Float Glass Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Report Covers Automotive Float Glass Manufacturer and is Segmented by Type (Clear, Tinted, Patterned, Wired, and Extra Clear/Low Ferrous Floated Glass), Application (Building and Construction, Automotive, Solar Glass, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Report Offers Market Size and Forecasts for Float Glass in Volume (Tons) for all the Above Segments.

Float Glass Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Float Glass Market Size

| Study Period | 2024 – 2030 |

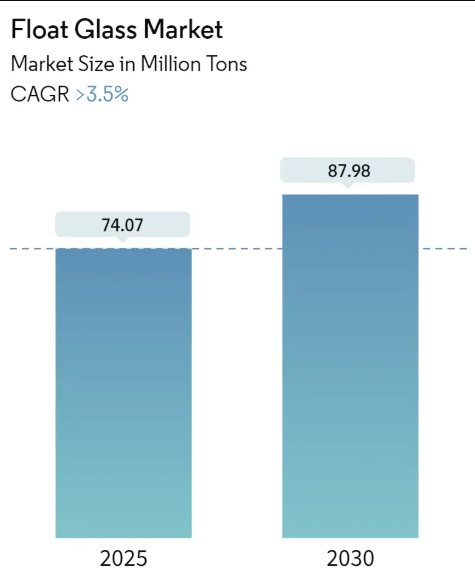

| Market Volume (2025) | 74.07 Million tons |

| Market Volume (2030) | 87.98 Million tons |

| CAGR | 3.50 % |

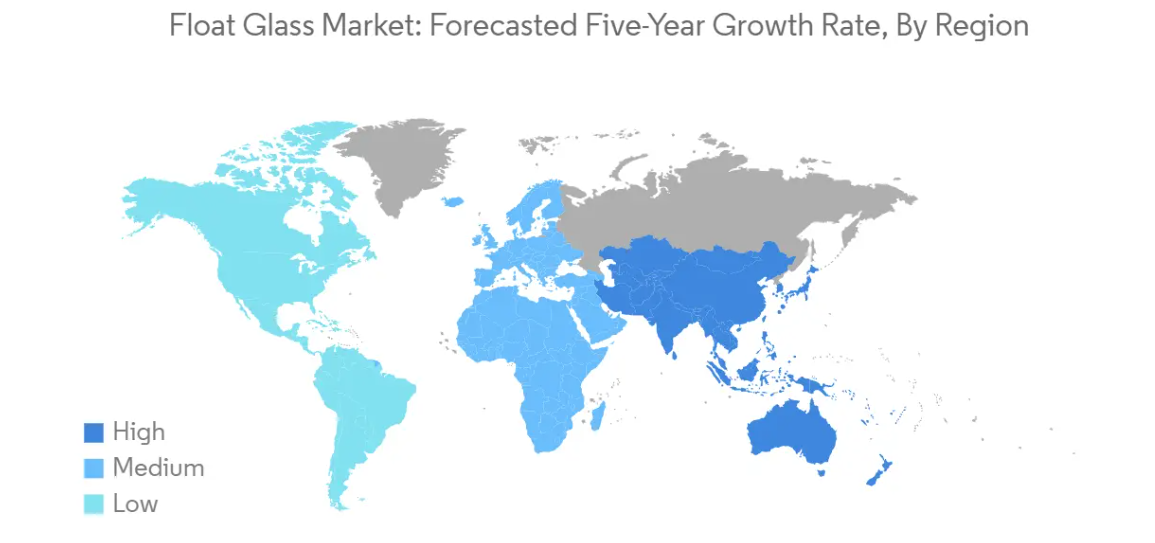

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Asia-Pacific |

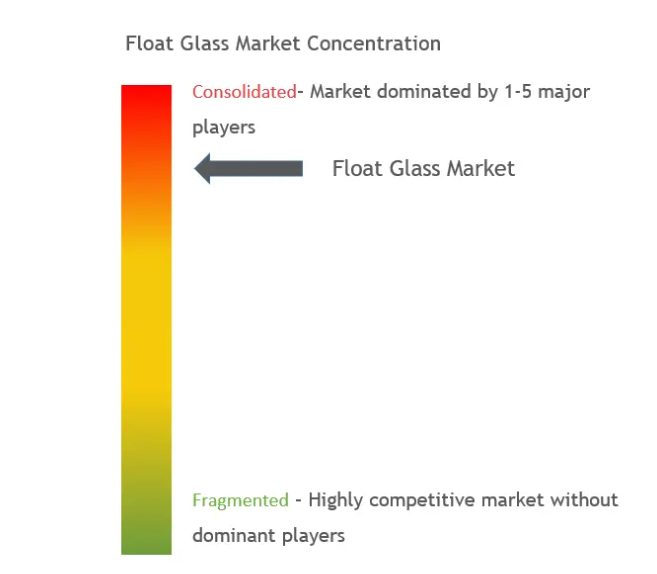

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Float Glass Market with other markets in Chemicals & Materials Industry

Float Glass Market Analysis

The Float Glass Market size is estimated at 74.07 million tons in 2025, and is expected to reach 87.98 million tons by 2030, at a CAGR of greater than 3.5% during the forecast period (2025-2030).

The float glass industry continues to evolve with technological advancements and changing market dynamics, particularly in manufacturing processes and product innovations. Manufacturers are increasingly focusing on developing specialized products with enhanced properties such as improved thermal insulation, solar control, and acoustic performance. The integration of smart technologies and digitalization in float glass production has led to improved efficiency and quality control. This transformation is evidenced by the growing adoption of automation and Industry 4.0 practices across major manufacturing facilities globally.

Supply chain optimization and raw material sourcing have become critical focus areas for industry participants, driven by the need for sustainable and cost-effective production methods. The industry has witnessed significant investments in capacity expansion and modernization of existing facilities to meet the growing demand across various end-use sectors. According to industry data, global solar photovoltaic capacity reached 843,086 MW in 2021, indicating the growing importance of float glass in solar applications and driving manufacturers to adapt their production capabilities accordingly.

Environmental sustainability has emerged as a key priority in the float glass industry, with manufacturers implementing various initiatives to reduce carbon emissions and energy consumption. Companies are increasingly investing in energy-efficient production technologies and exploring alternative energy sources for their manufacturing operations. The industry is witnessing a shift towards more sustainable production practices, including increased use of recycled glass (cullet) in manufacturing processes and development of eco-friendly coating technologies.

Product innovation and diversification continue to shape the competitive landscape, with manufacturers developing specialized products for emerging applications. The United Kingdom’s solar market demonstrates this trend, with over 15 GW of solar capacity and 556 MW connected in the first half of 2022, driving demand for specialized solar glass products. Manufacturers are focusing on developing value-added products with enhanced functionalities such as self-cleaning properties, enhanced durability, and improved energy efficiency characteristics to meet evolving customer requirements and regulatory standards. The role of glazing in enhancing energy efficiency and the use of processed glass in innovative applications further underscores the significance of the float glass market.

Float Glass Market Trends

Increasing Demand from the Construction Industry

The construction industry represents the major consumer of construction glass in the global market, with building glass being widely preferred due to its high degree of light transmission, ability to be produced in various colors and opacities, and excellent chemical inertness properties. In modern architecture, architectural glass serves a wide range of applications in both commercial and domestic buildings, from window glass and façades to interior partitions, balustrades, shop fronts, and railings for stairs and balconies. The global construction market, valued at approximately USD 7.2 trillion, is projected to grow at 3.6% in the current year, significantly driving construction glass demand across various construction applications. According to the Institution of Civil Engineers, construction output volume is forecasted to expand by 85%, reaching a substantial revenue of USD 15.5 trillion worldwide in the upcoming decade.

Architectural glass plays an increasingly crucial role in buildings by providing an attractive and easy-to-maintain exterior surface. Recent architectural trends show a significant shift toward using tempered glass in facades and roofs to optimize natural daylight, supported by advanced technologies such as Low-E and triple silver insulated products. In the commercial sector, commercial glass enables structures to be constructed that give the impression of being outside while providing the benefits of indoor protection from environmental elements. The American Institute of Architects projects that overall non-residential building construction will grow by 3.1% in 2022, with hotel construction expected to rise by 8.8% and office spaces by 0.1%, indicating strong potential for building glass demand in commercial applications.

Recovering Automotive Industry

The automotive sector represents a significant growth driver for the automotive glass market, particularly with the expanding electric vehicle (EV) segment and increasing focus on vehicle safety features. Automotive glass is extensively used in the production of windshields, side windows, and rear car glass, where it has substantially improved safety across all parameters. The material undergoes specialized processing, including heat and chemical treatments, to enhance its strength and ability to withstand external stress, making it ideal for automotive applications. The industry’s shift toward electric vehicles has created additional demand, with China’s EV industry alone valued at USD 124.21 billion, and sales anticipated to reach 6 million units by the end of the current year.

The automotive glass manufacturing sector continues to evolve with technological advancements and growing interest in vehicle design and aesthetics, compelling manufacturers to introduce innovative automotive glass products. Float glass production for automotive applications requires precise specifications and quality standards, particularly for safety features and structural integrity. The industry’s focus on lightweight vehicles for improved fuel efficiency, coupled with the rising production of electric vehicles, has led to increased demand for specialized float glass products. This trend is particularly evident in major automotive manufacturing countries where significant investments are being made in expanding float glass production capabilities to meet the growing demand from both conventional and electric vehicle segments.

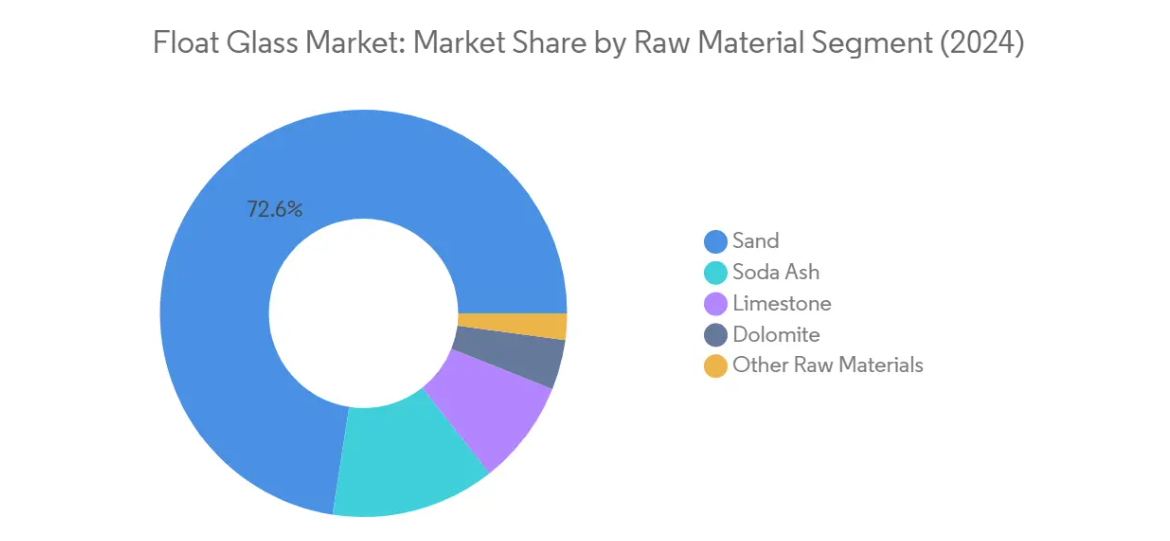

Segment Analysis: By Raw Material

Sand Segment in Float Glass Market

Sand dominates the float glass raw materials market, commanding approximately 73% of the market share in 2024. This substantial market position is attributed to sand being the primary source of silicon dioxide (SiO2), which is fundamental in float glass production. The segment’s dominance is supported by the stringent quality requirements in float glass manufacturing, where high silica content (over 95%) and exceptional chemical purity are essential. While sand deposits are common globally, only specific deposits meeting these strict technical specifications are suitable for float glass production, including fossil, beach, river, lake, or wind deposits. The industry’s focus on raw material quality prioritizes sand deposits that can deliver the desired clarity, strength, and durability in the final glass products.

Soda Ash Segment in Float Glass Market

The soda ash segment is experiencing significant growth in the float glass market for the period 2024-2029, driven by its crucial role in reducing melting temperatures and enhancing glass workability. This segment’s growth is propelled by the increasing adoption of energy-efficient manufacturing processes, as soda ash helps reduce furnace temperatures necessary for melting silica, thereby contributing to significant energy savings. The segment’s expansion is further supported by the growing focus on sustainable production methods and the material’s essential role in improving glass particle formation. Major manufacturers are increasingly investing in soda ash production capabilities to meet the rising demand from the float glass industry, particularly in regions with expanding construction and automotive sectors.

Remaining Segments in Raw Material Segmentation

The other significant raw materials in float glass production include limestone, dolomite, and various additional materials, each playing vital roles in the manufacturing process. Limestone serves as a crucial stabilizing agent and improves chemical resistance and durability, while dolomite enhances the viscosity of glass melt and increases both chemical and scratch resistance properties. Additional raw materials, though comprising a smaller market share, are essential for specific glass properties and characteristics. These segments continue to evolve with technological advancements in glass manufacturing, with manufacturers constantly exploring innovative combinations to improve product quality and manufacturing efficiency.

Segment Analysis: By Type

Clear Glass Segment in Float Glass Market

Clear float glass dominates the global float glass market, commanding approximately 63% market share in 2024. This segment’s prominence is driven by its extensive applications in the construction industry, particularly in windows, facades, and interior partitions. The segment’s superior optical properties, including high light transmission and distortion-free viewing, make it the preferred choice for both residential and commercial construction projects. Clear float glass’s versatility is further enhanced by its compatibility with various secondary processing methods like tempering, laminating, and coating, allowing it to meet diverse architectural requirements. The segment is experiencing robust growth at around 6% annually through 2029, primarily fueled by increasing demand from the construction sector and the recovering automotive industry, where it is extensively used in windshields and windows.

Remaining Segments in Float Glass Market by Type

The float glass market encompasses several other significant segments including tinted float glass, patterned, wired, and extra clear/low ferrous float glass. Tinted float glass serves as an essential component in applications requiring solar control and aesthetic appeal, particularly in commercial buildings and automotive applications. Patterned float glass offers unique decorative possibilities and privacy solutions, finding applications in both residential and commercial spaces. Wired float glass, despite its smaller market share, maintains its position in specific applications requiring fire resistance and security features. Extra clear/low ferrous float glass, with its superior optical properties and minimal green tint, caters to premium applications in solar panels, high-end architecture, and display units where maximum light transmission is crucial.

Segment Analysis: Application

Building and Construction Segment in Float Glass Market

The building and construction segment dominates the global float glass market, accounting for approximately 77% of the total market share in 2024. This significant market position is driven by the extensive use of float glass in various construction applications including windows, facades, doors, interior partitions, balustrades, shop fronts, and railings for stairs and balconies. The segment’s dominance is further strengthened by ongoing infrastructure development projects across major economies, particularly in the Asia-Pacific region where rapid urbanization and increasing middle-class population are driving construction activities. The versatility of float glass in modern architecture, its ability to provide natural daylight while maintaining energy efficiency, and its growing adoption in green building designs have solidified its position as the primary application segment in the market.

Solar Glass Segment in Float Glass Market

The solar glass segment is emerging as the fastest-growing application segment in the float glass market, projected to expand significantly during 2024-2029. This remarkable growth is primarily driven by increasing global focus on renewable energy adoption and substantial investments in solar power infrastructure worldwide. The segment’s growth is further supported by technological advancements in solar glass manufacturing, particularly in developing high-efficiency photovoltaic modules and concentrated solar power systems. Government initiatives promoting solar energy adoption, coupled with growing environmental consciousness and the push towards sustainable energy solutions, are creating robust demand for float glass in solar applications. The segment is witnessing increased innovation in areas such as anti-reflective coatings and ultra-clear float glass specifically designed for solar applications, further accelerating its growth trajectory.

Remaining Segments in Application

The automotive and other applications segments continue to play vital roles in the float glass market. The automotive segment maintains its significance through the consistent demand for windshields, side windows, and rear windows, particularly driven by the growing electric vehicle market and increasing safety regulations in the automotive industry. The other applications segment, which includes furniture, electronics, and specialty applications, contributes to market diversity through specialized uses of float glass in various industrial and consumer applications. These segments benefit from ongoing technological advancements in glass manufacturing and processing, particularly in areas of safety, durability, and aesthetic enhancement, while also adapting to emerging trends in their respective industries.

Float Glass Market Geography Segment Analysis

Float Glass Market in Asia-Pacific

The Asia-Pacific region represents the largest and most dynamic float glass market globally, driven by rapid urbanization, infrastructure development, and growing automotive production. China leads the regional market, followed by significant contributions from Japan, South Korea, and India. The region’s construction sector boom, particularly in commercial and residential buildings, continues to fuel demand for float glass products. Additionally, the expanding automotive manufacturing base, especially in countries like China, Japan, and South Korea, further strengthens market growth. The region also witnesses increasing adoption of energy-efficient glazing solutions and growing investments in solar energy projects.

Float Glass Market in China

China dominates the Asia-Pacific float glass market as the largest manufacturer and consumer. The country’s massive construction industry, coupled with its position as the world’s largest automotive market, drives substantial demand for float glass products. With approximately 56% share of the Asia-Pacific market in 2024, China maintains its leadership through extensive manufacturing capabilities and continuous technological advancements. The country’s float glass industry benefits from strong government support for infrastructure development, including ambitious projects like the NEOM city development. The nation’s commitment to sustainable building practices and energy-efficient construction further propels market growth, while its robust automotive sector, including the rapidly growing electric vehicle segment, ensures steady demand.

Float Glass Market Growth Potential in China

China continues to demonstrate exceptional growth potential in the float glass market, with an expected growth rate of approximately 8% during 2024-2029. The country’s aggressive push toward renewable energy, particularly in solar power installations, creates substantial opportunities for float glass manufacturers. China’s ongoing urbanization initiatives and the government’s focus on developing smart cities drive the demand for advanced construction glass solutions. The nation’s commitment to environmental sustainability has led to increased adoption of energy-efficient building materials, including specialized float glass products. Furthermore, China’s expanding presence in the global automotive market, especially in electric vehicles, continues to boost the demand for high-quality float glass products.

Float Glass Market in North America

The North American float glass market demonstrates strong stability and technological advancement, supported by robust construction activities and automotive manufacturing. The United States leads the regional market, while Canada and Mexico contribute significantly to the overall market dynamics. The region’s focus on energy-efficient building solutions and sustainable construction practices drives innovation in float glass products. The automotive sector’s recovery and growing emphasis on electric vehicles create additional demand streams. The region also benefits from increasing investments in commercial construction and infrastructure development projects.

Float Glass Market in United States

The United States maintains its position as the dominant force in the North American float glass market, with approximately 73% of the regional market share in 2024. The country’s leadership is supported by its extensive construction industry and significant automotive manufacturing base. The nation’s focus on energy-efficient building solutions and sustainable construction practices drives continuous innovation in float glass products. The commercial construction sector, particularly in urban areas, creates substantial demand for advanced building glass solutions. Additionally, the country’s growing emphasis on solar energy installations and green building practices further strengthens market growth.

Float Glass Market Growth Potential in Canada

Canada emerges as the fastest-growing market in North America, with an anticipated growth rate of approximately 5% during 2024-2029. The country’s construction sector demonstrates strong potential, supported by government initiatives and infrastructure development projects. Canada’s commitment to sustainable building practices and energy efficiency drives the demand for specialized insulating glass products. The nation’s growing focus on renewable energy, particularly solar power installations, creates additional opportunities for market expansion. Furthermore, the automotive sector’s recovery and increasing adoption of electric vehicles contribute to the market’s growth trajectory.

Float Glass Market in Europe

The European float glass market showcases strong technological advancement and innovation, particularly in energy-efficient and sustainable glass solutions. Germany leads the market, followed by significant contributions from France, the United Kingdom, Italy, and Spain. The region’s stringent building regulations and emphasis on energy efficiency drive the development of advanced flat glass products. The automotive sector, particularly the growing electric vehicle segment, creates steady demand. The region’s commitment to renewable energy, especially solar power installations, further supports market growth.

Float Glass Market in Germany

Germany maintains its position as the largest float glass market in Europe, driven by its robust construction industry and significant automotive manufacturing base. The country’s leadership in sustainable building practices and energy-efficient solutions creates substantial demand for advanced flat glass products. The nation’s strong focus on renewable energy, particularly solar power installations, provides additional growth opportunities. Germany’s automotive sector, including its growing electric vehicle segment, ensures consistent demand for high-quality automotive glass products.

Float Glass Market Growth Potential in Germany

Germany demonstrates strong growth potential in the European float glass market, supported by its continuous technological advancement and innovation in glass manufacturing. The country’s commitment to sustainable construction and energy efficiency drives the development of specialized construction glass products. The nation’s expanding solar energy sector creates additional opportunities for market growth. Furthermore, Germany’s leadership in automotive manufacturing, particularly in electric vehicles, ensures steady demand for advanced automotive glass solutions.

Float Glass Market in South America

The South American float glass market shows steady development, driven by increasing construction activities and automotive production. Brazil emerges as both the largest and fastest-growing market in the region, followed by Argentina. The region’s construction sector, particularly in residential and commercial segments, drives significant demand for building glass products. The growing focus on energy-efficient building solutions and sustainable construction practices creates opportunities for market expansion. The automotive sector’s recovery and increasing investments in infrastructure development further support market growth. The region also witnesses growing adoption of solar energy solutions, creating additional demand streams for specialized float glass products.

Float Glass Market in Middle East & Africa

The Middle East & Africa float glass market demonstrates significant potential, driven by extensive construction activities and infrastructure development projects. Saudi Arabia emerges as both the largest and fastest-growing market in the region, followed by South Africa. The region’s construction sector, particularly in commercial and residential segments, creates substantial demand for float glass products. The growing focus on sustainable building solutions and energy efficiency drives market development. The region’s increasing investments in solar energy projects create additional opportunities for market expansion. Furthermore, the automotive sector’s development and growing emphasis on infrastructure modernization support continued market growth.

Float Glass Industry Overview

Top Companies in Float Glass Market

The float glass market is led by major players including AGC Inc., Saint-Gobain, Guardian Glass, Nippon Sheet Glass, and Şişecam Group, who have established a strong global presence through extensive manufacturing networks. Companies are focusing on product innovation through significant R&D investments to develop specialized offerings like energy-efficient glass, ultra-clear glass, and smart glass solutions for emerging applications in the construction and automotive sectors. Operational excellence is being pursued through the modernization of production facilities, adoption of sustainable manufacturing practices, and optimization of supply chains. Strategic initiatives include vertical integration to secure raw material supplies, partnerships with technology providers, and collaborations with end-users for customized solutions. Geographic expansion remains a key focus area, with companies establishing new production facilities in high-growth markets while also pursuing selective acquisitions to strengthen market position.

Consolidated Market with Strong Regional Players

The global float glass market exhibits a consolidated structure with the top five manufacturers controlling a significant share of worldwide production capacity. While global conglomerates like AGC and Saint-Gobain maintain leadership positions through their multinational operations and integrated business models, several strong regional players have emerged, particularly in the Asia-Pacific region. These regional specialists have gained prominence through a focus on specific geographic markets and end-user segments. The industry has witnessed active merger and acquisition activity aimed at consolidation and geographic expansion, with established players acquiring local manufacturers to enhance market access and manufacturing capabilities. The high capital requirements and technical expertise needed for float glass production serve as significant entry barriers, contributing to market concentration.

Recent years have seen increased collaboration between established manufacturers and technology companies to develop innovative products, while some players have pursued backward integration by investing in raw material sources. Cross-border partnerships and joint ventures have become common as companies seek to combine complementary strengths and share risks in new market development. The industry structure is further characterized by long-term supply relationships with key customers in the construction and automotive sectors, creating stable demand channels but also increasing dependency on these core end-user segments.

Innovation and Sustainability Drive Future Growth

Success in the float glass market increasingly depends on companies’ ability to develop innovative products that address evolving customer needs while meeting stringent environmental standards. Incumbent players need to focus on expanding their premium product portfolio through technological advancement, particularly in areas like energy-efficient glass and smart glazing solutions. Building strong relationships with key customers through customized solutions and technical support services will be crucial for maintaining market share. Companies must also optimize their manufacturing footprint to balance production costs with market proximity while investing in sustainable production technologies to meet growing environmental regulations.

For emerging players looking to gain market share, specialization in specific market segments or geographic regions offers a viable entry strategy. Success will require developing differentiated products for underserved market segments while building efficient distribution networks. The ability to forge strategic partnerships with established players for technology access and market reach will be important for growth. Companies must also carefully manage substitution risks from alternative materials while staying compliant with evolving building codes and safety regulations. Investment in research and development capabilities, along with a focus on operational efficiency, will be essential for long-term competitiveness in this capital-intensive industry.

Float Glass Market Leaders

-

- AGC Inc.

- Nippon Sheet Glass Co., Ltd.

- Şişecam

- Saint-Gobain

- Guardian Glass, LLC

- *Disclaimer: Major Players sorted in no particular order