Austria Hospitality Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Austria Hospitality Market is Segmented by Type (Chain Hotels and Independent Hotels), by Segment (Service Apartments, Budget and Economy Hotels, Mid and Upper Mid-Scale Hotels and Luxury Hotels).

Austria Hospitality Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Austria Hospitality Market Size

| Study Period | 2019 – 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 – 2030 |

| Historical Data Period | 2019 – 2023 |

| CAGR | 4.00 % |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Hospitality Industry in Austria with other markets in Hospitality and Tourism Industry

Austria Hospitality Market Analysis

The Hospitality Industry in Austria Market is expected to register a CAGR of 4% during the forecast period.

Austria Hospitality Market Trends

Increasing Investments in the Accommodation Sector is Going to Drive the Market

According to TOPHOTELPROJECTS GmbH, the Alpine nation of Austria is adapting to catch the growing demand, by adding more than 12,000 rooms to the accommodation industry in the coming years to accommodate the rising number of visitors. According to its online database, 90 hotel projects are currently in the development pipeline in Austria, 62% of which are categorized as either first-class or luxury segments. Around 29 hotels are slated to be opened in 2020, which will add more than 4,000 rooms to the supply chain. Another 21 openings are scheduled for 2021 whereas around 9 for 2022. Out of all the openings, 27 hotels alone are going to be added in Austria’s capital city, Vienna, adding more than 5,500 rooms.

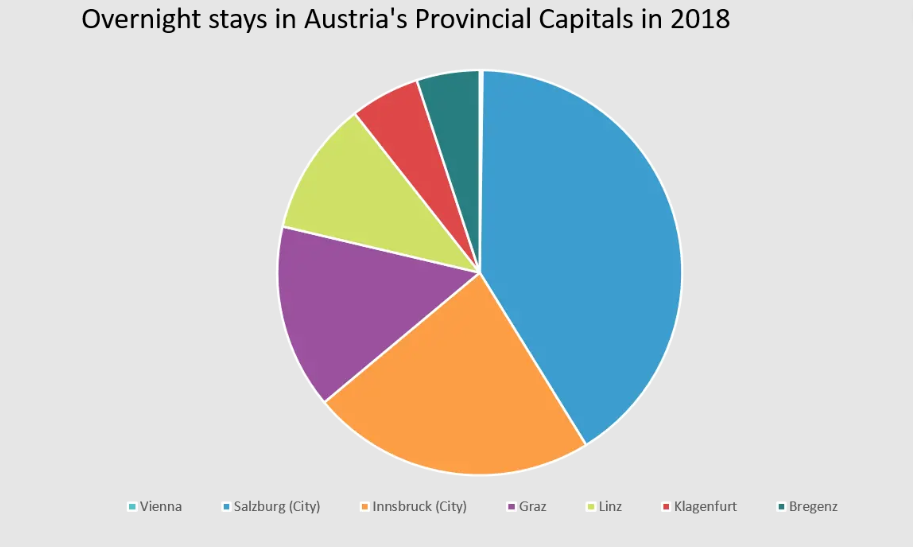

The Rising Number of Overnight stays in Austria’s Provincial Capitals Are Creating High Demand for More Hotels

According to Statistik Austria, the total number of overnight stays reached 149.8 million which indicated a 3.7% growth. Since 2000, the overall arrivals in Austrian cities have more than doubled, and 96% rise was recorded. Throughout the whole country, 70% growth in arrivals and 32% of overnight stays were recorded. The major tourist arrivals were observed to 9 cities and their share to the total arrivals to the cities was 5% more than that of in 2010 and the total number of overnight stays was increased to 16% in 2018 from 11% in 2010. Vienna attracted a total of 16.5 million overnight stays in 2018, of which 945,000 visited in February alone.

Austria Hospitality Industry Overview

AccorHotels has been offering the largest portfolio across all types of service tiers. The upper-midscale and luxury hotels are more in demand in the region than the others. The service apartments are gaining more significance in recent times and are forecasted to record a great share of the segment in the future.

Austria Hospitality Market Leaders

- AccorHotels

- Hilton Hotels & Resorts

- Motel One

- Private City Hotels

- Arcotel Hotels & Resorts

- *Disclaimer: Major Players sorted in no particular order

Austria Hospitality Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.2.3 Opportunities

- 4.3 Impact of COVID – 19 on the Hospitality Industry

- 4.4 Insights on Revenue Flows from Accommodation and Food and Beverage Sectors

- 4.5 Leading Cities in Austria With Respect to Number of Visitors

- 4.6 Investments (Real Estate, FDI and others) in the Hospitality Industry

- 4.7 Technological Innovations in the Hospitality Industry

- 4.8 Insights on Shared Living Spaces Impact on the Hospitality Industry

- 4.9 Insights on other Economic Contributors to the Hospitality Industry

- 4.10 Value Chain Analysis

- 4.11 Porter’s Five Forces Analysis

5. MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Chain Hotels

- 5.1.2 Independent Hotels

- 5.2 By Segment

- 5.2.1 Service Apartments

- 5.2.2 Budget and Economy Hotels

- 5.2.3 Mid and Upper mid scale Hotels

- 5.2.4 Luxury Hotels

6. COMPETITVE INTELLIGENCE

- 6.1 Market Concentration

- 6.2 Company Profiles

- 6.2.1 AccorHotels

- 6.2.2 Hilton Hotels & Resorts

- 6.2.3 Motel One

- 6.2.4 Ibis

- 6.2.5 Mercure Hotels

- 6.2.6 Private City Hotels

- 6.2.7 Renaissance Hotels & Resorts

- 6.2.8 Arcotel Hotels & Resorts

- 6.2.9 Star Inn Hotels

- 6.2.10 NH Hotel Group

- 6.2.11 Intercontinental Hotels & Resorts

- *List Not Exhaustive

- 6.3 Loyalty Programs Offered by Major Hotel Brands

7. INVESTMENT ANALYSIS

8. FUTURE OUTLOOK OF THE SECTOR

9. APPENDIX

Austria Hospitality Industry Segmentation

A complete background analysis of the Hospitality Industry in Austria, which includes an assessment of the industry associations, overall economy, and emerging market trends by segments, significant changes in the market dynamics, and market overview is covered in the report.

| By Type | Chain Hotels |

| Independent Hotels | |

| By Segment | Service Apartments |

| Budget and Economy Hotels | |

| Mid and Upper mid scale Hotels | |

| Luxury Hotels |

Austria Hospitality Market Research FAQs

The Austria Hospitality Market is projected to register a CAGR of 4% during the forecast period (2025-2030)

AccorHotels, Hilton Hotels & Resorts, Motel One, Private City Hotels and Arcotel Hotels & Resorts are the major companies operating in the Austria Hospitality Market.

The report covers the Austria Hospitality Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Austria Hospitality Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.