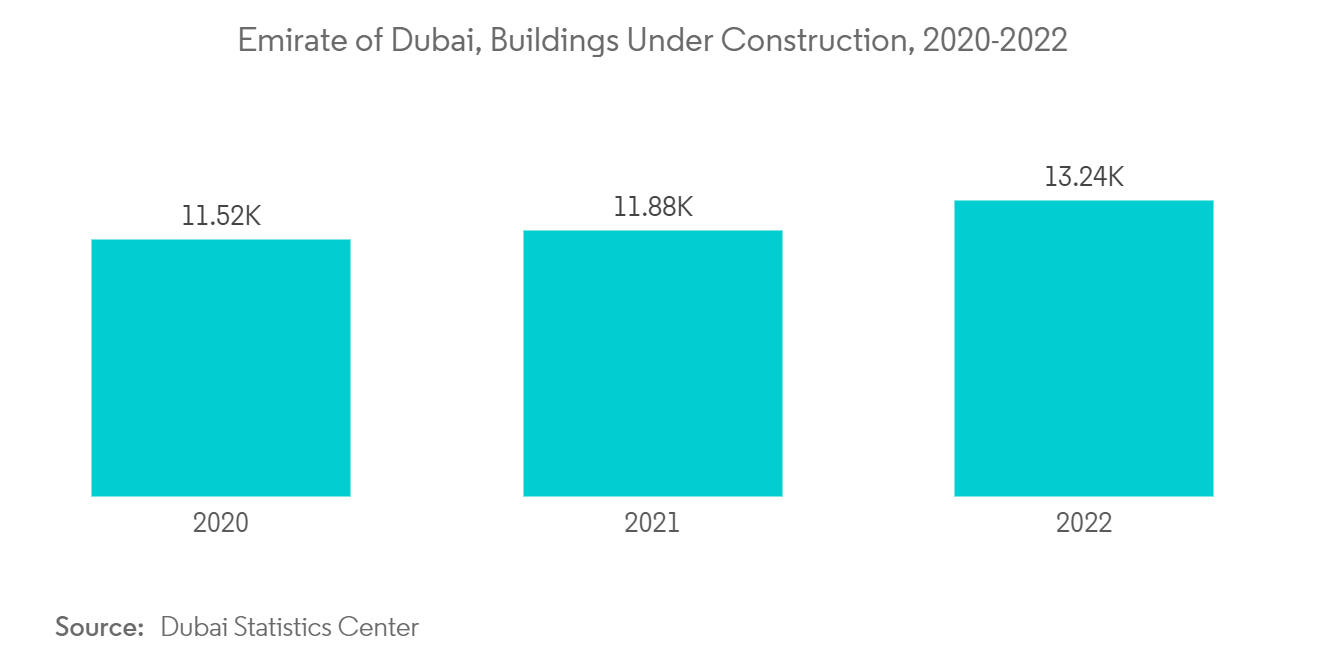

The growing demand for housing in urban areas, increased infrastructure development activities, and increased modernization and renovation of buildings to increase energy efficiency are all factors contributing to the growth of the construction market in GCC countries. Construction of commercial infrastructure, including offices, schools, hotels, restaurants, and recreational facilities, is increasing as a result of the region’s strong economic growth.

Developing nations are making significant investments in infrastructural development to address pressing issues like traffic congestion, population growth, high manufacturing costs, and deteriorating transportation infrastructure. Developed nations are investing in technologies like the hyperloop and earthquake-proof buildings to upgrade their existing infrastructure. Sales in the target market are rising as a result of these factors.

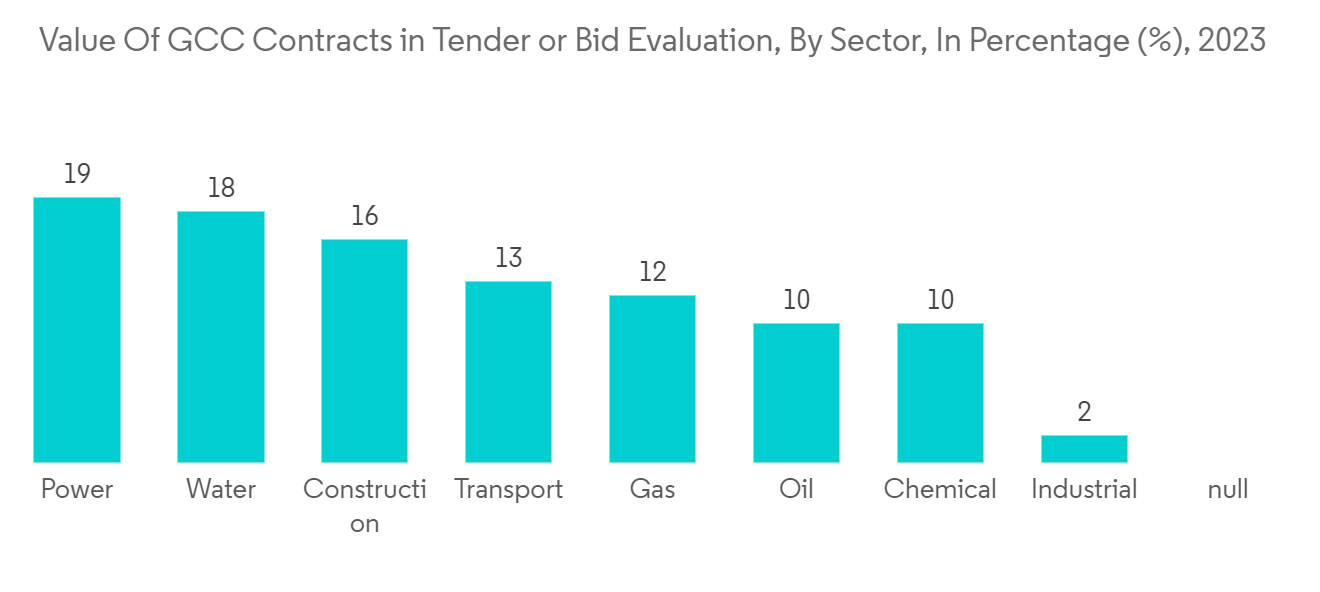

The GCC region is anticipated to award project contracts with a combined value of USD 110 billion this year. Among these, Saudi Arabia is expected to account for over half of the total as it accelerates the implementation of its Vision 2030 plans for economic diversification.

Out of the overall value, Saudi Arabia holds the highest share with USD 64 billion, followed by the United Arab Emirates with USD 23 billion, Kuwait with USD 10.2 billion, and Qatar with USD 10.1 billion.

Additional notable contracts include the USD 2.5 billion allocated for Abu Dhabi National Oil Company’s Al Mirfa desalination plant. In addition, there is a USD 2.5 billion project at Al Marjan Island, a leisure destination being constructed in Ras Al Khaimah, United Arab Emirates. Furthermore, a USD 1.2 billion contract for supplying utilities has been awarded for Red Sea Global’s (RSG) Amaala luxury hospitality development.

In line with the abovementioned factors, the market’s growth is expected to continue during the forecast period.

The United Arab Emirates Expected to Witness the Fastest Growth Rate

The UAE construction machinery market is expected to witness the fastest growth rate among the GCC countries over the coming years, as the construction industry is a key driver for the UAE’s economy. However, the industry has come under substantial pressure due to the prolonged slump in oil prices. Despite the prevailing climate, the construction industry remains resilient, and its outlook remains cautiously optimistic over the coming years.

The UAE government is focusing on making investments in energy and infrastructure, such as utilities, transportation, decarbonization, the production of renewable and nuclear energy, and addressing the persistent shortage of water. In the United Arab Emirates, numerous projects and opportunities for engineering and construction firms have been made possible by the government’s significant commitment and resources.

With both private and public players in the United Arab Emirates extensively focusing on investing in several new mega-construction projects, the demand for construction equipment in the country is witnessing surging growth. For instance,

- In February 2024, Larsen & Toubro announced that it had secured a substantial engineering, procurement, and construction (EPC) order to establish the largest renewable generation plant in the United Arab Emirates, marking a significant stride in the region’s commitment to sustainable energy.

- Further, in February 2024, Etihad Rail in the United Arab Emirates announced the commencement of the construction work on the UAE’s high-speed rail project. The company also stated that the early works for the UAE’s high-speed network would involve a contractor clearing and preparing sites for actual construction work, including Earthmoving and the diversion of existing infrastructure or utilities in the area.

The country’s development plan, which focuses on expanding its energy, transportation, and industrial infrastructure, will drive growth over the coming years. The UAE government has announced plans to implement a series of projects as part of the Projects of the 50 initiative to accelerate the country’s economic development, transform it into a comprehensive hub for all sectors, and attract USD 149.8 billion in FDI over the next nine years.

The United Arab Emirates must continue to develop its transportation and road infrastructure to meet the requirements of its expanding population and automobile fleet. This is consistent with the government’s plans to boost tourism and urbanism in Dubai and Abu Dhabi. The USD 11 billion Etihad rail project, the USD 5.9 billion proposed hyperloop project between Dubai and Abu Dhabi, the USD 2.7 billion Sheikh Zayed double-deck road project, and many other projects are in the pipeline for the country’s transportation and road infrastructure. Rail and road development will also be driven across the nation by the rising demand for urban transportation and the government’s plans to boost tourism and expand transportation infrastructure.

The abovementioned trends in the country are anticipated to result in positive demand for construction machinery during the forecast period.

GCC Construction Machinery Industry Overview

The GCC construction machinery market is mostly characterized by the presence of numerous international companies, resulting in a highly competitive market environment. Major players have been launching next-generation products and expanding their regional presence to cater to this anticipated rise in demand for construction equipment owing to the rise in construction projects and investments around GCC countries. For instance,

- In August 2023, Hitachi Construction Machinery Middle East Corporation FZE announced the launch of its new product, the ZW370-5A wheel loader, in the United Arab Emirates.

- In March 2022, Iridium Communications Inc. announced that it had jointly developed a link belt excavator with Sumitomo Construction Machinery Co. Ltd. Through this partnership, SCM initially added Iridium’s Short Burst Data Service to its Remote CARE service platform.

GCC Construction Machinery Market Leaders

- Caterpillar

- Komatsu

- Liebherr International AG

- Volvo Construction Equipment Corp.

- Kobelco Construction Machinery

- *Disclaimer: Major Players sorted in no particular order

GCC Construction Machinery Market News

- December 2023: Komatsu Ltd announced the launch of new PW168-11 and PW198-11 wheeled excavators in the construction equipment market.

- June 2023: Caterpillar Inc. introduced the advanced Cat 995 Wheel Loader. This new model boasted a significant 19% improvement over its predecessor. Additionally, it promised a reduction in hourly fuel consumption by up to 13% and an efficiency boost of 8%.

- July 2022: Caterpillar unveiled the new Cat 336 hydraulic excavator for construction sites and demanding applications. Its powerful hydraulic system can deliver digging forces and swing torque to support production in rugged outdoor conditions.

- April 2022: Liebherr developed an electric power unit for the LTC 1050-3.1 mobile electric crane, allowing it to run on either diesel or electricity. The new alternative LTC 1050-3.1 combines green credentials with efficiency. It has a conventional, low-emission internal combustion engine that meets Stage V emissions standards and produces 243 kW on and off the road (326 bhp). The engine can be fuelled with hydrogenated vegetable oil (HVO) with no restrictions, allowing it to reduce CO2 emissions by up to 90% compared to diesel.

- March 2022: The Volvo Construction Equipment company launched its EC550E crawler excavator in the Middle East. The excavator is designed to work on large infrastructure projects with high production levels.

GCC Construction Machinery Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Electrification of Construction Equipment May Propel the Market Growth

- 4.2 Market Restraints

- 4.2.1 Construction Rental Business May Hamper Market Growth

- 4.3 Industry Attractiveness – Porter’s Five Forces’ Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Size in USD Billion)

- 5.1 By Machinery Type

- 5.1.1 Cranes

- 5.1.2 Excavators

- 5.1.3 Loaders and Backhoes

- 5.1.4 Motor Graders

- 5.1.5 Telescopic Handlers

- 5.1.6 Other Machinery Types

- 5.2 By Application Type

- 5.2.1 Concrete Construction Equipment

- 5.2.2 Road Construction Equipment

- 5.2.3 Earth Moving Equipment

- 5.2.4 Material Handling Equipment

- 5.3 By Propulsion Type

- 5.3.1 Internal Combustion Engine (ICE)

- 5.3.2 Electric/Hybrid

- 5.4 By Country

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 Kuwait

- 5.4.4 Qatar

- 5.4.5 Oman

- 5.4.6 Bahrain

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Kobelco Construction Machinery Co. Ltd

- 6.2.2 Hitachi Construction Machinery

- 6.2.3 Sumitomo Construction Machinery

- 6.2.4 CNH Industries (Case Construction)

- 6.2.5 Caterpillar Inc.

- 6.2.6 Komatsu Ltd

- 6.2.7 Liebherr International AG

- 6.2.8 XCMG Construction Machinery Co. Ltd

- 6.2.9 J.C. Bamford Excavators Ltd (JCB)

- 6.2.10 Volvo Construction Equipment Corp.

- 6.2.11 Sany Heavy Industry Co. Ltd

- 6.2.12 Deere & Company

- 6.2.13 Hyundai Construction Equipment

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Automated Construction Machinery Gaining Importance

GCC Construction Machinery Industry Segmentation

Machinery and equipment used to complete various construction activities are considered construction machinery. The scope of the study includes excavators, loaders, road rollers, bulldozers, mobile cranes, and motor graders. The GCC construction machinery market has been segmented by machinery type, application type, propulsion type, and country.

By machinery type, the market is segmented into cranes, excavators, loaders and backhoes, motor graders, telescopic handlers, and other machinery types. By application type, the market is segmented into concrete construction equipment, road construction equipment, Earth moving equipment, and material handling equipment. By propulsion type, the market is segmented into internal combustion engine (ICE) and electric/hybrid. By country, the market is segmented into Saudi Arabia, the United Arab Emirates, Kuwait, Qatar, and Bahrain. The report offers market size and forecasts in value (USD) for all the above segments.

| By Machinery Type | Cranes |

| Excavators | |

| Loaders and Backhoes | |

| Motor Graders | |

| Telescopic Handlers | |

| Other Machinery Types | |

| By Application Type | Concrete Construction Equipment |

| Road Construction Equipment | |

| Earth Moving Equipment | |

| Material Handling Equipment | |

| By Propulsion Type | Internal Combustion Engine (ICE) |

| Electric/Hybrid | |

| By Country | Saudi Arabia |

| United Arab Emirates | |

| Kuwait | |

| Qatar | |

| Oman | |

| Bahrain |

GCC Construction Machinery Market Research FAQs

The GCC Construction Machinery Market size is expected to reach USD 6.89 billion in 2025 and grow at a CAGR of 6.04% to reach USD 9.24 billion by 2030.

In 2025, the GCC Construction Machinery Market size is expected to reach USD 6.89 billion.

Caterpillar, Komatsu, Liebherr International AG, Volvo Construction Equipment Corp. and Kobelco Construction Machinery are the major companies operating in the GCC Construction Machinery Market.

In 2024, the GCC Construction Machinery Market size was estimated at USD 6.47 billion. The report covers the GCC Construction Machinery Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the GCC Construction Machinery Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.