Electric Commercial Vehicle Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Electric Commercial Vehicle Market Report is Segmented by Vehicle Type (Buses, Trucks, Pick-Up Trucks, and Vans), Propulsion (Battery Electric Vehicles, Plug-In Hybrid Electric Vehicles, and Fuel Cell Electric Vehicles), Power Output (Less Than 150 KW, 150 250 KW, and Above 250 KW), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

Electric Commercial Vehicle Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Electric Commercial Vehicle Market Size

| Study Period | 2019 – 2030 |

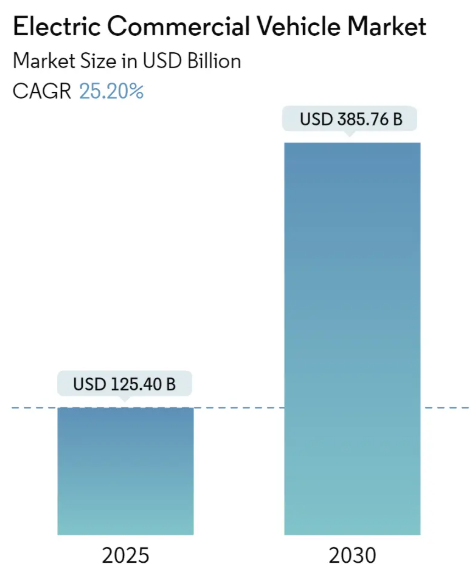

| Market Size (2025) | USD 125.40 Billion |

| Market Size (2030) | USD 385.76 Billion |

| CAGR (2025 – 2030) | 25.20 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Electric Commercial Vehicle Market with other markets in Automotive Industry

Automotive Materials & Coatings

Automotive Technology

Vehicles

Automotive Services

Auto Parts

Automotive Equipment

Electric Commercial Vehicle Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 25.20% (2025 – 2030) |

| Countries/ Region Covered: | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Major Players: | AB Volvo, Traton SE, BYD Motors Inc., Paccar Inc., Daimler Truck AG |

Electric Commercial Vehicle Market Analysis

The Electric Commercial Vehicle Market size is estimated at USD 125.40 billion in 2025, and is expected to reach USD 385.76 billion by 2030, at a CAGR of 25.2% during the forecast period (2025-2030).

Over the medium term, the use of electric vehicles is expected to become more popular in many developing countries, especially in the logistics and supply chain sectors. Strict environmental regulations worldwide are compelling many companies to switch to electric vehicles, further driving the market’s growth.

Automakers face growing pressure from governments worldwide to tackle greenhouse gas emissions. This involves cutting carbon emissions from diesel fuel combustion and investing in the advancement of electric vehicles.

The growing worldwide interest in eco-friendly transportation and cleaner energy has caused a surge in the appeal of electric commercial vehicles. However, consumers have encountered challenges such as limited vehicle range, high prices, a lack of available models, and insufficient knowledge. These issues are slowly being addressed through promotional campaigns and government regulations.

The electric commercial vehicle market is mainly driven by the need to reduce urban pollution and dependence on fossil fuels. It is currently the world’s largest market for such vehicles. China, India, and Japan are the leading countries contributing to the electric commercial vehicle market in the years to come.

Electric Commercial Vehicle Market Trends

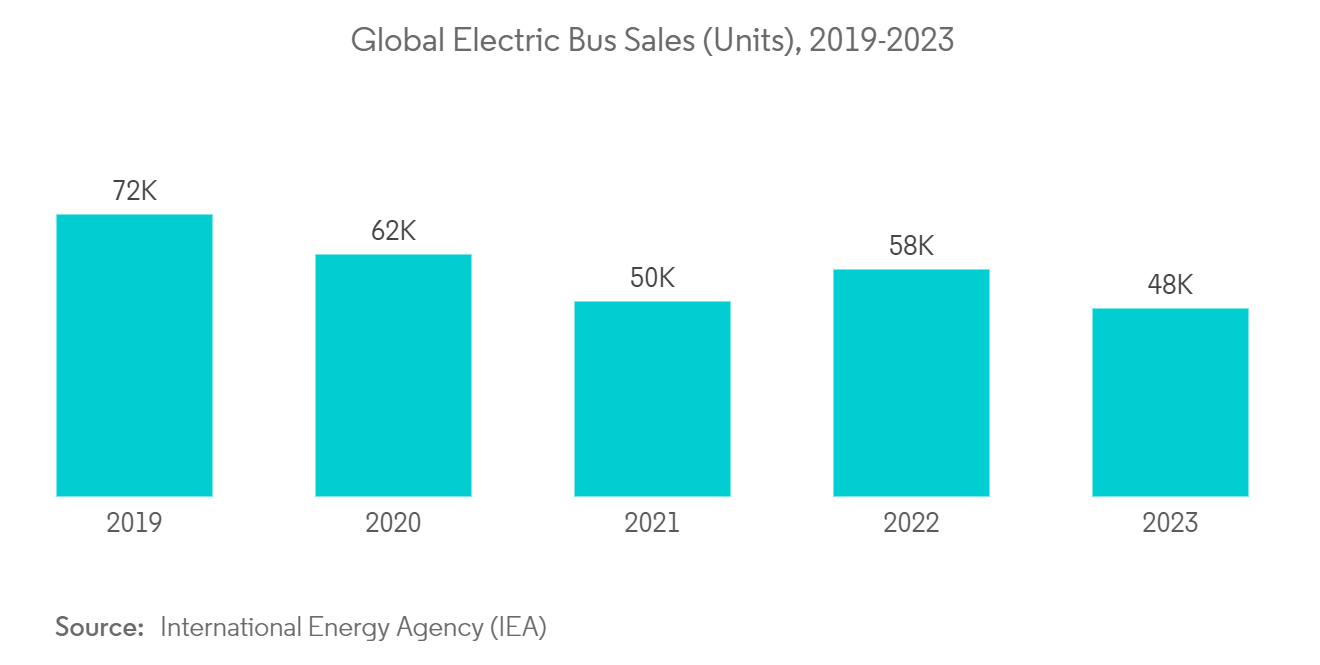

Buses Hold a Major Market Share

The cost of fuel is a significant expense for any vehicle. As fuel prices continue to rise, opting for an electric bus for public transportation decreases fuel expenses and reduces initial costs and overall ownership expenses. By 2030, the prices for electric buses are expected to come down to that of diesel fuel buses. Electric buses help reduce 81-83% of the maintenance and operating costs compared to a diesel-engine bus.

The growing public consciousness of air pollution and climate change, along with the steady rise in diesel prices, has motivated many state and city transportation authorities to prioritize the integration of clean public transportation solutions into their regional development strategies.

Electric buses provide a superior level of comfort for passengers compared to gasoline or diesel buses. Unlike traditional diesel buses, electric buses have minimal levels of noise, vibration, and harshness (NVH), enhancing the overall travel experience for passengers.

In the United States, the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) introduced the Safer Affordable Fuel-Efficient (SAFE) vehicles rule. This regulation establishes the requirements for the average fuel efficiency and emissions of greenhouse gases for both passenger and commercial vehicles.

The Zero-emission Vehicles (ZEV) Program mandates that vehicle manufacturers must sell a certain number of eco-friendly and zero-emission vehicles, which include electric, hybrid, and fuel cell-powered commercial and passenger vehicles. The ZEV program’s goal is to have 12 million zero-emission vehicles, including buses, on the roads in the country by 2030.

Worldwide, automobile manufacturers have created innovative vehicles to meet the diverse needs of their customers. For instance:

- In September 2023, India and the United States joined forces to launch up to 10,000 electric buses in India, creating a significant transformation in the country’s public transportation system.

With the above-mentioned developments across the world, the demand for electric buses is likely to grow in the coming years.

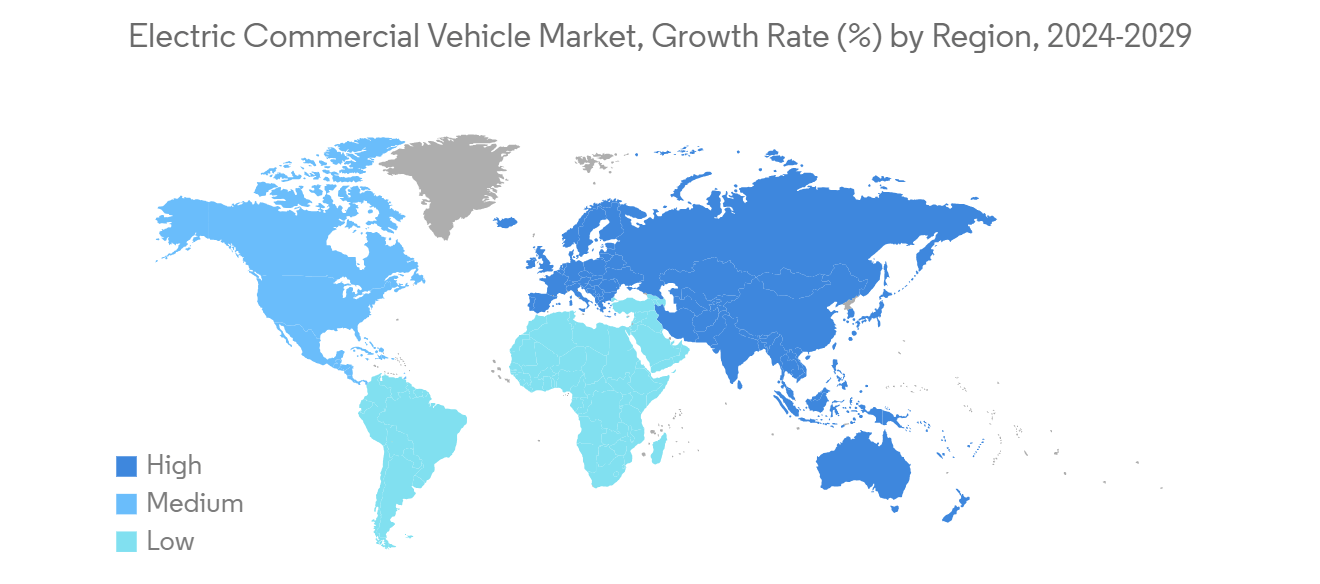

Asia-Pacific is Expected to Lead the Market

The Chinese government is promoting the use of electric vehicles and has announced plans to phase out diesel fuel used in tractors and construction equipment. By 2035, all new vehicles sold in China must be powered by new energy. Half of these vehicles must be electric, fuel cell, or plug-in hybrid, with the other half being hybrid vehicles.

The increasing installation of EV charging stations throughout China may lead to a higher demand for electric buses in major regions. The expansion of electric bus manufacturers across the country will likely drive the market during the forecast period.

China has a major presence of commercial vehicle manufacturers, such as BYD Co. Ltd and SAIC, with strong R&D facilities nationwide. This trend will likely create lucrative market opportunities during the forecast period. For instance:

- In October 2023, the Starship China concept truck was co-developed and officially launched by FAW Jiefang Group Co. and Shell China Ltd.

The state governments in India are including electric buses in their fleets to convert their ICE fleet of buses and reduce operational costs while reducing carbon emissions and improving air quality. For instance:

- In May 2024, the government of India announced its plans to incentivize the adoption of electric buses for intercity and interstate travel to promote zero-emission transportation across the country.

Japan is home to one of the planet’s most cutting-edge electric vehicle ecosystems. Major companies like Toyota and Nissan are taking impressive steps to develop and manufacture electric vehicles within the country.

The abundance of EV charging stations, surpassing the number of petrol and diesel outlets, indicates progress in the hybrid and electric vehicle market. These favorable conditions are expected to fuel Japan’s market and demand for commercial electric vehicles. Additionally, government funding supports the growth of Japan’s electric commercial vehicle market.

With such developments across the region, the demand for electric commercial vehicles will likely grow in the coming years.

Electric Commercial Vehicle Industry Overview

The electric commercial vehicle market is dominated by several key players, including BYD Motors Inc., AB Volvo, Daimler Truck AG, and Paccar Inc. The rapid expansion of electric commercial vehicle manufacturers across the country and the introduction of new models across major countries are expected to witness major growth for the market during the forecast period. For instance:

- In April 2024, Rizon, a brand of Daimler Truck AG, introduced class 4-5 electric trucks in Canada. The company will offer four variants of its battery-electric trucks, including the e16L, e16M, e18L, and the e18M, with GVW ratings ranging from 7.25 tons to 8.55 tons.

- In October 2023, Foton Motor introduced the Aumark next-generation light-duty truck and the Wonder next-generation micro-truck during a brand renewal and new product launch in Changsha, Hunan.

- In June 2023, the Bavarian State Government approved four out of five funding projects of MAN Truck & Bus. This funding supports the advancement of high-voltage batteries for electric trucks and buses. The government subsidy of USD 26.84 million at the Nuremberg site.

Electric Commercial Vehicle Market Leaders

- AB Volvo

- Traton SE

- BYD Motors Inc.

- Paccar Inc.

- Daimler Truck AG

- *Disclaimer: Major Players sorted in no particular order

Electric Commercial Vehicle Market News

- May 2024: Switch Mobility, a subsidiary of Ashok Leyland, announced plans to launch the electric light commercial vehicle IeV 3 in India. The IeV3 model is equipped with a lithium-ion battery with a range of about 120 km on a single charge.

- April 2024: Tresa Motors launched the V0.2, which represents a significant upgrade from its initial model. This new release features an 800V electric architecture powered by a central computing unit, advanced telemetry, and an in-house BMS (Battery Management System).

- October 2023: MAN Truck and Bus introduced its first-ever electric heavy-duty truck in Germany, consisting of the MAN eTGX for long-distance transportation and the MAN eTGS for distribution purposes.

Electric Commercial Vehicle Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Stringent Emission Regulations are Fueling Market Growth

- 4.2 Market Restraints

- 4.2.1 High Cost of Electric Commercial Vehicles May Hamper Growth

- 4.3 Industry Attractiveness – Porter’s Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Value in USD)

- 5.1 By Vehicle Type

- 5.1.1 Bus

- 5.1.2 Trucks

- 5.1.3 Pick-up Trucks

- 5.1.4 Vans

- 5.2 By Propulsion

- 5.2.1 Battery Electric Vehicles

- 5.2.2 Plug-in Hybrid Electric Vehicles

- 5.2.3 Fuel Cell Electric Vehicles

- 5.3 By Power Output

- 5.3.1 Less than 150 kW

- 5.3.2 150-250 kW

- 5.3.3 Above 250 kW

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 BYD Motors Inc.

- 6.2.2 AB Volvo

- 6.2.3 Traton SE

- 6.2.4 Daimler Truck AG

- 6.2.5 Zhengzhou Yutong Bus Co. Ltd

- 6.2.6 Ford Motor Company

- 6.2.7 Tesla Inc.

- 6.2.8 Proterra Inc.

- 6.2.9 Rivian Automotive Inc.

- 6.2.10 Tata Motor Limited

- 6.2.11 Olectra Greentech Limited

- 6.2.12 Paccar Inc.

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. An Overview of Electric Vehicle Charging Infrastructure Development Across the Region**

Electric Commercial Vehicle Industry Segmentation

An electric commercial vehicle refers to any one or more electric motor vehicles that are used for the transportation of goods or materials instead of passengers. A commercial vehicle is used for commercial or business purposes.

The electric commercial vehicle market is segmented by vehicle type, propulsion, power output, and geography. By vehicle type, the market is segmented into buses, trucks, pick-up trucks, and vans. By propulsion, the market is segmented into battery electric vehicles, plug-in hybrid electric vehicles, and fuel cell electric vehicles. By power output, the market is segmented into less than 150 kW, 150 kW to 250 kW, and above 250 kW. By geography, the market is segmented into North America, Europe, Asia-Pacific, South America, and Middle East and Africa. For each segment, the market sizing and forecast have been done based on the value (USD).

| By Vehicle Type | Bus | |

| Trucks | ||

| Pick-up Trucks | ||

| Vans | ||

| By Propulsion | Battery Electric Vehicles | |

| Plug-in Hybrid Electric Vehicles | ||

| Fuel Cell Electric Vehicles | ||

| By Power Output | Less than 150 kW | |

| 150-250 kW | ||

| Above 250 kW | ||

| By Geography | North America | United States |

| Canada | ||

| Rest of North America | ||

| By Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| By Geography | Asia-Pacific | India |

| China | ||

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| By Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| By Geography | Middle East and Africa | United Arab Emirates |

| Saudi Arabia | ||

| South Africa | ||

| Rest of Middle East and Africa |

Electric Commercial Vehicle Market Research FAQs

The Electric Commercial Vehicle Market size is expected to reach USD 125.40 billion in 2025 and grow at a CAGR of 25.20% to reach USD 385.76 billion by 2030.

In 2025, the Electric Commercial Vehicle Market size is expected to reach USD 125.40 billion.

AB Volvo, Traton SE, BYD Motors Inc., Paccar Inc. and Daimler Truck AG are the major companies operating in the Electric Commercial Vehicle Market.

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the Asia Pacific accounts for the largest market share in Electric Commercial Vehicle Market.

In 2024, the Electric Commercial Vehicle Market size was estimated at USD 93.80 billion. The report covers the Electric Commercial Vehicle Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Electric Commercial Vehicle Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Electric Commercial Vehicle Industry Report

The global commercial electric vehicle market is witnessing remarkable growth, driven by stringent emission regulations and advancements in battery technology. This market growth is supported by the decreasing costs of EV components, government subsidies, and a shift towards sustainable transportation. The industry outlook indicates that commercial EVs are becoming increasingly financially viable. The market, driven by consumer demand for eco-friendly solutions, sees electric heavy-duty trucks and vans leading the charge. Innovations such as wireless EV charging are enhancing fleet operational efficiency.

The Asia-Pacific region, with strong support from China, India, and Japan, is at the forefront of this shift. Market leaders are navigating challenges such as high development costs and component scarcity to drive the industry towards a sustainable future. For detailed insights, market reports and industry information offer comprehensive analysis and forecasts on market share, size, and revenue growth in the electric commercial vehicle sector.

The market segmentation by vehicle type, propulsion, and power output is crucial for understanding the market trends. Industry research and market analysis highlight the importance of market data and market predictions. The industry analysis reveals a positive market outlook and industry sales. Market overview and industry statistics are essential for understanding the market value and growth rate.