Civil Aerospace Simulation and Training Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Report Covers Global Civil Aerospace Simulation and Training Market Forecast and is Segmented by Simulator Type (Full Flight Simulator (FFS), Flight Training Devices (FTD), and Other Training Devices), by Application (Commercial Aviation and Space), and by Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa). The market size and forecast for the Civil Aerospace Simulation and Training Market are provided in terms of value (in USD million) for all the above segments.

Civil Aerospace Simulation and Training Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Civil Aerospace Simulation and Training Market Size

| Study Period | 2019 – 2030 |

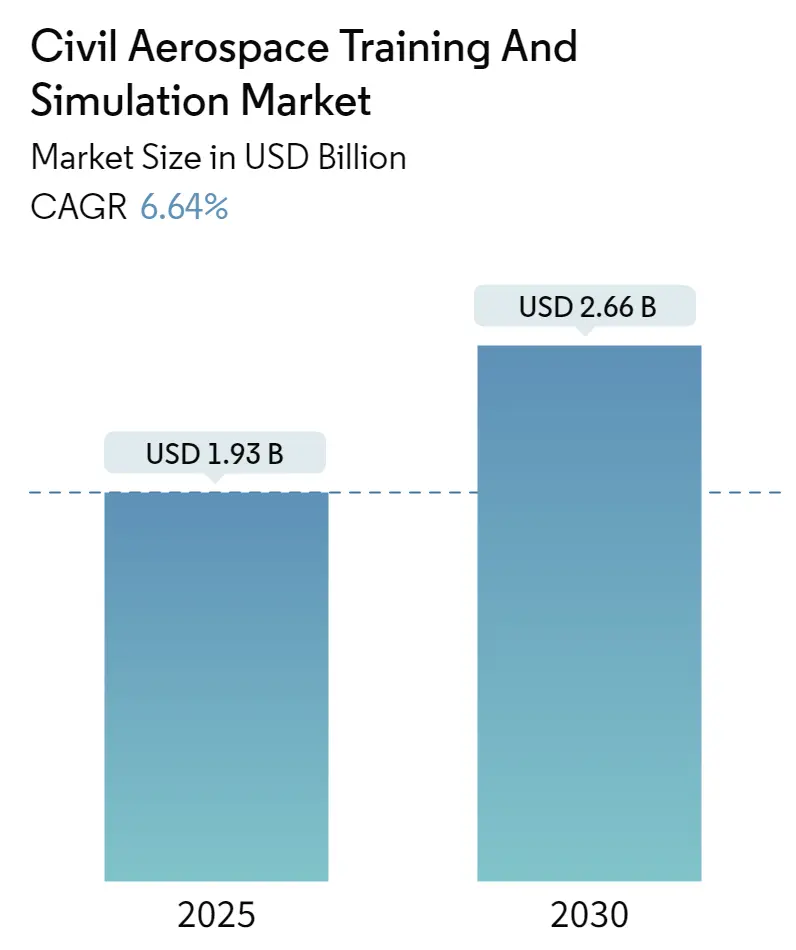

| Market Size (2025) | USD 1.93 Billion |

| Market Size (2030) | USD 2.66 Billion |

| CAGR (2025 – 2030) | 6.64 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Medium |

Major Players

|

Compare market size and growth of Civil Aerospace Training And Simulation Market with other markets in Aerospace & Defense Industry

Defense

Airport Operations

Aviation

Aerospace & Defense Technology

Air Taxi

Aircraft Parts

Civil Aerospace Simulation and Training Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 6.64% (2025 – 2030) |

| Countries/ Region Covered: | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Major Players: | CAE Inc., L3Harris Technologies, Inc, The Boeing Company, FlightSafety International, Indra Sistemas SA |

Civil Aerospace Simulation and Training Market Analysis

The Civil Aerospace Training And Simulation Market size is estimated at USD 1.93 billion in 2025, and is expected to reach USD 2.66 billion by 2030, at a CAGR of 6.64% during the forecast period (2025-2030).

Airlines around the globe were aggressively pursuing fleet expansion and network expansion plans before the emergence of the COVID-19 pandemic. However, following the impact of the COVID-19 pandemic, the airlines have canceled and deferred aircraft orders as well as furloughed their pilots to mitigate the losses due to the impact felt by the pandemic. The aviation industry started recovering in 2022 and gradually returning to its pre-COVID-19 level. According to the latest updates from IATA, ICAO, the Airports Council International (ACI), the UN World Tourism Organization (UNWTO), the World Trade Organization (WTO), and the International Monetary Fund (IMF), the international air passenger traffic in 2022 has improved compared to that of 2021. With the recovery of the aviation industry in 2022, the orders and deliveries of commercial aircraft witnessed a gradual increase, which led to a simultaneous increase in demand for simulators and training devices.

As the aviation industry is expected to return to pre-COVID levels and the fleet of commercial aircraft is expected to increase, the demand for pilots is also expected to increase. Also, currently, many airlines are facing the issue of a pilot shortage, which is affecting their daily operations. Generally, flights longer than 12 hours require a team of four pilots. However, several airlines are still operating such long-haul routes with three pilots due to a shortage of pilots. The shortage of pilots is expected to drive demand for new simulation and training solutions.Also, the planned investments in human space exploration programs during the forecast period are anticipated to generate demand for simulators for astronauts and training solutions in the coming years.

Civil Aerospace Simulation and Training Market Trends

Full Flight Simulator (FFS) Segment Expected to Account for the Highest Market Share During the Forecast Period

The full flight simulator (FFS) segment dominated the market and is expected to continue in the coming years. The full flight simulator is generally equipped with a motion actuator that replicates flight movement, offering a real-life-like experience inside the simulator that will allow trainees in the aerospace and aviation industries to receive a complete training experience. With the lack of trained and experienced pilots, airlines and companies are working on pilot training programs, which increases the market for full-flight simulators. In August 2022, CAE Inc. announced that it had signed a 15-year contract with Qantas Group for the development and operation of a new pilot training center in Sydney. CAE will deploy a new A320 full-flight simulator and purchase B787, A330, and B737NG full-flight simulators from the Qantas Group. Currently, the new and advanced FFS is being integrated with new technologies, like virtual reality, to improve the efficiency of training pilots.

For instance, in April 2022, the Mexican Federal Civil Aviation Agency awarded certification to Aeromexico’s second CAE 7000XR Boeing 737 MAX FFS. The airline acquired the simulator to cater to its training requirements as travel demand increased and its fleet grew. In May 2022, at the World Aviation Training Summit (WATS), CAE announced that it was expanding its Toronto Training Center for the purpose of deploying a CAE 7000XR Boeing 787 and a CAE 7000XR Boeing B737 MAX full-flight simulators (FFS). The president of CAE has said that this is to support Canadian airlines as international air travel is returning to normal levels after the COVID-19 pandemic.

Such developments in the market are likely to supplement the growth trajectory of the full flight simulator (FFS) segment over the forecast period.

Asia-Pacific is Anticipated to Register the Highest Growth During the Forecast Period

The increasing passenger traffic in the Asia-Pacific region is propelling the procurement of new aircraft by the airlines and aircraft operators in the region. Major airlines in the region, like China Eastern Airlines, China Southern Airlines, Air China, Indigo, Korean Air, and All Nippon Airways, have huge aircraft orders planned to be delivered during the forecast period. According to Boeing, there will be a demand for more than 244,000 new pilots in the Asia-Pacific region during the next two decades, with a demand for 126,000 pilots from China alone.

Accordingly, there have been significant developments concerning Civil Aviation Flight Training and Simulation in China. For instance, in April 2023, Boeing announced that they had brought its B737 MAX flight simulator to its Shanghai training center to fulfill the promise of improving pilot training for the aircraft in China after two fatal crashes in 2018 and 2019 led to it being grounded worldwide. Moreover, the United States plane maker has installed the B737 MAX Flight Training Device at its training hub at Shanghai Pudong International Airport to better support the operations of Chinese airlines. To increase the pilot training capacity in India, ALSIM was awarded a contract by the Airports Authority of India (AAI) in February 2021 to deliver three Flight Simulator Training Device (FSTD) simulators of EASA Flight Navigation and Procedure Trainer (FNPT) Multi Crew Coordination (MCC) level II types for single-aisle aircraft. All three FNPT II simulators are scheduled to enter service by 2022 at its training centers, namely, CATC Prayagraj, HTC Hyderabad, and NIATAM Gondia. Also, major countries in the region are accelerating their human space exploration programs. For instance, China is currently working to build its new space station, which is expected to be completed by 2022, and conducts deep-space human spaceflight by 2030. Such human space exploration plans are anticipated to propel the demand for space simulation and training solutions during the forecast period.

Civil Aerospace Simulation and Training Industry Overview

The civil aerospace training and simulation market is semi-consolidated. Some of the prominent players in the market for civil aerospace simulation and training are L3Harris Technologies Inc., The Boeing Company, CAE Inc., FlightSafety International, and Indra Sistemas S.A.

CAE Inc. has a majority share in commercial aviation simulators due to its global presence and brand image. In FY2021, the company delivered 36 full-flight simulators to its civil aviation customers, and in FY2022, the company delivered 30 FFS (a decrease of six simulators compared to the same period in FY2021).

Similarly, Lockheed Martin Corporation and The Boeing Company are some of the prominent companies that support NASA human space exploration programs. The increasing investments of the companies in developing new simulators with advanced features for training are anticipated to provide them with growth opportunities in the market in the coming years.

Civil Aerospace Simulation and Training Market Leaders

- CAE Inc.

- L3Harris Technologies, Inc

- The Boeing Company

- FlightSafety International

- Indra Sistemas SA

Civil Aerospace Simulation and Training Market News

April 2023: Boeing announced that they have brought its B737 MAX flight simulator to its Shanghai training center to fulfill the promise of improving pilot training for the aircraft in China after two fatal crashes in 2018 and 2019, led to it being grounded worldwide. Moreover, the company installed the B737 MAX Flight Training Device at its training hub at Shanghai Pudong International Airport to better support the operations of Chinese airlines

August 2022: CAE Inc. announced that it had signed a 15-year contract with Qantas Group for the development and operation of a new pilot training center in Sydney. CAE will deploy a new A320 full-flight simulator and purchase B787, A330, and B737NG full-flight simulators from the Qantas Group.

Civil Aerospace Simulation and Training Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter’s Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Simulator Type

- 5.1.1 Full Flight Simulator (FFS)

- 5.1.2 Flight Training Devices (FTD)

- 5.1.3 Other Training Devices

- 5.2 Application

- 5.2.1 Commercial Aviation

- 5.2.2 Space

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Turkey

- 5.3.5.4 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 L3Harris Technologies, Inc.

- 6.2.2 CAE Inc.

- 6.2.3 The Boeing Company

- 6.2.4 FlightSafety International Inc.

- 6.2.5 Raytheon Technologies Corporation

- 6.2.6 Indra Sistemas S.A.

- 6.2.7 ALSIM EMEA

- 6.2.8 ELITE Simulation Solutions AG

- 6.2.9 Multi Pilot Simulations BV

- 6.2.10 Lockheed Martin Corporation

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in the field of Pilot Training

Civil Aerospace Simulation and Training Industry Segmentation

An aerospace simulator is a software or hardware system designed to simulate various aspects of aerospace operations. These simulators are used for training pilots, conducting research, testing aircraft systems, and exploring aerospace concepts. Aerospace simulators can range from simple desktop applications to full-motion flight simulators used by commercial airlines and military organizations. They typically incorporate realistic graphics, physics models, and control interfaces to provide an immersive and interactive experience.

The market is segmented by simulator type, application, and geography. By simulator type, the market is segmented into full flight simulators (FFS), flight training devices (FTD), and other training devices. The other training devices include advanced aviation training devices (AATDs), basic aviation training devices (BATDs), and other visual and training tools used for training spacecraft crew. By application, the market is segmented into commercial aviation and space. The report also covers the market sizes and forecasts for the civil aerospace simulation and training market in major countries across different regions. For each segment, the market size is provided in terms of value (USD).

| Simulator Type | Full Flight Simulator (FFS) | |

| Flight Training Devices (FTD) | ||

| Other Training Devices | ||

| Application | Commercial Aviation | |

| Space | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Rest of Latin America | ||

| Geography | Middle East and Africa | United Arab Emirates |

| Saudi Arabia | ||

| Turkey | ||

| Rest of Middle East and Africa |

Civil Aerospace Simulation and Training Market Research FAQs

The Civil Aerospace Simulation And Training Market size is expected to reach USD 1.93 billion in 2025 and grow at a CAGR of 6.64% to reach USD 2.66 billion by 2030.

In 2025, the Civil Aerospace Simulation And Training Market size is expected to reach USD 1.93 billion.

CAE Inc., L3Harris Technologies, Inc, The Boeing Company, FlightSafety International and Indra Sistemas SA are the major companies operating in the Civil Aerospace Simulation And Training Market.

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the North America accounts for the largest market share in Civil Aerospace Simulation And Training Market.

In 2024, the Civil Aerospace Simulation And Training Market size was estimated at USD 1.80 billion. The report covers the Civil Aerospace Simulation And Training Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Civil Aerospace Simulation And Training Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.