Naval Vessel MRO Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

The Naval Vessel MRO Market Report is Segmented by Vessel Type (Aircraft Carriers, Destroyers, Frigates, Corvettes, Submarines, and Other Vessel Types), MRO Type (Engine MRO, Dry Dock MRO, Component MRO, and Modification), and Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa). The Report Offers Market Size and Forecast for all the Above Segments in Value (USD).

Naval Vessel MRO Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Naval Vessel MRO Market Size

| Study Period | 2019 – 2030 |

| Market Size (2025) | USD 59.48 Billion |

| Market Size (2030) | USD 65.96 Billion |

| CAGR (2025 – 2030) | 2.09 % |

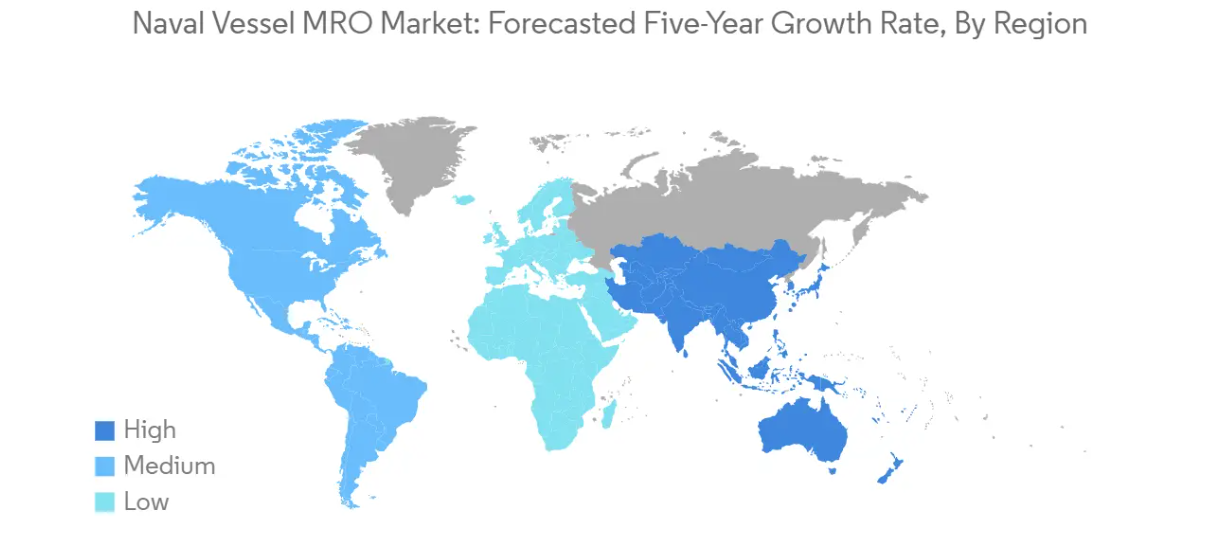

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

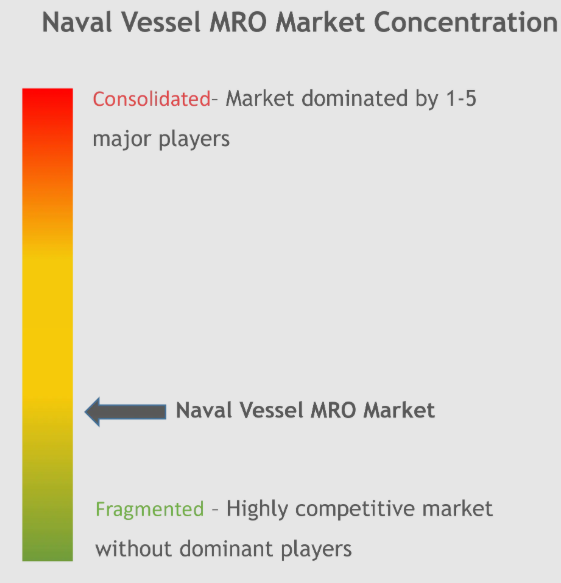

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Compare market size and growth of Naval Vessel Maintenance, Repair, And Overhaul (MRO) Market with other markets in Aerospace & Defense Industry

Defense

Airport Operations

Aviation

Aerospace & Defense Technology

Air Taxi

Aircraft Parts

Naval Vessel MRO Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

| Study Period: | 2019 – 2030 |

| CAGR: | 2.09% (2025 – 2030) |

| Countries/ Region Covered: | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Major Players: | General Dynamics Corporation, Huntington Ingalls Industries Inc., Lockheed Martin Corporation, Naval Group, BAE Systems plc |

Naval Vessel MRO Market Analysis

The Naval Vessel Maintenance, Repair, And Overhaul Market size is estimated at USD 59.48 billion in 2025, and is expected to reach USD 65.96 billion by 2030, at a CAGR of 2.09% during the forecast period (2025-2030).

The naval vessel MRO industry is experiencing significant transformation driven by increasing maritime security concerns and technological advancements in maintenance procedures. Global navies are rapidly modernizing their fleets, with current estimates showing more than 510 submarines in operation worldwide, highlighting the massive scale of vessel maintenance requirements. The integration of advanced technologies like robotics and automated inspection systems is revolutionizing traditional MRO practices, enabling more efficient and precise maintenance procedures while reducing vessel downtime.

The industry is witnessing a strong push toward indigenous manufacturing and maintenance capabilities, particularly in emerging maritime nations. China, with its fleet of more than 300 ships and submarines, has significantly expanded its domestic MRO infrastructure, setting a precedent for other nations to follow. This trend is reshaping the global naval vessel MRO market as countries invest in developing local expertise and facilities to reduce dependence on foreign contractors while ensuring strategic autonomy in naval vessel maintenance.

The United States continues to lead technological innovation in the naval vessel MRO market, with the US Navy maintaining over 490 ships in both active service and reserve fleet. The implementation of predictive maintenance systems and digital twin technology is becoming increasingly common, allowing for more precise scheduling of maintenance activities and better lifecycle management of naval assets. These technological advancements are helping navies optimize their maintenance schedules while reducing operational costs.

The Asia-Pacific region is emerging as a significant hub for naval vessel MRO activities, exemplified by Japan’s substantial investment in maritime defense capabilities, including a JPY 5.4 trillion defense budget approved for 2022. This regional growth is characterized by increasing partnerships between local shipyards and international MRO service providers, leading to knowledge transfer and capability enhancement. The focus on modernizing existing facilities and adopting advanced maintenance technologies is creating new opportunities for industry participants while raising the overall standards of naval vessel maintenance globally.

Naval Vessel MRO Market Trends

Increasing Naval Fleet Due to Growth in Maritime Disputes, Terrorism, and Piracy

The profound changes in the international strategic landscape have led to growing hegemonism, unilateralism, and power politics, which have fueled several ongoing global conflicts requiring enhanced naval capabilities. In response to security threats and the need to accomplish urgent, critical, and dangerous strategic missions, several modernization programs are currently underway to upgrade regional naval forces’ capabilities. This is evidenced by China’s expanded maritime presence and construction of military outposts on artificial islands, resulting in growing assertiveness from other regional claimants, including Japan, South Korea, the Philippines, and Vietnam.

The rise in maritime transport usage has led to increased criminal activities like piracy, trafficking of prohibited substances, maritime terrorism, and illegal immigration through sea routes. To counter these growing threats, global naval forces are increasingly focused on developing their capabilities through the procurement of various types of newer-generation naval vessels, including surface combatants and submarines. The anticipated adoption of an integrated system architecture ensuring encrypted data transfer between all naval assets of a nation is driving the need for enhanced fleet capabilities. This is further exemplified by the United States ramping up its military activity and naval presence across the world, which has consequently led adversaries to increase their naval fleet strengths to counter foreign presence and ensure combat-readiness.

Modernization and Upgradation of the Existing Naval Fleet

Mid-life upgrades have become essential for improving capabilities and extending the lifecycles of naval ships, with most countries opting for these upgrades after 15-20 years of operation to maintain large naval fleets for various missions. For instance, the Portuguese Navy has undertaken mid-life upgradation of its two M-frigates to extend their service lifespan to 2035, focusing on weapons, sensors, communication systems, propulsion, and power distribution systems. Similarly, the Royal Australian Navy’s eight Anzac-class frigates are undergoing mid-life upgrades at the BAE Systems Australia facility in Henderson, Western Australia, with the upgradation program for all eight ships scheduled for completion by early 2024.

The trend of smaller countries purchasing decommissioned ships from major naval powers like the United States, the United Kingdom, India, and Russia has generated significant demand for the ship repair and maintenance services market. This is illustrated by the Peruvian Navy’s acquisition of the corvette BAP Guise, which underwent extensive hull, mechanical, and electrical overhaul before delivery. The ship’s MTU 125V956 TB 82 diesel engines and GE LM 2500 gas turbines were disassembled and reviewed, with new parts installed where necessary. Additionally, the French Navy received its first upgraded La Fayette-class frigate, with work on a second frigate commencing simultaneously, demonstrating the growing focus on naval vessel maintenance across naval powers of varying sizes. The increasing need for vessel maintenance and types of overhauling is evident in these modernization efforts, highlighting the critical role of the ship MRO industry in sustaining naval capabilities.

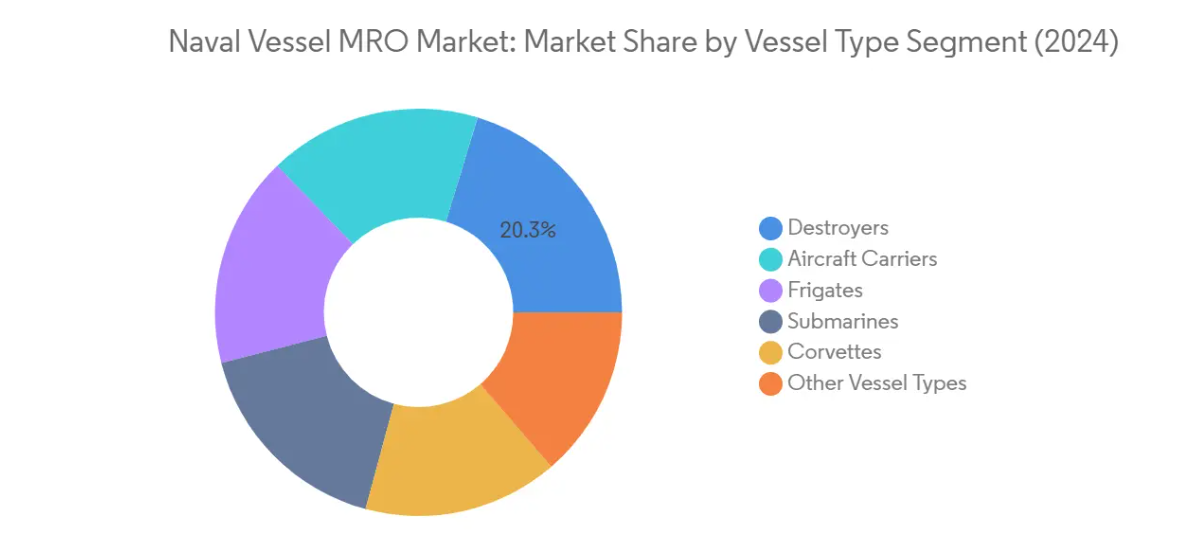

Segment Analysis: VESSEL TYPE

Destroyers Segment in Naval Vessel MRO Market

The Destroyers segment dominates the naval vessel MRO market, commanding approximately 20% of the total market share in 2024. This segment’s prominence is driven by the increasing complexity of modern destroyer fleets and their critical role in maritime defense operations. The segment is also experiencing the highest growth rate in the market, projected to grow at around 2% through 2029, driven by the increasing adoption of advanced combat systems and the need for regular maintenance of sophisticated radar and weapons systems. Major navies worldwide are investing heavily in destroyer modernization programs, particularly focusing on upgrading their electronic warfare capabilities, combat management systems, and propulsion systems. The segment’s growth is further supported by the increasing focus on extending the operational life of existing destroyer fleets through comprehensive maintenance and upgrade programs.

Remaining Segments in Vessel Type

The other significant segments in the naval vessel MRO market include Aircraft Carriers, Frigates, Submarines, Corvettes, and Other Vessel Types, each playing crucial roles in naval operations. Aircraft carriers require extensive maintenance due to their complex flight deck operations and propulsion systems. Frigates, being versatile multi-role vessels, demand regular maintenance of their weapons and sensor systems. Submarines present unique maintenance challenges due to their specialized underwater capabilities and nuclear propulsion systems in some cases. Corvettes, though smaller, require consistent maintenance to maintain their high-speed capabilities and combat readiness. The Other Vessel Types segment encompasses support vessels, patrol boats, and specialized naval craft, each requiring specific maintenance protocols to ensure operational effectiveness.

Segment Analysis: MRO TYPE

Dry Dock MRO Segment in Naval Vessel MRO Market

The Dry Dock MRO segment continues to dominate the naval vessel MRO market, accounting for approximately 39% of the total market share in 2024. This significant market position is attributed to the critical nature of dry dock maintenance, which includes heavy maintenance associated with vessel body and system repair. The segment’s prominence is driven by the growing need for detailed annual inspections of naval vessels, including comprehensive maintenance of the hull, propeller, rudder, and other underwater components that are normally inaccessible during sailing. Several countries are enhancing their local dry dock MRO capabilities to reduce vessel downtime and improve maintenance efficiency. The United States, for instance, is currently executing a major modernization program across its four primary shipyards to strengthen dry-docking infrastructure and capabilities.

Modification Segment in Naval Vessel MRO Market

The Modification segment is experiencing the highest growth rate in the global defense MRO – naval platforms market forecast during the 2024-2029 period, with an estimated growth rate of approximately 3%. This accelerated growth is primarily driven by the increasing need to outfit vessels with enhanced communications, weapons, and defense systems. Naval forces worldwide are investing significantly in upgrading onboard sensors and radar systems to enhance their overall situational awareness. The segment’s growth is further supported by the robust fleet sustainment investments being made by various navies to enhance their mission readiness. The modification works typically include upgrading existing equipment with advanced military electronics and modernizing air defense systems and weapons on older vessels to maintain combat effectiveness.

Remaining Segments in MRO Type

The Engine MRO and Component MRO segments also play vital roles in the overall marine MRO market. The Engine MRO segment is crucial as it involves maintaining and repairing the main engines, which account for a significant portion of machinery costs in the engine room. This segment focuses on routine maintenance checks and repairs to prevent breakdowns and ensure optimal performance in varying maritime conditions. The Component MRO segment encompasses the regular inspection, maintenance, and repair of various vessel components, including weapon systems, electrical systems, steering systems, and HVAC systems. Both segments are essential for maintaining fleet readiness and ensuring the operational efficiency of naval vessels.

Naval Vessel Maintenance, Repair, and Overhaul (MRO) Market Geography Segment Analysis

Naval Vessel MRO Market in North America

The North America naval vessels MRO market demonstrates robust growth driven by extensive naval modernization programs and fleet maintenance requirements. The United States and Canada represent the key markets in this region, with both countries focusing on maintaining their naval capabilities through regular maintenance and upgrades of existing vessels. The region benefits from advanced shipyard infrastructure, strong technological capabilities, and established defense contractors that provide comprehensive MRO services to support various vessel types, including submarines, aircraft carriers, destroyers, and frigates.

Naval Vessel MRO Market in the United States

The United States dominates the North America naval vessels MRO market, accounting for approximately 94% of the regional market share in 2024. The country maintains one of the world’s largest naval fleets, with over 490 ships in both active service and reserve fleet. The US Navy’s focus on fleet readiness and modernization drives continuous demand for MRO services. Multiple shipyards across the country provide comprehensive maintenance and repair services, supported by major defense contractors and specialized maintenance facilities. The country’s robust defense budget allocation for fleet maintenance and the presence of advanced technological capabilities further strengthen its position in the naval vessel MRO sector.

Naval Vessel MRO Market in Canada

Canada emerges as the fastest-growing market in North America, with a projected growth rate of approximately 3% during 2024-2029. The country’s naval modernization initiatives and fleet upgrade programs drive this growth trajectory. Canada’s focus on developing indigenous platforms and systems, while maintaining existing vessels, creates sustained demand for MRO services. The country’s strategic partnerships with various shipyards and ongoing programs for submarine maintenance and frigate modernization contribute to market expansion. The government’s commitment to enhancing naval capabilities and maintaining operational readiness of its fleet continues to drive investments in MRO services.

Naval Vessel MRO Market in Europe

The Europe naval vessels MRO market demonstrates significant diversity with multiple key players, including the United Kingdom, Germany, France, and Russia. Each country maintains specialized shipyards and maintenance facilities catering to their respective naval fleets. The region’s focus on modernizing aging naval vessels and enhancing maritime capabilities drives the demand for MRO services. European nations are increasingly investing in advanced maintenance technologies and developing indigenous MRO capabilities to support their naval assets effectively.

Naval Vessel MRO Market in Russia

Russia represents the largest market in Europe, commanding approximately 38% of the regional market share in 2024. The country maintains one of the largest naval fleets globally, comprising various vessel types, including submarines, destroyers, frigates, and support vessels. Russia’s extensive shipyard infrastructure and focus on maintaining its naval presence across strategic maritime regions drive continuous demand for MRO services. The country’s emphasis on indigenous maintenance capabilities and modernization of existing vessels supports market growth.

Naval Vessel MRO Market in France

France demonstrates strong growth potential in the Europe naval vessels MRO market, with a projected growth rate of approximately 2% during 2024-2029. The country’s strategic focus on maintaining its naval capabilities and modernizing its fleet drives demand for MRO services. France’s well-established shipyard infrastructure and expertise in naval maintenance contribute to market expansion. The country’s commitment to technological advancement in vessel maintenance and repair services, coupled with its strategic naval modernization programs, positions it for sustained growth in the MRO sector.

Naval Vessel MRO Market in Asia-Pacific

The Asia-Pacific naval vessels MRO market represents a dynamic market for naval vessel MRO services, characterized by increasing maritime activities and growing naval capabilities. Countries like China, India, Japan, and South Korea are making significant investments in their naval infrastructure and maintenance capabilities. The region’s geopolitical dynamics and focus on maritime security drive sustained demand for MRO services. Technological advancement and development of indigenous maintenance capabilities further contribute to market growth.

Naval Vessel MRO Market in China

China emerges as the dominant force in the Asia-Pacific naval vessels MRO market. The country’s extensive naval fleet, comprising over 300 ships and submarines, requires comprehensive maintenance and repair services. China’s focus on developing advanced maintenance capabilities and modernizing its naval assets drives market growth. The country’s strategic emphasis on indigenous MRO capabilities and expansion of shipyard infrastructure strengthens its position in the regional market.

Naval Vessel MRO Market in India

India demonstrates the highest growth potential in the Asia-Pacific region. The country’s strategic focus on expanding its naval capabilities and modernizing its fleet drives demand for MRO services. India’s emphasis on indigenous maintenance capabilities and development of specialized shipyard infrastructure supports market growth. The country’s partnerships with international shipbuilders and focus on technological advancement in maintenance services contribute to its expanding role in the regional MRO sector.

Naval Vessel MRO Market in Latin America

The South America naval vessels MRO market is characterized by growing maintenance requirements and modernization initiatives. Brazil emerges as both the largest and fastest-growing market in the region, driven by its extensive naval fleet and focus on indigenous maintenance capabilities. The region’s emphasis on maintaining operational readiness of existing vessels, coupled with budget constraints, shapes the demand for MRO services. Countries in the region are increasingly focusing on developing local maintenance capabilities while maintaining strategic partnerships with international service providers.

Naval Vessel MRO Market in Middle East and Africa

The Middle East and Africa naval vessels MRO market demonstrates growing significance in the naval vessel MRO market, driven by increasing maritime security requirements and fleet modernization programs. Saudi Arabia represents the largest market in the region, while the United Arab Emirates shows the fastest growth potential. The region’s strategic focus on developing indigenous maintenance capabilities and modernizing naval assets drives market expansion. Countries in this region are increasingly investing in advanced maintenance facilities and forming strategic partnerships with international service providers to enhance their MRO capabilities.

Naval Vessel MRO Industry Overview

Top Companies in Naval Vessel Maintenance, Repair, and Overhaul (MRO) Market

The naval vessel MRO market share is characterized by continuous technological advancement and innovation across service offerings, with major players investing heavily in artificial intelligence, predictive analytics, and robotics to enhance operational efficiency. Companies are increasingly focusing on developing integrated maintenance solutions that combine digital twin capabilities with predictive maintenance approaches to anticipate equipment failures before they occur. Strategic partnerships and collaborations with technology providers have become crucial for expanding service capabilities and geographic reach. Market leaders are also emphasizing the development of local manufacturing and maintenance capabilities through technology transfer initiatives and joint ventures, particularly in emerging markets. The industry has witnessed a significant shift towards the automation and digitalization of MRO operations, with companies investing in advanced information systems and smart maintenance solutions to reduce lead times and improve service delivery.

Fragmented Market with Strong Regional Players

The naval vessel MRO market exhibits a highly fragmented structure with a mix of global defense contractors, state-owned enterprises, and specialized regional players. Major global players like General Dynamics, BAE Systems, and ThyssenKrupp maintain a significant market presence through their comprehensive service portfolios and established relationships with naval forces worldwide. The market is characterized by the strong presence of government-owned shipyards and local players in Europe, Asia-Pacific, and increasingly in the Middle East, who cater to specific regional requirements and benefit from government support and preferential procurement policies.

The industry landscape is shaped by increasing consolidation efforts, particularly in mature markets, as companies seek to enhance their technological capabilities and expand their geographic footprint. Strategic partnerships and joint ventures have become common, especially in emerging markets where local content requirements and offset obligations drive collaboration between international and domestic players. The market also sees significant participation from diversified industrial conglomerates that leverage their broad technological expertise and financial resources to compete in the naval MRO sector, while specialized players focus on developing niche capabilities in specific service areas.

Innovation and Localization Drive Market Success

Success in the navy MRO market increasingly depends on companies’ ability to integrate advanced technologies while maintaining strong relationships with naval forces and local stakeholders. Incumbent players must focus on developing comprehensive digital solutions that enhance maintenance efficiency while investing in local capabilities to meet growing domestic content requirements. The ability to offer flexible and customized maintenance solutions, combined with strong project management capabilities and technical expertise, remains crucial for maintaining market position. Companies must also develop robust supply chain networks and partnerships to ensure reliable service delivery while managing costs effectively.

For new entrants and growing players, success lies in identifying and developing specialized capabilities in high-growth service segments while building a strong local presence in strategic markets. The high concentration of buyers in the form of national navies necessitates long-term relationship building and demonstrated technical competence. Companies must navigate complex regulatory requirements and security considerations while investing in workforce development and technology adoption. The increasing emphasis on environmental sustainability and energy efficiency in naval operations also presents opportunities for companies to differentiate their service offerings through innovative green technologies and sustainable maintenance practices. The ship repair maintenance service market is also witnessing a growing demand for such sustainable practices.

Naval Vessel MRO Market Leaders

-

- General Dynamics Corporation

- Huntington Ingalls Industries Inc.

- Lockheed Martin Corporation

- Naval Group

- BAE Systems plc

- *Disclaimer: Major Players sorted in no particular order

Naval Vessel MRO Market News

December 2023: The Indian Ministry of Defence awarded Cochin Shipyard a USD 59.5 million contract for repairing and maintaining naval vessels’ equipment and systems. The contract, initiated in Q2FY24 after the Ministry’s AoN, is set to conclude by Q1FY25. Cochin Shipyard, renowned for its expertise in both commercial and defense sectors, is intensifying its focus on sustainable maritime solutions. Notably, it recently collaborated with Adani Group, signing a memorandum for eco-friendly tugs, in line with India’s ‘Atmanirbhar Bharat’ initiative, to strengthen domestic shipbuilding.

October 2023: ST Engineering secured a contract to provide in-service support for two Fearless-class Patrol Vessels (PVs). Originally part of the Singapore Navy, these vessels now fall under the Royal Brunei Navy (RBN). The contract, valued at approximately USD 72 million, was inked with Muara Maritime Services Sdn Bhd (MMS) of Brunei Darussalam. It encompasses a range of services, including maintenance, repair, and overhaul (MRO). This collaboration was made possible through a joint effort between Darussalam Assets Sdn Bhd and Naval Vessels Lürssen (NVL), which established them as the primary MRO service provider for the RBN.

Naval Vessel MRO Market Report – Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter’s Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

- 5.1 Vessel Type

- 5.1.1 Aircraft Carriers

- 5.1.2 Destroyers

- 5.1.3 Frigates

- 5.1.4 Corvettes

- 5.1.5 Submarines

- 5.1.6 Other Vessel Types

- 5.2 MRO Type

- 5.2.1 Engine MRO

- 5.2.2 Dry Dock MRO

- 5.2.3 Component MRO

- 5.2.4 Modification

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Egypt

- 5.3.5.4 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 General Dynamics Corporation

- 6.2.2 Huntington Ingalls Industries Inc.

- 6.2.3 Lockheed Martin Corporation

- 6.2.4 NAVANTIA SA SME

- 6.2.5 ThyssenKrupp AG

- 6.2.6 BAE Systems PLC

- 6.2.7 Naval Group

- 6.2.8 Rolls-Royce PLC

- 6.2.9 Rhoads Industries Inc.

- 6.2.10 Abu Dhabi Ship Building Company

- 6.2.11 Larsen & Toubro Limited

- 6.2.12 Damen Shipyards Group

- 6.2.13 ST Engineering

- 6.2.14 FINCANTIERI SpA

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Naval Vessel MRO Industry Segmentation

The maintenance, repair, and overhaul operations conducted periodically on naval vessels are crucial for sustaining and extending the life of a ship. It involves all the functions related to the maintenance, overhaul, routine checks, inspection, repair, and modification of the vessel and its components. Performing MRO services helps ensure the safety and worthiness of naval vessels.

The market for naval vessel maintenance, repair, and overhaul (MRO) is segmented based on vessel type into submarines, frigates, corvettes, aircraft carriers, destroyers, and other vessel types. The other vessel types segment includes amphibious warfare ships, littoral combat ships, cruisers, mine countermeasure ships, and patrol ships. The market is segmented by MRO type into engine MRO, dry dock MRO, component MRO, and modification. The report also covers the market sizes and forecasts for the naval vessel MRO market in major countries across different regions. For each segment, the market size is provided in terms of value (USD).

| Vessel Type | Aircraft Carriers | ||

| Destroyers | |||

| Frigates | |||

| Corvettes | |||

| Submarines | |||

| Other Vessel Types | |||

| MRO Type | Engine MRO | ||

| Dry Dock MRO | |||

| Component MRO | |||

| Modification | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Russia | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Latin America | Brazil | ||

| Rest of Latin America | |||

| Middle East and Africa | United Arab Emirates | ||

| Saudi Arabia | |||

| Egypt | |||

| Rest of Middle East and Africa | |||

Naval Vessel MRO Market Research FAQs

The Naval Vessel Maintenance, Repair, And Overhaul Market size is expected to reach USD 59.48 billion in 2025 and grow at a CAGR of 2.09% to reach USD 65.96 billion by 2030.

In 2025, the Naval Vessel Maintenance, Repair, And Overhaul Market size is expected to reach USD 59.48 billion.

General Dynamics Corporation, Huntington Ingalls Industries Inc., Lockheed Martin Corporation, Naval Group and BAE Systems plc are the major companies operating in the Naval Vessel Maintenance, Repair, And Overhaul Market.

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, the Asia Pacific accounts for the largest market share in Naval Vessel Maintenance, Repair, And Overhaul Market.

In 2024, the Naval Vessel Maintenance, Repair, And Overhaul Market size was estimated at USD 58.24 billion. The report covers the Naval Vessel Maintenance, Repair, And Overhaul Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Naval Vessel Maintenance, Repair, And Overhaul Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.